PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910619

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910619

Printer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

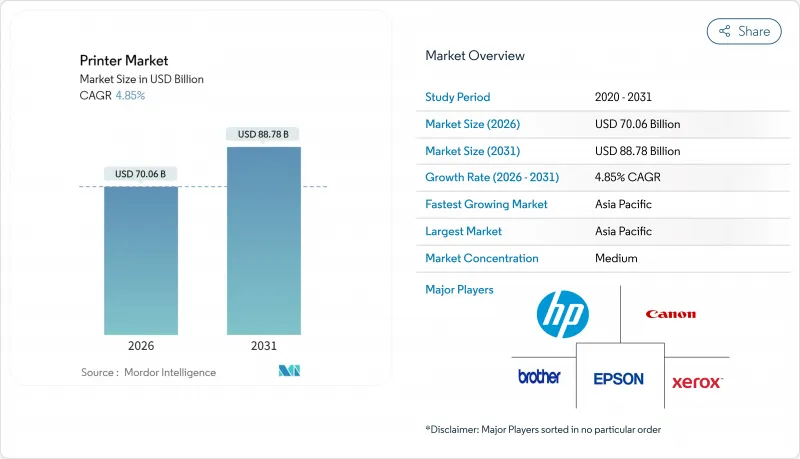

The Printer Market was valued at USD 66.82 billion in 2025 and estimated to grow from USD 70.06 billion in 2026 to reach USD 88.78 billion by 2031, at a CAGR of 4.85% during the forecast period (2026-2031).

Growth endures as traditional office printing contracts but new demand emerges from e-commerce logistics, packaging premiumization, and sustainability-driven upgrades. Multi-functional devices that consolidate print, scan, copy, and fax functions now dominate procurement decisions in hybrid offices. Ink-tank economics, thermal labeling for last-mile delivery, and color output for brand marketing keep hardware refresh cycles active even as printed office pages fall 20% from pre-pandemic levels. Manufacturers diversify into industrial and healthcare niches, buffering the printer market against digital substitution. Asia-Pacific leads revenue expansion, supported by manufacturing digitization, traceability rules, and expanding small business ecosystems.

Global Printer Market Trends and Insights

Surge in e-commerce parcel volumes boosting industrial thermal label printer demand in Asia-Pacific

Thermal printers now underpin parcel routing across mega-fulfilment hubs in China, India, and the ASEAN bloc. The equipment's ribbon-less architecture withstands humidity and dust while supporting millions of scannable labels per shift. Mandates for pharmaceutical and food traceability intensify demand for durable codes that survive bulk transport and cold-chain handling. Logistics operators select high-speed 6-inch models to streamline pick-pack-ship, and regional manufacturing supremacy compounds volume requirements. These fundamentals give thermal technology the strongest pull on the Asia-Pacific printer market growth, apec.org.

Rapid adoption of ink-tank/EcoTank models lowering total cost of ownership in emerging economies

Epson's shipment of 100 million EcoTank devices confirms latent appetite for cartridge-free printing, particularly among budget-focused micro-businesses. Refillable reservoirs slash per-page costs by up to 90% and reduce landfill waste by minimizing single-use plastics. Savings allow family stores, tuition centers, and start-ups to expand outreach materials without steep running expenses. Lower CO2 emissions strengthen compliance with green-procurement policies rolled out by several Latin American ministries. Together, these factors secure a multi-year boost to the printer market across high-population economies.

Corporate cloud migration shrinking transactional print volumes

Enterprise pivot to digital signatures, e-billing, and online forms pushes paper out of everyday workflows. HP confirmed a 20% page decline versus pre-COVID peaks. The shift is structural, supported by CFO mandates for paperless savings and ESG scorecards discouraging print dependence. While specialty verticals still require hard copies, the secular headwind caps overall unit growth in mature territories. Vendors counter by bundling workflow software and managed services, yet core office consumption continues to recede.

Other drivers and restraints analyzed in the detailed report include:

- Secure hard-copy archiving of critical documents

- Packaging premiumization driving UV-curable inkjet printers for short-run labels

- Rising raw-material costs inflating consumable prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Multi-functional printers held 60.22% of 2025 revenue, anchoring the printer market where hybrid workers need flexible, compact hardware. Vendors integrate auto-double-siding, voice-activated commands, and cloud connectors so units pivot seamlessly between home and office desks. Stand-alone laser engines persist in banks and government bureaus that lock down functions for security, but volumes decline as enterprises prioritize consolidation.

Large-format systems chart the fastest 5.12% CAGR, propelled by on-demand packaging proofs, wide-banner advertising, and architectural visualization workflows. The segment benefits from print-for-pay shops shifting to digital rolls that minimize substrate waste. Industrial presses serving corrugated and flexible packaging claim premium pricing as brand owners shorten product cycles. These dynamics keep the printer market resilient even while general office volumes soften.

Inkjet technology captured 48.10% of 2025 revenue and anchors the printer market via home, office, and light production segments. Breakthrough PrecisionCore and piezo heads raise native speeds and widen media latitude, helping inkjet displace entry laser units in school districts and SOHOs. The printer market size for inkjet installations in production label lines is projected to grow at an overall 4.43% CAGR as the cost per image falls.

Thermal engines, though smaller by value, outpace peers at 5.05% CAGR, lifted by parcel labeling, specimen tracking, and wristband printing. Energy-efficient LED models gain mindshare in Europe, where eco procurement frameworks reward lower power draw. Conversely, laser shipments face a sunset schedule at Epson, which will exit the category by 2026 to prioritize climate goals.

The Printer Market Report is Segmented by Printer Type (Multi-Functional, Stand-alone/Single-function, and More), Technology Type (Inkjet, Laser, LED, Thermal, and Dot-Matrix), Connectivity/Interface (Wired, and Wireless), Output Type (Color, and Monochrome), End-User Application (Residential, Commercial and Retail, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 41.10% of 2025 revenue and accelerates at a 5.02% CAGR, driven by factory automation in China and India, plus burgeoning e-commerce. Provincial grants for smart manufacturing subsidize digital label lines and serial-numbered packaging. National ID and healthcare card initiatives mandate secure print infrastructure, adding tailwinds to the printer market in the region.

North America's mature fleet gradually transitions from legacy toner boxes to energy-sipping ink deposits. Security mandates such as HIPAA sustain hard-copy repositories even as cloud file-sharing rises. Packaging converters deploy digital presses in quick-turn cosmetic and nutraceutical lines, nurturing pockets of growth.

Europe faces cost headwinds from RoHS3 and energy taxes, yet circular-economy rules prompt organizations to adopt repairable chassis and recycled consumables, sustaining replacement momentum. Eastern Europe sees incremental demand tied to near-shoring factories that require in-plant labeling. Overall, geographic spread balances the printer market against macro shocks.

- HP Inc.

- Canon Inc.

- Seiko Epson Corp.

- Brother Industries Ltd.

- Xerox Holdings Corp.

- Ricoh Co. Ltd.

- Konica Minolta Inc.

- Fujifilm Holdings Corp.

- Kyocera Document Solutions

- Zebra Technologies Corp.

- Dell Technologies Inc.

- Toshiba Tec Corp.

- Sharp Corp.

- Mimaki Engineering Co.

- Roland DG Corp.

- Agfa-Gevaert N.V.

- Honeywell Int'l. (Datamax-O'Neil)

- BIXOLON Co. Ltd.

- SATO Holdings Corp.

- TSC Auto ID Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in e-commerce parcel volumes boosting industrial thermal label printer demand in Asia-Pacific

- 4.2.2 Rapid adoption of ink-tank/EcoTank models lowering Total Cost of Ownerships for Small Office Home Offices in emerging economies

- 4.2.3 Secure hard-copy archiving of Critical Documents due to regulatory reasins

- 4.2.4 Packaging premiumization driving UV-curable inkjet printers for short-run labels

- 4.2.5 Sustainability pledges accelerating transition to LED printers and bio-based toners

- 4.3 Market Restraints

- 4.3.1 Corporate cloud migration shrinking transactional print volumes

- 4.3.2 Rising raw-material costs inflating consumable prices, delaying SMB upgrades

- 4.3.3 RoHS3 compliance costs limiting low-cost laser launches in Europe

- 4.3.4 Digital signature adoption curbing check and form printing in financial services

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printer Type

- 5.1.1 Multi-functional

- 5.1.2 Stand-alone/Single-function

- 5.1.3 Large-format

- 5.1.4 Industrial/Production

- 5.2 By Technology Type

- 5.2.1 Inkjet

- 5.2.2 Laser

- 5.2.3 LED

- 5.2.4 Thermal (Direct and Transfer)

- 5.2.5 Dot-Matrix

- 5.3 By Connectivity/Interface

- 5.3.1 Wired

- 5.3.2 Wireless (Wi-Fi, NFC, BT)

- 5.4 By Output Type

- 5.4.1 Color

- 5.4.2 Monochrome

- 5.5 By End-user Application

- 5.5.1 Residential

- 5.5.2 Commercial and Retail

- 5.5.3 Educational Institutions

- 5.5.4 Enterprises

- 5.5.5 Government

- 5.5.6 Healthcare and Logistics

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Rest of South America

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 Southeast Asia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Business Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 HP Inc.

- 6.4.2 Canon Inc.

- 6.4.3 Seiko Epson Corp.

- 6.4.4 Brother Industries Ltd.

- 6.4.5 Xerox Holdings Corp.

- 6.4.6 Ricoh Co. Ltd.

- 6.4.7 Konica Minolta Inc.

- 6.4.8 Fujifilm Holdings Corp.

- 6.4.9 Kyocera Document Solutions

- 6.4.10 Zebra Technologies Corp.

- 6.4.11 Dell Technologies Inc.

- 6.4.12 Toshiba Tec Corp.

- 6.4.13 Sharp Corp.

- 6.4.14 Mimaki Engineering Co.

- 6.4.15 Roland DG Corp.

- 6.4.16 Agfa-Gevaert N.V.

- 6.4.17 Honeywell Int'l. (Datamax-O'Neil)

- 6.4.18 BIXOLON Co. Ltd.

- 6.4.19 SATO Holdings Corp.

- 6.4.20 TSC Auto ID Technology

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment