PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851805

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851805

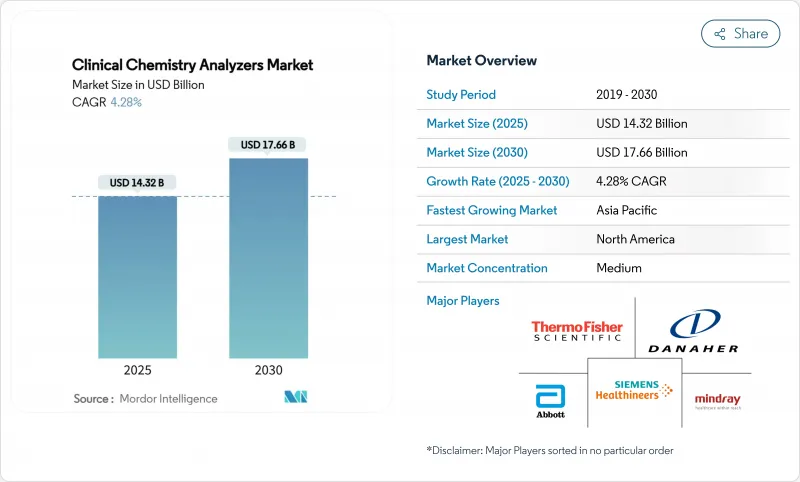

Clinical Chemistry Analyzers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The clinical chemistry analyzers market size stands at USD 14.32 billion in 2025 and is projected to reach USD 17.66 billion by 2030, advancing at a 4.28% CAGR during the forecast period.

The steady expansion reflects a maturing yet resilient space where automation, artificial intelligence, and data-centric workflows increasingly define value creation. Heightened demand for high-throughput instruments, combined with a pivot toward integrated informatics, is reshaping procurement decisions and softening the historic reliance on sheer test-volume growth. Vendors now differentiate by uptime, predictive maintenance, and middleware interoperability rather than reagent bundling alone. Hospital consolidation, point-of-care expansion, and chronic-disease surveillance continue to anchor daily test volumes, while capital investment cycles favor modular analyzers that can be field-upgraded as assay menus widen. Price pressures in emerging regions and stricter cybersecurity mandates remain headwinds, but the medium-term outlook is buoyed by demographic shifts and the migration of specialty biomarkers onto routine chemistry platforms, ensuring persistent demand for the clinical chemistry analyzers market.

Global Clinical Chemistry Analyzers Market Trends and Insights

Aging Population & Chronic-Disease Burden

Rapid demographic aging is intensifying chronic-disease testing needs, lifting daily demand for metabolic panels, cardiac markers, and renal function assays. Screening and monitoring protocols for diabetes, cardiovascular disorders, and chronic kidney disease have grown more stringent, producing test-volume curves that rise faster than population growth. High-throughput analyzers with auto-repeat and reflex testing options deliver the scalability required to keep pace with this influx, enabling laboratories to future-proof capacity without proportionate staffing increases. Instrument vendors that package workflow simulators and predictive analytics enjoy a competitive edge in capital tenders. In mature healthcare systems, pay-for-outcome reimbursement further cements the clinical chemistry analyzers market as a frontline resource for preventive care programs. Long term, demographic momentum ensures durable test volumes even amid episodic spending slowdowns.

Point-of-Care Adoption in Critical Care Settings

Emergency departments and intensive care units increasingly depend on near-patient chemistry panels that return results within minutes rather than hours. High-sensitivity cardiac troponin, lactate, and metabolic assessments now guide rapid triage, reducing door-to-needle times in myocardial infarction and sepsis pathways. bioMerieux's EUR 111 million move for SpinChip Diagnostics typifies strategic investment aimed at 10-minute cardiac marker turnaround. As device miniaturization narrows the analytical gap with central labs, decentralised workflows slash specimen transport delays and hospital length-of-stay, amplifying value for payers and providers. The resulting demand updraft positions benchtop systems and disposable microfluidic cartridges as high-growth niches within the clinical chemistry analyzers market.

Shortage of Skilled Lab Technologists

Vacancy rates of 17.3% in U.S. chemistry departments and 46% across total laboratory positions underline a widening skills gap. Recruitment lags stem from retiring baby-boom cohorts, limited training program capacity, and muted public visibility of the profession. While middleware automation eases manual workloads, oversight of quality-control flags and complex result interpretation still demands licensed staff. Laboratories respond with cross-training, relaxed credential prerequisites, and salary premiums, yet the supply-demand mismatch endures. For manufacturers, intuitive user interfaces, auto-verification algorithms, and remote diagnostics become product imperatives to counter workforce scarcity, reinforcing value propositions inside the clinical chemistry analyzers industry.

Other drivers and restraints analyzed in the detailed report include:

- AI-Enabled High-Throughput Automation

- Broader Metabolic/Specialty Chemistry Test Menu

- High Capital & Maintenance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The reagents segment accounted for 58.51% of clinical chemistry analyzers market size in 2024, reflecting the entrenched consumable model that underwrites laboratory cash flow. Revenues remain predictable as recurrent test volumes anchor demand for calibrators, controls, and enzyme substrates. Yet capital investments are tilting toward fully automated analyzer platforms that promise faster throughput, AI-backed maintenance, and consolidated assay menus, resulting in an 8.25% CAGR forecast for analyzers through 2030. Instrument purchases increasingly include middleware licenses and cloud dashboards bundled into total-solution contracts, signaling a shift from component pricing to outcome-based procurement.

Benchtop analyzers are outpacing floor-standing units in shipment growth, powered by point-of-care expansion and the repatriation of acute panels into emergency wards. Vendors differentiate via cartridge ergonomics, sample traceability, and rapid QC unlock times that maximize uptime. Reagent innovation centers on liquid-stable formulations with extended onboard stability, trimmed plastic volume per test, and barcoded pack tracking that feeds inventory analytics. Specialty chemicals for high-sensitivity cardiac troponin and emerging sepsis markers deliver premium margins, partially offsetting price erosion in basic metabolic reagents. The combined effect is a balanced ecosystem where consumables guarantee baseline revenue while hardware upgrades unlock step-change efficiency, fortifying long-term demand for the clinical chemistry analyzers market.

The Clinical Chemistry Analyzers Market Report is Segmented by Product Type (Analyzers [Floor-Standing High-Throughput, and More], Reagents, and Others), Types of Test (Basic Metabolic Panel, Liver Panel, Electrolyte Panels, and More), End User (Hospitals, Independent Diagnostic Laboratories, and More) and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 34.32% of 2024 revenue, anchored by robust reimbursement, rapid AI adoption, and a dense installed base of next-generation analyzers. The FDA's LDT Final Rule, while elevating compliance costs, cements a high regulatory bar that entrenches incumbent suppliers who can furnish validated systems and documentation at scale, bolstering overall sales momentum within the region. Europe follows with steady replacement demand but must navigate IVDR-driven re-certification workloads that tax manufacturer resources.

Asia-Pacific is forecast to post a vigorous 7.71% CAGR, driving outsized contribution to future global clinical chemistry analyzers market size. China leads volume growth, propelled by provincial hospital consolidation and chronic-disease screening mandates, even as volume-based-procurement schemes challenge vendor pricing power. India and Southeast Asian nations accelerate rural diagnostic outreach via public-private partnerships, boosting benchtop and semi-automated analyzer adoption. Latin America and the Middle East & Africa present mid-single-digit trajectories tied to health-insurance expansion and laboratory infrastructure modernization, albeit vulnerable to currency volatility. Vendors that tailor reagent pack sizes, financing terms, and field-service footprints to local realities capture disproportionate share, underscoring geography-specific execution as a decisive success factor in the clinical chemistry analyzers market.

- Abbott Laboratories

- Danaher Corp. (Beckman Coulter)

- Roche

- Siemens Healthineers

- Thermo Fisher Scientific

- HORIBA

- Sysmex Corp.

- Mindray Medical

- Johnson & Johnson (Ortho Clinical)

- Elitech Group

- Hitachi High-Tech

- Randox Laboratories

- DIRUI Industrial

- Bio-Rad Laboratories

- Shenzhen Mindray Bio-Medical

- Agappe Diagnostics

- Xylem Analytics (YSI)

- Erba Mannheim

- Tecom Science

- Medica Corp.

- Diasys Diagnostics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Population & Chronic-Disease Burden

- 4.2.2 Point-Of-Care Adoption In Critical Care Settings

- 4.2.3 AI-Enabled High-Throughput Automation

- 4.2.4 Broader Metabolic/Specialty Chemistry Test Menu

- 4.2.5 Sustainability Push For Energy-Efficient Analyzers

- 4.2.6 Monetization Of Analyzer-Generated Data

- 4.3 Market Restraints

- 4.3.1 Shortage Of Skilled Lab Technologists

- 4.3.2 High Capital & Maintenance Costs

- 4.3.3 Rare-Earth-Dependent Reagent Supply Risk

- 4.3.4 Rising Cybersecurity & Compliance Overhead

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Analyzers

- 5.1.1.1 Floor-standing High-Throughput

- 5.1.1.2 Modular/Integrated Systems

- 5.1.1.3 Benchtop

- 5.1.1.4 Semi-automated

- 5.1.2 Reagents

- 5.1.2.1 Calibrators & Controls

- 5.1.2.2 Consumables

- 5.1.3 Others (QC Materials, Software Licenses)

- 5.1.1 Analyzers

- 5.2 By Types of Test

- 5.2.1 Basic Metabolic Panel

- 5.2.2 Electrolyte Panel

- 5.2.3 Liver Panel

- 5.2.4 Lipid Profile

- 5.2.5 Thyroid Function Panel

- 5.2.6 Renal Function Panel

- 5.2.7 Cardiac Markers

- 5.2.8 Specialty Chemistries

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Independent Diagnostic Laboratories

- 5.3.3 Academic & Research Institutes

- 5.3.4 Point-of-Care Centers

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Danaher Corp. (Beckman Coulter)

- 6.3.3 F. Hoffmann-La Roche Ltd

- 6.3.4 Siemens Healthineers

- 6.3.5 Thermo Fisher Scientific

- 6.3.6 Horiba Ltd

- 6.3.7 Sysmex Corp.

- 6.3.8 Mindray Medical

- 6.3.9 Johnson & Johnson (Ortho Clinical)

- 6.3.10 Elitech Group

- 6.3.11 Hitachi High-Tech

- 6.3.12 Randox Laboratories

- 6.3.13 DIRUI Industrial

- 6.3.14 Bio-Rad Laboratories

- 6.3.15 Shenzhen Mindray Bio-Medical

- 6.3.16 Agappe Diagnostics

- 6.3.17 Xylem Analytics (YSI)

- 6.3.18 Erba Mannheim

- 6.3.19 Tecom Science

- 6.3.20 Medica Corp.

- 6.3.21 Diasys Diagnostics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment