PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851869

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851869

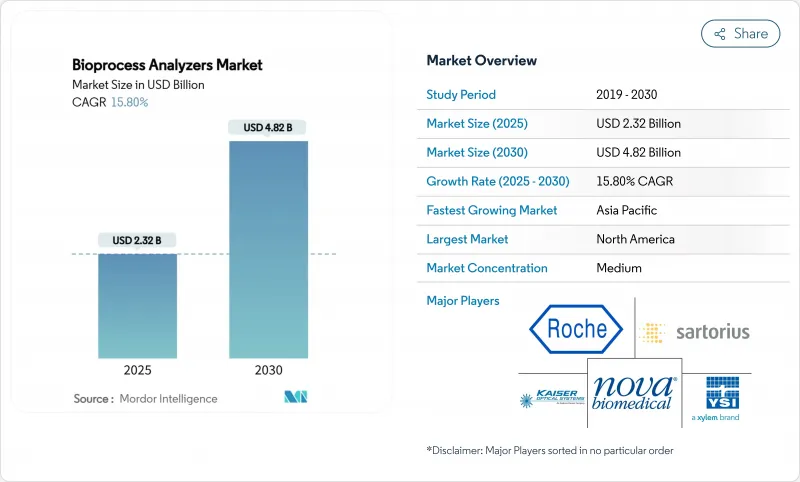

Bioprocess Analyzers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bioprocess analyzers market size stood at USD 2.32 billion in 2025 and is set to reach USD 4.82 billion by 2030, translating into a 15.81% CAGR over the forecast period.

Demand accelerates as manufacturers abandon retrospective batch testing in favor of real-time optimization, spurred by regulatory preference for continuous manufacturing and the pandemic-era proof of concept delivered during rapid COVID-19 vaccine scale-up. Growth links directly to expanded global biomanufacturing capacity, aggressive investment in single-use technology, and the maturing digital-twin ecosystem that fuses spectroscopy with AI-driven models for predictive quality control. Instruments remain the backbone of monitoring workflows, yet software and analytics capture disproportionate incremental dollars as factories deploy closed-loop control strategies. Regionally, North America retains a dominant installed base, while Asia-Pacific's surge in green-field plants drives the highest incremental volume. M&A continues at a measured pace, with leading suppliers consolidating to offer vertically integrated hardware-software-service stacks that help end-users navigate validation, data integrity, and workforce shortages.

Global Bioprocess Analyzers Market Trends and Insights

Growth of Biopharmaceutical Manufacturing Capacity

Rapid green-field and brown-field expansion pushes global installed capacity above 16.5 million L across more than 1,500 facilities, each new bioreactor requiring its own analytical suite. Samsung Biologics' Plant 5 alone adds 180,000 L, bringing the campus total to 784,000 L and catalyzing orders for spectroscopy, mass-spectrometry, and electrochemical sensors. Similar momentum is visible in North Carolina, where Fujifilm is building eight additional 20,000 L reactors, creating downstream pull for in-line Raman probes. Developing regions amplify demand because regulators mandate equivalency with ICH-compliant processes, forcing local manufacturers to buy validated systems from global vendors. Larger vessels intensify sample throughput requirements, nudging buyers toward multiplexed solutions that monitor metabolite, nutrient, and physicochemical indicators simultaneously. Collectively these projects raise the bioprocess analyzers market baseline and extend replacement cycles as firms standardize on platform technologies.

Rising Adoption of Process Analytical Technology (PAT)

The FDA's January 2025 draft guidance endorses real-time release testing, clarifying validation pathways and unfreezing capex that had been on hold. Manufacturers fast-track "Process Analytics 4.0," integrating Raman, NIR, and MS with machine-learning models that hit R2 > 0.9 for glucose, lactate, and IgG prediction in small-scale runs. Digital twins compare live data against mechanistic simulations, enabling feed-rate adjustments within seconds instead of hours. These closed-loop architectures cut deviations and shorten batch-review cycles, providing CFO-level ROI that accelerates budget approvals. Early adopters report 25% reductions in product-release timelines, reinforcing the business case for enterprise-wide roll-outs. Vendors respond by bundling software subscriptions with hardware to lock in long-term annuity revenue and differentiate against low-cost sensor entrants.

High Capital and Operating Costs

An integrated PAT workstation can top USD 100,000, discouraging adoption among seed-stage biotech firms and academic labs. Even when capital is secured, ongoing expenses for reagents, calibration standards, and service contracts erode budgets. Attempts to create DIY or open-hardware solutions lower entry barriers but lack the GMP pedigree required for licensed production. Cost-sensitive buyers delay upgrades, extending the use of legacy off-line assays despite productivity penalties. Vendors counter by offering leasing, pay-per-sample, and cloud-based analytics to smooth cash outflows. Still, sticker shock remains a tangible drag on short-term growth, particularly in regions where grant funding cycles dictate purchasing capacity.

Other drivers and restraints analyzed in the detailed report include:

- Increasing R&D Expenditure in Life Sciences

- Surge in Demand for Personalized Medicine

- Stringent Validation and Compliance Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware remained essential, with the instruments segment contributing 58.54% of 2024 revenue. That share reflects a baseline need for tangible sensors, spectroscopy units, and samplers that physically interact with bioreactors. Demand for single-use compatible probes expands the consumables annuity, particularly where disposable bags represent 85% of upstream workflows. The bioprocess analyzers market size for instruments is projected to scale in tandem with mega-plant roll-outs, but growth rates moderate as installed bases mature in legacy geographies.

Software and analytics, although just 14.1% of 2024 spending, deliver a 17.65% CAGR as factories transition to fully digital twins. AI-enabled platforms extend beyond data logging to predictive maintenance and automatic parameter correction, raising overall equipment effectiveness by double digits. The swelling data footprint encourages cloud-native architectures, driving partnerships between instrument vendors and hyperscale providers. This interplay shifts wallet share toward recurring licenses, reshaping vendor P&L and introducing SaaS valuation multiples into the traditionally hardware-centric bioprocess analyzers industry.

Raman spectroscopy captured 42.45% revenue in 2024 by offering non-destructive, water-tolerant insight into metabolite profiles without sample preparation. Inline fiber optics allow continuous tracking of glucose, lactate, and amino-acid pools, underpinning closed-loop nutrient feeds. Model libraries developed in mini-bioreactors transfer seamlessly to manufacturing scale, lowering calibration costs.

Mass spectrometry, however, edges into mainstream acceptance with a 17.94% CAGR. Microfluidic interfaces now permit online sampling at sub-milliliter volumes, enabling real-time titer and impurity maps previously possible only off-line. Vendors emphasize high-resolution, low-maintenance designs to dispel perceptions of complexity. NIR retains traction for biomass estimation, while electrochemical sensors offer low-cost redundancy for critical-quality attributes, rounding out a diversified measurement portfolio that sustains the bioprocess analyzers market.

The Bioprocess Analyzers Market Report is Segmented by Product (Instruments, and More), Measurement Principle (Raman Spectroscopy, and More), Type (Substrate Analysis, and More), Application (Vaccines, and More), End-User (Biopharmaceutical & Pharmaceutical Companies, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 40.32% of 2024 revenue due to a dense concentration of GMP facilities, proactive FDA policy on PAT, and more than USD 160 billion in announced pharmaceutical capex across 2025 projects. Mega-acquisitions such as Lonza's purchase of Roche's Vacaville site-housing 330,000 L of reactors-underscore continued maturation of the local supply chain. Meanwhile, draft BIOSECURE legislation could redirect USD 2.1 billion worth of biologics production contracts away from Chinese entities, further stimulating domestic instrument demand. In Canada, government co-investment grants expedite vaccine analytics expansion, offering additional runway for hardware sales.

Asia-Pacific posts a 16.54% CAGR as regional champions execute multi-billion-dollar builds. Samsung Biologics targets 964,000 L of capacity upon completion of Plant 6, generating downstream pull for spectroscopy, chromatography, and data-management systems. Japan's Five-Year Startup Plan allocates tax incentives for biotech, pushing smaller firms to equip pilot plants with scalable analytics. China's pursuit of CGMP parity anchors demand for FDA-validated instrumentation, while India's bioeconomy roadmap pushes indigenous companies to source high-spec measuring tools to tap western outsourcing flows. Southeast Asia emerges as a secondary hub, where CDMOs erect smaller yet sophisticated suites designed to export therapies under stringent ICH standards.

Europe maintains steady, low-double-digit growth underpinned by strong regulatory emphasis on data integrity and single-use innovation, epitomized by Sartorius' BioPAT Spectro Raman platform. Germany and Switzerland remain pillars for equipment design and application support, while Ireland leverages a skilled workforce and tax regimes to attract U.S. biologics projects. Elsewhere, Middle East & Africa and South America represent nascent opportunities: local governments fund technology-transfer consortia to secure vaccine self-sufficiency, creating pilot orders that seed future adoption. Together these regional dynamics maintain an upward trajectory for the global bioprocess analyzers market.

- 4BioCell

- Agilent Technologies

- Roche

- Groton Biosystems

- Kaiser Optical Systems

- Nova Biomedical

- Randox Laboratories

- Sartorius

- SYSBIOTECH

- Thermo Fisher Scientific

- YSI

- Mettler-Toledo International

- Hamilton Company

- Pall

- Eppendorf

- Applikon Biotechnology

- Shimadzu

- Emerson Electric (Rosemount)

- Cytiva

- Waters Corporation

- Beckman Coulter Life Sciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Biopharmaceutical Manufacturing Capacity

- 4.2.2 Rising Adoption of Process Analytical Technology (PAT)

- 4.2.3 Increasing R&D Expenditure in Life Sciences

- 4.2.4 Surge in Demand for Personalized Medicine

- 4.2.5 Expansion of Contract Manufacturing Organizations (CMOs)

- 4.2.6 Favorable Regulatory Support for Continuous Manufacturing

- 4.3 Market Restraints

- 4.3.1 High Capital and Operating Costs

- 4.3.2 Stringent Validation and Compliance Requirements

- 4.3.3 Shortage of Skilled Bioprocessing Professionals

- 4.3.4 Data Integration and Interoperability Challenges

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2024-2030)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.2 Consumables

- 5.1.3 Software & Analytics

- 5.2 By Measurement Principle

- 5.2.1 Raman Spectroscopy

- 5.2.2 Near-Infrared (NIR)

- 5.2.3 Mass Spectrometry

- 5.2.4 Electrochemical Sensors

- 5.3 By Type

- 5.3.1 Substrate Analysis

- 5.3.2 Metabolite Analysis

- 5.3.3 Concentration Detection

- 5.3.4 Physicochemical Parameter Monitoring

- 5.4 By Application

- 5.4.1 Vaccines

- 5.4.2 Antibiotics

- 5.4.3 Recombinant Proteins

- 5.4.4 Biosimilars

- 5.4.5 Other Applications

- 5.5 By End-User

- 5.5.1 Biopharmaceutical & Pharmaceutical Companies

- 5.5.2 Contract Manufacturing/Research Organizations

- 5.5.3 Academic & Research Institutes

- 5.5.4 Other End-Users

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 4BioCell GmbH & Co. KG

- 6.3.2 Agilent Technologies

- 6.3.3 F. Hoffmann-La Roche AG

- 6.3.4 Groton Biosystems

- 6.3.5 Kaiser Optical Systems Inc.

- 6.3.6 Nova Biomedical Corporation

- 6.3.7 Randox Laboratories Ltd

- 6.3.8 Sartorius AG

- 6.3.9 SYSBIOTECH GmbH

- 6.3.10 Thermo Fisher Scientific, Inc.

- 6.3.11 YSI Inc.

- 6.3.12 Mettler-Toledo International

- 6.3.13 Hamilton Company

- 6.3.14 Pall Corporation

- 6.3.15 Eppendorf SE

- 6.3.16 Applikon Biotechnology

- 6.3.17 Shimadzu Corporation

- 6.3.18 Emerson Electric (Rosemount)

- 6.3.19 Cytiva (Danaher)

- 6.3.20 Waters Corporation

- 6.3.21 Beckman Coulter Life Sciences

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment