PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851799

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851799

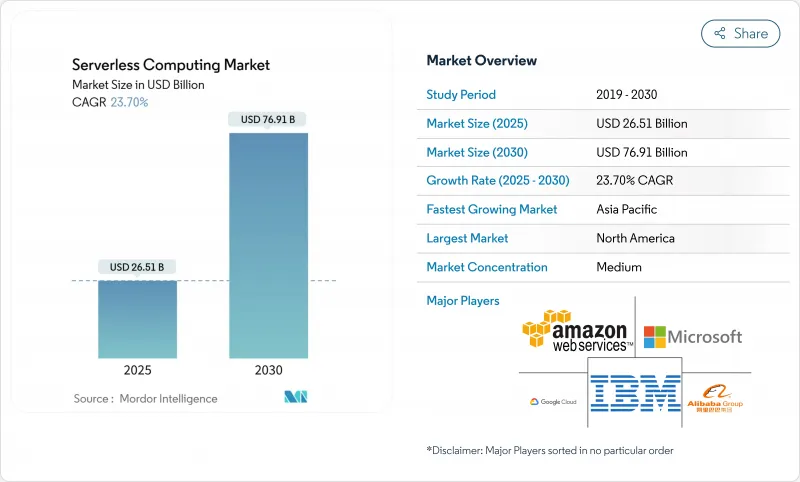

Serverless Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The serverless computing market is valued at USD 26.51 billion in 2025 and is forecast to touch USD 76.91 billion by 2030, advancing at a 23.7% CAGR.

Demand is rising because development teams want to write code without managing infrastructure, and hyperscale clouds now bundle robust observability, security and integration capabilities. Momentum is reinforced by event-driven microservices, edge-native 5G deployments, and real-time AI workloads that scale irregularly yet require sub-second response. Enterprises are moving from cost savings to innovation goals, using serverless to speed new digital products, automate DevSecOps and support data-sovereign architectures. Public cloud remains the dominant deployment model, but multi-cloud strategies are gaining ground as enterprises look to balance best-of-breed features with vendor risk.

Global Serverless Computing Market Trends and Insights

Accelerating Shift to Event-Driven Microservices in North American BFSI Modernization

Banks and insurers are replacing monoliths with granular services that react to card swipes, loan quotes and fraud signals in near real time. Using serverless functions, leading North American institutions trimmed development cycles by 35-40% and shaved 28.3% off infrastructure spend, freeing budget for new digital features. The model's pay-per-execute billing fits irregular transaction volumes common in payments and wealth platforms. API-first designs also simplify regulatory audits because each function can log, encrypt and version individually. As zero-trust rules tighten, BFSI teams prefer ephemeral compute that reduces attack surface while meeting stringent audit trails.

Surging Demand for DevSecOps-Ready Multi-Cloud Pipelines Across European Retail and E-commerce

European retailers race to match instant checkout and personalized offers while obeying GDPR. Eighty-nine percent now distribute serverless workloads across at least two clouds to avoid lock-in and maintain regional data residency. Built-in policy engines scan code on every commit, integrate security tests into CI/CD and auto-encrypt secrets, shrinking vulnerability windows. By shifting security left, teams cut remediation time and push features faster during seasonal peaks such as Singles' Day and Black Friday.

Debugging and Observability Gaps in Highly Distributed Micro-Functions

Traditional APM agents cannot trace ephemeral functions that live for milliseconds, leaving blind spots during root-cause analysis. Enterprises report troubleshooting serverless apps takes 2.4 times longer than monoliths because logs scatter across services and cold-starts mask latency outliers. Emerging solutions now inject lightweight span IDs and export them to open-standard back ends, yet maturity lags mainstream tooling. Until traces, metrics and logs consolidate seamlessly, risk-averse sectors will hesitate to migrate mission-critical systems.

Other drivers and restraints analyzed in the detailed report include:

- Roll-out of Edge-Native 5G MEC Driving Serverless Adoption Among Asia Telecom Operators

- Real-Time AI/ML Inference Workloads Propelling Function-as-a-Service Uptake in Healthcare

- Vendor Lock-In Risk Amplified by Proprietary Event Orchestration Engines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Managed Services held 62% of 2024 revenue as organizations prioritized turnkey operations, but Professional Services is expanding at an 18.4% CAGR to 2030 as firms tackle complex modernization programs. Many regulated enterprises hire consulting partners to redesign event schemas, refactor monoliths and validate compliance before going live. Advisory teams integrate serverless security patterns, policy-as-code and FinOps dashboards to maximize business value.

Professional Services also support culture change, training product squads on asynchronous design and observability best practices. As serverless footprints widen to analytics, AI and edge, continuous governance and platform engineering join development assistance in bundled engagements. This evolution sustains high-margin growth for integrators while improving enterprise time-to-value.

Function-as-a-Service captured 58% of spending in 2024 and will keep anchoring the serverless computing market through 2030. Yet Backend-as-a-Service is the star growth segment at 25% CAGR as teams seek higher-level constructs that collapse authentication, storage and real-time sync into API calls. Mobile developers in particular appreciate one-line integration for login and push notifications, cutting launch cycles from weeks to hours.

BaaS complements FaaS by offloading boilerplate tasks, letting functions focus on differentiated logic. Unified API gateways route traffic uniformly across both paradigms, while serverless containers fill performance gaps that demand longer-lived processes. The spectrum of abstractions allows architects to mix and match for cost, latency and compliance needs.

The Serverless Computing Market Report is Segmented by Service Model (Professional Services and Managed Services), Service Type (Function-As-A-Service (FaaS), Backend-As-A-Service (BaaS), and More), Deployment Model (Public Cloud, Private Cloud, and More), End-User Industry (IT and Telecommunications, BFSI, and More), and Geography

Geography Analysis

North America drove 38% of 2024 serverless revenue, supported by abundant cloud talent, aggressive digital banking roadmaps, and U.S. federal zero-trust directives that favor ephemeral compute for reduced attack surface. Enterprises leverage serverless to modernize legacy stacks, employ event streams for customer personalization, and run compliance-ready logging pipelines. Canada mirrors these patterns, especially among telcos integrating 5G edge functions, while Mexico's fintech startups adopt serverless to scale payment APIs securely.

Asia Pacific is the fastest-growing region, projected at 19.8% CAGR to 2030. China's internet majors invest in native serverless AI services, and India's booming SaaS sector embraces the pay-as-you-go model to manage unpredictable global demand. Japanese and South Korean manufacturers integrate edge functions for predictive maintenance, whereas ASEAN fintech and e-commerce players deploy multi-cloud serverless stacks to reach regional customers with low latency. The confluence of 5G MEC, affordable cloud spots and developer upskilling accelerates uptake across the region.

Europe maintains a strong position as organizations adopt multi-cloud to satisfy GDPR and state sovereignty rules. The United Kingdom, Germany and France lead with retail, banking and public-sector pilots that share common blueprints for encryption, audit and residency. Nordic countries push boundaries with green data-center integrations and event-driven energy grids. Vendors respond with localized zones and portable runtimes, reinforcing growth despite stricter compliance landscapes.

- Amazon Web Services Inc.

- Microsoft Corp.

- Google LLC

- Alibaba Group Holding Ltd.

- IBM Corp.

- Oracle Corp.

- SAP SE

- VMware Inc.

- Red Hat Inc.

- Cloudflare Inc.

- Fastly Inc.

- Tencent Cloud

- Huawei Cloud

- Netlify Inc.

- Vercel Inc.

- DigitalOcean Inc.

- Iron.io

- TriggerMesh Inc.

- Serverless Inc.

- Stackery Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating shift to event-driven microservices in North American BFSI modernisation

- 4.2.2 Surging demand for DevSecOps-ready multi-cloud pipelines across European retail and e-commerce

- 4.2.3 Roll-out of edge-native 5G MEC driving serverless adoption among Asia telecom operators

- 4.2.4 Real-time AI/ML inference workloads propelling Function-as-a-Service uptake in healthcare

- 4.2.5 Government Zero-Trust mandates boosting serverless security toolchains in US federal IT

- 4.2.6 Rapid expansion of API monetisation platforms in LATAM fintech ecosystems

- 4.3 Market Restraints

- 4.3.1 Debugging and observability gaps in highly distributed micro-functions

- 4.3.2 Vendor lock-in risk amplified by proprietary event orchestration engines

- 4.3.3 Data residency compliance hurdles for multi-region serverless data stores

- 4.3.4 Cold-start latency constraints in high-frequency trading and gaming workloads

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Technology Snapshot

- 4.9.1 API Gateway

- 4.9.2 Function-as-a-Service (FaaS)

- 4.9.3 Backend-as-a-Service (BaaS)

- 4.9.4 Database-as-a-Service (DBaaS)

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Model

- 5.1.1 Professional Services

- 5.1.2 Managed Services

- 5.2 By Service Type

- 5.2.1 Function-as-a-Service (FaaS)

- 5.2.2 Backend-as-a-Service (BaaS)

- 5.2.3 API Gateway

- 5.2.4 Container-as-a-Service (CaaS)

- 5.3 By Deployment Model

- 5.3.1 Public Cloud

- 5.3.2 Private Cloud

- 5.3.3 Hybrid Cloud

- 5.3.4 Multi-Cloud

- 5.4 By End-user Industry

- 5.4.1 IT and Telecommunications

- 5.4.2 BFSI

- 5.4.3 Retail and E-commerce

- 5.4.4 Government and Public Sector

- 5.4.5 Healthcare and Life Sciences

- 5.4.6 Industrial and Manufacturing

- 5.4.7 Media and Entertainment

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Nordics

- 5.5.4.1 Sweden

- 5.5.4.2 Norway

- 5.5.4.3 Denmark

- 5.5.4.4 Finland

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Egypt

- 5.5.6.4 Rest of Africa

- 5.5.7 Asia Pacific

- 5.5.7.1 China

- 5.5.7.2 India

- 5.5.7.3 Japan

- 5.5.7.4 South Korea

- 5.5.7.5 ASEAN

- 5.5.7.6 Rest of Asia Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services Inc.

- 6.4.2 Microsoft Corp.

- 6.4.3 Google LLC

- 6.4.4 Alibaba Group Holding Ltd.

- 6.4.5 IBM Corp.

- 6.4.6 Oracle Corp.

- 6.4.7 SAP SE

- 6.4.8 VMware Inc.

- 6.4.9 Red Hat Inc.

- 6.4.10 Cloudflare Inc.

- 6.4.11 Fastly Inc.

- 6.4.12 Tencent Cloud

- 6.4.13 Huawei Cloud

- 6.4.14 Netlify Inc.

- 6.4.15 Vercel Inc.

- 6.4.16 DigitalOcean Inc.

- 6.4.17 Iron.io

- 6.4.18 TriggerMesh Inc.

- 6.4.19 Serverless Inc.

- 6.4.20 Stackery Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment