PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851863

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851863

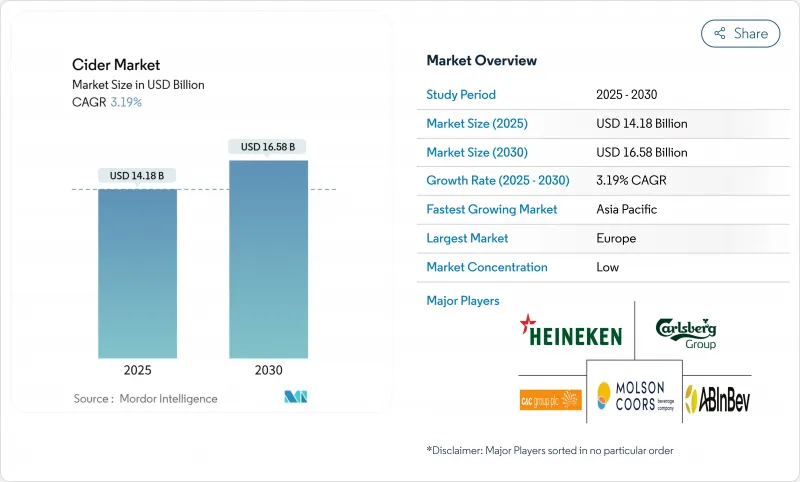

Cider - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cider market size is estimated to be valued at USD 14.18 billion in 2025 and is expected to reach USD 16.58 billion by 2030, at a CAGR of 3.19% during the forecast period (2025-2030).

The cider market is witnessing significant growth as younger consumers in urbanizing economies increasingly recognize cider as a lighter, fruit-forward alternative to beer. This growth is further supported by the category's maturation in legacy regions. The premium segment of the market strategically leverages its craft-oriented positioning, integrates functional ingredients, and emphasizes sustainability-focused messaging. These approaches collectively enhance brand loyalty, foster consumer engagement, and enable higher price realization. Despite the proliferation of competing ready-to-drink segments, the market continues to benefit from health-conscious moderation trends and cider's natural gluten-free attributes, which sustain steady demand. Additionally, innovations in packaging, particularly the shift toward cans, are driving new consumption occasions while addressing environmental sustainability concerns. These factors are becoming increasingly critical in shaping consumer purchasing behavior and influencing market dynamics.

Global Cider Market Trends and Insights

Growing demand for low-alcohol and health-conscious drinks

Shifting consumer preferences toward low-alcohol and health-conscious beverages are emerging as a significant growth driver in the hard cider market. The low-alcohol segment has gained a dominant position, supported by the rising influence of wellness campaigns that advocate for moderation in alcohol consumption. To meet this demand, producers are employing advanced production techniques, such as controlled fermentation and reverse osmosis, which effectively reduce ethanol content while preserving the beverage's flavor profile. This technological innovation has enabled the low-alcohol segment to achieve higher growth rates compared to traditional higher-ABV styles. Additionally, the integration of functional enhancements, including probiotic cultures and adaptogenic botanicals, is strengthening cider's appeal as a wellness-oriented beverage. These shifting consumer trends are creating lucrative opportunities for the development of premium low-ABV product lines and are expanding the occasions for cider consumption.

Innovation in flavors and seasonal offerings

In the intensely competitive hard cider market, smaller brands are strategically differentiating themselves by focusing on seasonal and fruit-forward recipes to attract and retain consumer interest. In the United States, the market experiences two prominent demand surges: one during summer social gatherings and the other during autumn harvest celebrations. Younger adult consumers, who prioritize unique experiences and prefer beverages with reduced bitterness, are increasingly gravitating toward innovative offerings such as barrel-aged ciders, wild-yeast fermentation techniques, and tropical fruit flavor integrations. These strategies not only enable brands to command premium pricing but also reposition cider as a versatile and contemporary beverage, effectively expanding its consumer base and moving beyond its traditional association with autumn. Furthermore, companies are intensifying their focus on product innovation and the introduction of flavored ciders. For instance, in October 2024, Farmland, in partnership with Minneapolis' Number 12 Cider, introduced a Maple Bacon-flavored Cider, strategically timed to align with the fall season and cater to evolving consumer preferences.

Limited penetration in traditional markets

Limited penetration in traditional markets poses a significant challenge to the growth of the cider market, particularly in regions such as Asia and the Middle East. Cultural preferences and stringent licensing regulations continue to act as substantial barriers, restricting the category's expansion. In 2024, India implemented formal cider standards, which introduced additional complexities, including labeling requirements and excise compliance, further complicating market entry. Moreover, the dependence on three-tier distribution systems inflates operational costs and extends the payback period for new brands, discouraging investment unless high volumes can be achieved. Despite these challenges, the cider market holds potential for growth, driven by favorable demographic shifts and rising disposable incomes. This potential could be unlocked further with the relaxation of import duties and the scaling up of local bottling operations.

Other drivers and restraints analyzed in the detailed report include:

- Growth of craft and artisanal alcohol movements

- Increased popularity of gluten-free and alternative alcohols

- High competition from RTD and flavored drinks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, Apple Cider commands a dominant 53.58% market share, underscoring a strong consumer preference for traditional flavors and the expertise of leading manufacturers. Yet, it's the Fruit Flavored variants that are surging ahead, boasting a robust 3.54% CAGR growth rate projected through 2030. This trend hints at a market shift towards flavor diversification and premium positioning. Meanwhile, Mixed Fruit Cider finds its niche, blending the familiar apple base with complementary fruits, catering to both traditionalists and the adventurous. Ingredient choices spotlight a strategic tug-of-war: producers grapple with upholding heritage authenticity while also venturing into modern flavor innovations, all in a bid to expand their market reach without compromising brand equity.

Specialty cider apple varieties remain in limited supply across major production regions, creating challenges for manufacturers. As a result, many producers are compelled to utilize dessert apple culls or juice concentrates instead of purpose-grown cider apples. Furthermore, fluctuations in apple pricing significantly impact production costs. Juice stock prices vary widely, ranging from USD 6.00 to USD 18.00 per hundredweight depending on the variety and quality. Meanwhile, juice apples sourced from Washington state command a premium price, ranging between USD 100.00 and USD 130.00 per ton, reflecting their higher demand and quality standards. Apple cider, though still leading in volume, is experiencing a slowdown in growth, attributed to market saturation and a limited flavor variety. Fruit-flavored ciders, with their sweeter and more approachable taste, align seamlessly with the trends of low-alcohol and gluten-free beverages, making them ideal for ready-to-drink formats.

The Low Alcohol segment commands 78.47% market share in 2024 while simultaneously achieving the fastest growth at 3.76% CAGR, indicating both category dominance and internal expansion dynamics. This performance reflects strategic innovation by producers, who are developing advanced low-alcohol variants that deliver complex flavors while aligning with the preferences of health-conscious consumers. On the other hand, High Alcohol cider variants target niche markets that value stronger flavor profiles and traditional fermentation methods. However, these variants face challenges from increasing moderation trends and stricter regulatory measures. This segmentation aligns with the alcoholic beverage industry's broader shift toward mindful consumption, where lower alcohol content supports social drinking occasions without compromising on taste.

Regulatory developments increasingly support the low-alcohol category. The World Health Organization's SAFER initiative aims to reduce harmful alcohol use by 10% by 2025. Similarly, Canada's updated alcohol consumption guidelines advocate zero alcohol as the only risk-free option, creating favorable policy conditions for low-alcohol alternatives in North America. Production methods for low-alcohol cider, such as controlled fermentation, reverse osmosis for alcohol removal, and blending techniques, ensure the retention of organoleptic properties while reducing alcohol content. Although these processes require significant technical investment, they enable premium positioning within the health-conscious consumer segment.

The Cider Market Report is Segmented by Ingredient (Apple Cider, Mixed Fruit Cider, and Others), Alcohol Content (Low Alcohol and High Alcohol), Packaging Format (Bottles and Cans), Category (Mass and Premium), Distribution Channel (Off-Trade and On-Trade), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Europe maintained its dominant position with a 43.47% market share, driven by the well-established cider traditions in key markets such as the United Kingdom, Spain, and Ireland. However, the region's high excise tax regimes continue to pose challenges for small-scale producers, limiting their ability to expand. Despite these constraints, major industry players like Heineken are leveraging innovation to sustain growth. For instance, Heineken's Inch's series aligns with evolving consumer preferences by incorporating sustainability narratives, thereby strengthening its market presence.

The Asia-Pacific region is positioned as the fastest-growing geography, recording a robust compound annual growth rate (CAGR) of 4.65%. Mainland China, with its emerging consumer base, is demonstrating a strong appetite for diverse and innovative flavor profiles, creating significant opportunities for market expansion. In India, recent regulatory developments that differentiate between soft and hard cider have created a more structured market environment. This regulatory clarity is enabling new entrants to follow the path of early movers like Thirsty Fox, which has successfully capitalized on this evolving landscape.

North America plays a pivotal role in driving the global cider market. In the U.S., consolidation of distribution channels is pushing smaller producers to focus on taproom sales and agritourism. Treasury Department-led competition studies are advocating franchise law reforms, which could reshape the competitive landscape. In Canada, producers benefit from abundant dessert-grade apples and favorable excise tax policies on lower-alcohol fruit wines, enhancing cost competitiveness. In Mexico, the United States-Mexico-Canada Agreement (USMCA) offers growth opportunities, but high slotting fees from dominant chain retailers remain a barrier for smaller players. In South America, rising demand for premium beverages and the growth of local craft cider are driving the market, though economic instability and weak distribution networks limit expansion. In the Middle East and Africa, the market is nascent but supported by a growing expatriate population and evolving preferences. However, strict regulations and cultural restrictions on alcohol sales continue to cap growth.

- Heineken N.V.

- C and C Group plc

- Carlsberg Group

- Molson Coors Beverage Co.

- Anheuser-Busch InBev

- Asahi Group Holdings

- Kopparbergs Brewery

- Aston Manor

- Boston Beer Co.

- Seattle Cider Co.

- Westons Cider

- Thatchers Cider

- Hogan's Cider

- Woodchuck Cidery

- Vander Mill

- Gwynt y Ddraig Cyder

- Brothers Drinks Co.

- Vintage Wine Estates

- Minhas Craft Brewery

- SheppyI's Cider

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for low-alcohol and health-conscious drinks

- 4.2.2 Innovation in flavors and seasonal offerings

- 4.2.3 Growth of craft and artisanal alcohol movements

- 4.2.4 Increased popularity of gluten-free and alternative alcohols

- 4.2.5 Expansion of on-trade and social drinking culture

- 4.2.6 Product innovation with functional ingredients

- 4.3 Market Restraints

- 4.3.1 Limited penetration in traditional markets

- 4.3.2 Fluctuating Raw Material Prices

- 4.3.3 High competition from RTD and flavored drinks

- 4.3.4 Stringent government regulations

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Ingredient

- 5.1.1 Apple Cider

- 5.1.2 Mixed Fruit Cider

- 5.1.3 Others

- 5.2 By Alcohol Content

- 5.2.1 Low Alcohol

- 5.2.2 High Alcohol

- 5.3 By Packaging Format

- 5.3.1 Bottles

- 5.3.2 Cans

- 5.4 By Category

- 5.4.1 Mass

- 5.4.2 Premium

- 5.5 By Distribution Channel

- 5.5.1 On-Trade

- 5.5.2 Off-Trade

- 5.5.2.1 Supermarkets/Hypermarkets

- 5.5.2.2 Specialty Stores

- 5.5.2.3 Online Retail Stores

- 5.5.2.4 Others Distribution Channel

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 Indonesia

- 5.6.3.6 South Korea

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Heineken N.V.

- 6.4.2 C and C Group plc

- 6.4.3 Carlsberg Group

- 6.4.4 Molson Coors Beverage Co.

- 6.4.5 Anheuser-Busch InBev

- 6.4.6 Asahi Group Holdings

- 6.4.7 Kopparbergs Brewery

- 6.4.8 Aston Manor

- 6.4.9 Boston Beer Co.

- 6.4.10 Seattle Cider Co.

- 6.4.11 Westons Cider

- 6.4.12 Thatchers Cider

- 6.4.13 Hogan's Cider

- 6.4.14 Woodchuck Cidery

- 6.4.15 Vander Mill

- 6.4.16 Gwynt y Ddraig Cyder

- 6.4.17 Brothers Drinks Co.

- 6.4.18 Vintage Wine Estates

- 6.4.19 Minhas Craft Brewery

- 6.4.20 SheppyI's Cider

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK