PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851813

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851813

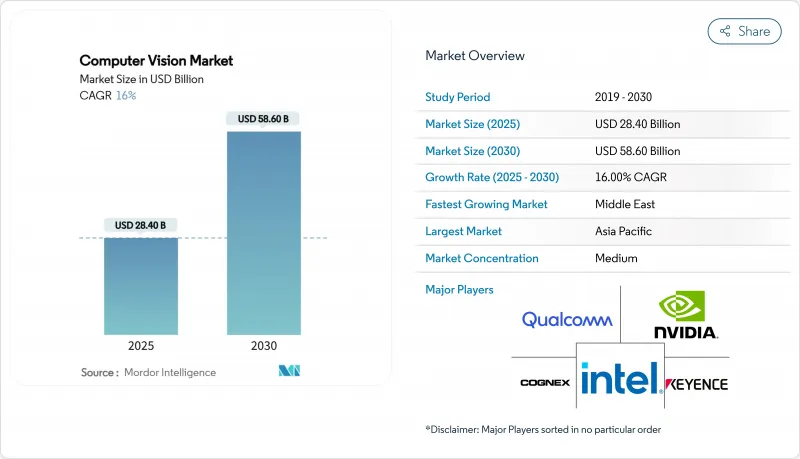

Computer Vision - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Computer Vision Market size is estimated at USD 28.40 billion in 2025, and is expected to reach USD 58.60 billion by 2030, at a CAGR of 16% during the forecast period (2025-2030).

Growth pivots around faster edge-AI chipsets that move inference from cloud servers to on-device processors, a shift encouraged by stricter automotive and manufacturing regulations that insist on real-time, auditable inspection data. Demand also benefits from acute labor shortages on factory floors, increasing use of vision-guided robotic,s and wider industrial camera uptake across Asia-Pacific's export-oriented plant,s Sohu. Simultaneously, automotive OEMs implement multi-camera ADAS suites to comply with EU General Safety Regulation II, turning regulatory deadlines into volume shipments for embedded visionsensorsr. Export-control rules on advanced chips tighten supply for Tier 2 economies, yet they accelerate domestic semiconductor investments, altering competitive dynamics in the computer vision market.

Global Computer Vision Market Trends and Insights

Rising Adoption of Vision-Guided Robotics in Manufacturing

Plant managers escalate automation beyond pick-and-place routines as collaborative robots equipped with advanced vision now handle assembly verification and defect inspection that previously required human eyes. NIST classifies machine vision as an enabling pillar for robotic flexibility, especially in semiconductor and biomanufacturing cleanrooms where sub-micron tolerances are non-negotiable.Hyundai's electronics lines report higher first-pass yield after introducing mobile robots that retrain algorithms on mixed data sets, keeping models current without halting production. Vision-guided cobots also underpin predictive maintenance, identifying tool wear before failures disrupt schedules. Return on investment outperforms humanoid robotics, widening use in construction and agritech, where unstructured settings once resisted automation. Together, these shifts reshape factory economics by curbing reliance on scarce skilled labor and boosting throughput consistency in high-mix lines.

Stringent Quality-Control Mandates Across Regulated Industries

Regulators now view automated optical inspection as essential after repeated recalls exposed limitations of manual checks. EU General Safety Regulation II obliges automakers to embed pedestrian-detection cameras and emergency-braking logic from July 2024, compelling tier-one suppliers to redesign electronic control units around vision models. Pharmaceutical packagers deploy deep-learning vision to verify blister-seal integrity and label accuracy, aligning with FDA validation guidelines for automated inspection. Food processors integrate Cognex In-Sight sensors that achieve 100% foreign-object detection, reducing contamination callbacks and strengthening audit trails.Environmental agencies likewise demand continuous video evidence of effluent compliance, turning vision systems from discretionary spend into risk-mitigation assets that influence procurement decisions.

Complex System-Integration Requirements

Legacy factory lines rely on proprietary field-bus protocols and unshielded wiring that complicate the drop-in replacement of manual inspection with camera systems. Harsh shop-floor vibration and electromagnetic noise degrade image fidelity, demanding ruggedized optics and lengthy calibration cycles. When multi-sensor fusion adds LiDAR or thermal inputs, integrators must synchronize data streams across heterogeneous real-time operating systems, extending deployment timelines for small and mid-sized enterprises that lack in-house expertise. Custom middleware and safety certification inflate project budgets, sometimes eclipsing initial ROI calculations and postponing adoption.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Automotive ADAS Camera Integration

- Edge-AI Chipsets Lowering Latency & Power for On-Device Vision

- Shortage of Skilled Computer-Vision Engineers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024 hardware accounted for 68.0% of computer vision market revenue as enterprises purchased industrial cameras, illumination units and dedicated processors to retrofit production lines. Within this total, edge-AI accelerators exhibit a 24.5% CAGR through 2030, the fastest trajectory among all sub-components, as designers replace discrete GPU farms with low-power ASICs and NPUs embedded at the image source. Camera modules remain the largest slice, yet their dollar share narrows as intelligent sensors merge image capture and inference, trimming cabling costs and latency. Optics vendors profit from hyperspectral lenses that detect material signatures beyond the visible spectrum for agriculture and recycling. On the software side, containerized inference stacks and middleware now receive annual subscription budgets larger than perpetual-license algorithms, reflecting the pivot toward continuous model retuning. The computer vision market size for hardware is forecast to exceed USD 34 billion by 2030, supported by resilient capital expenditure among automotive and electronics OEMs.

Software platforms contribute 32.0% of 2024 outlay and grow steadily as firms valorize data pipelines and DevOps integration over one-off deployments. Edge orchestration frameworks help distribute model updates across thousands of endpoints, turning device fleets into adaptive sensor networks. The shift aligns with rising cyber-security concerns that favor on-premises data handling and transparent audit trails. As a result, systems integrators bundle turnkey stacks that compress time-to-value for mid-tier factories lacking dedicated ML teams, in turn expanding addressable demand for the computer vision market.

The Computer Vision Market is Segmented by Components (Hardware and Software), by End-User Industry (Life Science, Manufactur Automotive, Retail and E-Commerce, Logistics and Warehousing and More) and Geography.

Geography Analysis

Asia-Pacific commanded 41.0% of the computer vision market revenue in 2024, buoyed by China's industrial camera sales that rose from CNY 18.5 billion in 2023 to CNY 20.7 billion in 2024, a 28.35% jump tied to rapid robotics adoption. Japan's chip foundries and South Korea's smartphone OEMs sustain high unit demand for wafer-scale AOI tools, while India scales precision-agriculture pilots to offset climate stress on food supply. Government green-factory programs subsidize retrofits with smart cameras, anchoring a steady capital-spending stream even amid macro headwinds. Export-control policies restricting top-tier GPUs push local fabs toward domestic accelerators, gradually lifting regional self-reliance.

The Middle East exhibits the fastest trajectory at 17.2% CAGR to 2030, propelled by Saudi Arabia's USD 100 billion AI fund and the UAE's ambition to rank among the top 10 global AI hubs by 2031. State-backed smart-city builds in Riyadh and Dubai purchase large volumes of surveillance cameras with edge analytics for traffic flow and critical-infrastructure protection. Parallel investments in logistics automation at ports and free zones further enlarge the computer vision market in the Gulf.

North America benefits from NHTSA's impending automatic-braking mandate, driving continuous ADAS camera shipments, while the US Department of Defense bankrolls vision-centric autonomy projects, sustaining a robust procurement c. Europe's Industry 4.0 policy fund supports AI-powered inspection retrofits, and its strict labeling standards stimulate demand in food and pharma plants. However, talent scarcity and chip export curbs moderate near-term growth, highlighting the need for local training initiatives and diversified silicon supply.

- Intel Corporation

- Cognex Corporation

- Keyence Corporation

- Sony Group Corp.

- NVIDIA Corporation

- Omron Corporation

- Basler AG

- Teledyne FLIR LLC

- Qualcomm Inc.

- Google LLC

- Advanced Micro Devices (AMD)

- Adlink Technology Inc.

- Hikvision Robotics

- Stemmer Imaging AG

- Dahua Technology

- Zebra Technologies

- Amazon Web Services (AWS)

- Clarifai Inc.

- Allied Vision Technologies

- OpenCV.ai

- Matrox Imaging

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of vision-guided robotics in manufacturing

- 4.2.2 Stringent quality-control mandates across regulated industries

- 4.2.3 Surge in automotive ADAS camera integration

- 4.2.4 Edge-AI chipsets lowering latency and power for on-device vision

- 4.2.5 Hyperspectral and neuromorphic sensors opening new use-cases

- 4.3 Market Restraints

- 4.3.1 Complex system-integration requirements

- 4.3.2 Shortage of skilled computer-vision engineers

- 4.3.3 Escalating data-labeling cost inflation

- 4.3.4 Export-control curbs on advanced vision processors

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Components

- 5.1.1 Hardware

- 5.1.1.1 Cameras

- 5.1.1.2 Processors (GPUs / ASIC / FPGA)

- 5.1.1.3 Optics and Lighting

- 5.1.2 Software

- 5.1.2.1 Traditional Algorithms

- 5.1.2.2 Deep-Learning Frameworks

- 5.1.2.3 Edge Middleware

- 5.1.1 Hardware

- 5.2 By End-user Industry

- 5.2.1 Life Sciences

- 5.2.2 Manufacturing

- 5.2.2.1 Electronics Assembly

- 5.2.2.2 Food and Beverage

- 5.2.2.3 Packaging

- 5.2.3 Defense and Security

- 5.2.4 Automotive

- 5.2.4.1 ADAS

- 5.2.4.2 Autonomous Vehicles

- 5.2.5 Retail and E-commerce

- 5.2.6 Logistics and Warehousing

- 5.2.7 Agriculture and Forestry

- 5.2.8 Other Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 India

- 5.3.3.5 ASEAN

- 5.3.3.6 Australia and New Zealand

- 5.3.3.7 Rest of Asia-Pacific

- 5.3.4 Middle East

- 5.3.4.1 GCC

- 5.3.4.2 Turkey

- 5.3.4.3 Rest of Middle East

- 5.3.5 Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Nigeria

- 5.3.5.3 Rest of Africa

- 5.3.6 South America

- 5.3.6.1 Brazil

- 5.3.6.2 Argentina

- 5.3.6.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Intel Corporation

- 6.4.2 Cognex Corporation

- 6.4.3 Keyence Corporation

- 6.4.4 Sony Group Corp.

- 6.4.5 NVIDIA Corporation

- 6.4.6 Omron Corporation

- 6.4.7 Basler AG

- 6.4.8 Teledyne FLIR LLC

- 6.4.9 Qualcomm Inc.

- 6.4.10 Google LLC

- 6.4.11 Advanced Micro Devices (AMD)

- 6.4.12 Adlink Technology Inc.

- 6.4.13 Hikvision Robotics

- 6.4.14 Stemmer Imaging AG

- 6.4.15 Dahua Technology

- 6.4.16 Zebra Technologies

- 6.4.17 Amazon Web Services (AWS)

- 6.4.18 Clarifai Inc.

- 6.4.19 Allied Vision Technologies

- 6.4.20 OpenCV.ai

- 6.4.21 Matrox Imaging

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment