PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851878

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851878

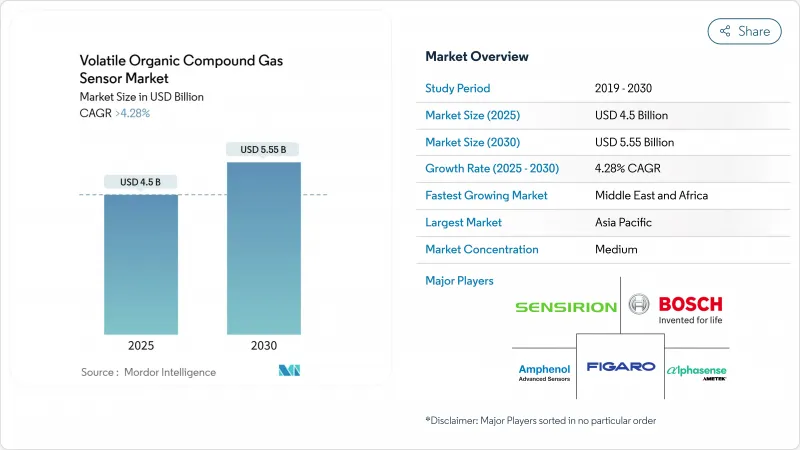

Volatile Organic Compound Gas Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The VOC sensors market stands at USD 4.5 billion in 2025 and is projected to reach USD 5.55 billion by 2030, reflecting a 4.28% CAGR.

Demand strengthens as indoor-air-quality codes narrow permissible volatile-organic-compound exposure limits, prompting commercial buildings to install continuous monitors. Smart-home hub vendors bundle VOC detection to distinguish premium offerings, while automotive and battery manufacturers rely on rapid-response sensors to detect solvent leakage on electric-vehicle production lines. Low-power micro-electromechanical-system photoionization detectors allow badge-style wearables for industrial staff, and green-building certifications award points for real-time air-quality reporting. These converging trends anchor growth across the VOC sensors market worldwide.

Global Volatile Organic Compound Gas Sensor Market Trends and Insights

Stricter Indoor-Air-Quality Standards across North America & Europe

Building owners must demonstrate continuous compliance with tightened exposure limits for formaldehyde, benzene and other VOCs. Bulk procurement of fixed wall-mounted detectors and BACnet gateways supports rapid retrofits in hospitals, schools and transit hubs. Demand concentrates on projects governed by ASHRAE-62.1 and EN-16798 guidelines, anchoring short-term momentum for the VOC sensors market.

Integration of VOC Sensors into Smart-Home IoT Platforms

Voice-assistant hubs and connected thermostats position VOC sensing as a wellness feature. MOS chips drawing less than 20 mW integrate over I2C or BLE, while Matter 1.2 interoperability enables vendor-agnostic pairing. High shipment volumes widen the addressable base and lower unit prices, sustaining medium-term growth for the VOC sensors market.

Calibration Drift of PID Sensors in High-Humidity Climates

PID output can drop 15% in environments above 85% relative humidity as water molecules quench photoionisation. Users incur added costs for compensation algorithms and frequent recalibration, tempering near-term uptake in food-processing plants and pulp mills across Southeast Asia and parts of South America.

Other drivers and restraints analyzed in the detailed report include:

- Demand from EV Battery Manufacturing Lines in Asia

- Adoption of Low-Power MEMS-PID Sensors Enabling Wearable Badges

- Lack of Harmonised Interoperability Protocols among Sensor Brands

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

MOS devices generated 26% of revenue in 2024, holding the largest VOC sensors market share because they balance price and performance. Photoionization detectors will post an 8.2% CAGR through 2030, outpacing the overall VOC sensors market. Premium industrial users require sub-3-second response times and wide chemical coverage, driving the VOC sensors market size for PID modules upward. Future MOS roadmaps incorporate multi-pixel arrays for species selectivity, while PID vendors explore graphene windows to reach sub-ppm sensitivity.

Across the MOS segment, falling wafer costs and temperature-modulation algorithms safeguard incumbent share even as niche applications shift to PID or quartz-crystal microbalance designs. Entrants must navigate intellectual-property clusters covering heater-drive patterns, which raise barriers in the VOC sensors market.

Wall-mounted panels captured 41.5% of 2024 revenue and remain core to building-automation retrofits that rely on PoE cabling. Wearable badges post the highest 9.6% CAGR, reflecting regulatory emphasis on personal exposure data in digital logbooks. The VOC sensors market size tied to badges climbs steadily as MEMS-PID designs prove eight-hour battery life.

Portable handheld detectors retain relevance for first responders but cede volume to continuous fixed monitors that support compliance documentation. Multi-parameter IAQ cubes face competition from smart-thermostat OEMs that integrate individual sensors directly onto motherboard daughtercards, yet they still contribute meaningfully to the VOC sensors market.

The Volatile Organic Compound Gas Sensor Market Report is Segmented by Sensor Technology (Photoionization Detector, Optical, and More), Device Form Factor (Wearable Badges, and More), Connectivity (Wired, Wireless), End-Use Industry (Industrial Safety, and More), Detection Range (Less Than 1 Ppm, and More), Distribution Channel (Direct Sales, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 31.9% of 2024 turnover, supported by gigafactory and cathode-active-material capacity expansions in China, Japan and South Korea. PID sensors pair with edge-analytics boxes to meet rapid compliance audits that require real-time dashboards delivered to provincial environmental bureaus. Investments in battery and semiconductor supply chains position Asia-Pacific as the foremost region within the VOC sensors market.

North America benefits from a building-retrofit cycle funded by federal tax credits that subsidize high-efficiency HVAC systems integrating VOC monitoring. Enterprise campuses use LoRaWAN IAQ nodes to track workplace wellness, and Canada's green-building council awards LEED points for continuous reporting, reinforcing the VOC sensors market.

Europe's Ecodesign directive pushes manufacturers to disclose VOC performance in use. Fixed monitors maintain acetone vapors below 10 ppm in German automotive paint shops. The Middle East and Africa post the quickest 9.2% CAGR as smart-city pilots in Saudi Arabia and the United Arab Emirates embed IAQ dashboards into municipal command centers, and South African mines trial wearable badges for underground crews, enlarging the regional VOC sensors market.

South America experiences steadier growth. Brazil aligns national exposure limits with ACGIH tables, driving procurement by petrochemical complexes near Sao Paulo. Mexico's maquiladora corridor adds low-cost MOS sensors to comply with USMCA environmental clauses, supporting the VOC sensors market across the region.

- ABB Ltd.

- Alphasense Ltd.

- Aeroqual Limited

- Ion Science Ltd.

- EcoSensors Inc.

- SGX Sensortech Ltd.

- Renesas Electronics Corp.

- Sensirion AG

- Amphenol Advanced Sensors

- Figaro Engineering Inc.

- Bosch Sensortec GmbH

- AMS OSRAM AG

- City Technology (Honeywell Intl.)

- GfG Europe Ltd.

- MicroJet Technology Co., Ltd.

- Riken Keiki Co., Ltd.

- Dragerwerk AG and Co. KGaA

- Kaiterra

- Siemens AG

- Spec Sensors LLC

- NevadaNano Inc.

- Zhengzhou Winsen Electronics Tech. Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening Indoor Air-Quality Standards across North America and Europe

- 4.2.2 Integration of VOC Sensors into Smart-Home IoT Platforms

- 4.2.3 Demand from EV Battery Manufacturing Lines in Asia for Solvent-Leak Detection

- 4.2.4 Adoption of Low-Power MEMS-PID Sensors Enabling Wearable VOC Badges

- 4.2.5 Green-Building Certification Schemes Mandating Continuous VOC Monitoring

- 4.3 Market Restraints

- 4.3.1 Calibration Drift of PID Sensors in High-Humidity Climates

- 4.3.2 Lack of Harmonised Interoperability Protocols among Sensor Brands

- 4.3.3 Price Sensitivity in Mass-Market Smart-Home Segment

- 4.3.4 Supply-Chain Volatility for Semiconductor Sensor Materials

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Technology

- 5.1.1 Photoionization Detector (PID)

- 5.1.2 Metal Oxide Semiconductor (MOS)

- 5.1.3 Electrochemical Sensor

- 5.1.4 Optical Fiber Sensor

- 5.1.5 Quartz Crystal Microbalance (QCM)

- 5.1.6 Others

- 5.2 By Device Form Factor

- 5.2.1 Fixed/Wall-Mounted Monitors

- 5.2.2 Handheld/Portable Detectors

- 5.2.3 Wearable Badges

- 5.2.4 Integrated Multi-Parameter IAQ Monitors

- 5.2.5 Embedded Sensor Modules

- 5.3 By Connectivity

- 5.3.1 Wired (BACnet, Modbus, Ethernet, CAN)

- 5.3.2 Wireless

- 5.3.2.1 Wi-Fi

- 5.3.2.2 Bluetooth/BLE

- 5.3.2.3 Zigbee/Thread

- 5.3.2.4 LoRaWAN/NB-IoT/LTE-M

- 5.4 By End-use Industry

- 5.4.1 Industrial Process Safety

- 5.4.2 Oil and Gas and Petrochemical

- 5.4.3 Automotive and Transportation

- 5.4.4 Consumer Electronics and Smart Homes

- 5.4.5 Commercial Buildings and Offices

- 5.4.6 Healthcare and Pharmaceuticals

- 5.4.7 Food and Beverage Production

- 5.4.8 Academic and RandD Laboratories

- 5.4.9 Others

- 5.5 By Detection Range

- 5.5.1 Less than 1 ppm

- 5.5.2 1 - 10 ppm

- 5.5.3 10 - 100 ppm

- 5.5.4 Greater than 100 ppm

- 5.6 By Distribution Channel

- 5.6.1 Direct Sales

- 5.6.2 Distributor / VAR Channel

- 5.6.3 E-commerce

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 Middle East

- 5.7.4.1 Israel

- 5.7.4.2 Saudi Arabia

- 5.7.4.3 United Arab Emirates

- 5.7.4.4 Turkey

- 5.7.4.5 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 ABB Ltd.

- 6.4.2 Alphasense Ltd.

- 6.4.3 Aeroqual Limited

- 6.4.4 Ion Science Ltd.

- 6.4.5 EcoSensors Inc.

- 6.4.6 SGX Sensortech Ltd.

- 6.4.7 Renesas Electronics Corp.

- 6.4.8 Sensirion AG

- 6.4.9 Amphenol Advanced Sensors

- 6.4.10 Figaro Engineering Inc.

- 6.4.11 Bosch Sensortec GmbH

- 6.4.12 AMS OSRAM AG

- 6.4.13 City Technology (Honeywell Intl.)

- 6.4.14 GfG Europe Ltd.

- 6.4.15 MicroJet Technology Co., Ltd.

- 6.4.16 Riken Keiki Co., Ltd.

- 6.4.17 Dragerwerk AG and Co. KGaA

- 6.4.18 Kaiterra

- 6.4.19 Siemens AG

- 6.4.20 Spec Sensors LLC

- 6.4.21 NevadaNano Inc.

- 6.4.22 Zhengzhou Winsen Electronics Tech. Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment