PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851810

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851810

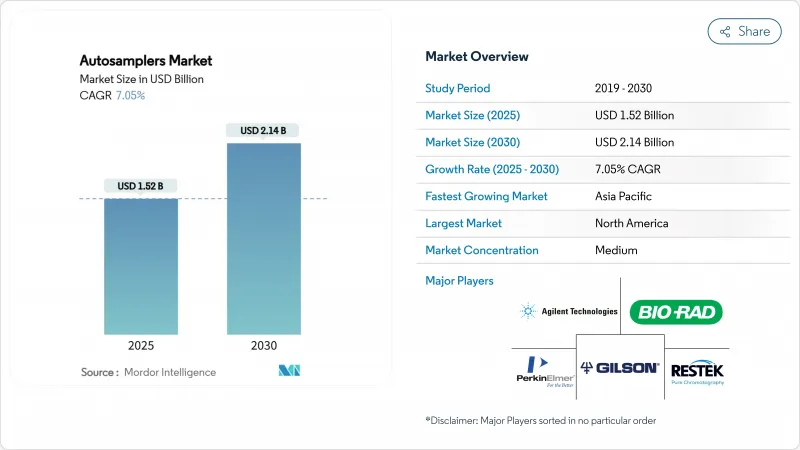

Autosamplers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Autosamplers Market size is estimated at USD 1.52 billion in 2025, and is expected to reach USD 2.14 billion by 2030, at a CAGR of 7.05% during the forecast period (2025-2030).

Strong replacement demand from pharmaceutical quality-control laboratories, together with growing environmental and food-safety testing volumes, sustains steady equipment revenues. Regulatory bodies such as the FDA now require detailed analytical method validation, prompting laboratories to adopt automated sample-injection platforms that eliminate operator variability and safeguard data integrity. Vendors also benefit from continuous upgrades toward AI-ready autosamplers that predict maintenance needs and reduce unplanned downtime. Heightened scrutiny of PFAS compounds in water supplies, pesticide residues in produce, and impurities in new chemical entities further widens the application base, pushing the autosamplers market toward higher throughput and improved sensitivity. Ongoing capital investment in Asia Pacific manufacturing sites positions developing nations as critical future volume drivers for high-capacity systems.

Global Autosamplers Market Trends and Insights

Advancing Role of Chromatography in Drug Approval Workflows

The FDA now mandates tighter controls on analytical method robustness, and that shift forces biopharma companies to automate sample handling to comply with data-integrity expectations. Automated autosamplers minimize human error, thereby ensuring reproducibility across global manufacturing networks. Centralized digital audit trails created by integrated sampling platforms accelerate dossier assembly for regulatory submissions. Complex biologic molecules demand multi-lane chromatography sequences, which are only practical with unattended autosampler operation. Biosimilar developers adopt identical strategies to prove comparability, extending demand across both novel and follow-on therapeutics. In consequence, the autosamplers market secures stable volumes from every late-stage development program moving through the pipeline.

Tighter Global Food-Safety & Environmental Regulations

EU Farm-to-Fork objectives and updated US drinking-water standards for PFAS impose lower detection limits that conventional manual injection cannot meet. Food and environmental laboratories therefore integrate autosamplers capable of processing dense sample batches while holding low carry-over. Contract testing organizations upgrade platforms to win regulatory tenders, driving replacement purchases every three to five years. Equipment vendors embed flexible racks that accept diverse container types, allowing a single unit to address both environmental and food matrices, which improves utilization. Multinational retailers, now subject to supplier-verification rules, demand certified laboratory partners, reinforcing capital cycles. These intertwined pressures add incremental growth to the autosamplers market across agriculture, water, and packaging industries.

Shortage of Chromatography-Skilled Operators

Many senior analysts retire faster than universities can train replacements, pushing laboratories to depend on fewer specialists. The skills gap complicates method-development projects that still require expert oversight even after automation. Small laboratories often postpone autosampler purchases because they cannot guarantee local support for troubleshooting. Equipment suppliers now bundle remote diagnostics and certified training to mitigate the talent deficit, yet onboarding still delays utilization by several months. Asia Pacific nations feel the shortage most acutely due to rapid laboratory expansion outstripping educational capacity. This workforce imbalance suppresses a portion of latent demand in the autosamplers market until operator pipelines stabilize.

Other drivers and restraints analyzed in the detailed report include:

- Lab-Automation Push for Higher Analytical Throughput

- Expansion of Omics-Driven Clinical Diagnostics

- High Capex & Budget Limits at SME Labs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Integrated autosampler systems secured 59.61% of autosamplers market share in 2024 as laboratories favored turnkey combinations that align mechanically and electronically with chromatography instruments. Liquid chromatography models lead volume shipments because HPLC and UHPLC remain the backbone of pharmaceutical release testing. Gas chromatography systems maintain relevance in petrochemical forensics and environmental VOC monitoring, while dual-mode designs support both techniques within one chassis. Continuous firmware updates now enable remote calibration that cuts maintenance calls by 20%, ensuring uptime for validated production lines. The complementary accessories subsegment vials, syringes, temperature-control blocks drives recurring sales that cushion vendors against equipment-cycle swings. Green-chemistry variants with micro-volume injection reduce solvent use by 40%, an attractive metric for sustainability-focused laboratory managers. Over the forecast horizon, headspace and SPME platforms expand fastest at a 10.64% CAGR through 2030, propelled by global rules on aromatic hydrocarbon and organophosphate residues in food and soil. These growth dynamics preserve top-line momentum and broaden the autosamplers market.

Consumables and modular upgrades also lift average selling prices across installed bases. High-capacity racks that hold 1,000 microtiter vials support cell-culture metabolite screening at biotech firms, replacing manual sample batching. AI-driven needle health diagnostics now predict seal wear, triggering just-in-time ordering of replacement parts and reducing unexpected downtime. Vendors actively cross-sell de-ionized water filtration units and in-line degassers, embedding themselves as single-source suppliers for entire analytical workcells. This bundling strategy reinforces customer retention and amplifies lifetime revenues per instrument. Sustained innovation across core systems and accessories therefore underpins a healthy autosamplers market size during the coming decade.

The Autosamplers Market Report is Segmented by Product (Systems [Liquid Chromatography Autosamplers, Gas Chromatography Autosamplers, Headspace & SPME Autosamplers] and Accessories), End User (Pharmaceutical & Biopharmaceutical Companies, Environmental & Water-Testing Labs, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.36% of autosamplers market size in 2024 because of deep pharmaceutical pipelines, NIH research grants, and active EPA enforcement of contaminant rules. US laboratories adopt AI-enhanced autosamplers early, citing productivity gains that justify premium pricing. Canadian biotech clusters in Toronto and Vancouver accelerate purchases for genomic medicine trials, while Mexican near-shore plants align analytical methods with US import regulations. Vendor service networks and same-day consumables delivery sustain high uptime across the region.

Asia Pacific posts a 12.09% CAGR through 2030, the fastest worldwide, as China and India expand formulation and active-ingredient manufacturing to capture global outsourcing contracts. Government subsidies in Shenzhen and Hyderabad offset up to 30% of automation capital costs, catalyzing multi-line deployments. Domestic instrument makers partner with leading brands to co-develop low-price variants, expanding reach into county-level environmental bureaus. South Korea and Japan emphasize clinical-diagnostic automation for precision-medicine initiatives, thereby diversifying regional demand. The combined momentum redefines the autosamplers market as a truly global arena rather than a legacy Western niche.

Europe records steady growth driven by REACH chemical regulations and the Farm-to-Fork strategy that mandates rigorous monitoring of pesticide residues. German chemical giants retrofit legacy QC labs with solvent-saving autosamplers to hit corporate carbon targets. The United Kingdom continues parallel compliance with EU analytical directives post-Brexit, preserving investment continuity. Eastern European CRO clusters in Poland and the Czech Republic leverage cost advantages to win bioequivalence studies, fueling additional equipment orders. Middle East & Africa and South America follow with gradual adoption, constrained by financing gaps and technical-skills shortages yet supported by expanding petrochemical and food-export sectors. Overall, geography trends collectively strengthen the autosamplers market trajectory toward diversified regional sales.

- Agilent Technologies

- Thermo Fisher Scientific

- Shimadzu

- Waters Corporation

- PerkinElmer

- Bio-Rad Laboratories

- Gilson

- Restek

- Scion Instruments

- Tecan Group

- HTA s.r.l.

- KNAUER Wissenschaftliche Gerate GmbH

- CTC Analytics AG

- Trajan Scientific (LEAP)

- GERSTEL GmbH

- DANI Instruments SpA

- LCTech GmbH

- ModuVision Technologies

- Valco Instruments (VICI)

- Ellutia Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Advancing Role of Chromatography in Drug Approval Workflows

- 4.2.2 Tighter Global Food-Safety & Environmental Regulations

- 4.2.3 Lab-Automation Push for Higher Analytical Throughput

- 4.2.4 Expansion of Omics-Driven Clinical Diagnostics

- 4.2.5 Ai-Enabled Predictive-Maintenance Autosamplers

- 4.2.6 Green-Chemistry Micro-Volume Injection Designs

- 4.3 Market Restraints

- 4.3.1 Shortage of Chromatography-Skilled Operators

- 4.3.2 High Capex & Budget Limits at Sme Labs

- 4.3.3 Stringent Validation & Compliance Timelines

- 4.3.4 Fragmented IP & Patent-Litigation Risks

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Systems

- 5.1.1.1 Liquid Chromatography Autosamplers

- 5.1.1.2 Gas Chromatography Autosamplers

- 5.1.1.3 Headspace & SPME Autosamplers

- 5.1.2 Accessories

- 5.1.1 Systems

- 5.2 By End User

- 5.2.1 Pharmaceutical & Biopharmaceutical Companies

- 5.2.2 Environmental & Water-Testing Labs

- 5.2.3 Academic & Contract Research Laboratories

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Agilent Technologies, Inc.

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Shimadzu Corporation

- 6.3.4 Waters Corporation

- 6.3.5 PerkinElmer Inc.

- 6.3.6 Bio-Rad Laboratories Inc.

- 6.3.7 Gilson Inc.

- 6.3.8 Restek Corporation

- 6.3.9 Scion Instruments

- 6.3.10 Tecan Group Ltd.

- 6.3.11 HTA s.r.l.

- 6.3.12 KNAUER Wissenschaftliche Gerate GmbH

- 6.3.13 CTC Analytics AG

- 6.3.14 Trajan Scientific (LEAP)

- 6.3.15 GERSTEL GmbH

- 6.3.16 DANI Instruments SpA

- 6.3.17 LCTech GmbH

- 6.3.18 ModuVision Technologies

- 6.3.19 Valco Instruments (VICI)

- 6.3.20 Ellutia Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment