PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851830

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851830

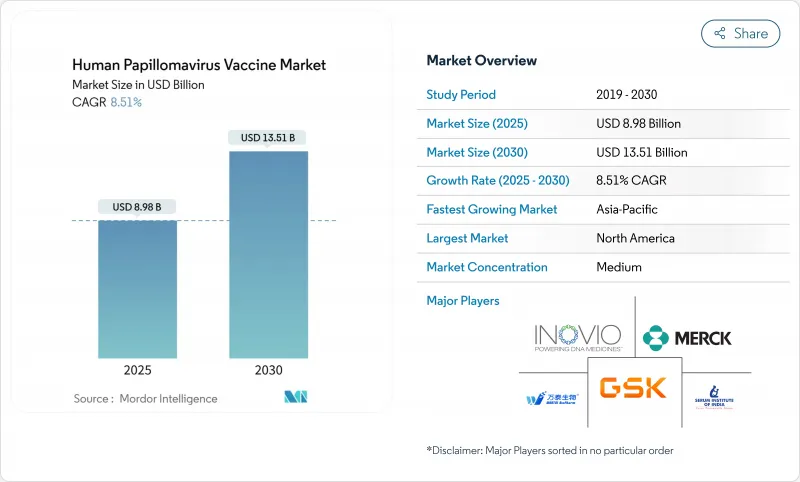

Human Papillomavirus Vaccine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The human papillomavirus vaccine market is valued at USD 8.98 billion in 2025 and is on track to reach USD 13.51 billion by 2030, advancing at an 8.51% CAGR.

Single-dose schedules endorsed by the World Health Organization (WHO) in late-2024 , a surge of low- and middle-income country (LMIC) manufacturers, and widening gender-neutral policies are redefining clinical demand patterns. The rapid uptake of nonavalent formulations, large-scale government funding commitments in India, China and the European Union, and the extension of FDA labels to cover head-and-neck cancers together sustain robust volume growth. Manufacturers are simultaneously re-tooling production for single-dose regimens and region-specific multivalent platforms, while payers negotiate tiered pricing that broadens access without eroding margins. These forces position the human papillomavirus vaccine market for sustained expansion across public programs and premium private segments worldwide.

Global Human Papillomavirus Vaccine Market Trends and Insights

Approval of New Multivalent HPV Vaccines

Recent FDA clearance of Gardasil 9 for head-and-neck cancer prevention extends protective reach beyond gynecological malignancies and opens male adult segments. Merck and several Asian developers are advancing next-generation multivalent candidates aimed at HPV types highly prevalent in Africa and South-East Asia, reinforcing the premium tier of the human papillomavirus vaccine market. WHO's pipeline review lists more than 20 therapeutic vaccines, signalling future convergence of preventive and therapeutic modalities . Collectively, these innovations underpin volume growth and encourage price differentiation across regions.

Government & Multi-Lateral Funding Accelerators

India's 2024 budget funded a national girls' program using locally produced Cervavac at USD 24 per private-sector dose, creating the largest single expansion in the human papillomavirus vaccine market. Gavi's USD 600 million commitment and UNICEF's aggregate procurement surpassing 93 million doses since 2013 provide stable demand forecasts that justify capacity builds in Asia and Latin America . Similar agreements under PAHO in 2025 further aggregate regional orders, lowering unit cost and widening access.

Stringent Biologics Regulations

Complex biologics frameworks require exhaustive safety and potency data, driving development costs above USD 1 billion per candidate and delaying approvals for regional manufacturers. European Medicines Agency dossiers add another tier of compliance, while WHO prequalification remains essential for multilateral tenders. These layers heighten time-to-market and favor incumbents with deep capital reserves, tempering the growth of smaller entrants in the human papillomavirus vaccine market.

Other drivers and restraints analyzed in the detailed report include:

- Gender-Neutral Immunization Policies

- One-Dose Schedule Endorsed By WHO

- Vaccine Hesitancy & Misinformation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Quadrivalent vaccines retained 67.53% share in 2024, underpinning broad national program penetration. Their entrenched status supports predictable revenue flow, yet premium-priced nonavalent products are outpacing at a 9.24% CAGR. The human papillomavirus vaccine market size for nonavalent offerings is expanding strongly in North America and Europe as payers endorse wider oncogenic strain coverage. This shift also benefits middle-income consumers willing to pay for broader protection, even while procurement agencies in LMICs continue purchasing cost-efficient quadrivalent or bivalent doses.

Global clinical evidence shows Gardasil 9 delivering near-universal cervical cancer protection and 90% efficacy against other HPV-related conditions. WHO prequalification of Cecolin for single-dose schedules and Walrinvax for two-dose regimes broadens supply options, pressuring price points in the human papillomavirus vaccine market. Looking forward, region-specific multivalent candidates designed for African and Asian strain prevalence may further fragment the competitive field.

Cervical cancer prevention accounted for 69.98% of 2024 revenue thanks to entrenched public-health focus and decades of supportive data. Yet anal cancer prevention is rising fastest at 9.31% CAGR because gender-neutral policies recognize growing male disease burden. The human papillomavirus vaccine market share for cervical applications will gradually erode as non-cervical indications gain prominence, though absolute revenues continue growing.

FDA extension of Gardasil 9 to head-and-neck cancers validates expansion beyond female-centric indications and informs adult catch-up programs. Peer-reviewed data reveal a rising incidence of oropharyngeal cancer among men, catalyzing policy updates worldwide. Manufacturers are therefore repositioning value propositions toward comprehensive cancer prophylaxis that appeals to both sexes.

The Human Papillomavirus Vaccine Market is Segmented by Vaccine Type (Bivalent, Quadrivalent, and More), Indication (Cervical Cancer, Anal Cancer, Penile Cancer, and More), Distribution Channel (Public and Private), Age Group (Adults and Pediatric) and Geography (North America, Europe, Asia-Pacific, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 39.48% share reflects early adoption, broad insurance coverage, and ongoing gender-neutral catch-up initiatives. The United States still shows payment-linked gaps, yet Canada's 2024 single-dose recommendation for those aged 9-20 positions it as a policy bellwether. Mexico's participation in PAHO's elimination roadmap promises synergies in pricing and procurement across the sub-region.

Asia-Pacific leads growth at a 9.22% CAGR, propelled by India's fully funded girls' program and China's surge of domestic producers challenging Western incumbents. Merck's 41% Q1-2025 sales decline in China highlights intensifying price competition and regulatory complexity. Japan's shift to 9-valent vaccines for boys and girls, together with Australia's mature elimination strategy, illustrates the diversity of policy models that collectively enlarge the human papillomavirus vaccine market size across the region.

Europe continues policy innovation through its 90% female coverage and expanding male vaccination mandate, underwritten by EUR 20 million in EU4Health funds. Competitive tenders sustain affordability without compromising supply security. The Middle East and Africa face cold-chain and hesitancy barriers, yet Nigeria's 2024-2025 drive to reach 7.7 million girls shows that community-centric engagement can secure high utilization. In South America, PAHO's 2025 partnership with Spanish agencies enhances access to 9-valent vaccines, while differential economics across the continent necessitate phased rollouts.

- Merck

- GlaxoSmithKline

- Serum Institute of India Pvt Ltd

- Walvax Biotechnology Co. Ltd

- Bharat Biotech

- Innovax (Xiamen Innovax Biotech)

- Wantai BioPharm

- Sinovac Biotech

- INOVIO Pharmaceuticals

- Novartis

- AstraZeneca

- Dynavax Technologies

- CSL Seqirus

- Shenzhen Kangtai Biological

- Pfizer

- Sanofi

- VBI Vaccines

- Geneos Therapeutics

- Takeda Pharmaceuticals

- Daiichi-Sankyo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Approval of New Multivalent HPV Vaccines

- 4.2.2 Government & Multi-Lateral Funding Accelerators

- 4.2.3 Gender-Neutral Immunization Policies

- 4.2.4 Rising HPV-Linked Cancer Incidence

- 4.2.5 One-Dose Schedule Endorsed By WHO

- 4.2.6 Emergence of LMIC-Based Vaccine Manufacturers

- 4.3 Market Restraints

- 4.3.1 Stringent Biologics Regulations

- 4.3.2 Vaccine Hesitancy & Misinformation

- 4.3.3 High Procurement Cost for Mics

- 4.3.4 Cold-Chain & Last-Mile Gaps in LMICs

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vaccine Type

- 5.1.1 Bivalent

- 5.1.2 Quadrivalent

- 5.1.3 Nonavalent

- 5.2 By Indication

- 5.2.1 Cervical Cancer

- 5.2.2 Anal Cancer

- 5.2.3 Penile Cancer

- 5.2.4 Oropharyngeal Cancer

- 5.2.5 Genital Warts

- 5.2.6 Others

- 5.3 By Distribution Channel

- 5.3.1 Public

- 5.3.2 Private

- 5.4 By Age Group

- 5.4.1 Adults

- 5.4.2 Pediatric

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Merck & Co., Inc.

- 6.3.2 GSK plc

- 6.3.3 Serum Institute of India Pvt Ltd

- 6.3.4 Walvax Biotechnology Co. Ltd

- 6.3.5 Bharat Biotech

- 6.3.6 Innovax (Xiamen Innovax Biotech)

- 6.3.7 Wantai BioPharm

- 6.3.8 Sinovac Biotech Ltd

- 6.3.9 INOVIO Pharmaceuticals

- 6.3.10 Novartis AG

- 6.3.11 AstraZeneca plc

- 6.3.12 Dynavax Technologies

- 6.3.13 CSL Seqirus

- 6.3.14 Shenzhen Kangtai Biological

- 6.3.15 Pfizer Inc.

- 6.3.16 Sanofi SA

- 6.3.17 VBI Vaccines

- 6.3.18 Geneos Therapeutics

- 6.3.19 Takeda Pharmaceutical

- 6.3.20 Daiichi-Sankyo

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment