PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851846

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851846

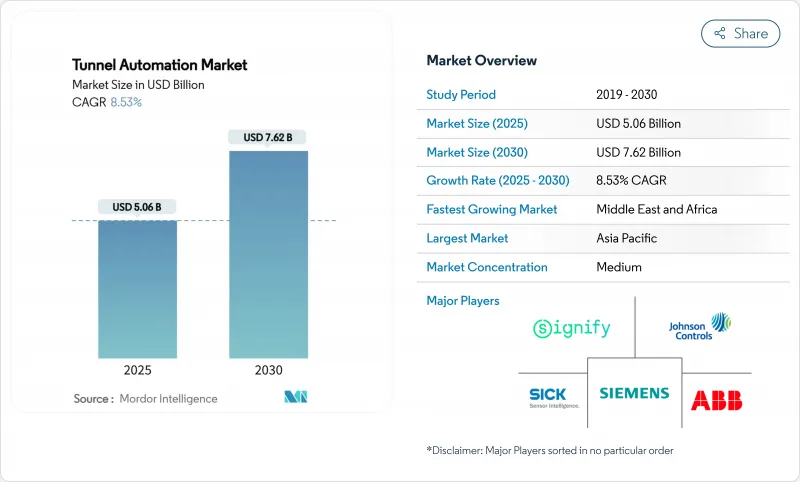

Tunnel Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The tunnel automation market size reached USD 5.06 billion in 2025 and is projected to attain USD 7.62 billion by 2030, reflecting an 8.53% CAGR and underscoring the rising demand for integrated, safety-compliant infrastructure upgrades around the world.

Intensifying regulatory mandates, widespread adoption of IoT-enabled supervisory control and data acquisition (SCADA) platforms, and sustained public-sector funding for transportation corridors are reinforcing the growth trajectory of the tunnel automation market. Hardware components remain indispensable, yet the market is rapidly pivoting toward software-rich, data-driven solutions that streamline maintenance, ensure real-time decision-making, and offset skilled labor shortages. Flexible financing models-especially energy-performance contracting-are also expanding adoption by converting capital expenditure into guaranteed operational savings. At the same time, heightened cyber-security and data-privacy standards are prompting operators to embed secure-by-design architectures across connected assets.

Global Tunnel Automation Market Trends and Insights

Government Regulations Mandating Tunnel Safety and Sustainability Upgrades

Worldwide policy frameworks are accelerating the adoption curve of tunnel automation market deployments. The US National Tunnel Inspection Standards require biennial reviews and force operators to introduce automated safety systems, effectively creating a mandatory replacement cycle. Comparable directives within the Trans-European Transport Network compel projects like the Brenner Base Tunnel to employ advanced monitoring that can shift 50 million tonnes of freight from road to rail.Legislated targets for energy savings add an environmental dimension by encouraging LED lighting retrofits and high-efficiency ventilation. China's oversight bodies now require intelligent management across new expressways, as demonstrated by the Tianshan Shengli Tunnel's in-house automation technology. The cumulative effect of these mandates is a sizeable, compliance-driven spending pool that shields capital budgets from typical deferment cycles.

Rising Integration of IoT-enabled SCADA and Cloud Analytics

Real-time analytics allow operators to reduce tunnel downtime by up to 40%, extending equipment life and aligning operations with predictive maintenance strategies. Siemens' upgrades at Spain's Somport Tunnel merged SIMATIC WinCC OA with redundant S7-1500H PLCs, delivering unified emergency and asset management. Advanced cloud platforms apply machine-learning algorithms to patterns in air-quality and equipment data, yet also widen the attack surface for malicious actors. Bridging this knowledge gap requires reskilling maintenance crews and formalizing cyber-security governance models that align operational technology (OT) with IT best practices.

High Upfront CAPEX and Integration Complexity

Comprehensive automation requires significant capital, especially where legacy tunnels demand bespoke retrofit designs and phased rollouts that can stretch timelines by up to two years. US federal P100 standards for net-zero-ready facilities increase baseline specifications and thus initial budgets. Energy-performance contracts partly offset these costs; Johnson Controls' USD 5.8 million Cobb County program generated USD 2.06 million in utility savings, proving that guaranteed performance can unlock new funding channels. Persistent shortages of specialist technicians further complicate integration workstreams.

Other drivers and restraints analyzed in the detailed report include:

- Global Surge in Transportation Infrastructure Investments

- AI-driven Predictive Lighting and Ventilation Optimisation

- Cyber-security and Data-privacy Risks in Connected Assets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware accounted for 46.4% of the tunnel automation market in 2024, reflecting the foundational need for sensors, controllers, and power infrastructure. Software, however, is set to outpace all other offerings with a 9.8% CAGR, propelled by AI-enabled analytics that facilitate predictive maintenance and autonomous decision-making.

Herrenknecht's Connected platform illustrates the transition by tracking TBM performance globally and providing real-time insights that cut downtime. Services-installation, calibration, and lifecycle management-round out the portfolio and embody a rising share of recurring revenue as operators outsource expertise.

Lighting and power supply systems dominated with 38.5% share, emphasizing the importance of energy-efficient LEDs and smart power controls. Safety and fire-detection sensors are forecast to lead growth at 9.4% CAGR, aligned with stricter incident-prevention regulations.

ABB's variable-speed ventilation drives inside Asia's longest road tunnel exemplify component integration that enhances air-quality management while cutting energy costs ABB. The rising proliferation of multi-parameter sensors enables real-time structural health monitoring that was previously unattainable.

The Global Tunnel Automation Market Report is Segmented by Offering (Hardware, Software, Services), Component (Lighting and Power Supply, Signalization and Control, and More), Automation Level (Semi-Automated, Fully-Automated), Application (Traffic Management and SCADA, and More), Tunnel Type (Roadways and Highways, Railways and Metros, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 42.5% hold on the tunnel automation market stems from relentless capital investment, state-backed industrial policies, and the widespread embrace of Industry 4.0 norms. China's scale advantage enables shorter construction cycles, cutting project lead-times nearly in half through extensive automation, as demonstrated in Xinjiang's Tianshan Shengli tunnel. Singapore's Changi project underscores regional proficiency in integrating aviation infrastructure with state-of-the-art tunnel systems, while Australia's autonomous TBMs confirm technical maturity. Public-private partnerships are standard, aligning operator incentives with long-run energy and safety objectives.

The Middle East is on a rapid ascent with a 10.9% CAGR outlook. Saudi Arabia's Vision 2030 subsidizes large-scale, smart-city corridors where robotic fabrication, AI-assisted monitoring, and carbon-neutral targets converge. Qatar's rail build-out and the UAE's metro networks deploy modular tunnel packages that are pre-fitted with IoT sensors, reducing on-site configuration. Competitive procurement frameworks prioritize vendors that can deliver turnkey, fully integrated ecosystems.

Europe sustains measured growth supported by strict compliance regimes and cross-border megaprojects. The Brenner Base Tunnel attracts EU co-funding for modal-shift objectives, while Germany's SudLink electricity link uses Herrenknecht TBMs to lay power conduits that decarbonize the grid. Brownfield retrofits dominate, particularly LED replacements that achieve documented 60% energy savings.

- Siemens AG

- ABB Ltd

- Johnson Controls International plc

- Signify Holding B.V.

- SICK AG

- SICE Tecnologiay Sistemas

- Agidens NV

- Indra Sistemas S.A.

- Advantech Co., Ltd.

- CODEL International Ltd

- Herrenknecht AG

- Schreder Group

- Nyx Hemera Technologies

- Tunnelsoft GmbH

- Epiroc AB

- Sandvik AB

- CRCHI (China Railway Construction Heavy Industry)

- CREC (Holding)

- LNSS China

- Phoenix Contact GmbH

- SITECO GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government regulations mandating tunnel safety and sustainability upgrades

- 4.2.2 Rising integration of IoT-enabled SCADA and cloud analytics

- 4.2.3 Global surge in transportation infrastructure investments

- 4.2.4 AI-driven predictive lighting and ventilation optimisation

- 4.2.5 Autonomous TBMs accelerating project timelines

- 4.2.6 Energy-performance-contracting models for legacy retrofit

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX and integration complexity

- 4.3.2 Cyber-security and data-privacy risks in connected assets

- 4.3.3 Fragmented procurement standards across transport agencies

- 4.3.4 Shortage of tunnel-automation talent in remote regions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment and Funding Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Component

- 5.2.1 Lighting and Power Supply

- 5.2.2 Signalisation and Control

- 5.2.3 HVAC and Ventilation

- 5.2.4 Safety / Fire-Detection Sensors

- 5.2.5 Other Components

- 5.3 By Automation Level

- 5.3.1 Semi-Automated

- 5.3.2 Fully-Automated

- 5.4 By Application

- 5.4.1 Traffic Management and SCADA

- 5.4.2 Environmental Monitoring and Ventilation

- 5.4.3 Lighting Control

- 5.4.4 Emergency and Safety Systems

- 5.5 By Tunnel Type

- 5.5.1 Roadways and Highways

- 5.5.2 Railways and Metros

- 5.5.3 Water and Utility Conveyance

- 5.5.4 Mining and Energy

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 ASEAN-5

- 5.6.4.7 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Qatar

- 5.6.5.1.5 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Nigeria

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Siemens AG

- 6.4.2 ABB Ltd

- 6.4.3 Johnson Controls International plc

- 6.4.4 Signify Holding B.V.

- 6.4.5 SICK AG

- 6.4.6 SICE Tecnologiay Sistemas

- 6.4.7 Agidens NV

- 6.4.8 Indra Sistemas S.A.

- 6.4.9 Advantech Co., Ltd.

- 6.4.10 CODEL International Ltd

- 6.4.11 Herrenknecht AG

- 6.4.12 Schreder Group

- 6.4.13 Nyx Hemera Technologies

- 6.4.14 Tunnelsoft GmbH

- 6.4.15 Epiroc AB

- 6.4.16 Sandvik AB

- 6.4.17 CRCHI (China Railway Construction Heavy Industry)

- 6.4.18 CREC (Holding)

- 6.4.19 LNSS China

- 6.4.20 Phoenix Contact GmbH

- 6.4.21 SITECO GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment