PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851775

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851775

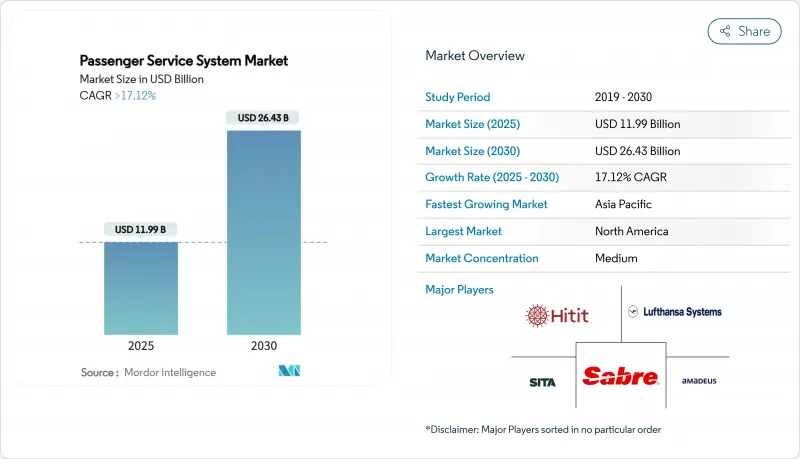

Passenger Service System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Passenger Service System market size stands at USD 11.99 billion in 2025 and is forecast to advance to USD 26.43 billion by 2030, translating into a 17.12% CAGR.

This vigorous expansion reflects airlines' accelerated shift toward cloud-native architectures, AI-driven retailing and offer-and-order management platforms. Airlines are routing part of the USD 37 billion technology budget released in 2024 toward next-generation Passenger Service System market upgrades that cut legacy infrastructure outlays and unlock dynamic revenue streams. Full-service carriers rely on large-scale migrations to modernize mainframe-bound applications, while low-cost carriers spearhead agile roll-outs that shorten time-to-market for new ancillary products. Regionally, North American incumbents continue to lead standardization around IATA ONE Order, yet Asia-Pacific airlines supply the strongest volume uplift and the highest rate of new system adoptions. Competitive intensity rises as cloud-born specialists integrate modular APIs into existing Passenger Service System market deployments, pushing traditional vendors to invest heavily in R&D and strategic partnerships with hyperscale providers.

Global Passenger Service System Market Trends and Insights

Rise in Air-Travel Passengers

Global passenger numbers are projected to reach 5.2 billion in 2025, placing unprecedented load on legacy reservation architectures. United Airlines' migration from 50-year-old mainframes to an Amazon Bedrock-enabled stack shows how carriers now translate complex passenger name records into plain-language objects that scale elastically . Asia-Pacific airports such as Bangkok's Suvarnabhumi and Phuket are targeting over 130 million passengers, prompting USD 18 billion in PSS-aligned infrastructure programs. Larger trip volumes multiply transaction requests, forcing airlines to adopt cloud-native Passenger Service System market deployments capable of real-time inventory orchestration and dynamic pricing.

Rapid Cloud Adoption Across Airline IT Stacks

Ninety-five percent of airlines list cloud migration as a top CIO priority, citing 40% cuts in total cost of ownership and faster release cycles once mainframe dependencies disappear. Sabre completed retirement of its proprietary mainframe in favor of Google Cloud, removing USD 100 million in annual operational costs while unlocking micro-services for personalized offers Delta Air Lines' AWS partnership equips its revenue-management algorithms with on-demand compute power for seat-level pricing decisions. Together, these moves confirm that airlines embracing cloud-native Passenger Service System market frameworks gain measurable agility and margin upside.

High Upfront Licence and Migration Costs

Comprehensive PSS modernization can exceed USD 100 million for a major carrier, discouraging many regionals from abandoning legacy contracts. Airlines often phase migrations over 3-5 years to contain cash-flow shocks, yet still face dual-run expenses during cut-over periods. Smaller operators struggle to negotiate favorable terms with dominant vendors, perpetuating vendor lock-in across the Passenger Service System market. Cloud OPEX models offset some capital burden, but licence fees for sophisticated offer-and-order modules remain a hurdle until transaction volumes scale sufficiently.

Other drivers and restraints analyzed in the detailed report include:

- Growing Appetite for Ancillary-Revenue Merchandising

- IATA ONE Order Accelerating End-to-End PSS Upgrades

- Legacy Mainframe Lock-in Among Tier-1 Carriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger Service System market size figures underline software's 69.5% revenue contribution in 2024. Airlines continue renewing core licences for platforms such as Amadeus Altea and SabreSonic, yet they increasingly bundle consulting and migration assistance in multi-year service engagements. The services segment's 18.4% CAGR stems from carriers demanding cloud architecture design, NDC schema mapping and AI model training beyond mere implementation. Tier-one carriers now structure partnerships that combine shared code-bases with DevOps squads from suppliers, transferring knowledge that accelerates feature releases.

The changing procurement mix highlights a pivot to outcome-based contracts measurable by ancillary revenue uplift or downtime reduction. Vendors respond by packaging managed services with uptime SLAs and continuous optimization cycles. As a result, software revenues grow steadily, but service-driven differentiation sets the competitive tempo. Airlines that secure high-quality integration support compress migration timelines and unlock early mover gains in dynamic retailing-advantages that ripple through the wider Passenger Service System market.

Cloud deployments claimed 53.2% of the Passenger Service System market share in 2024 and they lead with an 18.9% CAGR. Carriers prefer OPEX-aligned subscription models that scale with ticket volumes and sidestep capital-heavy data-center upgrades. Sabre's strategic partnership with Google Cloud allows airlines to plug into natural-language AI APIs without provisioning on-prem infrastructure. United Airlines reports sub-second response times for complex itinerary searches after refactoring its shopping engine on AWS, demonstrating operational upside accessible only via hyperscale resources.

On-premise installations persist mainly among transatlantic legacy carriers bound by historical investments and strict data-residency rules. Even here, hybrid deployments emerge: transactional cores stay local for latency, while forecasting and personalization run in the cloud. The growing proportion of cloud contracts signals that future Passenger Service System market upgrades will default to micro-service architectures, allowing airlines to activate new modules-loyalty, disruption management, sustainability reporting-through simple API toggles rather than extensive code rewrites.

The Passenger Service System Market Report is Segmented by Type (Software, Services), Application (Reservation and Booking Management, Inventory Management, Check-In and Boarding, and More), Deployment (On-Premise, Cloud), Airline Type (Full-Service Carrier, Low-Cost Carrier, Hybrid Carrier, Charter and Regional Operator), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 33.8% of global revenue in 2024, propelled by early adoption of cloud-native stacks and sustained investment programs such as Southwest's USD 1.7 billion modernization roadmap. Carriers exploit robust regional hyperscale infrastructure to deploy AI-enhanced disruption management, dynamic pricing and biometric boarding across extensive domestic networks. However, deep customization around mainframe remnants slows down full adoption of ONE Order, requiring phased migration strategies that temper short-term agility gains. The Passenger Service System market now experiences a dual-speed trajectory in the region: legacy majors inch toward modular architectures while newer entrants leapfrog directly to offer-and-order models.

Asia-Pacific is the fastest-growing theatre, posting a 19.5% CAGR as governments pour over USD 18 billion into airport upgrades that embed standardized CUPPS and CUSS interfaces. Rising middle-class leisure demand and aggressive fleet expansion create fertile ground for greenfield digital stacks. Airlines such as Riyadh Air, Vietravel and Akasa opt for cloud-native platforms from inception, avoiding the mainframe drag faced elsewhere. The region's surge in low-cost travel also encourages sophisticated ancillary merchandising, channeling more transactions into the Passenger Service System market than seat growth alone would indicate.

Europe remains a critical innovation lab thanks to stringent data-protection and passenger-rights frameworks driving omni-channel and ESG functionality. British Airways' Nevio adoption highlights a continent-wide emphasis on offer and order convergence, while Air France-KLM's planned majority stake in SAS signals further consolidation and platform harmonization . Meanwhile, the Middle East and parts of Africa attract attention for state-led airline launches equipped with brand-new cloud platforms that sidestep legacy hurdles. Collectively, these dynamics reinforce a multipolar Passenger Service System market in which regulatory maturity, investment cycles and passenger demographics shape adoption speed and functionality focus.

- Amadeus IT Group SA

- Sabre Corporation

- Societe Internationale de Telecommunications Aeronautiques (SITA) N.V.

- Hitit Bilgisayar Hizmetleri A.?.

- Radixx International Inc.

- Takeflite Solutions Limited

- Bravo Passenger Solutions Pte. Limited

- Collins Aerospace (Raytheon Technologies)

- Enoyaone Ltd.

- InteliSys Aviation Systems Inc.

- Unisys Corporation

- Videcom International Limited

- Lufthansa Systems GmbH & Co. KG

- Travel Technology Interactive S.A.

- Navitaire LLC

- Mercator Solutions FZE

- IBS Software Services Pvt. Ltd.

- AeroCRS Ltd.

- TravelSky Technology Limited

- WorldTicket A/S

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in air-travel passengers

- 4.2.2 Rapid cloud adoption across airline IT stacks

- 4.2.3 Growing appetite for ancillary-revenue merchandising

- 4.2.4 Mandates for seamless omni-channel passenger experience

- 4.2.5 IATA ONE Order accelerating end-to-end PSS upgrades

- 4.2.6 Airport CUTE/CUPPS sunset pushing airlines to modern PSS APIs

- 4.3 Market Restraints

- 4.3.1 High upfront licence and migration costs

- 4.3.2 Legacy mainframe lock-in among Tier-1 carriers

- 4.3.3 Growing data-sovereignty rules complicating cross-border hosting

- 4.3.4 Talent shortage in New Distribution Capability (NDC) integration

- 4.4 Value Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Application

- 5.3.1 Reservation and Booking Management

- 5.3.2 Inventory Management

- 5.3.3 Check-in and Boarding

- 5.3.4 Loyalty Management

- 5.3.5 Others

- 5.4 By Airline Type

- 5.4.1 Full-Service Carrier

- 5.4.2 Low-Cost Carrier

- 5.4.3 Hybrid Carrier

- 5.4.4 Charter and Regional Operator

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amadeus IT Group SA

- 6.4.2 Sabre Corporation

- 6.4.3 Societe Internationale de Telecommunications Aeronautiques (SITA) N.V.

- 6.4.4 Hitit Bilgisayar Hizmetleri A.?.

- 6.4.5 Radixx International Inc.

- 6.4.6 Takeflite Solutions Limited

- 6.4.7 Bravo Passenger Solutions Pte. Limited

- 6.4.8 Collins Aerospace (Raytheon Technologies)

- 6.4.9 Enoyaone Ltd.

- 6.4.10 InteliSys Aviation Systems Inc.

- 6.4.11 Unisys Corporation

- 6.4.12 Videcom International Limited

- 6.4.13 Lufthansa Systems GmbH & Co. KG

- 6.4.14 Travel Technology Interactive S.A.

- 6.4.15 Navitaire LLC

- 6.4.16 Mercator Solutions FZE

- 6.4.17 IBS Software Services Pvt. Ltd.

- 6.4.18 AeroCRS Ltd.

- 6.4.19 TravelSky Technology Limited

- 6.4.20 WorldTicket A/S

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment