PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851773

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851773

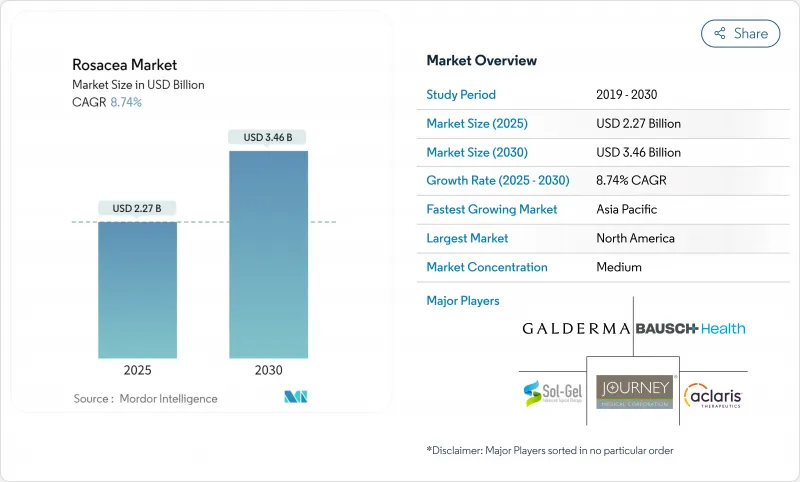

Rosacea - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The rosacea treatment market size stands at USD 2.27 billion in 2025 and is forecast to climb to USD 3.46 billion by 2030, translating into an 8.74% CAGR over the period.

The steady expansion is propelled by breakthrough regulatory approvals, refinements in drug-delivery science, and telehealth-enabled care pathways that emphasize early intervention and long-term adherence. Alpha-adrenergic agonists safeguard their leadership position, while JAK inhibitors gather momentum as precision immunomodulators. Topical therapies still dominate dispensing volumes, yet the first-in-class oral agent Emrosi is shifting prescribing behavior toward systemic convenience. North America anchors global revenue because of robust reimbursement and specialist density, whereas Asia-Pacific provides the fastest incremental growth as dermatology infrastructure and consumer purchasing power mature. Across all regions, digital diagnostics and e-pharmacy logistics compress the distance between diagnosis and therapy initiation, expanding the treated population and supporting sustainable market acceleration.

Global Rosacea Market Trends and Insights

Rising Prevalence Among Adults 30-60 Years Drives Demand

Incidence among people aged 30-60 years is climbing, aligning treatment need with peak earning capacity and autonomy in healthcare decision-making. Stress, diet, and environmental exposures in developed regions intensify symptom onset, boosting physician visits and prescription volumes. Patients increasingly recognize rosacea as a medical disorder rather than a cosmetic nuisance, bolstering willingness to pursue chronic pharmacotherapy. The demographic swell ensures a stable base of treatment candidates, underpinning long-range expansion of the rosacea treatment market .

FDA Approvals of Novel Topical Agents Accelerate Innovation

Recent regulatory momentum redefined therapeutic benchmarks. EPSOLAY's micro-encapsulated benzoyl peroxide achieved near-70% lesion reduction in 12 weeks, validating sustained-release chemistry as a means to marry efficacy with tolerability . Emrosi became the first oral therapy approved for concurrent control of erythema and inflammatory lesions, demonstrating superiority to Oracea yet retaining safety parity. These clearances compress development timelines for next-wave agents and intensify pipeline investment, lifting the innovation baseline across the rosacea treatment industry.

High Cost of Branded Prescriptions Limits Access

Retail prices for premium branded gels can run between USD 60.90 and USD 152.25 per daily treatment success, burdening patients and insurers alike. Prior authorization hurdles and tiered formularies steer many users toward older generics, capping uptake of innovative agents despite clinical superiority. The financial barrier is most pronounced in emerging economies, dampening the rosacea treatment market expansion potential until cost-containment or differential pricing models gain traction.

Other drivers and restraints analyzed in the detailed report include:

- Growing Tele-Dermatology & E-Pharmacy Uptake Transforms Care

- Advances in Micro-Encapsulated Drug Delivery Enhance Efficacy

- Treatment-Related Irritation & Poor Adherence Undermine Outcomes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alpha-adrenergic agonists retained 38.40% of rosacea treatment market share in 2024 by rapidly shrinking facial erythema through vasoconstriction. JAK inhibitors, albeit from a smaller base, are logging a 9.26% CAGR as clinical evidence confirms their ability to curb both inflammatory lesions and redness in refractory patients. Antibiotics, especially doxycycline derivatives, preserve utility for papulopustular subtypes, whereas azelaic acid persists as a dual-action topical for mild cases. Ivermectin remains resilient but relies on a concentrated API supply chain that could expose the segment to volatility. Benzoyl peroxide re-enters clinician armamentaria under micro-encapsulated designs that override historical tolerability barriers. Competitive positioning therefore revolves around combining mechanistic complementarity with advanced carriers that secure patient comfort.

The rosacea treatment market size for alpha-adrenergic agonists is forecast to advance steadily, yet their rosacea treatment market share could cede ground if JAK inhibitors achieve broader label indications. Pipeline diversity favors combination products that harness rapid vasoconstriction with immunomodulation, promising step-down strategies that prolong remission. Branded incumbents counter this threat by investing in lifecycle extensions such as lower-concentration formulations and patient-friendly applicators. Collectively, drug-class competition illustrates a pivot toward precision targeting over blanket anti-inflammation, a trajectory that redefines therapy algorithms and invites new entrants.

The Report Covers Rosacea Market Statistics and is Segmented by Drug Class (Antibiotics, Alpha Agonists, Retinoid, Corticosteroids, Immunosuppressants, and Other Drug Classes), Mode of Administration (Topics and Oral), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Provides the Value (in USD Million) for the Above Segments.

Geography Analysis

North America held 42.23% rosacea treatment market share in 2024 on the back of insurance coverage and physician density. FDA agility in green-lighting novel entities such as EPSOLAY and Emrosi further cements the region as the launchpad for global rollouts . Europe delivers steady gains amid stringent but harmonized regulation; the new EU micro-plastic directive may, however, nudge reformulation costs for certain leave-on gels. Asia-Pacific exhibits a 10.32% CAGR through 2030 as urban consumers adopt dermatology services and telehealth bridges rural access gaps. South America and the Middle East & Africa are earlier-stage but move in tandem with rising specialist training programs and public education drives.

The rosacea treatment market size differential favors regions with reimbursement support, yet sheer population weight positions Asia-Pacific as the dominant long-run volume engine. Western companies court the region via strategic licensing that pairs novel molecules with local distribution prowess. Domestic generics producers, meanwhile, capture cost-sensitive segments, intensifying price competition. Exchange-rate trends, regulatory review pace, and digital infrastructure maturity will dictate regional trajectory interplay over the forecast window.

Third paragraph: In Europe, national health technology assessments influence time-to-market, compelling manufacturers to compile robust real-world evidence beyond pivotal trials. This requirement could delay uptake but ultimately fortifies retention through proven cost-utility. Latin American markets lean on public-private partnerships to seed dermatology capacity, offering multinationals pilot grounds for subscription-based care models. The evolving geography matrix thus blends mature profitability in North America with emerging-market scale upside, collectively fueling a resilient global rosacea treatment market.

- Galderma

- Bausch Health

- Abbvie

- Leo Pharma

- Foamix Pharmaceuticals Ltd. (Sol-Gel)

- Journey Medical

- Sol-Gel Technologies Ltd.

- Almirall S.A.

- Novan, Inc.

- Pfizer

- Johnson & Johnson

- Sun Pharmaceuticals Industries

- Lupin

- Taro Pharmaceutical Industries Ltd.

- Sato Pharmaceutical Co., Ltd.

- Menlo Therapeutics Inc.

- Tarsus Pharmaceuticals, Inc.

- Mylan

- Perrigo Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence among adults 30-60 yrs

- 4.2.2 FDA approvals of novel topical agents

- 4.2.3 Growing tele-dermatology & e-pharmacy uptake

- 4.2.4 Advances in micro-encapsulated drug delivery

- 4.2.5 JAK-inhibitor pipeline targeting immune pathways

- 4.2.6 AI-powered diagnostic apps boosting early detection

- 4.3 Market Restraints

- 4.3.1 High cost of branded prescriptions

- 4.3.2 Treatment-related irritation & poor adherence

- 4.3.3 EU micro-plastic rule risk to leave-on gels

- 4.3.4 API supply-chain concentration for ivermectin

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2023-2030)

- 5.1 By Drug Class

- 5.1.1 Alpha-adrenergic Agonists

- 5.1.2 Antibiotics (Tetracyclines, Macrolides)

- 5.1.3 Azelaic Acid & Derivatives

- 5.1.4 Ivermectin

- 5.1.5 Benzoyl Peroxide & Others

- 5.2 By Route of Administration

- 5.2.1 Topical

- 5.2.2 Oral

- 5.2.3 Others (Injectables, Device-assisted)

- 5.3 By End-user Facility

- 5.3.1 Hospitals & Dermatology Clinics

- 5.3.2 Home-care Settings

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Galderma S.A.

- 6.3.2 Bausch Health Companies Inc.

- 6.3.3 AbbVie Inc.

- 6.3.4 Leo Pharma A/S

- 6.3.5 Foamix Pharmaceuticals Ltd. (Sol-Gel)

- 6.3.6 Journey Medical Corporation

- 6.3.7 Sol-Gel Technologies Ltd.

- 6.3.8 Almirall S.A.

- 6.3.9 Novan, Inc.

- 6.3.10 Pfizer Inc.

- 6.3.11 Johnson & Johnson (Janssen)

- 6.3.12 Sun Pharmaceutical Industries Ltd.

- 6.3.13 Lupin Limited

- 6.3.14 Taro Pharmaceutical Industries Ltd.

- 6.3.15 Sato Pharmaceutical Co., Ltd.

- 6.3.16 Menlo Therapeutics Inc.

- 6.3.17 Tarsus Pharmaceuticals, Inc.

- 6.3.18 Mylan N.V.

- 6.3.19 Perrigo Company plc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment