PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851864

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851864

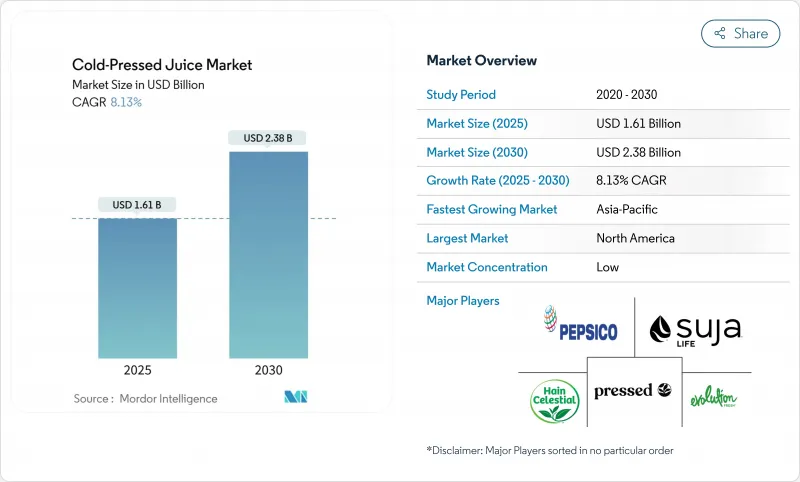

Cold Pressed Juice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cold-pressed juice market size is estimated to be USD 1.61 billion in 2025 to USD 2.38 billion by 2030, registering a CAGR of 8.13%.

This growth is primarily driven by increasing global health awareness, a shift toward premium and convenient breakfast options, and advancements like high-pressure processing technology, which extends shelf life while retaining nutritional value. Regulatory standards, such as the FDA's Juice HACCP requirements, play a crucial role in enhancing consumer trust and encouraging product innovation. Additionally, the rising demand for functional wellness beverages, the expansion of online retail channels, and the adoption of sustainable packaging solutions are further strengthening the market's growth prospects.

Global Cold Pressed Juice Market Trends and Insights

Rising demand for functional-health beverages

As consumers increasingly prioritize immunity support, gut health, and cognitive wellness, beverage formulations are evolving beyond their traditional nutritional profiles. The functional beverage segment is witnessing significant growth, driven by health-conscious consumers who now see beverages as conduits for targeted wellness benefits. In response, cold-pressed juice manufacturers are moving beyond general nutrition, infusing their products with adaptogens, probiotics, and botanical extracts tailored to specific health concerns. This trend isn't limited to ingredient enhancements; it also encompasses flavor profiles that resonate with wellness. Botanical flavors, such as lavender and rosemary, are gaining popularity as consumers link these tastes to therapeutic benefits. By positioning themselves as functional, brands not only differentiate from conventional juice offerings but also command premium pricing, carving out sustainable competitive advantages in a crowded marketplace.

Growing health consciousness

Consumers are increasingly focusing on preventive healthcare, paying closer attention to ingredient lists, and choosing products that align with their wellness goals. The USDA's updated definition of "healthy," set to take effect in February 2025, introduces new guidelines for nutrient content claims . These changes are expected to significantly impact how cold-pressed juices are marketed and formulated. In 2024, 70% of consumers expressed trust in the USDA organic seal, according to the Organic Produce Network, reflecting a strong preference for transparent and regulated health claims over generic marketing messages. Younger consumers, who frequently use social media to research and verify health claims, are driving this trend. This shift creates opportunities for brands that can support their wellness claims with credible scientific evidence. As these younger, health-conscious consumers move into higher income brackets, their preferences are likely to continue fueling market growth.

Short shelf-life and availability of ambient juices

The cold-pressed juice industry depends heavily on refrigerated distribution, but this reliance creates challenges in regions with inadequate cold-chain infrastructure. High-pressure processing (HPP) technology provides a solution by extending the shelf life of juices from 3-5 days to 30-45 days while preserving their nutritional value. However, the high cost of HPP equipment makes it difficult for smaller producers to adopt this technology. Studies show that using HPP at 450 MPa for 180 seconds effectively retains flavonoid content and ensures microbiological stability for up to 90 days, addressing the issue of limited shelf life. This limitation is particularly problematic for international markets and e-commerce, where longer transit times can affect product quality. Emerging technologies, such as cold plasma treatment, offer promising alternatives. These methods could help extend shelf life without requiring significant financial investment, making them more accessible to smaller producers.

Other drivers and restraints analyzed in the detailed report include:

- Premiumisation of on-the-go breakfast among consumers

- Growing demand for clean label and organic juices

- High price point limiting affordability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, fruit juice holds a leading 55.33% market share, driven by its strong consumer recognition and well-established distribution networks that favor single-fruit products. Traditional fruit juices benefit from clear FDA regulations, which outline specific standards for products like orange and grapefruit juices . These regulations provide manufacturers with straightforward guidelines for compliance, ensuring product consistency and quality. On the other hand, vegetable juices maintain a smaller yet steady market share, supported by health-conscious consumers who prefer their lower sugar content and the added nutritional benefits of vegetable-based nutrients.

The blends category is the fastest-growing segment, with a notable 9.77% CAGR projected through 2030. This growth is fueled by increasing consumer interest in more complex flavor combinations and the enhanced nutritional value that blends offer compared to single-ingredient juices. Manufacturers are leveraging this demand by combining complementary ingredients to improve taste, boost nutritional content, and manage costs effectively. Recent innovations in this segment include the incorporation of functional ingredients such as adaptogens and botanicals, which appeal to health-focused consumers seeking specific wellness benefits. Additionally, the category benefits from flexible regulatory guidelines that allow creative ingredient combinations while ensuring compliance with FDA juice labeling standards.

The organic segment is projected to grow at an impressive CAGR of 11.67% through 2030, making it the fastest-growing category among all segments. This growth is primarily driven by consumers increasingly willing to pay a premium for clean-label products and transparent supply chains. The USDA's Strengthening Organic Enforcement rule is a significant factor in ensuring supply chain integrity, which has strengthened consumer trust in organic claims. The USDA organic seal, in particular, has become a widely recognized and trusted indicator of authenticity for many consumers.

In 2024, conventional products dominate the market with a substantial 72.13% share. This dominance is supported by well-established supply chains, lower production costs, and affordability, making these products accessible to price-sensitive consumers. However, the reliance on conventional products also reflects the current limitations of organic production, which cannot yet scale to meet the entire market demand. Despite this stability, conventional producers face growing pressure as consumers increasingly prioritize ingredient transparency and wellness-focused products. To maintain their market position, conventional producers must adapt by investing in clean-label formulations that align with shifting consumer preferences.

The Cold Pressed Juice Market Report Segments the Industry by Category (Fruit Juice, Vegetable Juice, and Blends); Nature (Organic and Conventional); Packaging (PET Bottles, Glass Bottles, Recyclable-Pouch, and Others); Distribution Channel (On-Trade and Off-Trade); and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America holds the largest market share at 33.67%, driven by strong consumer acceptance of premium cold-pressed juice products and a well-established cold-chain infrastructure that ensures smooth distribution. The region's dominance is supported by regulatory frameworks like the FDA's HACCP requirements, which focus on maintaining product safety while encouraging innovation . The market's maturity is further highlighted by strategic moves such as Bolthouse Farms' acquisition of Evolution Fresh, aimed at improving operational efficiency and consolidating market presence.

Asia-Pacific is the fastest-growing market, with a projected CAGR of 11.93% through 2030. This rapid growth is fueled by urbanization, increasing disposable incomes, and a growing focus on health among the expanding middle class. Leading beverage companies, such as Asahi, are diversifying their product offerings to include health-focused beverages and alcohol alternatives, catering to the rising demand for functional drinks. Social media platforms like TikTok are influencing younger consumers to choose organic and functional beverages, creating significant opportunities for cold-pressed juice brands that effectively utilize digital marketing. Additionally, the region's growth is supported by improvements in retail infrastructure and cold-chain systems, enabling the distribution of premium products.

Europe continues to experience steady growth, driven by consumers' preference for sustainable and clean-label products. Regulatory support for organic and environmentally friendly practices further strengthens the market. Consumers in the region increasingly favor eco-friendly packaging and production methods, offering opportunities for brands that prioritize sustainability throughout their supply chains. In contrast, South America, and Middle East and Africa are emerging markets with notable growth potential. However, challenges such as limited cold-chain infrastructure and price sensitivity among consumers currently restrict their growth. Over time, economic development and urbanization in these regions are expected to create favorable conditions for the adoption of premium beverages.

- PepsiCo Inc. (Naked Juice)

- Suja Life LLC

- Pressed Juicery Inc.

- The Hain Celestial Group, Inc. (BluePrint)

- Evolution Fresh

- Juice Press LLC

- Cold-Pressed Juicery B.V.

- Raw Pressery Private Limited

- Greenhouse Juice Co.

- Village Juicery Inc.

- Little West

- Pure Green LLC

- Vive Organic

- Urban Remedy

- Juice Generation

- Rus Organic

- Fresh Press

- Kedia Organic

- Nutripress

- Lumi Juice

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for functional-health beverages

- 4.2.2 Growing health consciousness

- 4.2.3 Premiumisation of on-the-go breakfast among consumers

- 4.2.4 Growing demand for clean label and organic juices

- 4.2.5 Surge in D2C subscription models

- 4.2.6 Rising disposable incomes enabling premium purchases

- 4.3 Market Restraints

- 4.3.1 Short shelf-life and availability of ambient juices

- 4.3.2 High price point limiting affordability

- 4.3.3 Consumer perception of "high sugar" in fruit-dominant blends

- 4.3.4 Regulatory and labeling challenges on cold-pressed juices

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers/Consumers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Category

- 5.1.1 Fruit Juice

- 5.1.2 Vegetable Juice

- 5.1.3 Blends

- 5.2 By Nature

- 5.2.1 Organic

- 5.2.2 Conventional

- 5.3 By Packaging Type

- 5.3.1 PET Bottles

- 5.3.2 Glass Bottles

- 5.3.3 Recyclable-Pouch/Tetra-Pak

- 5.3.4 Others (Cans/rPET/Plant-based Packaging)

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience/Grocery Stores

- 5.4.2.3 Online Stores

- 5.4.2.4 Other Off-Trade Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Peru

- 5.5.2.6 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Netherlands

- 5.5.3.6 Poland

- 5.5.3.7 Belgium

- 5.5.3.8 Sweden

- 5.5.3.9 Spain

- 5.5.3.10 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 Indonesia

- 5.5.4.6 South Korea

- 5.5.4.7 Thailand

- 5.5.4.8 Singapore

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 PepsiCo Inc. (Naked Juice)

- 6.4.2 Suja Life LLC

- 6.4.3 Pressed Juicery Inc.

- 6.4.4 The Hain Celestial Group, Inc. (BluePrint)

- 6.4.5 Evolution Fresh

- 6.4.6 Juice Press LLC

- 6.4.7 Cold-Pressed Juicery B.V.

- 6.4.8 Raw Pressery Private Limited

- 6.4.9 Greenhouse Juice Co.

- 6.4.10 Village Juicery Inc.

- 6.4.11 Little West

- 6.4.12 Pure Green LLC

- 6.4.13 Vive Organic

- 6.4.14 Urban Remedy

- 6.4.15 Juice Generation

- 6.4.16 Rus Organic

- 6.4.17 Fresh Press

- 6.4.18 Kedia Organic

- 6.4.19 Nutripress

- 6.4.20 Lumi Juice

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK