PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851835

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851835

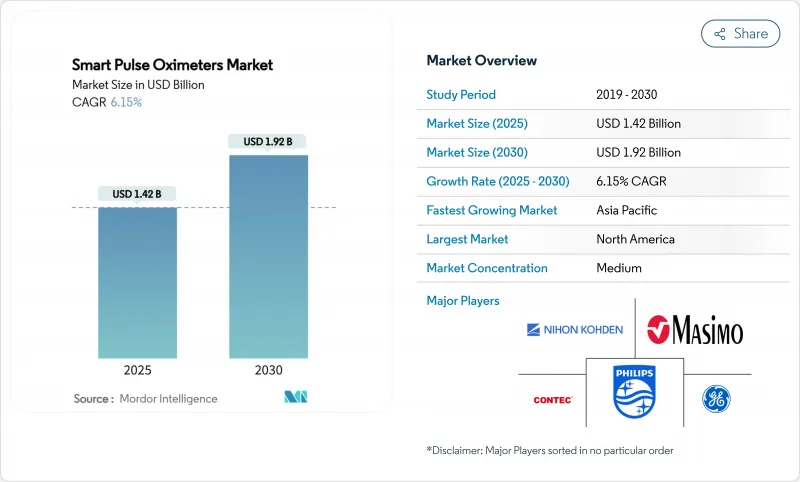

Smart Pulse Oximeters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart pulse oximeters market size reached USD 1.42 billion in 2025 and is on track to reach USD 1.92 billion by 2030, advancing at a 6.15% CAGR.

Digital health integration, wider home-monitoring use, and regulatory clarity are accelerating product upgrades that blend traditional photoplethysmography with cloud-based analytics. Demand remains brisk in hospitals and clinics, yet consumer electronics brands are expanding access by embedding clinically validated sensors in smartphones and wearables. Artificial-intelligence algorithms that correct for motion artefacts and skin-tone bias strengthen clinical confidence, while reimbursement codes for remote patient monitoring encourage provider adoption. Together, these factors underpin steady value expansion and intensifying competition within the smart pulse oximeters market.

Global Smart Pulse Oximeters Market Trends and Insights

Rising Prevalence of Chronic Respiratory and Cardiovascular Diseases

Higher COPD and heart-failure caseloads keep clinicians focused on continuous SpO2 surveillance. Programs that embed connected oximeters into COPD pathways cut hospitalization frequency by 65% while achieving 88.6% patient adherence, establishing compelling use-case proof. Value-based-care models reward these preventive outcomes, pushing hospitals to adopt devices with predictive analytics that spot exacerbations early. Machine-learning layers built atop longitudinal SpO2 data enable timely interventions, reducing emergency-department visits. Consequently, chronic-disease pressure makes the smart pulse oximeters market central to disease-management ecosystems rather than a peripheral gadget.

Increasing Adoption of Home Healthcare and Remote Patient Monitoring

COVID-19 normalized at-home pulse oximetry, and payers now reimburse remote patient monitoring services. Clinical validation of Samsung's smartphone sensor at 2.6% RMSD against arterial blood gas has placed medical-grade capability in more than 100 million phones, scaling access at negligible marginal cost. Providers leverage dashboards that aggregate live SpO2 feeds, allowing timely outreach without extra clinic appointments. Cost savings, improved patient satisfaction, and easier chronic-condition surveillance are accelerating device orders, cementing remote monitoring as a structural growth pillar for the smart pulse oximeters market.

High Device Cost and Inconsistent Reimbursement Policies

Premium pricing for medical-grade sensors deters adoption among smaller facilities and self-pay consumers. Reimbursement varies widely by insurer and region, complicating ROI assessments for multi-site rollouts. Although remote-monitoring programs yield downstream savings by reducing readmissions, front-loaded hardware expenses and uncertain payor timelines prolong decision cycles. Lower-cost designs are entering the market, yet validation demands and certification fees constrain dramatic price cuts, pressuring commercial strategies across the smart pulse oximeters market.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Wearable and Connected Pulse Oximetry

- Growing Government Support for Digital Health and Telemedicine

- Stringent Regulatory and Clinical Validation Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Finger units retained 44.56% market share in 2024 thanks to familiar form factors and low training needs. Conversely, connected variants are set to post an 8.54% CAGR through 2030, injecting cloud telemetry and big-data analytics into everyday care. Wrist-worn models appeal to athletic and sleep-health niches, and multi-parameter patches spotlight the future of ambulatory monitoring. OxiWear's continuous-monitoring ear clip, recently FDA-cleared, illustrates the pathway to wearable medical devices with uninterrupted SpO2 streams. Continuous data flow expands clinician insight and underpins predictive-care algorithms, securing a rising share of the smart pulse oximeters market size for wireless categories.

Their surge owes much to interoperability advances that let devices pair with smartphones and hospital dashboards in seconds. Developers now prioritize ISO-compliant Bluetooth Low Energy stacks and encrypted APIs, guaranteeing health-record compatibility. That user-centric engineering shortens onboarding, trims support costs, and accelerates institutional procurement cycles. As result, connected formats are outpacing legacy standalone models within the broader smart pulse oximeters market.

Standalone monitors still dominate with 55.46% revenue because ICU protocols require vetted hardware that meets strict alarm standards. Even so, phone-based sensors will expand at an 8.87% CAGR, as Samsung and Apple prove camera-plus-LED arrays can clear FDA thresholds. Developers supply SDKs enabling third-party telehealth apps to cache encrypted SpO2 snapshots, multiplying software revenue prospects. When insurers reimburse remote-monitoring CPT codes, clinicians increasingly prescribe app-based oximetry, fueling adoption and diversifying the smart pulse oximeters market.

In parallel, smartwatches are edging toward medical-device clearance. Apple's patent hurdles show IP risk, yet technical feasibility is proven. Wearable platforms support continuous background readings, informing sleep-apnea detection and exercise recovery analytics. Standardized firmware updates deliver algorithm refinements without hardware swaps, prolonging device life cycles and feeding recurring-software revenue loops inside the smart pulse oximeters industry.

The Smart Pulse Oximeters Market Report is Segmented by Product Type (Finger Pulse Oximeters, and More), Operating Platform (Stand-Alone Devices, and More), Application (Chronic Disease Management, and More), End User (Hospitals & Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America delivered 44.32% revenue in 2024 on the back of reimbursement certainty and an innovation cluster spanning Silicon Valley to Boston. Nine of the top 10 US hospitals standardize on Masimo SET technology for ICU monitoring, anchoring corporate share in the smart pulse oximeters market. Canada's reimbursement for virtual-ward pilots and Mexico's cross-border trade policies support steady regional throughput.

Asia-Pacific, meanwhile, is forecast at a 7.34% CAGR through 2030 and has become the dominant volume engine. China's medtech output has grown 28% annually since 2019, aided by generous R&D tax credits and hospital-procurement quotas favoring domestic brands. Japan's USD 40 billion device market centres on telemonitoring to manage its super-aged demographic, with local distributors partnering US sensor specialists. India's production-linked incentives target USD 50 billion in medical-device sales by 2030, opening greenfield capacity for oximeter assembly under revised quality norms. South Korea couples advanced semiconductor packaging with OLED expertise to produce ultra-thin reflective sensors, cementing the region as an innovation crucible for the smart pulse oximeters market.

Europe prioritizes safety and compliance under MDR, giving incumbents with robust CE portfolios a competitive moat. Germany drives R&D collaborations between university hospitals and SMEs, while France funds remote-monitoring pilots via national health insurance. Post-Brexit UK maintains MHRA alignment yet sets independent accelerated-access pathways. Regulators routinely delist non-compliant online listings, underscoring enforcement vigilance. Collectively, these policies sustain moderate yet dependable contribution to global smart pulse oximeters market growth.

- Masimo

- Medtronic

- Koninklijke Philips

- GE Healthcare

- Nonin Medical

- Nihon Kohden

- Halma plc (SunTech Medical)

- Contec Medical Systems

- OMRON

- ICU Medical (Smiths Group plc)

- iHealth Labs

- Apple

- Samsung Electronics Co.

- Garmin

- Resmed

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic Respiratory and Cardiovascular Diseases

- 4.2.2 Increasing Adoption of Home Healthcare and Remote Patient Monitoring

- 4.2.3 Technological Advancements in Wearable and Connected Pulse Oximetry

- 4.2.4 Growing Government Support for Digital Health and Telemedicine

- 4.2.5 Expansion of E-Commerce Channels for Consumer Health Devices

- 4.2.6 Post-Pandemic Focus on Hospital Oxygen Saturation Monitoring Standards

- 4.3 Market Restraints

- 4.3.1 High Device Cost and Inconsistent Reimbursement Policies

- 4.3.2 Stringent Regulatory and Clinical Validation Requirements

- 4.3.3 Data Accuracy Concerns in Diverse Patient Populations

- 4.3.4 Intensifying Price Competition and Margin Compression

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Finger Pulse Oximeters

- 5.1.2 Hand-held Pulse Oximeters

- 5.1.3 Wrist-worn Pulse Oximeters

- 5.1.4 Wireless/Connected Pulse Oximeters

- 5.1.5 Multi-parameter Smart Wearables (SpO?-enabled)

- 5.2 By Operating Platform

- 5.2.1 Stand-Alone Devices

- 5.2.2 Smartphone-Integrated Sensors

- 5.2.3 Smartwatch-Integrated Sensors

- 5.3 By Application

- 5.3.1 Chronic Disease Management (COPD, CHF, Etc.)

- 5.3.2 Critical & Emergency Care

- 5.3.3 Post-Operative Monitoring

- 5.3.4 Sleep & Respiratory Therapy

- 5.3.5 Sports & Wellness Tracking

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Home Healthcare

- 5.4.4 Sports & Fitness Centers

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Masimo Corporation

- 6.3.2 Medtronic plc

- 6.3.3 Koninklijke Philips N.V.

- 6.3.4 GE Healthcare

- 6.3.5 Nonin Medical, Inc.

- 6.3.6 Nihon Kohden Corporation

- 6.3.7 Halma plc (SunTech Medical)

- 6.3.8 Contec Medical Systems

- 6.3.9 Omron Corporation

- 6.3.10 ICU Medical (Smiths Group plc)

- 6.3.11 iHealth Labs

- 6.3.12 Apple Inc.

- 6.3.13 Samsung Electronics Co.

- 6.3.14 Garmin Ltd.

- 6.3.15 ResMed Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment