PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851848

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851848

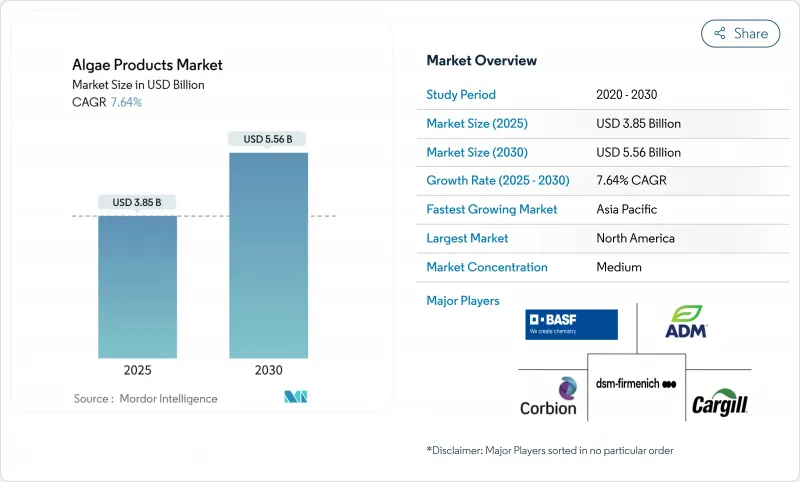

Algae Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The algae products market size is estimated at USD 3.85 billion in 2025 and is expected to reach USD 5.56 billion by 2030, at a CAGR of 7.64% during the forecast period (2025-2030).

Regulatory approvals are broadening ingredient options, shifting commercial momentum from niche applications to mainstream adoption. A prime example is the FDA's approval of Galdieria extract blue in May 2025, according to the Federal Register. As demand surges for natural colorants, plant-based proteins, and sustainable lipids, capital is increasingly funneled into advanced photobioreactor capacities. Concurrently, cost-reduction initiatives aimed at enhancing support-structure efficiency are successfully narrowing the gap with conventional ingredients as per Pacific Northwest National Laboratory (PNNL). North America maintains its leadership, bolstered by consistent safety frameworks. In contrast, Asia-Pacific is witnessing the fastest growth, driven by a booming aquaculture sector and government mandates for biofuels. While competitive intensity is moderate, there's enough rivalry to fuel innovation. Yet, this landscape also allows established players to fortify their positions through scale and patents.

Global Algae Products Market Trends and Insights

Growing Demand for Plant-Based Protein Ingredients

Microalgae, particularly Spirulina and Chlorella, are gaining traction in sports nutrition, meat alternatives, and infant formulas due to their high protein content, reaching up to 70% of their dry weight. A 2024 study from the University of Exeter highlighted Spirulina's muscle-boosting protein, comparable to mycoprotein. AlgaeCore Technologies secured USD 19 million to refine its Simplii Texture process, which eliminates off-notes and creates fibrous structures without extrusion, as per the Pacific Northwest National Laboratory (PNNL). Brevel's Israeli facility is producing neutral-flavor microalgae protein using sugar-based fermentation, reducing the cost gap with soy and pea proteins. Rising demand for sustainable, plant-based proteins is driving innovation and scaling efforts in the microalgae market.

Increasing Use of Natural Food Colorants and Texturants

In a notable policy shift, the FDA approved four algae-derived pigments in 2025, including the Galdieria extract blue. This move accelerates the market entry of natural alternatives. Notably, the spirulina extract benefits from a certification exemption, sidestepping the periodic batch fees associated with synthetic dyes. At the same time, advancements in fermentation are enhancing pigment heat stability. This allows confectionery and baking companies to seamlessly transition from synthetic blues and reds, without compromising on hue intensity. Additionally, the growing consumer demand for clean-label and plant-based products is further driving the adoption of algae-derived pigments. The increasing focus on sustainability and reducing reliance on synthetic ingredients also aligns with the broader industry trends, making algae products a preferred choice. Collectively, these developments are elevating algal carotenoids from niche ingredients to essential components, driving the growth of the algae products market.

Regulatory Ambiguities for Novel Algae-Based Foods in Emerging Economies

India's Food Safety and Standards Authority has yet to provide a definitive direction for algal proteins, leaving companies to navigate a maze of inconsistent approvals at the state level. In contrast, the EU (European Union) took decisive action in 2024, incorporating 20 algae species into its Novel Food Status Catalogue. This strategic move not only spared companies a significant EUR 10 million in administrative costs but also underscored a widening market gap. India's regulatory uncertainties have hampered the uptake of algae-based products, curtailing their domestic market potential. Meanwhile, the EU's forward-thinking stance has made it a magnet for investment and innovation in the algae sector. Consequently, global producers are increasingly favoring regions with clearer approval processes, leading to a slowdown in technology transfers to more budget-friendly areas.

Other drivers and restraints analyzed in the detailed report include:

- Support from Organic Farming and Circular Economy Initiatives

- Broadening Applications Across Diverse Industries

- Supply-Chain Constraints for Algae Raw Materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, brown algae commanded a dominant 43.01% share of the algae products market, bolstered by established carrageenan and alginate supply chains in coastal regions of Asia and South America. Decades of infrastructure development, coupled with stringent specification standards, have cemented customer loyalty, particularly in dairy gelling and wound-care dressing applications. However, the segment's reliance on largely wild-harvested cultivation leaves it vulnerable to climate-induced fluctuations in biomass. Additionally, the limited scalability of wild-harvest methods poses challenges in meeting the growing global demand. Efforts to transition toward controlled aquaculture systems are underway, but widespread adoption remains slow due to high initial investment costs.

Green algae, on the other hand, is emerging as the fastest-growing segment, projected to maintain a robust 9.36% CAGR through 2030. This growth is driven by strains like Chlorella and Chlamydomonas, achieving impressive yields exceeding 0.3 g L-1 day-1. By employing fermentation-based processes, producers sidestep photosynthetic challenges, enabling them to position plants closer to renewable energy sources. Innovations in recombinant platforms are paving the way for lucrative pharmaceuticals, and ProFuture's development of a flavor-neutral Chlorella addresses past sensory limitations. Furthermore, green algae's versatility in applications such as biofuels and animal feed enhances its market potential. The segment's rapid advancements are attracting significant investments, further accelerating its growth trajectory.

The Algae Products Market Report is Segmented by Source (Brown Algae, Red Algae, Green Algae, Blue-Green Algae), Product Type (Hydrocolloids, Algal Protein, Carotenoids, Lipids, and Other Product Types), Application (Personal Care and Cosmetics, Food and Beverage, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America held a commanding 34.54% share of the algae products market. Multinationals find reassurance in the FDA's clear stance on color additives and its Generally Recognized as Safe (GRAS) processes. Meanwhile, public-private funding, exemplified by the Department of Energy's USD 20.2 million investment in algae-to-fuel consortia, bolsters technical advancements. In Alberta, pilots of cold-climate photobioreactors showcase potential cost parity, even at latitude 53°, expanding the region's agricultural possibilities. The region's focus on innovation and regulatory clarity has attracted significant investments from both domestic and international players. Additionally, advancements in photobioreactor technology are expected to further enhance production efficiency and scalability.

Asia-Pacific, projected to grow at an 8.98% CAGR through 2030, reaps benefits from China's mandates on microalgae biodiesel and its integrated aquaculture initiatives. Coastal provinces are incentivizing onshore raceway ponds, linking them to wastewater remediation goals, which in turn reduces input expenses. While Japan and South Korea focus on supplying high-purity strains for the cosmetics industry, ASEAN countries are capitalizing on their year-round sunlight to cultivate protein biomass for export. The region's diverse climatic conditions and government support create a conducive environment for algae cultivation. Furthermore, increasing demand for sustainable and renewable resources is driving innovation and partnerships across the Asia-Pacific algae products market.

Europe marries its sustainability agenda with robust research and development. The EU's 2024 inclusion of 20 new algae species in its Novel Food Catalogue accelerates commercial ventures. The Carbon Border Adjustment Mechanism is motivating steel producers to establish algal units on-site, allowing them to harness flue gas CO2 and generate protein-rich biomass for animal feed. Additionally, Horizon Europe grants are fueling the expansion of integrated biorefineries, solidifying the continent's technological dominance in the global algae products arena. The region's commitment to reducing carbon emissions aligns with its push for algae-based solutions in various industries. Moreover, collaborations between academia and industry are fostering innovation and ensuring the scalability of algae-based technologies.

- Archer Daniels Midland Company

- Cargill, Incorporated

- BASF SE

- DSM-Firmenich AG

- Corbion NV

- AlgoSource Group

- Cyanotech Corporation

- Pond Technologies Inc.

- Phycom BV

- Zhejiang Binmei Biotechnology Co., Ltd

- Algenol Biotech LLC

- DIC Group

- BlueBioTech GmbH

- Cellana Inc.

- Fuji Chemical Industries Co., Ltd

- AlgaEnergy S.A

- Algatechnologies Ltd.

- Tate & Lyle PLC (CP Kelco)

- Murugappa Group (E.I.D. - Parry)

- Tianjin Norland Biotech Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Plant-Based Protein Ingredients

- 4.2.2 Increasing Use of Natural Food Colorants and Texturants

- 4.2.3 Technological Advancements in Algae Cultivation and Processing

- 4.2.4 Support from Organic Farming and Circular Economy Initiatives

- 4.2.5 Broadening Applications Across Diverse Industries

- 4.2.6 Rising Investments in Algae-Based Biofuel Development

- 4.3 Market Restraints

- 4.3.1 High Capital Expenditure for Photobioreactor Scale-Up

- 4.3.2 Regulatory Ambiguities for Novel Algae-Based Foods in Emerging Economies

- 4.3.3 Supply Chain Constraints for Algae Raw Materials

- 4.3.4 High Production Costs Compared to Conventional Alternatives

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Brown Algae

- 5.1.2 Red Algae

- 5.1.3 Green Algae

- 5.1.4 Blue-green Algae

- 5.2 By Product Type

- 5.2.1 Hydrocolloids

- 5.2.1.1 Carrageenan

- 5.2.1.2 Alginate

- 5.2.1.3 Others

- 5.2.2 Algal Protein

- 5.2.3 Carotenoids

- 5.2.4 Lipids

- 5.2.5 Other Product Types

- 5.2.1 Hydrocolloids

- 5.3 By Application

- 5.3.1 Food and Beverage

- 5.3.2 Personal Care and Cosmetics

- 5.3.3 Dietary Supplements

- 5.3.4 Pharmaceuticals

- 5.3.5 Animal Feed

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Cargill, Incorporated

- 6.4.3 BASF SE

- 6.4.4 DSM-Firmenich AG

- 6.4.5 Corbion NV

- 6.4.6 AlgoSource Group

- 6.4.7 Cyanotech Corporation

- 6.4.8 Pond Technologies Inc.

- 6.4.9 Phycom BV

- 6.4.10 Zhejiang Binmei Biotechnology Co., Ltd

- 6.4.11 Algenol Biotech LLC

- 6.4.12 DIC Group

- 6.4.13 BlueBioTech GmbH

- 6.4.14 Cellana Inc.

- 6.4.15 Fuji Chemical Industries Co., Ltd

- 6.4.16 AlgaEnergy S.A

- 6.4.17 Algatechnologies Ltd.

- 6.4.18 Tate & Lyle PLC (CP Kelco)

- 6.4.19 Murugappa Group (E.I.D. - Parry)

- 6.4.20 Tianjin Norland Biotech Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK