PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851852

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851852

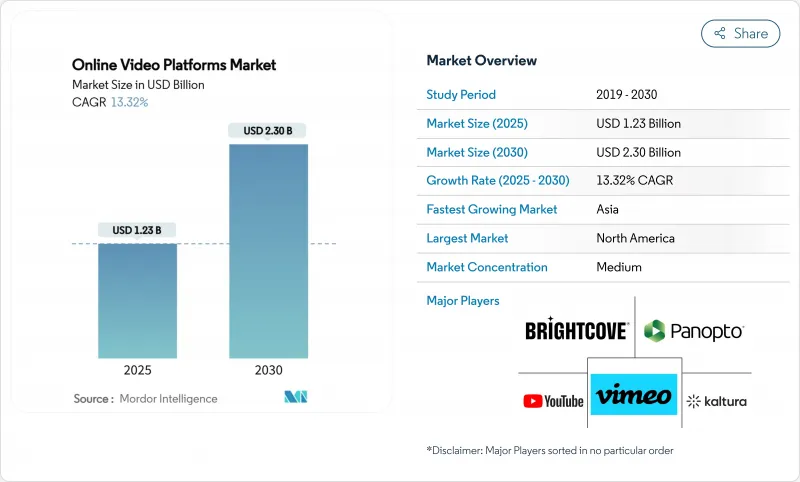

Online Video Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The online video platforms market size is estimated at USD 1.23 billion in 2025 and is forecast to reach USD 2.30 billion by 2030, expanding at a 13.32% CAGR.

Growth reflects a decisive shift from legacy content delivery to AI-enabled ecosystems that weave together programmatic advertising, data analytics, and multi-revenue streams. Commercial 5G roll-outs are lowering latency thresholds, allowing live and interactive formats to flourish. Enterprises are embedding video across functions-training, communications, and marketing-accelerating demand for feature-rich, security-compliant platforms. Meanwhile, regulatory pressure for local content is prompting sizable investment in regional production hubs, thereby creating differentiated supply in underserved languages. Rising adoption of cloud-native services anchors scalability, but a pivot toward hybrid deployments signals mounting concern over compliance, cost, and data sovereignty.

Global Online Video Platforms Market Trends and Insights

Programmatic Advertising Revolutionizes Video Monetization

Programmatic buying now underpins nearly 60% of TV and video ad spend in 2025, streamlining transactions between advertisers and publishers. Automated auctions integrate first-party data, boosting targeting accuracy across connected-TV and mobile inventory. Self-serve tools widen access, enabling small businesses to compete alongside global brands. As a result, content owners unlock incremental revenue without expanding sales teams. The New York Times recorded a 30% uplift after adopting programmatic video in 2024, confirming the model's scalability

Mobile-First Video Consumption Reshapes Content Strategies

More than 70% of viewers watch streaming content on smartphones; in many emerging markets the ratio exceeds 80% . Publishers are optimizing vertical formats and sub-60-second clips to suit scroll-based behavior. Implementation of mobile-centric ad units-including rewarded and interactive overlays-improves completion rates, driving CPM premiums for short-form inventory. Monetization success stories, such as BuzzFeed's 40% revenue spike following a vertical-video push in 2024, encourage broader adoption. The trend also lowers production costs, supporting higher content cadence and granular audience segmentation.

Content Delivery Costs Challenge Emerging-Market Expansion

Limited backbone capacity inflates CDN fees, compressing margins for ad-supported services in Asia and Latin America. While 5G and edge nodes promise relief, current cost structures complicate freemium strategies where ARPU lags developed regions. Vendors experiment with peer-assisted delivery and Media over QUIC to tame bandwidth bills

Other drivers and restraints analyzed in the detailed report include:

- 5G Infrastructure Enables Next-Generation Experiences

- Corporate Adoption Accelerates Digital Transformation

- Ad-Blocking Technologies Threaten Revenue Models

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Live Streaming captured 48% share of the online video platforms market in 2024, underscoring its ubiquity across entertainment, sports, and corporate events. Adoption widened as 5G decreased latency and boosted reliability, allowing platforms to position live video as a premium engagement lever. The segment continues to attract brands seeking real-time interaction with audiences. Video Analytics, although smaller in revenue, is advancing at an 18% CAGR, reflecting higher enterprise spending on data-driven optimization. The availability of cloud APIs that automate object detection, sentiment analysis, and content moderation is transforming video into a decision-support asset. As enterprises quantify ROI through engagement metrics and conversion lift, analytics budgets rise accordingly, further diversifying revenue inside the online video platforms market.

The remaining categories-User-Generated Content, DIY platforms, and SaaS-based professional suites-serve varied user personas yet benefit from the same underlying infrastructure. Consumer-facing UGC apps emphasize social virality and creator tools, whereas professional suites integrate workflows like asset management and multi-CDN routing. Collectively, these niches reinforce platform choice and keep competitive intensity high.

Solutions commanded 70% revenue in 2024, led by video delivery and distribution toolkits essential for high-quality streaming. Security modules such as multi-DRM vaults and watermarking complement delivery pipelines, especially for studios and sports leagues. Analytics add-ons unlock incremental subscription or licensing revenue, incentivizing vendors to bundle features. The online video platforms market size for services, however, is scaling quickly as organizations shift from capital expenditure to operating expenditure models. Managed Services show 15% CAGR because enterprises prefer outsourcing encoding, localization, and 24/7 monitoring to specialists with economies of scale.

Professional Services remain indispensable when integrating video stacks into complex IT environments. Custom player development, API orchestration, and compliance audits ensure that platform rollouts meet both technical and regulatory requirements. This consultative layer differentiates full-service vendors from pure-play software providers.

The Online Video Platforms Market Report is Segmented by Type (Live Streaming, Video Content Management, Video Analytics, UGC Platforms, Self-service/DIY, Saas Professional), Component (Solutions, Services), Streaming Type (Live, Vod), Deployment Mode (Cloud, On-Premises, Hybrid), End User (Media and Entertainment, E-Learning, BFSI, and More) and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 35% of global revenue in 2024, fueled by mature broadband, high ARPU, and deep penetration of connected-TV devices. Media buyers in the region allocate nearly 60% of combined TV and video budgets to digital video in 2025, a trend that amplifies platform revenue streams. The robust ecosystem of cloud providers, software vendors, and content creators fosters rapid experimentation with AI-driven personalization and interactive formats.

Asia-Pacific is advancing fastest at a 15% CAGR and is projected to add USD 16.2 billion in revenue between 2024 and 2029. The surge stems from smartphone ubiquity, lower data tariffs, and escalating demand for local-language content. India alone is forecast to deliver over one quarter of incremental premium video revenue, helped by regional language originals and sports rights. Chinese platforms leverage super-app ecosystems to cross-sell subscriptions and micro-transactions, reinforcing user stickiness. In Southeast Asia, bundled mobile-data plans stimulate first-time streaming adoption among price-sensitive consumers.

Europe retains solid position owing to enterprise adoption and regulatory impetus. The EU's Audiovisual Media Service Directive obliges global platforms to invest in European storytelling, channeling funds into regional studios and jobs. Meanwhile, Latin America sees accelerating growth as fiber deployments reach secondary cities, lifting streaming quality and ad inventory. The Middle East and Africa remain nascent but promising; expanding 4G and 5G coverage, plus rising youth populations, underpin demand for culturally relevant content.

- Alphabet Inc. (YouTube LLC)

- Vimeo Inc. (IAC/InterActiveCorp)

- Brightcove Inc.

- IBM Corporation (IBM Video Streaming)

- Kaltura Inc.

- Panopto Inc.

- Wistia Inc.

- JW Player (Longtail Ad Solutions Inc.)

- Vidyard (BuildScale Inc.)

- Dacast Inc.

- Mux Inc.

- Qumu Corporation

- Dailymotion

- Wowza Media Systems LLC

- MediaPlatform Inc.

- Muvi LLC

- SproutVideo LLC

- Cloudflare Stream

- Bitmovin Inc.

- Vbrick Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Monetization Opportunities through Programmatic Advertising Growth in North America

- 4.2.2 Surge of Short-Form Mobile Video Consumption in Asia

- 4.2.3 Increasing 5G Penetration Enabling Ultra-Low-Latency Live Streaming

- 4.2.4 Corporate Adoption of Video for Training and Internal Communications in Europe

- 4.2.5 Cloud-native AI-powered Video Analytics Enhancing Viewer Engagement

- 4.2.6 Regulatory Push for Local Content Quotas Driving Platform Investments in Middle East

- 4.3 Market Restraints

- 4.3.1 High CDN Costs in Emerging Markets Limiting Profitability

- 4.3.2 Ad-blocking Adoption Reducing Advertising Revenues

- 4.3.3 Fragmented Digital Rights Management Standards Complicating Global Distribution

- 4.3.4 Rising Data-privacy Compliance Burden (GDPR, CPRA) on Platform Operations

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Macroeconomic factors Impact on the Industry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Live Streaming

- 5.1.2 Video Content Management Systems

- 5.1.3 Video Analytics

- 5.1.4 User-Generated Content Platforms (UGC)

- 5.1.5 Self-service/DIY Platforms

- 5.1.6 SaaS-based Professional Platforms

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.1.1 Transcoding and Processing

- 5.2.1.2 Video Delivery and Distribution

- 5.2.1.3 Video Analytics and Engagement

- 5.2.1.4 Video Security and DRM

- 5.2.1.5 Video Content Management

- 5.2.2 Services

- 5.2.2.1 Professional Services

- 5.2.2.2 Managed Services

- 5.2.1 Solutions

- 5.3 By Streaming Type

- 5.3.1 Live

- 5.3.2 Video on Demand (VoD)

- 5.4 By Deployment Mode

- 5.4.1 Cloud

- 5.4.2 On-premises

- 5.4.3 Hybrid

- 5.5 By End User

- 5.5.1 Media and Entertainment

- 5.5.2 E-learning and Education

- 5.5.3 BFSI

- 5.5.4 Retail and eCommerce

- 5.5.5 IT and Telecommunications

- 5.5.6 Healthcare and Life Sciences

- 5.5.7 Government and Public Sector

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Peru

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Alphabet Inc. (YouTube LLC)

- 6.3.2 Vimeo Inc. (IAC/InterActiveCorp)

- 6.3.3 Brightcove Inc.

- 6.3.4 IBM Corporation (IBM Video Streaming)

- 6.3.5 Kaltura Inc.

- 6.3.6 Panopto Inc.

- 6.3.7 Wistia Inc.

- 6.3.8 JW Player (Longtail Ad Solutions Inc.)

- 6.3.9 Vidyard (BuildScale Inc.)

- 6.3.10 Dacast Inc.

- 6.3.11 Mux Inc.

- 6.3.12 Qumu Corporation

- 6.3.13 Dailymotion

- 6.3.14 Wowza Media Systems LLC

- 6.3.15 MediaPlatform Inc.

- 6.3.16 Muvi LLC

- 6.3.17 SproutVideo LLC

- 6.3.18 Cloudflare Stream

- 6.3.19 Bitmovin Inc.

- 6.3.20 Vbrick Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment