PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910614

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910614

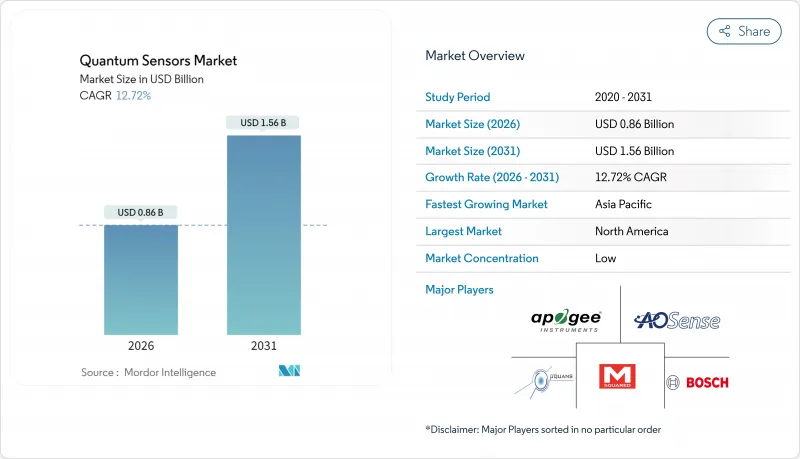

Quantum Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The quantum sensors market size in 2026 is estimated at USD 0.86 billion, growing from 2025 value of USD 0.76 billion with 2031 projections showing USD 1.56 billion, growing at 12.72% CAGR over 2026-2031.

This rapid expansion stems from synchronized government and commercial investments aimed at overcoming the limits of classical sensing in timing, navigation, and field-measurement tasks. Pentagon programs that counter GPS spoofing, Chinese and European flagship projects, and Boeing's flight tests of quantum inertial systems validate near-term demand for ruggedized devices capable of strategic-grade performance. National quantum budgets topping USD 25 billion intensify the race to secure domestic supply chains, while wafer-scale fabrication lowers unit costs and opens fresh commercial pathways. Space agencies, telecom operators, autonomous vehicle developers, and cloud data-center owners now explore system-level benefits ranging from nanosecond synchronization to subsurface resource mapping. Headwinds persist-decoherence in cold-atom devices, export-control regimes, and alkali-vapor cell bottlenecks-but advances in error-compensation algorithms and CMOS-compatible processes continue to reduce deployment risk.

Global Quantum Sensors Market Trends and Insights

Growing Defense Funding for Quantum PNT

Pentagon contracts worth USD 2.7 billion issued since 2024 illustrate the strategic need for quantum positioning, navigation and timing systems that remain accurate when GPS signals are jammed or spoofed. NATO's Defence Innovation Accelerator echoes this priority, and the United Kingdom earmarked GBP 185 million for quantum timing and navigation R&D in 2024. Australia added AUD 127 million to similar efforts, underscoring a global consensus that quantum PNT is a critical enabler of autonomous weapons, resilient communications and expeditionary logistics. As a result, defense ministries now procure atomic clocks, quantum accelerometers and magnetometers in parallel, creating long-tail demand that stabilizes early-stage supply chains. Vendor roadmaps increasingly emphasize radiation-hardened packaging, shock tolerance and field-calibration tools to satisfy stringent military standards.

National Quantum Initiatives & Budgets

China's USD 15 billion National Laboratory for Quantum Information Sciences, the renewed USD 12 billion US National Quantum Initiative and the EU's EUR 7 billion Quantum Flagship collectively institutionalize quantum sensors as sovereignty technologies. Japan's trillion-yen moonshot program specifically targets commercialization milestones by 2030, linking academic breakthroughs to corporate manufacturing lines. Such multi-year appropriations deliver predictable funding for universities, defense primes and start-ups, stimulating joint pilot projects and cross-licensing agreements. They also trigger protective export-control regimes that encourage local sourcing of vapor-cell components, lasers and vacuum sub-assemblies. The resulting policy mix raises near-term compliance costs yet guarantees sustained R&D pipelines feeding the quantum sensors market.

High Deployment & Maintenance Costs

Cold-atom interferometers require ultra-high vacuum chambers, laser-frequency locks and magnetic shielding that together raise capital outlay to as much as USD 2 million per site-orders of magnitude above classical accelerometers. Nitrogen-vacancy diamond devices must sometimes operate at cryogenic temperatures, introducing helium handling and servo-control subsystems. Skilled technicians versed in atomic physics and optics are scarce, and their salaries amplify OPEX. Mobile and airborne users face additional burdens of vibration isolation, pressurization and thermal management within tight SWaP envelopes, limiting uptake to premium applications where quantum performance delivers clear ROI.

Other drivers and restraints analyzed in the detailed report include:

- Demand for High-Precision Autonomous Navigation

- Commercial Rollout of Quantum Clocks in Telecom/Datacenters

- Spaceborne Climate-Monitoring Gravimeters

- Environmental Sensitivity of Cold-Atom Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Atomic clocks maintained the largest 31.45% share of the quantum sensors market in 2025 as telecom carriers and data-center operators synchronized networks requiring nanosecond accuracy. Quantum gravimeters and gradiometers are the fastest-growing product cohort, expanding at a 15.92% CAGR through 2031 as Earth-observation satellites and oil-and-gas exploration projects seek higher-resolution mass-density maps. Quantum magnetometers service neurology, mineral prospecting and electronic-warfare tasks, whereas quantum accelerometers and gyroscopes underpin inertial navigation when GPS is denied. PAR quantum sensors and miscellaneous niche devices round out an increasingly diversified catalogue. Vendors now integrate multiple sensor types into hybrid payloads, enabling single modules to output timing, inertial and magnetic data streams for autonomous-system fusion algorithms. This convergence promises economy of scale and a broader customer base, supporting sustained revenue lift for the quantum sensors market.

A second wave of innovation centers on wafer-scale fabrication that embeds vapor cells and photonic waveguides directly on CMOS backplanes. Early prototypes achieve 40% component cost reduction and improved thermal stability. Suppliers that master these processes can ship die-level subsystems for high-volume assembly, accelerating diffusion into industrial automation, precision agriculture and smart-grid monitoring. Cross-licensing among start-ups, defense primes and semiconductor foundries signals imminent shifts toward standardized form factors that mirror classical MEMS sensor commoditization.

Cold-atom interferometry led with 44.35% quantum sensors market share in 2025, benefiting from decades of lab validation and steadily maturing laser cooling techniques. Its unmatched sensitivity in gravimetry and inertial measurement remains central to geodesy and defense programs. Nitrogen-vacancy diamond sensors post the swiftest 16.63% CAGR thanks to room-temperature operation and biocompatibility that open paths in magnetocardiography, magnetoencephalography and nanoscale materials research. Rydberg-atom electric-field sensors, with 100 MHz instantaneous bandwidth, target radar and spectrum-analysis tasks formerly outside quantum reach. Optomechanical and photonic devices promise chip-level integration with existing optical equipment, while superconducting interference systems deliver sub-femtotesla sensitivity for cryogenic physics.

Diversification of mechanisms broadens addressable markets yet places pressure on component supply chains. Diamond growth chambers, cesium/rubidium vapor cells and high-coherence laser diodes each require specialized manufacturing setups. Ecosystem players respond by forming consortia that pool IP and co-invest in shared facilities, anticipating the economies of scale necessary to satisfy multi-sector demand spikes in the quantum sensors market.

Quantum Sensors Market Segmented by Product Type (Atomic Clocks, Quantum Magnetometers and More), Sensing Mechanism (Cold-Atom Interferometry, Nitrogen-Vacancy Diamond and More), Deployment Platform (Ground-Based, Airborne, Spaceborne, and More), End-User (Defense & Security, Space & Satellite and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 36.40% of global revenue in 2025, anchored by DARPA, NASA and National Science Foundation-funded research clusters plus a steady flow of Pentagon contracts that de-risk supplier investment in ruggedized designs. Export-control frameworks such as ITAR impose licensing overhead but also protect local intellectual property, concentrating early production in US-based fabs. Canada's quantum research corridor around Waterloo adds complementary photonic-integration expertise, expanding the regional ecosystem.

Asia-Pacific is on track for the fastest 15.95% CAGR, driven by China's USD 15 billion quantum program and Japan's moonshot initiative that pairs academic consortia with industrial titans in electronics and materials. Australia funds commercialization centers that match start-ups with end users in mining and defense, while South Korea's roadmap allocates tax incentives for semiconductor foundries capable of vapor-cell and diamond-defect manufacture. This investment wave positions the region as both a demand and supply powerhouse, elevating its weight in the quantum sensors market.

Europe maintains a cohesive, moderate-growth trajectory under the EUR 7 billion Quantum Technologies Flagship. Germany, France and the Netherlands specialize respectively in semiconductor tooling, laser systems and atomic-chip packaging, forming a transnational supply chain. ESA's space-sensor contracts pull universities and aerospace primes into joint ventures that combine cold-atom payloads with advanced small-sat buses. Regulatory clarity on dual-use export and data-sovereignty issues helps European vendors target civil-market niches such as precision agriculture and smart-grid monitoring without facing the same degree of ITAR restraints.

- AOSense Inc.

- Robert Bosch GmbH

- Muquans SAS (iXblue)

- M Squared Lasers Ltd.

- Microchip Technology Inc.

- Apogee Instruments Inc.

- Campbell Scientific Inc.

- LI-COR Biosciences Inc.

- Skye Instruments Ltd.

- Q-CTRL Pty Ltd

- Infleqtion Inc.

- SBQuantum Inc.

- iXblue SAS

- Teledyne e2v Semiconductors

- Honeywell Quantum Solutions (Quantinuum)

- Surrey Satellite Technology Ltd.

- SiTime Corp.

- Micro-G LaCoste LLC

- Atomionics Pte Ltd.

- SBQ Instruments AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing defense funding for quantum PNT

- 4.2.2 National quantum initiatives and budgets

- 4.2.3 Demand for high-precision autonomous navigation

- 4.2.4 Commercial rollout of quantum clocks in telecom/datacenters

- 4.2.5 Spaceborne climate-monitoring gravimeters

- 4.2.6 Wafer-scale fabrication drives cost decline

- 4.3 Market Restraints

- 4.3.1 High deployment and maintenance costs

- 4.3.2 Environmental sensitivity/decoherence of cold-atom systems

- 4.3.3 Alkali-vapor cell supply-chain bottlenecks (under-radar)

- 4.3.4 Export-control restrictions on quantum tech (under-radar)

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Atomic Clocks

- 5.1.2 Quantum Magnetometers

- 5.1.3 Quantum Accelerometers and Gyroscopes

- 5.1.4 Quantum Gravimeters and Gradiometers

- 5.1.5 PAR Quantum Sensors

- 5.1.6 Other Product Types

- 5.2 By Sensing Mechanism

- 5.2.1 Cold-Atom Interferometry

- 5.2.2 Nitrogen-Vacancy (NV) Diamond

- 5.2.3 Rydberg-Atom Electric-Field Sensors

- 5.2.4 Optomechanical / Photonic Sensors

- 5.2.5 Superconducting Quantum Interference Sensors

- 5.3 By Deployment Platform

- 5.3.1 Ground-based

- 5.3.2 Airborne

- 5.3.3 Spaceborne

- 5.3.4 Marine / Sub-surface

- 5.4 By End-user

- 5.4.1 Defense and Security

- 5.4.2 Space and Satellite

- 5.4.3 Oil, Gas and Mining

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Transportation and Automotive

- 5.4.6 Telecom and Datacenters

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Chile

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 Australia

- 5.5.4.5 India

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AOSense Inc.

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Muquans SAS (iXblue)

- 6.4.4 M Squared Lasers Ltd.

- 6.4.5 Microchip Technology Inc.

- 6.4.6 Apogee Instruments Inc.

- 6.4.7 Campbell Scientific Inc.

- 6.4.8 LI-COR Biosciences Inc.

- 6.4.9 Skye Instruments Ltd.

- 6.4.10 Q-CTRL Pty Ltd

- 6.4.11 Infleqtion Inc.

- 6.4.12 SBQuantum Inc.

- 6.4.13 iXblue SAS

- 6.4.14 Teledyne e2v Semiconductors

- 6.4.15 Honeywell Quantum Solutions (Quantinuum)

- 6.4.16 Surrey Satellite Technology Ltd.

- 6.4.17 SiTime Corp.

- 6.4.18 Micro-G LaCoste LLC

- 6.4.19 Atomionics Pte Ltd.

- 6.4.20 SBQ Instruments AB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment