PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910597

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910597

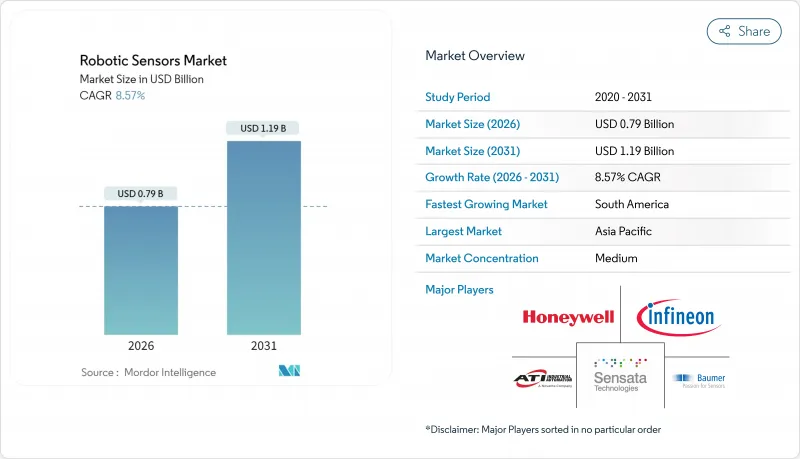

Robotic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The robotic sensors market is expected to grow from USD 0.73 billion in 2025 to USD 0.79 billion in 2026 and is forecast to reach USD 1.19 billion by 2031 at 8.57% CAGR over 2026-2031.

Growth stems from record-high industrial-robot deployments, rapid gains in collaborative and humanoid platforms, and the steady infusion of edge-AI modules that elevate perception accuracy and response times. Force-torque devices underpin precision assembly lines, while vision systems accelerate as deep-learning models migrate from the cloud to the robot arm. Semiconductor makers now bundle sensing, processing, and safety logic on a single chip, giving factories lower latency and better cyber-physical resilience. End-users in automotive, electric-vehicle, and healthcare domains intensify spending on multimodal sensing to improve yield, traceability, and human-machine cooperation. Regionally, Asia-Pacific's dense manufacturing base and policy incentives support scale economics, whereas South America's automation catch-up provides a high-growth runway.

Global Robotic Sensors Market Trends and Insights

Industrial-robot installations hit record levels

Global operational stock crossed 4 million units in 2024, forcing manufacturers to adopt richer sensing suites that go beyond encoders to vision, force, and tactile modalities. FANUC's 500i-A CNC control, with 2.7X CPU throughput, illustrates how faster on-board computing now digests complex sensor streams in real time. Collaborative cells amplify demand for redundant safety sensing, while Delta's D-Bot cobots demonstrate payload-specific plug-and-play sensor packages that simplify integration. High install volumes shorten the payback period for advanced perception, locking in orders across the robotic sensors market.

E-commerce logistics demand for sensorised AMRs

Robust online retail lifted the global mobile-robot space to USD 4.5 billion in 2024, propelling need for wide-angle perception, mapping, and package-quality assessment inside dynamic warehouses. Low-cost 3D ultrasonic arrays such as Sonair's deliver 180 X 180 degree coverage while undercutting LiDAR by up to 80%, trimming capital hurdles for mid-tier fulfilment centers. AI-enhanced vision now differentiates between pallet racks, forklifts, and staff apparel, boosting uptime and throughput. Touch-enabled grippers let AMRs handle fragile SKUs, expanding use cases and fuelling sensor volumes.

Persistent MEMS supply-chain volatility

Trade restrictions on gallium and antimony alongside natural-disaster risks at Asian foundries strain lead times and elevate die-level costs. Sourceability forecasts continued wafer-start bottlenecks through 2026, squeezing availability for high-pin-count sensor ASICs. Labor shortages add uncertainty, prompting some OEMs to dual-source or relocate backend packaging, yet such moves raise capital intensity and operational complexity.

Other drivers and restraints analyzed in the detailed report include:

- Rapid price decline of six-axis force-torque sensors

- Regulatory incentives for human-robot collaboration

- CapEx barriers for SMEs in emerging markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vision sensors are forecast to post a 13.27% CAGR from 2026-2031, outpacing all other categories. At the same time, force-torque devices retained 27.62% share of the robotic sensors market in 2025. The mass adoption of high-speed visual inspection and pick-and-place tasks legitimises investment in on-board GPUs and ASICs that compress inference latency below 30 ms. As camera prices slide, even mid-tier OEMs adopt dual-sensor stereo rigs to tackle depth estimation. Force sensing stays indispensable for press-fit, deburring, and electronic-connector assembly, where sub-newton accuracy safeguards yield. Cognex's 2023 revenue of USD 837.5 million signals cyclical yet resilient appetite for machine vision hardware when capex rebounds.

Sensor miniaturization lets builders co-locate proximity, temperature, and vision modules within tight robot wrists, reducing cabling and electromagnetic noise. Tactile arrays such as XELA Robotics' uSkin, with 0.1 gram-force sensitivity, deepen dexterity on grippers, but they still sit in the "others" bucket of the robotic sensors market. The fusion of stereo vision, IMU, and force vectors bolsters compliance control during assembly of irregular parts, a capability prized in wearable-device lines and customised orthopedics. Standardised M12 connectors and Power-over-Ethernet streamline installation, widening accessibility for SMEs. Over the forecast window, suppliers that offer modular, AI-ready vision suites are expected to capture a disproportionate slice of incremental robotic sensors market size in this segment.

Industrial robots have historically anchored demand, accounting for 54.62% of the robotic sensors market size in 2025. Their entrenched role in welding, painting, and electronics assembly ensures a stable replacement cycle. However, humanoid platforms are projected to lead growth with a 36.7% CAGR through 2031, energised by sustained venture capital inflows and component cost deflation. Tacta Systems' capital raise underscores confidence that humanoids can address logistics, retail, and eldercare gaps once safety and dexterity reach human parity.

Collaborative robots continue to win midsize factories that need flexible line changeovers and cannot afford extensive guarding. Edge-AI subsystems now allow 'zero-programming' teach modes, lowering skill thresholds and expanding the addressable user base. Professional service robots surge across hospitals and airports, where infection-control or passenger-service tasks require reliable perception and gentle interaction. Yaskawa's MOTOMAN NEXT family demonstrates self-optimising motion planning, a trend that multiplies sensor count per unit as platforms aim for situational awareness. Over the horizon, accelerated adoption in humanoids will further diversify the robotic sensors market, giving suppliers a potent new volume pool beyond classical industrial automation.

The Robotic Sensors Market Report is Segmented by Sensor Type (Force & Torque Sensors, Vision Sensors, and More), Robot Type (Industrial Robots, Collaborative Robots, Service Robots - Professional, and More), End-User Industry (Automotive & EV, Electronics & Semiconductor, and More), Sensing Technology (Strain-Gauge, Capacitive, Optical, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 34.72% revenue share in 2025, buoyed by China's industrial-upgrade subsidies, Japan's Society 5.0 blueprint, and South Korea's memory-chip investment wave. OMRON's JPY 876.1 billion net sales validate robust regional appetite for sensor-driven automation. Close proximity to MEMS fabs compresses lead times, while local tier-one automakers and electronics giants guarantee baseline demand. Geopolitical frictions around chip export controls, however, may force supply-chain re-routing and incremental costs.

Europe follows, anchored by Germany's Industry 4.0 roadmap and rigorous safety statutes that elevate certified sensing systems. SICK's EUR 2.307 billion turnover in 2024 underscores healthy momentum, especially in automotive and logistics hubs. Southern Europe's growing cobot footprint, exemplified by FANUC's Iberia expansion, widens market breadth. Nordic firms push envelope applications in offshore wind and mining, where IP-rated, vibration-hardy sensors prevail.

