PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851840

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851840

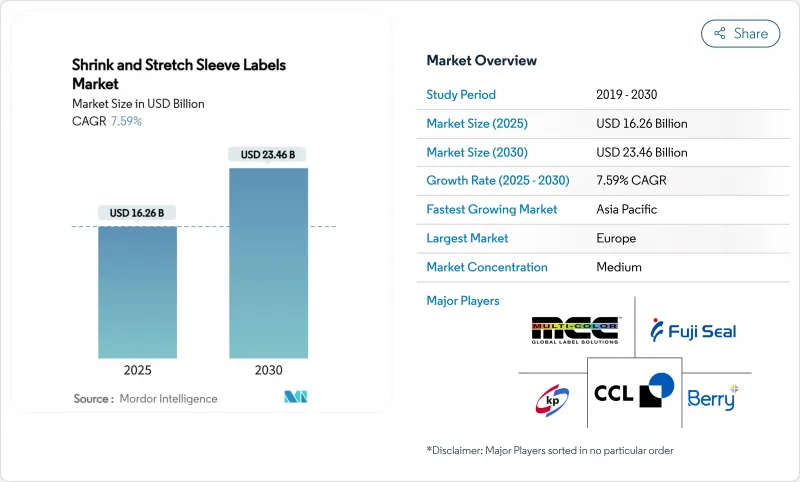

Shrink And Stretch Sleeve Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The shrink and stretch sleeve labels market size stands at USD 16.26 billion in 2025 and is forecast to climb to USD 23.46 billion by 2030, reflecting a steady 7.59% CAGR.

Expansion rests on brand owners seeking 360-degree graphics that lift shelf impact, fulfill tamper-evident mandates, and align with strict recycling targets. Rapid gains in digital inkjet capacity let converters print short runs of 1,000 sleeves or fewer, slashing entry costs for craft brewers and niche beverage producers. Pharmaceutical regulations that require visible integrity indicators reinforce demand, while functional drinks favor light-blocking sleeves that maintain ingredient potency. Europe leads by value thanks to early adoption of premium packaging, yet Asia-Pacific registers the quickest growth as rising disposable incomes boost packaged beverage consumption.

Global Shrink And Stretch Sleeve Labels Market Trends and Insights

Growth in Packaged Beverages and Functional Drinks

Functional drinks use sleeve technology to protect light-sensitive nutrients and display expanded nutritional panels. One in three shoppers now ranks immune support as a top purchase criterion, strengthening demand for drinks formulated with vitamin C, elderberry, and probiotics. Full-body graphics give brands 150% more printable area than pressure-sensitive labels, allowing claims, QR codes, and authenticity seals. Premier Protein trimmed plastic by 35% by migrating to PET bottles wrapped in light-blocking shrink sleeves that feature perforations for easy removal during recycling. Craft brewers that previously needed orders of 100,000 decorated cans now source as few as 7,000 cans fitted with shrink sleeves, widening access for seasonal releases.

Digital Inkjet Short-Run Printing Lowering MOQ for Niche SKUs

Water-based inkjet presses achieve production speeds 2.3 times higher than earlier systems while eliminating solvent residue concerns in food packaging. Converters now profitably accept 1,000-unit jobs versus the 100,000-unit threshold required for flexography, enabling hyper-targeted SKUs for regional promotions and e-commerce bundles. Design iterations finalize in days, not weeks, giving marketers real-time feedback loops. Digital volume is projected to reach 9.7% of total label output by 2029, expanding at a 4.4% CAGR in square-meter terms. Shrink and stretch sleeve labels market participants that integrate inline finishing with inkjet heads gain agility that legacy gravure lines cannot match.

Competition from Stand-Up Pouches and Direct-to-Container Printing

Lightweight pouches use 60% less plastic than rigid bottles and cost only USD 0.20 per unit compared with USD 0.50 for comparable PET containers.Digital can printers such as Velox now run 500 cans per minute, eliminating sleeve film altogether and appealing to sustainability-focused craft brands. Direct decoration removes the heat tunnel, trim scrap, and adhesive usage inherent to shrink lines. Cost differentials widen in high-volume carbonated beverages where sleeve application adds 2-2.5 times unit cost relative to offset printing. The shrink and stretch sleeve labels market nonetheless preserves relevance by serving irregular containers that pouches or cans cannot mimic.

Other drivers and restraints analyzed in the detailed report include:

- Demand for 360° High-Definition Graphics to Boost Shelf Appeal

- Shift Toward Recyclable PETG and Floatable Sleeve Films

- Resin-Price Volatility from Geopolitical Supply Shocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Shrink sleeves controlled 73.2% of the shrink and stretch sleeve labels market in 2024, reflecting their proven fit for complex bottle geometries and tamper-evident safety seals. High-speed automatic applicators run beyond 800 bottles per minute with error rates under 0.5%, a performance metric difficult for alternate formats. Stretch sleeves need no heat tunnel, trimming energy use by up to 40%, and support recycling because consumers can easily remove them before disposal. The segment's 8.3% CAGR through 2030 surpasses overall market pace as European beverage brands adopt low-carbon packaging to achieve Scope 3 commitments.

Although shrink technology retains primacy, future production likely evolves toward a dual-solution ecosystem. Shrink formats will secure pharmaceutical vials, functional drinks, and contoured household cleaners that demand form-fitting coverage. Stretch sleeves will expand in water, dairy, and economy cola where price sensitivity intersects with sustainability positioning. Production lines increasingly pair servo-driven mandrel applicators with vision systems that inspect sleeve placement in real time, minimizing rework. Suppliers confirm that both sleeve types now accept the same water-based inkjet inks, simplifying graphic changeovers and reinforcing flexible manufacturing strategies in the shrink and stretch sleeve labels market.

Shrink and Stretch Sleeve Labels Market is Segmented by Type (Shrink Sleeve, Stretch Sleeve), Material (PVC, PET/PET-G, PE, OPP and OPS, Other Materials), End User (Food, Soft Drinks, Alcoholic Drinks, Cosmetics and Household, Pharmaceutical, Other End Users), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe retained 29.8% revenue in 2024 due to robust environmental policies and a culture of premium packaging. Germany, France, and the United Kingdom direct a sizable share of capital expenditure toward sleeve film lines fitted with energy-efficient infrared tunnels. EU Packaging and Packaging Waste Regulation stipulates recyclability by 2030, driving demand for PET-based sleeves that detach cleanly in wash plants. The region's average selling price per thousand sleeves exceeds the global mean by 12% because of sophisticated graphic requirements and low minimum runs requested by boutique spirits.

Asia-Pacific records the fastest trajectory at an 8.1% CAGR thanks to surging disposable income, urbanization, and the rise of functional beverages. China's express packaging standard GB 43352-2023 restricts heavy metals in inks, compelling local converters to adopt compliant chemistries. Thailand pilots label-free PET bottles that store product data in QR codes printed on caps, pressuring traditional sleeve volumes yet opening new avenues for smart interactive films. Japan's early adoption of water-based inkjet for flexible film aligns with its plastics resource circulation act, fostering home-grown innovations that resonate across regional markets.

North America benefits from a vibrant craft beer ecosystem and a well-established healthcare framework. Tamper-evident needs in pharmaceuticals and over-the-counter nutritional supplements ensure a baseline of steady demand. South America leverages abundant PET resin supply yet remains exposed to currency swings that limit capital spending on high-end presses. The Middle East and Africa trail in installed capacity but exhibit pockets of high value in premium imported spirits and personal care, which rely on sleeves for brand elevation. Taken together, geographic diversity underpins the long-term resilience of the shrink and stretch sleeve labels market.

- CCL Industries

- Fuji Seal International

- Berry Global Group

- Multi-Color Corporation

- KP Klockner Pentaplast

- Amcor PLC

- Huhtamaki Oyj

- Fort Dearborn Company

- Taghleef Industries

- Siegwerk Druckfarben

- Macfarlane Labels

- Avery Dennison Corp.

- Clondalkin Group

- Cenveo Worldwide

- Schur Flexibles

- Hammer Packaging

- Sleeve Seal Inc.

- PDC-Europe

- Fortalab Labels

- Akar Shrink Packs

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for 360 degrees high-definition graphics to boost shelf appeal

- 4.2.2 Rising demand for tamper-evident and anti-counterfeit packaging

- 4.2.3 Growth in packaged beverages and functional drinks

- 4.2.4 Shift toward recyclable PETG and floatable sleeve films

- 4.2.5 Digital inkjet short-run printing lowering MOQ for niche SKUs

- 4.2.6 Smart interactive features (thermochromic, QR) enabling marketing

- 4.3 Market Restraints

- 4.3.1 Recycling hurdles of multimaterial sleeves contaminating PET streams

- 4.3.2 Competition from stand-up pouches and direct-to-container printing

- 4.3.3 Resin-price volatility from geopolitical supply shocks

- 4.3.4 EU/NA curbs on PVC sleeves inflating compliance costs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Assesment of macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Shrink Sleeve

- 5.1.2 Stretch Sleeve

- 5.2 By Material

- 5.2.1 PVC

- 5.2.2 PET / PET-G

- 5.2.3 PE

- 5.2.4 OPP and OPS

- 5.2.5 Other Materials (PO, PLA, etc.)

- 5.3 By End User

- 5.3.1 Food

- 5.3.2 Soft Drinks

- 5.3.3 Alcoholic Drinks

- 5.3.4 Cosmetics and Household

- 5.3.5 Pharmaceutical

- 5.3.6 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Australia and New Zealand

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 UAE

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Nigeria

- 5.4.5.2.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CCL Industries

- 6.4.2 Fuji Seal International

- 6.4.3 Berry Global Group

- 6.4.4 Multi-Color Corporation

- 6.4.5 KP Klockner Pentaplast

- 6.4.6 Amcor PLC

- 6.4.7 Huhtamaki Oyj

- 6.4.8 Fort Dearborn Company

- 6.4.9 Taghleef Industries

- 6.4.10 Siegwerk Druckfarben

- 6.4.11 Macfarlane Labels

- 6.4.12 Avery Dennison Corp.

- 6.4.13 Clondalkin Group

- 6.4.14 Cenveo Worldwide

- 6.4.15 Schur Flexibles

- 6.4.16 Hammer Packaging

- 6.4.17 Sleeve Seal Inc.

- 6.4.18 PDC-Europe

- 6.4.19 Fortalab Labels

- 6.4.20 Akar Shrink Packs

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment