PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851806

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851806

3D Printed Medical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

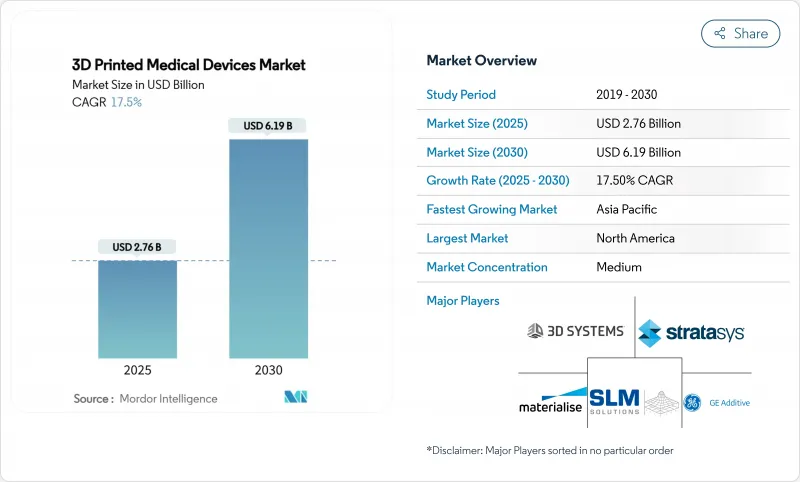

The 3D Printed Medical Devices Market size is estimated at USD 2.76 billion in 2025, and is expected to reach USD 6.19 billion by 2030, at a CAGR of 17.5% during the forecast period (2025-2030).

Adoption accelerates as point-of-care manufacturing shortens lead times, material science improves polymer and metal performance, and regulators issue clearer pathways for patient-specific devices. Hospital-owned print laboratories already cut surgical planning time by 62 minutes per case, saving USD 3,720 per procedure while keeping quality under surgeons' direct control. Laser beam melting continues to anchor high-value orthopedic and cranio-maxillofacial implants, yet binder jetting gains momentum for faster batch production of metal components. Competitive intensity rises as hardware revenues soften; incumbents now pivot toward software, bioprinting partnerships, and workflow automation to defend margins and capture recurring revenue from consumables.

Global 3D Printed Medical Devices Market Trends and Insights

Easy Mass-Customization Capability

Patient-specific printing removes the constraint of one-size-fits-all devices. Since August 2024, 3D Systems' EXT 220 MED platform has supported more than 60 cranioplasties, each matched precisely to the patient's anatomy. Basel surgeons implanted the first MDR-compliant 3D-printed PEEK facial implant in March 2025, bypassing prolonged external supply chains. Operating rooms now generate surgical guides with 100% dimensional accuracy, replacing iterative template revisions. Complex trabecular structures printed in titanium or PEEK foster osseointegration and mitigate stress shielding, directly improving orthopedic outcomes. The shift from mass production to mass customization underpins higher clinical value and supports premium reimbursement models.

Rising Transplant Waiting Lists

More than 100,000 Americans remain on transplant lists, spurring investment in tissue and organ bioprinting. Bioprinting firms secured record funding in 2024, and the related market is projected to grow at an 11.8% CAGR to 2034. Galway researchers in 2025 printed contractile heart tissue that morphs under cell-generated forces, bringing functional organs closer to clinical reality.As vascularization techniques mature, bioprinted constructs move beyond research and toward regulated therapy, positioning the segment as a long-term relief valve for organ shortages.

Stringent FDA Class-III Device Clearance Pathway

Implantable devices often default to class-III, demanding exhaustive biocompatibility and clinical evidence. ISO 10993-1 guidance can stretch review cycles 12-18 months longer than for traditional forgings. Still, the agency's 510(k) database logged notable 2024 wins: Curiteva's PEEK lumbar fusion and Restor3D's cementless knee replacement gained clearance, illustrating that equivalence arguments are possible even for additively manufactured implants. Achieving predicate alignment remains complex when lattice structures or gradient compositions have no historical analogs.

Other drivers and restraints analyzed in the detailed report include:

- Cost and Lead-Time Reduction vs. Subtractive Manufacturing

- Surge in Hospital-Owned Point-of-Care Print Labs

- High Material Qualification Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware generated 61% of the 3D printed medical devices market size in 2024 because hospitals and service bureaus first invest in printers and clean-room modifications. Industrial bioprinters cost USD 200,000-500,000, reinforcing up-front capital intensity. Printer utilization subsequently feeds recurring revenue through polymers, metal powders, and cell-laden hydrogels, a pattern evident as Stratasys posted record consumables revenue even while total sales slipped in 2024.

Printers alone no longer differentiate suppliers; workflow software now shortens design iterations, automates support generation, and links directly to sterilization logs. AI-driven platforms cut complex anatomical model preparation from 100 hours to 18 hours, lifting throughput for overstretched clinical engineers. Service offerings remain fragmented, yet health-system buyers increasingly demand integrated ecosystems that combine hardware, validated materials, cloud rendering, and on-site support contracts.

Prosthetics and implants commanded 39% of the 3D printed medical devices market share in 2024, anchored by cranio-maxillofacial and orthopedic demand. Surgeons value latticed titanium hip cups or PEEK skull plates that reduce stress shielding and enable imaging clarity. Regenerative medicine pushes tissue engineering forward at an 11.8% CAGR, outpacing traditional implant growth as scaffold vascularization and immune modulation mature.

Printed surgical guides and instruments further widen the application mix, cutting intraoperative time and improving resection accuracy. University Hospital Basel proved regulatory viability when its team implanted the first MDR-compliant facial PEEK device on-site in March 2025. Tissue engineering will broaden into organ-on-chip platforms that aid drug discovery, reinforcing convergence between device and pharmaceutical workflows.

3D Printed Medical Devices Market is Segmented by Offering (Hardware and Software), Type (Surgical Guides, Surgical Instruments, Prosthetics and Implants, and More), Material (Plastics, Metal, and Metal Alloy Powders and More), Technology(laser Beam Melting, Photopolymerization (UV), Electron Beam Melting and More, ) End User(Hospitals and Surgical Centers, Specialty Clinics) and Geography.

Geography Analysis

North America contributed 46% of global revenue in 2024, reflecting early FDA guidance, mature reimbursement codes, and heavy hospital infrastructure investment. The region's ecosystem deepens as DARPA channels grants into battlefield bioprinting and smart bandages that merge additive electronics with antimicrobial delivery. Consolidation continues; Enovis paid EUR 800 million for LimaCorporate, expanding its 3D-printed titanium hip portfolio.

Asia-Pacific held a 20% share but outpaced the global 17.5% CAGR. China's NMPA cleared 61 innovative devices in 2024, an 11% year-on-year increase that shortens time-to-market for domestic startups. Japan's USD 40 billion medical device sector grows 5.5% annually, driven by aging demographics that demand minimally invasive implants. India harmonizes its regulatory code with IMDRF principles, attracting foreign direct investment for local printer assembly and powder atomization.

Europe balances strict MDR requirements with robust R&D incentives. Germany invests in additive qualifications that transfer know-how from automotive firms to orthopedic suppliers, while UK universities spin out software startups specializing in generative implant design. Sustainability policies emphasizing circular manufacturing favor additive techniques that reuse powders and eliminate machining waste.

- 3D Systems

- Stratasys

- Materialise

- EOS GmbH

- SLM Solutions

- Renishaw

- GE Additive

- Carbon

- Desktop Metal

- Organovo

- PrintBio

- Prodways Group

- Curiteva

- Formlabs

- Concept Laser

- Arcam AB

- Dentsply Sirona

- Zimmer Biomet

- Johnson and Johnson (DePuy Synthes)

- Medtronic

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream: Easy mass-customization capability

- 4.2.2 Mainstream: Rising transplant waiting lists

- 4.2.3 Mainstream: Cost and lead-time reduction vs. subtractive manufacturing

- 4.2.4 Under-the-radar: Surge in hospital-owned point-of-care print labs

- 4.2.5 Under-the-radar: ISO/ASTM 52931 biocompatibility standard unlocking new polymers

- 4.2.6 Under-the-radar: Defense-funded battlefield bioprinting programs

- 4.3 Market Restraints

- 4.3.1 Mainstream: Stringent FDA class-III device clearance pathway

- 4.3.2 Mainstream: High material qualification costs

- 4.3.3 Under-the-radar: Shortage of GMP-grade bio-inks

- 4.3.4 Under-the-radar: Cyber-sabotage risks in distributed print files

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter'ss Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offerings

- 5.1.1 Hardware

- 5.1.1.1 3D Printers

- 5.1.1.1.1 FDM Printers

- 5.1.1.1.2 SLS Printers

- 5.1.1.1.3 SLA/DLP Printers

- 5.1.1.1.4 Bioprinters

- 5.1.1.2 Materials

- 5.1.2 Software

- 5.1.1 Hardware

- 5.2 By Type

- 5.2.1 Surgical Guides

- 5.2.2 Surgical Instruments

- 5.2.3 Prosthetics and Implants

- 5.2.3.1 Orthopedic

- 5.2.3.2 Dental

- 5.2.3.3 Cranio-maxillofacial

- 5.2.4 Tissue Engineering Products

- 5.3 By Materials

- 5.3.1 Plastics

- 5.3.2 Metal and Metal Alloy Powders

- 5.3.3 Biocompatible Polymers

- 5.3.4 Ceramics

- 5.4 By Technology

- 5.4.1 Laser Beam Melting

- 5.4.2 Photopolymerization (UV)

- 5.4.3 Electron Beam Melting

- 5.4.4 Extrusion-based

- 5.4.5 Binder Jetting

- 5.5 By End User

- 5.5.1 Hospitals and Surgical Centers

- 5.5.2 Specialty Clinics

- 5.5.3 Academic and Research Institutes

- 5.5.4 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia and New zealand

- 5.6.4.6 Rest of APAC

- 5.6.5 Middle East

- 5.6.5.1 GCC

- 5.6.5.2 Turkey

- 5.6.5.3 Israel

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 3D Systems

- 6.4.2 Stratasys

- 6.4.3 Materialise

- 6.4.4 EOS GmbH

- 6.4.5 SLM Solutions

- 6.4.6 Renishaw

- 6.4.7 GE Additive

- 6.4.8 Carbon

- 6.4.9 Desktop Metal

- 6.4.10 Organovo

- 6.4.11 PrintBio

- 6.4.12 Prodways Group

- 6.4.13 Curiteva

- 6.4.14 Formlabs

- 6.4.15 Concept Laser

- 6.4.16 Arcam AB

- 6.4.17 Dentsply Sirona

- 6.4.18 Zimmer Biomet

- 6.4.19 Johnson and Johnson (DePuy Synthes)

- 6.4.20 Medtronic

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment