PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851822

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851822

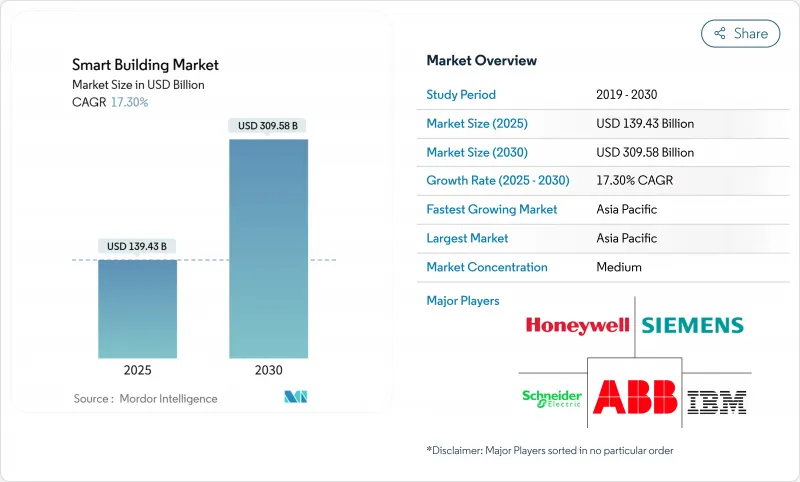

Smart Building - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart building market is valued at USD 139.43 billion in 2025 and is forecast to reach USD 309.58 billion by 2030, advancing at a 17.30% CAGR.

Enhanced integration of operational technology and information technology, combined with real-time analytics, is converting buildings from passive assets into active energy nodes. Cyber-secure, open architectures are being selected ahead of proprietary systems as owners seek to unify lighting, HVAC, security, and energy management on a single platform. Retrofit demand is climbing because commercial real-estate portfolios must align with net-zero pathways, while utilities are rewarding buildings that automate demand response with new tariff structures. Asia Pacific leads adoption as China and India scale national smart-city programs that mandate connected building infrastructure.

Global Smart Building Market Trends and Insights

Escalating Net-Zero Carbon Mandates Driving Comprehensive Building Retrofits

Net-zero regulations require deep energy refurbishment because buildings generate 40% of global emissions. Mandates covering whole portfolios are pushing owners to install high-efficiency HVAC, electrify heat, and layer analytics that verify performance. ABB estimates the retrofit opportunity could reach USD 3.9 trillion by 2050 as decarbonization deadlines shorten. Regional differences in definitions are accelerating local innovation, with many city codes surpassing national targets.

IoT Sensor Proliferation Enabling Real-Time Building Intelligence

An expanding sensor base is giving operators granular visibility into occupancy, equipment health, and indoor-air quality. China hosts 31 million smart buildings, while the United States has 16 million as of 2025. Platforms such as Johnson Controls' OpenBlue have documented 10%-12% energy savings by turning raw data into prescriptive controls. Demand for low-power wireless sensors is rising as industrial sensor revenue approaches USD 29.9 billion in 2025.

Legacy BMS Protocol Fragmentation Impeding System Integration

Older Building Management Systems use proprietary protocols that complicate retrofits. A 2024 MDPI review identified this fragmentation as a top barrier, often forcing owners to deploy middleware or replace entire subsystems. Integration delays raise project costs and can erode the business case for advanced analytics.

Other drivers and restraints analyzed in the detailed report include:

- OT-IT Cybersecurity Convergence Enabling Integrated Building Platforms

- Utility Demand-Response Programs Accelerating Smart Building Adoption

- Semiconductor Supply-Chain Volatility Impacting Device Availability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 68% of 2024 revenue, reflecting their central role in lighting control, security integration, and energy management. Cloud-native Building Management Systems are replacing on-premise servers, cutting upgrade downtime and enabling faster feature deployment. Services hold a smaller share but are growing at 17.68% CAGR as owners outsource analytics, cybersecurity monitoring, and lifecycle maintenance. This shift is easing internal skill shortages while creating recurring revenue streams for vendors.

Wider availability of open APIs is driving partnerships between solution providers and specialist service firms. The smart building market is seeing managed-service contracts bundled with outcome-based guarantees that commit vendors to energy-saving thresholds. As artificial-intelligence modules become embedded, demand for continuous tuning and model retraining rises, reinforcing service growth.

Wired Ethernet, BACnet MS/TP, and power-over-Ethernet still connect 55.2% of smart devices, but wireless installations are expanding at an 18.8% CAGR. Radio protocols offer install flexibility for heritage buildings where core drilling is impractical. Wi-Fi 6/6E enhances bandwidth for video analytics, while Zigbee and Thread handle low-power sensors. DECT NR+ introduces sub-GHz coverage for dense device clusters, a standard now backed by Siemens and Schneider Electric.

Growing device density is shifting designs toward multi-protocol access points that coordinate Bluetooth beacons, LoRaWAN meters, and 5G gateways on a converged backbone. Cyber-hardened mesh architectures allow edge devices to negotiate credentials autonomously, cutting commissioning time.

The Smart Building Market Report is Segmented by Component (Solutions and Services), Connectivity Technology (Wired and Wireless), Building Lifecycle (New Construction and Retrofit), Building Type (Residential, Commercial, Industrial and Logistics, and More), and Geography

Geography Analysis

Asia Pacific led the smart building market with a 31.7% share in 2024 and will maintain the fastest 20.4% CAGR through 2030. National smart-city programs in China, South Korea, and Singapore mandate connected building systems that feed city-wide digital twins. India's Grade-A commercial real estate expansion is also embedding intelligent lighting, air-quality sensors, and renewable microgrids.

North America follows closely, propelled by utility demand-response programs and mandatory carbon-performance disclosure. The U.S. Better Buildings Initiative has already logged USD 22 billion in savings, validating the financial case for analytics retrofits. Canada's national building code now references smart-meter-compatible controls, nudging regional adoption.

Europe shows strong policy alignment via the EU Taxonomy, Energy Performance of Buildings Directive, and Renovation Wave strategy. Data-sovereignty rules encourage edge computing, so vendors supply on-site AI inference engines coupled with cloud dashboards. Scandinavia is pioneering district heating integration, while Germany expands smart-meter gateways that communicate secure load data to grid operators.

- Honeywell International Inc.

- Siemens AG

- Schneider Electric SE

- Johnson Controls International plc

- ABB Ltd.

- Cisco Systems Inc.

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Legrand SA

- Emerson Electric Co.

- Delta Electronics, Inc.

- Robert Bosch GmbH

- Hitachi, Ltd.

- United Technologies Corp. (Carrier)

- Trane Technologies plc

- Avnet, Inc. (IoTConnect)

- Softdel (UNIDEL Group)

- Verdigris Technologies, Inc.

- KMC Controls, Inc.

- BuildingIQ, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Net-Zero Carbon Mandates in OECD Commercial Real Estate

- 4.2.2 Proliferation of Building IoT Sensor Deployments Driving Real-time Analytics

- 4.2.3 Convergence of OT-IT Cyber-security Frameworks Enabling Integrated Platforms

- 4.2.4 Utility Demand-Response Incentives Accelerating Smart Retrofits in North America

- 4.2.5 Rapid Urban Campus Digital-Twin Deployments in Asia for Operational Resilience

- 4.2.6 EU Taxonomy Requirements Boosting Green Building Investments

- 4.3 Market Restraints

- 4.3.1 Fragmented Legacy BMS Protocols Hindering Interoperability in Existing Stock

- 4.3.2 Capex Inflation for Semiconductor-Intensive Devices Post-2024 Shortage

- 4.3.3 Data-privacy Concerns Limiting Cloud-based Building Analytics in Europe

- 4.3.4 Skills Gap in AI-enabled Facility Management across Emerging Markets

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Building Energy Management Systems

- 5.1.1.2 Infrastructure Management Systems

- 5.1.1.3 Intelligent Security Systems

- 5.1.1.4 Lighting Control Systems

- 5.1.1.5 HVAC Control Systems

- 5.1.1.6 Other Solutions

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Connectivity Technology

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.2.2.1 Wi-Fi

- 5.2.2.2 ZigBee / Z-Wave

- 5.2.2.3 Bluetooth Low Energy

- 5.2.2.4 6LoWPAN and Others

- 5.3 By Building Lifecycle

- 5.3.1 New Construction

- 5.3.2 Retrofit

- 5.4 By Building Type

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.2.1 Office

- 5.4.2.2 Retail

- 5.4.2.3 Hospitality

- 5.4.2.4 Airports and Transportation Hubs

- 5.4.3 Industrial and Logistics

- 5.4.4 Institutional (Healthcare, Education, Government)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Middle East

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 United Arab Emirates

- 5.5.4.3 Turkey

- 5.5.4.4 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Nigeria

- 5.5.5.3 Kenya

- 5.5.5.4 Rest of Africa

- 5.5.6 Asia Pacific

- 5.5.6.1 China

- 5.5.6.2 India

- 5.5.6.3 Japan

- 5.5.6.4 South Korea

- 5.5.6.5 ASEAN

- 5.5.6.6 Rest of Asia Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Siemens AG

- 6.4.3 Schneider Electric SE

- 6.4.4 Johnson Controls International plc

- 6.4.5 ABB Ltd.

- 6.4.6 Cisco Systems Inc.

- 6.4.7 IBM Corporation

- 6.4.8 Huawei Technologies Co., Ltd.

- 6.4.9 Legrand SA

- 6.4.10 Emerson Electric Co.

- 6.4.11 Delta Electronics, Inc.

- 6.4.12 Robert Bosch GmbH

- 6.4.13 Hitachi, Ltd.

- 6.4.14 United Technologies Corp. (Carrier)

- 6.4.15 Trane Technologies plc

- 6.4.16 Avnet, Inc. (IoTConnect)

- 6.4.17 Softdel (UNIDEL Group)

- 6.4.18 Verdigris Technologies, Inc.

- 6.4.19 KMC Controls, Inc.

- 6.4.20 BuildingIQ, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment