PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851781

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851781

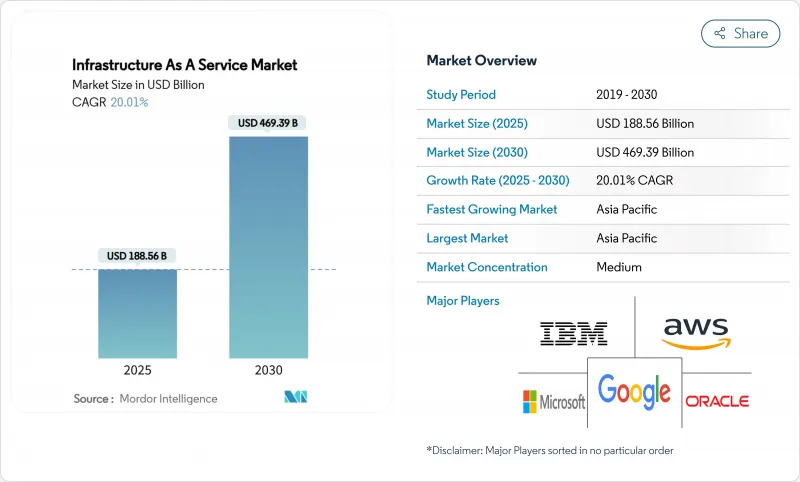

Infrastructure As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Infrastructure As A Service Market size is estimated at USD 188.56 billion in 2025, and is expected to reach USD 469.39 billion by 2030, at a CAGR of 20.01% during the forecast period (2025-2030).

Demand from generative-AI training, accelerating enterprise hybrid migrations, and hyperscaler capital expenditure above USD 250 billion per year underpin this trajectory. Liquid-cooled data-center designs, edge deployments supporting 5G latency, and sovereign AI initiatives together keep investment levels high. Competition intensifies as hyperscalers chase regional capacity while domestic providers leverage data-residency mandates. Power-purchase agreements for renewables are growing in length and scale because operators need to mitigate grid constraints and meet tightening sustainability targets. Collectively, these forces propel the cloud infrastructure market into its next phase of geographically distributed, AI-ready growth.

Global Infrastructure As A Service Market Trends and Insights

Accelerating Gen-AI Infrastructure Demand

Generative-AI training clusters require GPU racks drawing 700 W per chip, pushing liquid cooling adoption from 10% of data halls in 2024 to an estimated 20% in 2025. Hyperscalers now redesign campuses around 1 MW liquid-cooled racks, standardizing 400 V DC power distribution to curtail conversion losses, DataCenterFrontier. Enterprises echo the trend: nearly 40% of data-center operators plan to use liquid cooling by 2026 to host AI workloads. These technical shifts reshape facility blueprints, making AI-ready designs a default requirement across the cloud infrastructure market.

Enterprise Hybrid and Multi-Cloud Migration Spike

Organizations now spread workloads across multiple clouds to balance cost and compliance. IBM's USD 6.4 billion HashiCorp acquisition in 2024 deepens automation for multi-cloud orchestration. Oracle's and Google's multicloud tie-up eliminates egress fees for Oracle Database inside Google regions, removing a long-standing barrier to workload portability. Banking adoption is especially strong: 70% of institutions have moved beyond pilots, spurred by data-residency rules and operational-resilience tests. As hybrid patterns scale, specialized service providers find new revenue in governance and security advisory, reinforcing a virtuous cycle for the cloud infrastructure market.

Escalating Energy-Grid Constraints

Data centers already drew 4.4% of US electricity in 2023; the share may hit 12% by 2028, stressing legacy grids. Northern Virginia and Texas, once prime hubs, now ration megawatt allocations, sending operators to Indiana or Mississippi for fresh capacity. Ireland anticipates up to 70% of national power heading to digital loads by 2030, prompting moratoriums in some counties. Operators respond with immersion cooling that cuts facility power use by 95%, yet those retrofits demand fresh capital and extended build timelines. Limited electricity, therefore, slows the near-term expansion of the cloud infrastructure market.

Other drivers and restraints analyzed in the detailed report include:

- Hyperscaler CAPEX Race Exceeding USD 250 Billion

- Edge-to-Core Latency Requirements in the 5G Era

- Data-Sovereignty and Extraterritoriality Conflicts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Public cloud held 71.0% of revenue in 2024, a reflection of a decade-long migration away from on-premises stacks. The hybrid tier, however, records the fastest 24.0% CAGR through 2030 as regulated industries mesh on-prem control with off-prem scale. Financial-services leaders credit hybrid setups for meeting customer-experience targets while passing regulatory audits. The cloud infrastructure market size for hybrid deployments is projected to reach USD 142 billion by 2030, underscoring its role in balancing latency-sensitive and compliance-critical workloads.

A sharp increase in private connectivity options such as AWS Outposts and Azure Stack supports this hybrid wave. CME Group's private Google Cloud region in Aurora illustrates how mission-critical trading stays local yet leverages public-cloud tooling. Multifaceted orchestration software-boosted by IBM's HashiCorp deal-lowers complexity barriers. As maturity rises, the cloud infrastructure industry increasingly views deployment decisions as a portfolio exercise rather than a binary choice.

The Infrastructure As A Service Market is Segmented by Deployment Mode (Public Cloud, Private Cloud and Hybrid Cloud), Service Type(Compute As A Service (CaaS), Storage As A Service (STaaS), Database / Analytics As A Service (DBaaS) and More), End-User Industry(BFSI, IT and Telecom, Healthcare and Life Sciences) and Geography.

Geography Analysis

Asia Pacific owns 43.2% of global revenue in 2024 and sustains the fastest 21.4% CAGR as sovereign AI programs in China, Japan, and India funnel subsidies into domestic clouds. China's East Data-West initiative alone channels CNY 400 billion annually toward eight megaclusters, redistributing computing inland and lowering coastal congestion. Japan approaches JPY 2 trillion (USD 13.4 billion) in data-center value by 2030, buoyed by AWS's USD 15 billion and Oracle's USD 8 billion pledges. India gains from NTT's USD 1.5 billion expansion and local tax incentives favoring digital infrastructure.

North America remains the second-largest base but sees relative growth slow as legacy hubs saturate. Energy limitations redirect projects to overlooked states: AWS earmarks USD 11 billion for Indiana, Compass breaks ground on a USD 10 billion Mississippi campus, and STACK commits over 1 GW in Northern Virginia. Canada's Digital Ambition program accelerates federal cloud adoption, propelled by Shared Services Canada's brokerage role.

Europe balances demand with carbon-neutral targets. Regulations such as DORA compel financial firms to diversify providers while national energy caps limit capacity in traditional locations like Dublin and Amsterdam. Alternative metros-Berlin, Warsaw, Oslo, Zurich, Milan, Vienna, and Marseille-rise thanks to renewable grids and supportive permitting regimes. The EU's aim for zero-carbon data centers by 2030 spurs investment in heat-reuse schemes and offshore wind tie-ins, shaping the next phase of the cloud infrastructure market.

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- Alibaba Cloud

- IBM Cloud

- Oracle Cloud Infrastructure (OCI)

- Tencent Cloud

- Huawei Cloud

- OVHcloud

- DigitalOcean

- Rackspace Technology

- Hetzner

- Equinix Metal

- Cloudflare Workers / R2

- Linode / Akamai

- Oracle Cloud (Japan)

- Liquid Sky (Africa)

- Wasabi Technologies

- Scaleway

- SAP Business Technology Platform (BTP-IaaS portion)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream Accelerating Gen-AI infrastructure demand

- 4.2.2 Mainstream Enterprise hybrid & multi-cloud migration spike

- 4.2.3 Mainstream Hyperscaler CAPEX race (>$250 bn in 2025)

- 4.2.4 Mainstream Edge-to-core latency requirements in 5G era

- 4.2.5 Under-the-radar Long-duration green-energy PPAs unlocking new DC sites

- 4.2.6 Under-the-radar Government sovereign-AI sandboxes mandating local IaaS nodes

- 4.3 Market Restraints

- 4.3.1 Mainstream Escalating energy-grid constraints

- 4.3.2 Mainstream Data-sovereignty & extraterritoriality conflicts

- 4.3.3 Under-the-radar Liquid-cooling supply-chain bottlenecks

- 4.3.4 Under-the-radar Surging insurance premiums for >100 MW hyperscale campuses

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (AI accelerators, liquid cooling, Zero-Trust fabrics)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Mode

- 5.1.1 Public Cloud

- 5.1.2 Private Cloud

- 5.1.3 Hybrid Cloud

- 5.2 By Service Type

- 5.2.1 Compute as a Service (CaaS)

- 5.2.2 Storage as a Service (STaaS)

- 5.2.3 Networking & CDN

- 5.2.4 Database / Analytics as a Service (DBaaS)

- 5.2.5 Disaster-Recovery as a Service (DRaaS)

- 5.2.6 Managed Hosting / Dedicated Cloud

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 IT & Telecom

- 5.3.3 Healthcare & Life Sciences

- 5.3.4 Media & Entertainment

- 5.3.5 Retail & e-Commerce

- 5.3.6 Government & Public Sector

- 5.3.7 Manufacturing & Automotive

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 UAE

- 5.4.5.1.2 Saudi Arabia

- 5.4.5.1.3 Turkey

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Nigeria

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Amazon Web Services (AWS)

- 6.4.2 Microsoft Azure

- 6.4.3 Google Cloud Platform (GCP)

- 6.4.4 Alibaba Cloud

- 6.4.5 IBM Cloud

- 6.4.6 Oracle Cloud Infrastructure (OCI)

- 6.4.7 Tencent Cloud

- 6.4.8 Huawei Cloud

- 6.4.9 OVHcloud

- 6.4.10 DigitalOcean

- 6.4.11 Rackspace Technology

- 6.4.12 Hetzner

- 6.4.13 Equinix Metal

- 6.4.14 Cloudflare Workers / R2

- 6.4.15 Linode / Akamai

- 6.4.16 Oracle Cloud (Japan)

- 6.4.17 Liquid Sky (Africa)

- 6.4.18 Wasabi Technologies

- 6.4.19 Scaleway

- 6.4.20 SAP Business Technology Platform (BTP-IaaS portion)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space & Unmet-Need Assessment