North America remains innovation-centric, with US labs refining AI-on-edge perception and Canadian mines adopting rugged sensors for autonomous hauling. Mexico's near-shoring trend channels production lines into Bajio corridors, pulling demand for cost-effective sensing. South America, despite lower installed base, is on track for the fastest CAGR at 10.45% as Brazilian automakers, Argentinian grain handlers, and Chilean lithium refiners automate to offset labor shortages and meet ESG audits. Regional development banks and multinationals co-finance pilot projects, seeding long-run sensor demand across the robotic sensors market.

- ATI Industrial Automation (Novanta Inc.)

- Bota Systems AG

- Baumer Group

- FANUC Corporation

- FUTEK Advanced Sensor Technology, Inc.

- Honeywell International Inc.

- Infineon Technologies AG

- OMRON Corporation

- Sensata Technologies Holding plc

- TE Connectivity Ltd.

- Tekscan, Inc.

- Sick AG

- Keyence Corporation

- Cognex Corporation

- Epson Robotics (Seiko Epson Corp.)

- Yaskawa Electric Corporation

- Delta Electronics, Inc.

- DENSO Wave Incorporated

- Bosch Rexroth AG

- Rockwell Automation, Inc.

- Schunk GmbH and Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industrial-robot installations hit record levels

- 4.2.2 E-commerce logistics demand for sensorised AMRs

- 4.2.3 Rapid price decline of six-axis force-torque sensors

- 4.2.4 Regulatory incentives for human-robot collaboration

- 4.2.5 Edge-AI sensor fusion modules for humanoid robots

- 4.2.6 Open-source ROS2 hardware reference designs

- 4.3 Market Restraints

- 4.3.1 Persistent MEMS supply-chain volatility

- 4.3.2 CapEx barriers for SMEs in emerging markets

- 4.3.3 Cyber-security certification costs for smart sensors

- 4.3.4 Export-control limits on advanced tactile ICs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 Force and Torque Sensors

- 5.1.2 Vision Sensors

- 5.1.3 Proximity Sensors

- 5.1.4 Position/Encoders

- 5.1.5 Temperature Sensors

- 5.1.6 Pressure Sensors

- 5.1.7 Others (Tactile, LiDAR, Ultrasonic)

- 5.2 By Robot Type

- 5.2.1 Industrial Robots

- 5.2.2 Collaborative Robots (Cobots)

- 5.2.3 Service Robots - Professional

- 5.2.4 Service Robots - Domestic

- 5.2.5 Humanoid Robots

- 5.3 By End-user Industry

- 5.3.1 Automotive and EV

- 5.3.2 Electronics and Semiconductor

- 5.3.3 Logistics and Warehousing

- 5.3.4 Food and Beverage

- 5.3.5 Healthcare and Medical Devices

- 5.3.6 Other Industries (Metals, Plastics, etc.)

- 5.4 By Sensing Technology

- 5.4.1 Strain-gauge

- 5.4.2 Capacitive

- 5.4.3 Optical (CMOS, LiDAR)

- 5.4.4 Magnetic and Hall-effect

- 5.4.5 Piezoelectric

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ATI Industrial Automation (Novanta Inc.)

- 6.4.2 Bota Systems AG

- 6.4.3 Baumer Group

- 6.4.4 FANUC Corporation

- 6.4.5 FUTEK Advanced Sensor Technology, Inc.

- 6.4.6 Honeywell International Inc.

- 6.4.7 Infineon Technologies AG

- 6.4.8 OMRON Corporation

- 6.4.9 Sensata Technologies Holding plc

- 6.4.10 TE Connectivity Ltd.

- 6.4.11 Tekscan, Inc.

- 6.4.12 Sick AG

- 6.4.13 Keyence Corporation

- 6.4.14 Cognex Corporation

- 6.4.15 Epson Robotics (Seiko Epson Corp.)

- 6.4.16 Yaskawa Electric Corporation

- 6.4.17 Delta Electronics, Inc.

- 6.4.18 DENSO Wave Incorporated

- 6.4.19 Bosch Rexroth AG

- 6.4.20 Rockwell Automation, Inc.

- 6.4.21 Schunk GmbH and Co. KG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment