PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851844

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851844

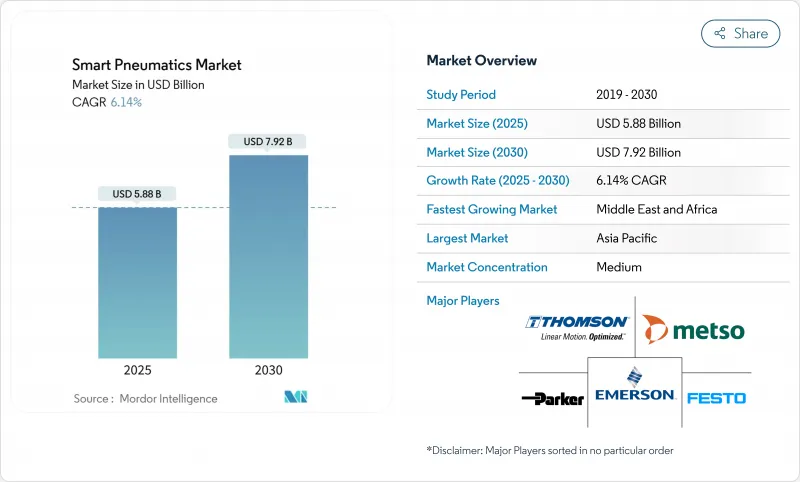

Smart Pneumatics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart pneumatics market is valued at USD 5.88 billion in 2025 and is forecast to reach USD 7.92 billion by 2030, reflecting a 6.14% CAGR.

Growth is propelled by the fusion of compressed-air power with IIoT connectivity, which allows real-time monitoring, energy optimization, and predictive maintenance within factory environments. Manufacturers are prioritizing pneumatic upgrades that reduce unplanned downtime, cut compressed-air leaks, and integrate seamlessly with MES and cloud analytics. Regional momentum is strongest in Asia-Pacific, where large-scale semiconductor investments and government automation programs are expanding the installed base of connected pneumatic devices. Meanwhile, the Middle East shows rapid uptake in oil-and-gas wellhead applications, where safety-critical valve actuation benefits from live health diagnostics. Competition centers on data stewardship, with leading suppliers adding AI capabilities that convert sensor data into actionable insights.

Global Smart Pneumatics Market Trends and Insights

Predictive-maintenance imperatives in automotive tier-1 plants

Automotive tier-1 suppliers are embedding pressure, flow, and temperature sensors into cylinder assemblies to detect wear patterns weeks before failure. European body-in-white lines have documented 20-30% maintenance cost reductions and near-zero unplanned stops by coupling pneumatic sensor streams with machine-learning algorithms that flag anomaly clusters. North American power-train plants replicate the model to protect line takt times, and Asian OEMs are piloting it as local labour shortages intensify. As electrified vehicle programs expand, mixed-model assembly lines rely on fault-prediction accuracy to sustain hourly throughput. Predictive health data from smart pneumatic devices therefore shifts maintenance planning from calendar to condition-based logic, preserving uptime and compressing inventory of critical spares.

Integration of IO-Link-ready sensors in pneumatic valves

IO-Link converts valves from passive air switches into addressable field devices. Emerson field data indicates commissioning time cuts of 40% when valve islands self-identify and auto-populate controller tags. Eight Class A ports on a single master support combinations of flow, pressure, and position sensors placed up to 30 m from PLC cabinets without signal loss. Faster device replacement lowers mean-time-to-repair, while parameter backups prevent manual set-point errors. Japan and South Korea have accelerated adoption in electronics packaging lines that must swap tooling frequently. As factories unify sensor connectivity on IO-Link, pneumatic diagnostics feed edge gateways that push alarm packets to CMMS applications, closing the loop between operations and maintenance.

Lack of Ethernet-IP interoperability with legacy fieldbus islands

Brownfield sites often operate PROFIBUS, DeviceNet, or CC-Link islands that cannot natively exchange CIP objects. Adding protocol gateways introduces 5-15 ms latency, which jeopardizes time-critical blow-off sequences in high-speed pick-and-place units. Isolated automation pockets hinder end-to-end data visibility, forcing maintenance teams to juggle multiple diagnostic tools. Multi-protocol nodes and Time-Sensitive Networking promise relief, yet widespread deployment awaits capital-budget cycles. Until then, system integrators must design hybrids that compromise on either speed or cost, slowing refresh projects that would otherwise expand the smart pneumatics market.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated semiconductor capacity build-out in China and Taiwan

- Safety-critical adoption in oil and gas well-heads

- High TCO versus electromechanical alternatives in light-duty lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smart pneumatic valves anchored the smart pneumatics market with 45% revenue in 2024, supplying most industries with sensor-rich manifold platforms that broadcast pressure, flow, and cycle counts to PLCs. Valve health metrics inform condition-based overhaul schedules, helping automotive paint shops avoid overspray defects linked to pressure drift. Integration of IO-Link within manifold blocks simplifies expansion, as eight-way masters accept hot-swap cartridges without rewiring. Add-on analytics calculate leakage per valve, highlighting energy losses invisible in legacy systems. Semiconductor fabs adopt stainless-steel variants that comply with cleanroom particulate standards, reinforcing demand continuity.

Smart pneumatic modules are accelerating at an 8.5% CAGR through 2030, outpacing single-function components by bundling valve control, pressure regulation, and edge computing in one enclosure. Festo's Motion Terminal runs downloadable apps that switch a module from on/off control to proportional regulation or vacuum generation in minutes. Such flexibility lowers SKU counts and speeds product changeovers in fast-moving consumer-goods plants. Modules also embed energy-savings algorithms that auto-reduce stand-by pressure, supporting factory-wide decarbonization goals. Their expanding role in system-level orchestration positions them as pivotal contributors to the smart pneumatics market, particularly in greenfield lines designed for plug-and-play scalability.

Hardware accounted for 60% of 2024 revenue, reflecting the replacement cycle of valves, cylinders, regulators, and manifolds that populate factory floors. New-generation cylinders incorporate magnetic encoders delivering 0.1 mm resolution positional feedback, enabling coordinated multi-axis moves in packaging cells. Miniaturized flow sensors fit into regulator bodies, capturing consumption data down to the litre. Vendors increasingly ship hardware with secure boot firmware to guard against unauthorized code injection, aligning with OT cybersecurity frameworks.

Services represent the fastest-growing component at a 10% CAGR from 2025-2030. Cloud dashboards aggregate valve-island KPIs, rank them by anomaly risk, and generate automatic work orders in CMMS platforms. Energy-audit services use the data to assign cost values to leaks, convincing finance departments to fund air-line retrofits. Remote-assist subscriptions let vendor specialists access device logs, guiding plant technicians through corrective actions and reducing travel. Over time, this data-driven service layer converts transactional product sales into recurring revenue, an approach echoed by similar transitions in the smart pneumatics industry.

Smart Pneumatics Market Segmented by Product Type (Smart Pneumatic Valves, Smart Pneumatic Actuators and Smart Pneumatic Modules), Component, Instrument Type, End-User Industry (Automotive, Oil & Gas and Food & Beverage), Communication Protocol (EtherNet/IP, PROFINET and IO-Link), Distribution Channel and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 38% revenue in 2024, supported by China's automation drive under "Made in China 2025" and Taiwan's NT$32.9 billion semiconductor investments. High-density factory clusters adopt valve manifolds with built-in analytics that flag compressed-air leaks before they inflate utility bills. Japanese automotive plants roll out IO-Link enabled cylinders across stamping presses, cutting changeover times during multi-model shifts. Local vendors such as Ningbo Smart Pneumatic supply cost-optimized modules tailored to regional SMEs, intensifying competition and stimulating rapid price-performance improvements that strengthen regional dominance.

North America represents a mature yet innovation-focused buyer base. Automotive OEMs connect valve islands to cloud AI engines that predict line stoppages 30 days in advance, reducing downtime penalties. The CHIPS Act incentivizes new fabs in Arizona, Texas, and Ohio, each specifying ISO Class 1 clean-compressed-air networks with live dew-point alarms. Energy-reduction mandates push plants to adopt air-management systems capable of shutting off feed lines during idle periods, reflecting a broader push toward sustainability in the smart pneumatics market.

The Middle East is expected to grow at 7.5% CAGR through 2030. National oil companies retrofit wellheads with PLC-based safety shutdown units integrating dual-redundant pneumatic actuators that broadcast stem-movement profiles to central control rooms. The harsh climate drives demand for corrosion-resistant alloys, extended-temperature seals, and self-diagnosing valve blocks that anticipate sand ingress. Beyond oil and gas, Gulf states invest in food and pharmaceutical plants to diversify economies, adopting modular pneumatics that fit isolated facilities with limited local engineering support. This emerging demand widens the geographic footprint of smart pneumatics market suppliers.

- Emerson Electric Co. (incl. Aventics)

- Festo SE and Co. KG

- Parker Hannifin Corporation

- SMC Corporation

- Bosch Rexroth AG

- Siemens AG (Industrial Automation)

- Rotork plc

- IMI Norgren (part of IMI plc)

- Bimba Manufacturing Co. (a part of IMI)

- PHD Inc.

- PNEUMAX S.p.A.

- Cypress EnviroSystems Corp.

- AirTAC International Group

- Ningbo Smart Pneumatic Co. Ltd.

- Bosch Rexroth AG

- Thomson Industries Inc.

- The Smart Actuator Company Ltd.

- Aventics (now part of Emerson)

- Ham-Let Group

- Metso Automation (Flow Control)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Predictive-maintenance imperatives in automotive tier-1 plants (Europe)

- 4.1.2 Integration of IO-Link-ready sensors in pneumatic valves (North America)

- 4.1.3 Accelerated semiconductor capacity build-out in China and Taiwan

- 4.1.4 Safety-critical adoption in oil and gas well-heads (Middle East)

- 4.2 Market Restraints

- 4.2.1 Lack of Ethernet-IP interoperability with legacy fieldbus islands

- 4.2.2 High TCO versus electromechanical alternatives in light-duty lines

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory or Technological Outlook

- 4.4.1 Global ISO 5599-2 digital valve standardization

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Smart Pneumatic Actuators

- 5.1.1 Smart Pneumatic Modules

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Instrument Type

- 5.3.1 Cylinders

- 5.3.2 Transducers

- 5.3.3 Switches

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Oil and Gas

- 5.4.3 Food and Beverage

- 5.5 By Communication Protocol

- 5.5.1 EtherNet/IP

- 5.5.2 PROFINET

- 5.5.3 IO-Link

- 5.6 By Distribution Channel

- 5.6.1 Direct Sales

- 5.6.2 Indirect / System-Integrator

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia

- 5.7.4 Middle East

- 5.7.4.1 Israel

- 5.7.4.2 Saudi Arabia

- 5.7.4.3 United Arab Emirates

- 5.7.4.4 Turkey

- 5.7.4.5 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Emerson Electric Co. (incl. Aventics)

- 6.3.2 Festo SE and Co. KG

- 6.3.3 Parker Hannifin Corporation

- 6.3.4 SMC Corporation

- 6.3.5 Bosch Rexroth AG

- 6.3.6 Siemens AG (Industrial Automation)

- 6.3.7 Rotork plc

- 6.3.8 IMI Norgren (part of IMI plc)

- 6.3.9 Bimba Manufacturing Co. (a part of IMI)

- 6.3.10 PHD Inc.

- 6.3.11 PNEUMAX S.p.A.

- 6.3.12 Cypress EnviroSystems Corp.

- 6.3.13 AirTAC International Group

- 6.3.14 Ningbo Smart Pneumatic Co. Ltd.

- 6.3.15 Bosch Rexroth AG

- 6.3.16 Thomson Industries Inc.

- 6.3.17 The Smart Actuator Company Ltd.

- 6.3.18 Aventics (now part of Emerson)

- 6.3.19 Ham-Let Group

- 6.3.20 Metso Automation (Flow Control)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis