PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851849

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851849

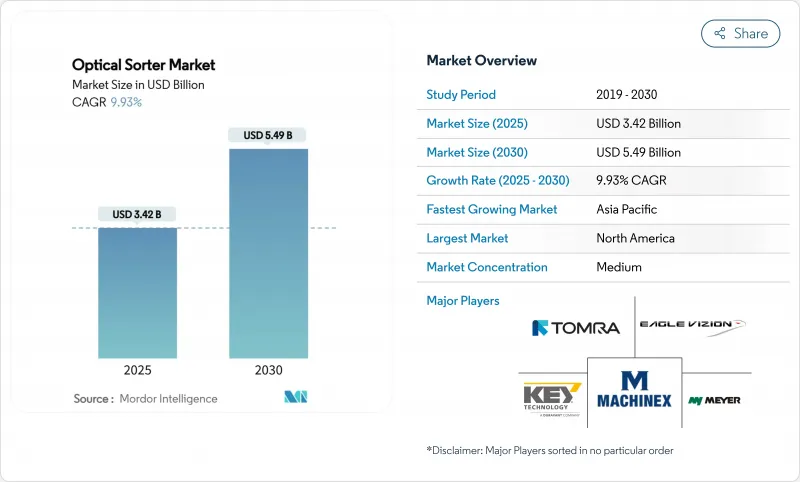

Optical Sorter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The optical sorting market size is estimated at USD 3.42 billion in 2025 and is forecast to climb to USD 5.49 billion by 2030, advancing at a 9.93% CAGR.

This expansion stems from three intersecting forces: widening labor gaps across manufacturing hubs, increasingly stringent food-safety and recycling mandates, and rapid diffusion of AI-driven hyperspectral imaging that detects defects invisible to the human eye or to legacy camera systems. Suppliers are also benefiting from falling sensor costs and government funding that offsets capital expenditure for high-efficiency sorting equipment in food, recycling, and mining facilities. Competitive intensity is rising as Asian entrants roll out lower-priced, AI-infused platforms while Western incumbents integrate deep-learning modules into existing belt systems to protect installed bases. In parallel, sustainability regulations such as Extended Producer Responsibility (EPR) in Asia and deposit-return schemes in Europe continue to enlarge the total addressable market by tightening purity requirements for plastics, metals, and textiles.

Global Optical Sorter Market Trends and Insights

Automation demand in large-scale North American food plants

Persistent staffing gaps-615,000 manufacturing jobs remained vacant in the United States at end-2024-are forcing processors to replace manual inspectors with high-speed optical sorters that sustain 24/7 uptime while securing 25-35% higher product yield. Platform vendors now bundle vision algorithms that learn from production drifts to preserve accuracy without halting the line. Capital budgets reflect this priority shift as U.S. food manufacturers pumped USD 55 billion into automation between 2021 and 2024, allocating a growing slice to next-generation belt sorters capable of 99% detection precision.

Tightening global HACCP and EU food-hygiene regulations

EU Regulation 2023/915 explicitly positions optical sorting as an endorsed mitigation step against mycotoxins and physical contaminants, compelling processors targeting European shelves to adopt certified systems. Comparable rules are rippling across Asia, prompting multinational food companies to synchronize quality-control investments. Compliance audits increasingly request digital defect logs, a feature integrated into AI-enabled sorters that archive every rejected item for traceability.

High CapEx for hyperspectral and X-ray systems in SME grain mills

A fully loaded hyperspectral sorter can exceed USD 500,000, a threshold that strains balance sheets of small and medium grain processors. surveys rank upfront cost as the primary barrier to advanced equipment, especially where credit lines remain tight. Without leasing schemes, many mills continue to rely on less capable camera-only machines.

Other drivers and restraints analyzed in the detailed report include:

- Labor shortages and wage inflation in European recycling

- AI-driven hyperspectral breakthroughs

- Frequent calibrations increase downtime in continuous-flow mining

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In revenue terms, camera systems anchored 34.21% of optical sorting market share in 2024 owing to versatility in color-based defect removal. The optical sorting market size attributable to NIR platforms is on course to post the quickest 11.8% CAGR as processors exploit spectral fingerprints to distinguish polymers, proteins, and valuable ore fractions. Vendors now embed machine-learning engines that raise detection accuracy up to 95%, trimming false-reject rates by double digits. Laser solutions retain niche demand for geometry-based differentiation, while hyperspectral systems target premium segments such as aflatoxin detection in pistachios or gemstone sorting. X-ray transmission finds growing traction in dense-material separation within copper and lithium mines, complementing optical sensors when density rather than color determines value recovery.

Blended sensing is becoming standard as OEMs stack cameras, NIR arrays, and short-wave infrared detectors inside the same chassis. This convergence cuts footprint, eases calibration, and broadens target defect profiles. Euro-funded R&D consortia expect AI-assisted hyperspectral modules to lift overall yield by 20% against 2023 baselines. As multinationals demand turnkey solutions, platform suppliers that master cross-sensor data fusion stand to secure long-term service contracts

The Optical Sorter Market Report is Segmented by Technology (X-Ray Transmission, Camera Solutions and More), End-User Industry (Food Processing, Recycling, Mining, and More), Platform (Belt, Freefall and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 34% of 2024 revenues as processors embraced automation to tackle persistent labor scarcity and to comply with FSMA and state-level recycled-content statutes. Federal energy grants totaling USD 33 million earmarked for smart manufacturing accelerate optical-sorting retrofits across meat, dairy, and beverage facilities. Canada's Plastics Innovation Challenges funnel additional funds toward AI-led hyperspectral projects, enabling recyclers to double flexible-packaging recovery.

Asia-Pacific is forecast for a leading 12.9% CAGR to 2030, propelled by China's first fully automated carton-sorting plant in Xiamen and Japan's demographic headwinds that lift demand for robotic vision systems. Vietnam's EPR rollout mandates brands to finance downstream purity improvements, mobilizing capex for optics-rich PET and HDPE sorting. South Korea's 49% jump in plastic waste since 2018-and a 70% recycling-rate goal-bolsters orders for high-throughput belt platforms, while Australia leverages its AUD 200 million Recycling Modernisation Fund to back local optical-sorter assembly, shortening supply chains.

Europe sustains steady demand by coupling circular-economy directives with subsidies for textile, WEEE, and fiber-based packaging recovery. ANDRITZ's automated line in France that classifies garments by fiber composition illustrates how EU funding expands beyond food and beverage into new feedstocks. Latin America and Middle East & Africa remain nascent but strategic, with copper and lithium mines in Chile and Zimbabwe piloting sensor-based pre-concentration to offset declining ore grades and constrained water resources.

- TOMRA Systems ASA

- Buhler Group

- Key Technology Inc. (Duravant LLC)

- Hefei Meyer Optoelectronic Technology Inc.

- Satake Corporation

- Sesotec GmbH

- Cimbria A/S (AGCO Corporation)

- Machinex Industries Inc.

- Pellenc ST

- Eagle Vizion Inc.

- Raytec Vision S.p.A

- Steinert GmbH

- National Recovery Technologies Inc.

- Binder+Co AG

- Angelon Electronics Co. Ltd.

- Techik Instrument Co. Ltd.

- Hefei Baite Optoelectronic Technology Co. Ltd.

- Bhler Sortex Limited

- Bollegraaf Group

- Colour Sorting Group (CSG)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automation Demand for High-Throughput Sorting in Large-Scale Food Processing Plants Across North America

- 4.2.2 Tightening Global HACCP and EU Food-Hygiene Regulations Elevating Adoption of Optical Sorting

- 4.2.3 Labor Shortages and Wage Inflation Accelerating Automation Investments in European Recycling Facilities

- 4.2.4 Declining Ore Grades in Copper and Lithium Mines Triggering Sensor-Based Pre-Concentration in South America

- 4.2.5 Extended Producer Responsibility (EPR) Mandates Boosting High-Purity Plastic Flake Sorting in Asia

- 4.2.6 AI-Driven Hyperspectral Imaging Breakthroughs Expanding Addressable Use-Cases Beyond Color Sorting

- 4.3 Market Restraints

- 4.3.1 High CapEx for Hyperspectral and X-ray Systems Limiting Penetration in SME Grain Mills

- 4.3.2 Frequent Calibrations Elevate Downtime Cost in Continuous-Flow Mining Operations

- 4.3.3 Limited Availability of Skilled Vision Engineers in Developing Regions

- 4.3.4 Data Security Concerns Around Cloud-Connected Sorting Lines

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Cameras

- 5.1.2 Lasers

- 5.1.3 NIR Sorters

- 5.1.4 Hyperspectral Cameras

- 5.1.5 X-ray Transmission

- 5.2 By Platform

- 5.2.1 Belt

- 5.2.2 Freefall

- 5.2.3 Lane

- 5.2.4 Hybrid

- 5.3 By End-User Industry

- 5.3.1 Food Processing

- 5.3.1.1 Fruits and Vegetables

- 5.3.1.2 Grains and Cereals

- 5.3.1.3 Nuts and Dry Fruits

- 5.3.1.4 Meat and Seafood

- 5.3.1.5 Confectionery and Snacks

- 5.3.2 Recycling

- 5.3.2.1 Plastics

- 5.3.2.2 Metals

- 5.3.2.3 Glass

- 5.3.2.4 E-waste

- 5.3.3 Mining

- 5.3.3.1 Coal

- 5.3.3.2 Precious and Base Metals

- 5.3.3.3 Industrial Minerals

- 5.3.4 Other Industries

- 5.3.1 Food Processing

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Turkey

- 5.4.5.2 South Africa

- 5.4.5.3 Saudi Arabia

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TOMRA Systems ASA

- 6.4.2 Buhler Group

- 6.4.3 Key Technology Inc. (Duravant LLC)

- 6.4.4 Hefei Meyer Optoelectronic Technology Inc.

- 6.4.5 Satake Corporation

- 6.4.6 Sesotec GmbH

- 6.4.7 Cimbria A/S (AGCO Corporation)

- 6.4.8 Machinex Industries Inc.

- 6.4.9 Pellenc ST

- 6.4.10 Eagle Vizion Inc.

- 6.4.11 Raytec Vision S.p.A

- 6.4.12 Steinert GmbH

- 6.4.13 National Recovery Technologies Inc.

- 6.4.14 Binder+Co AG

- 6.4.15 Angelon Electronics Co. Ltd.

- 6.4.16 Techik Instrument Co. Ltd.

- 6.4.17 Hefei Baite Optoelectronic Technology Co. Ltd.

- 6.4.18 Bhler Sortex Limited

- 6.4.19 Bollegraaf Group

- 6.4.20 Colour Sorting Group (CSG)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment