PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851809

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851809

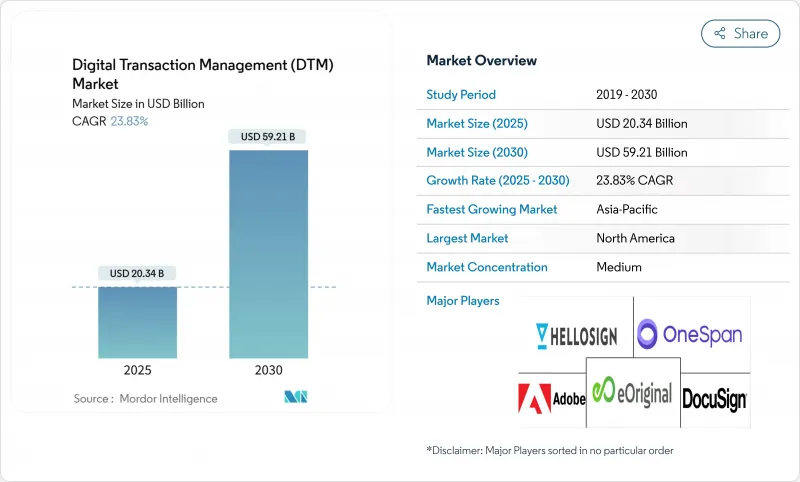

Digital Transaction Management (DTM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The digital transaction management market stands at USD 20.34 billion in 2025 and is projected to reach USD 59.21 billion by 2030, sustaining a robust 23.83% CAGR.

Investors view this trajectory as evidence that organizations now treat digital workflows as part of core strategy rather than back-office optimization. Accelerated deployment of blockchain for tamper-proof audit trails, rapid adoption of remote-work policies that favor cloud delivery, and a steady rise in generative-AI document tools collectively reinforce demand. Cyber-regulation alignment-most notably HIPAA, GDPR, and eIDAS-further legitimizes solutions that guarantee data integrity, identity assurance, and global enforceability.

Global Digital Transaction Management (DTM) Market Trends and Insights

Accelerating E-Signature Adoption Across Regulated Industries

U.S. election rules now allow e-signatures in 43 states, and the Department of Transportation is finalizing amendments that treat electronic attestations as legally valid for drug-testing records. These precedents demonstrate how statutory openness removes residual skepticism, letting enterprises shorten document cycles by 75% while maintaining compliance. Large health providers, for example, rely on qualified electronic signatures to synchronize cross-state consent forms without postal delays, thereby elevating patient satisfaction and trimming administrative overhead.

Shift Toward End-to-End Contract Lifecycle Automation in BFSI and Government

Banks process more than 20,000 active contracts simultaneously, exposing them to revenue leakage of up to 9% when oversight is weak. The rollout of blockchain-backed Citi Token Services shows how real-time settlement can shrink operational risk and unlock working-capital benefits for treasurers. Government agencies follow suit by centralizing procurement documents into searchable repositories, enabling near-instant policy audits and mitigating fraud. Together, these moves underscore why holistic automation-beyond simple e-signatures-is becoming mandatory budgeting line-item for CIOs.

Complex Cross-Border Crypto-Signature Regulations

eIDAS assigns top evidentiary weight to Qualified Electronic Signatures, yet mutual recognition outside the EU remains uneven (helpx.adobe.com). Additionally, data sovereignty mandates such as GDPR conflict with extraterritorial requests under the US CLOUD Act (isaca.org). This patchwork raises legal counsel costs and elongates go-to-market plans for providers trying to support multinational workflows, therefore tempering the digital transaction management market's near-term acceleration.

Other drivers and restraints analyzed in the detailed report include:

- Generative-AI Assistants Reducing Document Turn-Around Times

- Digital Identity Frameworks Catalyzing Adoption

- Limited 5G / Edge Infrastructure in Rural Areas Slowing Mobile DTM Usage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 70% of 2024 revenue, but services are forecast to expand at a 28.3% compound rate to 2030, the highest within the digital transaction management market. Financial institutions upgrading legacy stacks often lack in-house regulatory expertise, fueling demand for integration, compliance, and managed support. Example engagements in 2024 reduced processing errors and operating expense when consultancy teams unified e-signature workflows with core banking ledgers.

The solutions category is not stagnant; blockchain modules embed immutable audit trails while AI classification automates data capture. Vendors release vertical-specific templates that satisfy HIPAA and SOC 2 out-of-the-box, shortening time-to-value for healthcare and finance clients. Nevertheless, the intricate nature of mission-critical workflows implies ongoing reliance on external specialists, which sustains the services revenue curve.

Cloud platforms held 75% share in 2024, and their 26.1% CAGR means the digital transaction management market size for cloud deployments could double well before 2030. Enterprises value subscription pricing, rapid provisioning, and certified data centers that pass ISO 27001 and FedRAMP audits. Multi-cloud architectures now route sensitive data to local sovereign clouds while reserving burst capacity on public infrastructure, balancing agility with compliance.

On-premise installations still exist for defense, critical infrastructure, and select financial institutions, yet even these buyers adopt hybrid control planes that mirror cloud features behind the firewall. As encryption key management, confidential computing, and zero-trust frameworks mature, resistance to full cloud conversion will erode, maintaining the upward bias in cloud uptake.

The Digital Transaction Management Market Report is Segmented by Component (Solutions, Services), Deployment Mode (Cloud, On-Premise), Organization Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (Banking, Financial Services and Insurance, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 30.21% of digital transaction management market revenue in 2024. Mature legal clarity around electronic records encourages both private-sector and federal adoption. The U.S. Department of Transportation's pending rule on electronic drug-testing forms demonstrates continuous regulatory reinforcement of digital trust (federalregister.gov). Healthcare compliance roadmaps in the United States similarly accelerate usage, as providers exploit HIPAA-compatible e-signature stacks to streamline claims (iclg.com). Technology vendors headquartered in the region continue to roll out AI features that differentiate service quality and justify premium licensing.

Asia-Pacific is the fastest-growing arena with a 28.6% CAGR. The region processes more than half of the world's digital payments, and B2C e-commerce is projected to exceed EUR 4 trillion (USD 4.3 trillion) by 2027 (tmcnet.com). India's Unified Payments Interface aims beyond 200 billion annual transactions, intensifying demand for scalable signature engines. Hospitality, logistics, and public administration segments likewise embrace digital contracts to keep pace with a mobile-first consumer base. Regulatory heterogeneity remains, yet countries such as Indonesia recognize digital contracts provided core consent principles are satisfied (mondaq.com), signaling gradual convergence.

Europe benefits from the harmonized eIDAS regime, where qualified electronic signatures hold equivalence with handwritten ones (helpx.adobe.com). The forthcoming eIDAS 2.0 provisions and the EU Digital Identity Wallet promise seamless cross-border signing, reinforcing market confidence. Latin America and the Middle East and Africa record smaller baselines but high growth rates. Government digitization programs in Brazil and Gulf economies, coupled with expanding broadband access, create favorable conditions for the digital transaction management industry in those territories.

- Adobe Inc.

- DocuSign, Inc.

- Dropbox, Inc.

- Nintex Global Ltd.

- Namirial S.p.A.

- OneSpan Inc.

- Wolters Kluwer N.V.

- Entrust Corporation

- SignEasy Inc.

- Mitratech Holdings Inc.

- Sertifi, Inc.

- Thales Group (Gemalto N.V.)

- Nitro Software Ltd.

- airSlate Inc.

- PandaDoc Inc.

- Conga (Apttus Corporation)

- Zoho Corporation Pvt. Ltd.

- ZorroSign, Inc.

- Topaz Systems Inc.

- InfoCert S.p.A.

- AssureSign LLC

- eOriginal, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating E-Signature Adoption Across Regulated Industries

- 4.2.2 Shift Toward End-to-End Contract Lifecycle Automation in BFSI and Government

- 4.2.3 Mandatory Remote-Work Compliance Spurring Cloud-Based DTM Uptake

- 4.2.4 Generative-AI Assistants Reducing Document Turn-Around Times

- 4.2.5 Click-Wrap Acceptance Driving E-Commerce Conversion in Asia

- 4.2.6 Digital Identity Frameworks (eIDAS 2.0, Aadhaar, NID) Catalyzing Adoption

- 4.3 Market Restraints

- 4.3.1 Complex Cross-Border Crypto-Signature Regulations

- 4.3.2 High Cost of Qualified Remote ID Assurance in Emerging Markets

- 4.3.3 Fragmented Legacy Core-Banking Workflows Hindering Full Automation

- 4.3.4 Limited 5G / Edge Infrastructure in Rural Areas Slowing Mobile DTM Usage

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Macroeconomic Trend Impact Assessment

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Organization Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 Banking, Financial Services and Insurance

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Retail and E-commerce

- 5.4.4 Government and Public Sector

- 5.4.5 IT and Telecommunications

- 5.4.6 Education

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Adobe Inc.

- 6.4.2 DocuSign, Inc.

- 6.4.3 Dropbox, Inc.

- 6.4.4 Nintex Global Ltd.

- 6.4.5 Namirial S.p.A.

- 6.4.6 OneSpan Inc.

- 6.4.7 Wolters Kluwer N.V.

- 6.4.8 Entrust Corporation

- 6.4.9 SignEasy Inc.

- 6.4.10 Mitratech Holdings Inc.

- 6.4.11 Sertifi, Inc.

- 6.4.12 Thales Group (Gemalto N.V.)

- 6.4.13 Nitro Software Ltd.

- 6.4.14 airSlate Inc.

- 6.4.15 PandaDoc Inc.

- 6.4.16 Conga (Apttus Corporation)

- 6.4.17 Zoho Corporation Pvt. Ltd.

- 6.4.18 ZorroSign, Inc.

- 6.4.19 Topaz Systems Inc.

- 6.4.20 InfoCert S.p.A.

- 6.4.21 AssureSign LLC

- 6.4.22 eOriginal, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment