PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851832

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851832

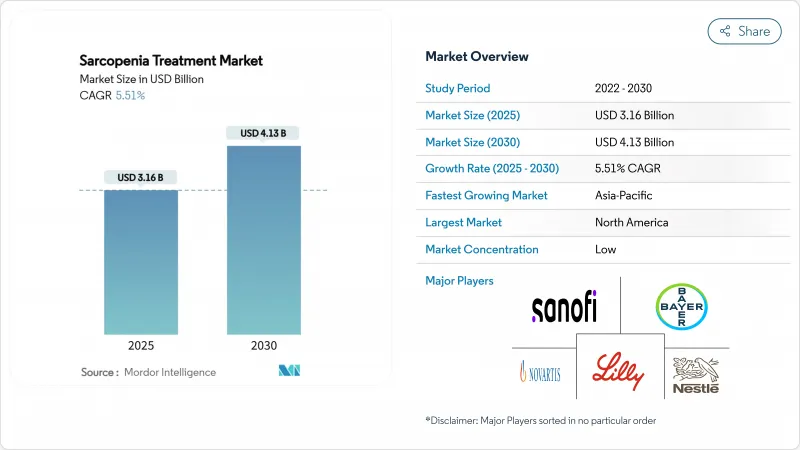

Sarcopenia Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The sarcopenia treatment market size stands at USD 3.16 billion in 2025 and is forecast to reach USD 4.13 billion by 2030, reflecting a 5.51% CAGR.

Moderate expansion stems from a formal disease classification that is raising diagnosis rates while reimbursement pathways broaden in the most developed health systems Growing acceptance of evidence-based nutritional protocols, early pipeline momentum for myostatin inhibitors and selective androgen receptor modulators (SARMs), and rising use of digital diagnostics all underpin steady uptake across care settings. Competitive differentiation is most visible in Asia-Pacific, where healthy-aging programmes are scaling rapidly, and in North America, where accelerated regulatory engagement is shortening review times for novel candidates. Meanwhile, persistent regulatory uncertainty around clinical endpoints and the ongoing absence of an FDA- or EMA-approved pharmacological product restrain the pace at which prescribers pivot from supplementation to drug-based regimens.

Global Sarcopenia Treatment Market Trends and Insights

Accelerating Global Geriatric Demographic

A rapidly aging world is sharply boosting sarcopenia prevalence. United Nations data project that people aged >= 65 will number 2.2 billion by the late 2070s. Higher life expectancy raises the absolute pool of at-risk adults, and clinical studies reveal that 25.4% of older patients living with type 2 diabetes subsequently develop sarcopenia. Payers are responding by embedding muscle-health screening into chronic-disease pathways. Japan's community screening campaigns have already trimmed hospitalization rates tied to muscle weakness, demonstrating direct cost offsets. The upshot is earlier diagnosis, rising prescription volumes of high-quality protein blends, and heightened enrolment in exercise programmes that complement pharmacotherapy.

Intensified Biopharma Pipeline Investment

Clinical momentum is accelerating as sponsors advance SARMs and myostatin inhibitors. Rejuvenate Biomed's RJx-01 improved grip strength and fatigue resistance in Phase 1b, prompting a Phase 2 multicentre trial in 2024. Parallel work on GLP-1-adjunct therapies has gained urgency; Veru Inc.'s enobosarm preserved 71% more lean mass than semaglutide alone in a 2025 read-out. Investor appetite is further buoyed by early indications of dual indications in osteoporosis and frailty, suggesting broader reimbursement potential. These advances signal a near-term inflection that could erode the nutritional segment's dominance once pivotal data mature.

Lack of Globally Approved Pharmacological Therapies

No drug has yet cleared either FDA or EMA review specifically for sarcopenia, keeping many physicians anchored to nutritional protocols. Late-stage candidates occasionally boost lean mass yet miss functional-endpoint hurdles, undermining regulatory confidence. This gap delays payer coverage and limits prescriber willingness to label sarcopenia on claims forms, muting near-term pharmaceutical uptake even as pipelines swell.

Other drivers and restraints analyzed in the detailed report include:

- Formal Disease Classification and Reimbursement

- Government Healthy-Aging and Malnutrition-Mitigation Initiatives

- Divergent International Diagnostic Consensus Guidelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nutritional formulations generated 80.91% of the sarcopenia treatment market revenue in 2024, bolstered by ready retail access and expanding clinical evidence that leucine-enriched protein elevates muscle-protein synthesis. Sales surged through retail pharmacies where seniors seek pharmacist counselling, while subscription e-commerce sites enhanced adherence through auto-refill. At the same time, the pharmaceutical segment is pacing ahead at a 6.99% CAGR as testosterone and ACE inhibitors progress toward pivotal trials. The sarcopenia treatment market size for pharmaceuticals could exceed USD 266 million by 2030 if first-in-class approvals align with guideline harmonisation.

Pipeline diversity underpins this acceleration. Enobosarm's ability to mitigate GLP-1-induced lean-mass loss has attracted the interest of endocrinologists, and Epirium Bio's MF-300 targets mitochondrial pathways, with an IND cleared in late 2024. Combination regimens pairing high-quality protein with oral SARMs are also in early testing, aiming to deliver multimodal benefits across strength, endurance, and daily-living function.

Oral therapies commanded 87.37% share of sarcopenia treatment market sales in 2024, a legacy of consumer familiarity with powders, tablets, and chewables. The convenience of once-daily sachets aligns with geriatric adherence realities, and manufacturers continue to fortify products with vitamin D, omega-3s, and probiotics for added differentiation. In contrast, parenteral options-chiefly peptide biologics delivered subcutaneously-are expanding at an 5.92% CAGR. High bioavailability and the possibility of quarterly dosing make injectables attractive for patients facing malabsorption or severe mobility limitations.

Developers are refining depot formulations to minimise clinic visits, and long-acting myostatin antibodies have shown durable increases in appendicular lean mass in early pilots. Transdermal patches remain exploratory but could open niche use cases in regional muscle loss.

The Sarcopenia Treatment Market Report is Segmented Into by Treatment Type (Protein Supplements, Pharmaceuticals, and Combinational Therapies), by Route of Administration (Oral, Parenteral, and Transdermal / Topical), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Others), Disease Type (Primary Sarcopenia and Secondary Sarcopenia), and Geography). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 42.57% of sarcopenia treatment market revenue in 2024, driven by robust reimbursement and a dense network of geriatricians familiar with curated protein blends and investigational SARMs. FDA Fast Track status for Lipocine's LPCN 1148 in December 2024 underscores growing regulatory focus on cirrhosis-related sarcopenia, while AI-enabled screening tools from health-tech firms help primary-care doctors spot early deficits. The sarcopenia treatment market size in the region is projected to climb steadily as Medicare Advantage plans integrate preventive muscle-health benefits.

Asia-Pacific is the fastest-growing arena at a 7.17% CAGR between 2025 and 2030. Japan's national Frailty Check programme subsidises grip-strength testing in pharmacies, while China channels public-private capital into elder-care hubs outfitted with resistance-training technology. Local pharma players such as Astellas and Jiangsu Hengrui are funnelling R&D funds into myostatin-antibody franchises tailored for East-Asian phenotypes. High smartphone penetration also accelerates adoption of tele-nutrition services that ship personalised sachets.

Europe retains a solid foothold owing to longstanding geriatric-care infrastructure and the unifying role of EWGSOP2 definitions. Germany and the United Kingdom are piloting "muscle-clinics" that co-manage osteoporosis and sarcopenia under one roof, boosting adherence. Horizon-Europe grants incentivise SMEs to develop strength-measuring wearables compliant with data-protection rules, while Mediterranean countries emphasise protein enrichment of traditional diets. South America, the Middle East, and Africa are smaller but advancing as multilateral health-aid programmes finance community-nutrition schemes that stock protein blends in primary-care centres.

- Nestle Health Science

- Abbott Laboratories

- Bayer

- Sanofi

- Novartis

- Eli Lilly and Company

- Amgen

- Pfizer

- GlaxoSmithKline

- Regeneron Pharmaceuticals

- MyoPax GmbH

- Biophytis

- Epirium Bio

- Turn Biotechnologies, Inc.

- TNF Pharmaceuticals

- EUSOL Biotech Co., Ltd.

- ONCOCROSS CO., LTD

- BPGbio, Inc.

- Lipocine

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Global Geriatric Demographic Expanding Sarcopenia Prevalence

- 4.2.2 Intensified Biopharma Pipeline Investment in Myostatin Inhibitors and SARMs

- 4.2.3 Formal Disease Classification and Reimbursement Pathways Boosting Diagnosis Rates

- 4.2.4 Robust Clinical Evidence for High-Quality Protein and Amino-Acid Nutrition Therapy

- 4.2.5 Government Healthy-Aging and Malnutrition-Mitigation Initiatives Widening Access

- 4.2.6 Emergence of Digital Diagnostics and Wearables Facilitating Early Detection

- 4.3 Market Restraints

- 4.3.1 Lack of Globally Approved Pharmacological Therapies Constraining Physician Adoption

- 4.3.2 Divergent International Diagnostic Consensus Guidelines Creating Market Uncertainty

- 4.3.3 Safety & Compliance Concerns with Long-Term High-Dose Supplement Use

- 4.3.4 Elevated R&D Costs and Attrition Rates in Anabolic Drug Development Impeding Investment

- 4.4 Value-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers / Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value USD)

- 5.1 By Treatment Class

- 5.1.1 Nutritional Supplements

- 5.1.1.1 Protein Supplements (Whey, Casein, Collagen)

- 5.1.1.2 Amino-Acid Supplements (Leucine, HMB, Creatine)

- 5.1.1.3 Vitamin D and Calcium Supplements

- 5.1.1.4 Vitamin B12 and Folate Supplements

- 5.1.1.5 Omega-3 Fatty-Acid Supplements

- 5.1.2 Pharmaceuticals

- 5.1.2.1 Hormone-Replacement Therapy (Testosterone & Analogues)

- 5.1.2.2 ACE Inhibitors and Angiotensin II Receptor Blockers

- 5.1.2.3 Others (Growth-Hormone Secretagogues)

- 5.1.3 Combination Therapies

- 5.1.1 Nutritional Supplements

- 5.2 By Route of Administration

- 5.2.1 Oral

- 5.2.2 Parenteral

- 5.2.3 Transdermal / Topical

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Retail Pharmacies

- 5.3.3 Online Pharmacies

- 5.3.4 Others

- 5.4 By Disease Type

- 5.4.1 Primary (Age-Related) Sarcopenia

- 5.4.2 Secondary Sarcopenia

- 5.4.2.1 Activity-Related

- 5.4.2.2 Disease-Related

- 5.4.2.3 Nutrition-Related

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Nestle Health Science

- 6.3.2 Abbott Laboratories

- 6.3.3 Bayer AG

- 6.3.4 Sanofi S.A.

- 6.3.5 Novartis AG

- 6.3.6 Eli Lilly and Company

- 6.3.7 Amgen Inc.

- 6.3.8 Pfizer Inc.

- 6.3.9 GlaxoSmithKline plc

- 6.3.10 Regeneron Pharmaceuticals, Inc.

- 6.3.11 MyoPax GmbH

- 6.3.12 Biophytis

- 6.3.13 Epirium Bio

- 6.3.14 Turn Biotechnologies, Inc.

- 6.3.15 TNF Pharmaceuticals

- 6.3.16 EUSOL Biotech Co., Ltd.

- 6.3.17 ONCOCROSS CO., LTD

- 6.3.18 BPGbio, Inc.

- 6.3.19 Lipocine

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment