PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910650

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910650

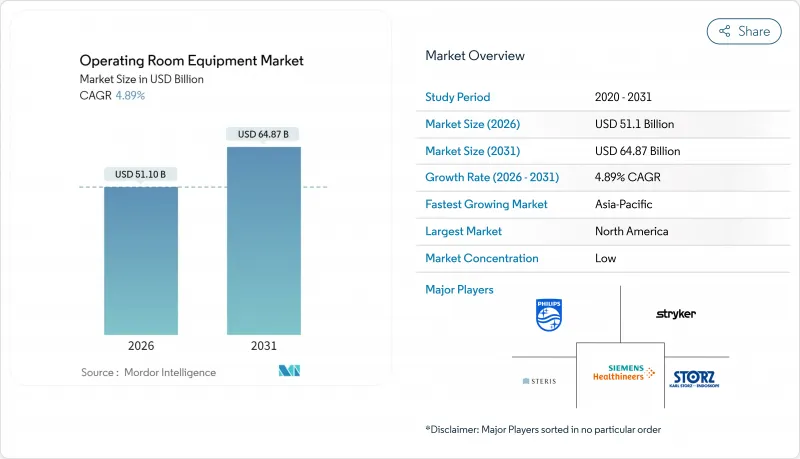

Operating Room Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Operating Room Equipment Market market size in 2026 is estimated at USD 51.1 billion, growing from 2025 value of USD 48.72 billion with 2031 projections showing USD 64.87 billion, growing at 4.89% CAGR over 2026-2031.

Spending patterns now favor technologies that compress procedure time, improve visualization, and embed artificial intelligence rather than pure capacity expansion. Hybrid theaters equipped with intra-operative imaging and AI-driven workflow software continue to draw budget priority as hospitals address post-pandemic surgical backlogs. Capital outlays also track demographic shifts, with Asia-Pacific health systems investing in new surgical suites, while North American providers refresh installed bases with cyber-secure, upgrade-ready platforms. Consolidation among suppliers is reshaping competitive dynamics, as large vendors buy niche innovators to round out integrated portfolios and secure multiyear service contracts.

Global Operating Room Equipment Market Trends and Insights

Growing Incidence of Chronic Diseases Requiring Surgeries

Cardiovascular, oncologic, and musculoskeletal disorders are pushing surgical volumes higher as populations age and lifestyle risks rise. Orthopedic arthroscopy alone is projected to illustrate sustained demand for high-throughput OR platforms. Clinicians require multipurpose tables, versatile imaging, and advanced anesthesia workstations to handle comorbid patients who often need staged interventions. Vendors able to bundle interoperable systems that shorten turnover while maintaining safety benefit most as payers scrutinize cost per episode.

Rising Number of Hospitals and Government Funding

Capacity expansion programs in India, Indonesia, and mainland China translate into repeat tenders for core devices such as ceiling pendants, electrosurgical generators, and basic patient monitors. Domestic manufacturing incentives lower import duties and widen price segments, prompting global companies to release mid-tier lines optimized for local service conditions. Sweden-based Getinge targets 45% unit share in India by offering modular sterile processing and table packages calibrated to emerging-market budgets.

High Capital & Maintenance Costs of OR Equipment

Comprehensive hybrid installations exceed USD 3 million including shielding, HVAC upgrades, and service contracts. Value-oriented buyers therefore prefer modular ceiling columns and retrofit-ready imaging rails that extend asset life. Leasing and equipment-as-a-service models convert capex to predictable opex, yet total cost of ownership still rises when software licenses, cybersecurity patches, and training are considered.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of Minimally-Invasive & Image-Guided Surgeries

- Rapid Shift Toward Hybrid ORs With Advanced Intra-Op Imaging

- Shortage of Skilled Peri-Operative Personnel

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Anesthesia workstations generated the largest revenue slice in 2025 at 25.31%. Demand is inelastic because every procedure requires airway management and physiologic monitoring. The operating room equipment market size for anesthesia devices is forecast to grow steadily with case volumes rather than spike. In contrast, surgical imaging systems are on track for an 11.05% CAGR through 2031, propelled by hybrid vascular and neuro suites that need real-time guidance. The operating room equipment market size for imaging solutions is projected to reach double-digit billions by 2031 as providers bundle flat-panel detectors, navigation, and augmented reality overlays.

Electrosurgical generators retain relevance as minimally invasive techniques proliferate, yet innovation now centers on intelligent energy modulation that adapts to tissue impedance. Ceiling-mounted medical pendants evolve into network hubs supplying power, gases, and data, making them indispensable to connected OR ecosystems. Smoke evacuation installations accelerate after multiple US states mandated their use, with Missouri enforcing compliance from January 2026. Display makers such as LG introduce 4 K mini-LED monitors that enhance depth perception and color fidelity for delicate microsurgery.

The Operating Room Equipment Market Report is Segmented by Product (Anesthesia Devices, Surgical Imaging Systems, Electrosurgical Devices, and More), Mobility (Fixed/In-built, Modular/Retrofit, Mobile/Portable), End User (Hospitals, Ambulatory Surgical Centers, Out-Patient Facilities/Specialty Clinics), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands 37.55% revenue due to reimbursement systems that fund early adoption of AI-enabled workflow tools and cyber-secure networks. US hospitals plan a 9% uplift in capital spend through 2026 to combat elective backlogs and modernize legacy suites. Canadian provincial health authorities co-finance hybrid theaters to reduce patient transfers, while Mexican private chains equip high-end campuses to attract medical tourists. The operating room equipment market continues to value vendor-neutral integration layers so facilities can mix platforms while complying with FDA cybersecurity directives.

Asia-Pacific posts the fastest 6.54% CAGR as India and China ramp surgical infrastructure across public and private sectors. International suppliers open training academies-Medtronic's Robotics Experience Studio in Southeast Asia exemplifies the strategy-to upskill staff and prove return on investment. Japan and South Korea focus on aging-related specialties, investing in robotic scopes and smart anesthesia systems that cut length of stay. Price-sensitive segments in Indonesia, Vietnam, and the Philippines favor modular pendants and durable diagnostic imaging as gateways to comprehensive OR builds.

Europe sustains moderate expansion led by Germany, France, and the United Kingdom co-funding carbon-reduction retrofits and helium-efficient MRI suites. The partnership between Philips and imaging provider Evidia to deploy sustainable scanners shows climate alignment influencing procurement. Middle East & Africa growth concentrates in Gulf Cooperation Council states where flagship academic hospitals purchase full hybrid packages to capture inbound medical tourism. South America, spearheaded by Brazil, modernizes gradually amid currency swings, leaning on local assemblers for basic tables and lights while importing premium vascular imaging.

- Koninklijke Philips

- STERIS

- Stryker

- Karl Storz

- Siemens Healthineers

- Baxter

- Getinge

- Medtronic

- GE Healthcare

- Mizuho

- Dragerwerk

- Olympus

- Hill-Rom

- Skytron

- Conmed

- Zimmer Biomet

- Danaher

- Sony Medical Systems

- EIZO Corp.

- Trumpf Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Incidence of Chronic Diseases Requiring Surgeries

- 4.2.2 Rising Number of Hospitals and Government Funding

- 4.2.3 Increasing Adoption of Minimally-Invasive & Image-Guided Surgeries

- 4.2.4 Rapid Shift Toward Hybrid ORs With Advanced Intra-Op Imaging

- 4.2.5 Deployment of AI-Driven Workflow Analytics for OR Efficiency

- 4.2.6 Post-Pandemic Backlog of Electives Triggering OR Upgrades

- 4.3 Market Restraints

- 4.3.1 High Capital & Maintenance Costs of OR Equipment

- 4.3.2 Shortage of Skilled Peri-Operative Personnel

- 4.3.3 Cyber-Security Risks in Integrated OR Platforms

- 4.3.4 Regulatory Delays for AI-Enabled Surgical Devices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Anesthesia Devices

- 5.1.2 Surgical Imaging Systems

- 5.1.3 Electrosurgical Devices

- 5.1.4 Operating Tables

- 5.1.5 Surgical & Exam Lights

- 5.1.6 Patient Monitors

- 5.1.7 Medical Pendants & Booms

- 5.1.8 Smoke Evacuation Systems

- 5.1.9 Other OR Equipment

- 5.2 By Mobility

- 5.2.1 Fixed / In-built

- 5.2.2 Modular / Retrofit

- 5.2.3 Mobile / Portable

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Out-patient Facilities / Specialty Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Koninklijke Philips NV

- 6.3.2 STERIS

- 6.3.3 Stryker Corporation

- 6.3.4 Karl Storz SE & Co. KG

- 6.3.5 Siemens Healthineers AG

- 6.3.6 Baxter International

- 6.3.7 Getinge AB

- 6.3.8 Medtronic plc

- 6.3.9 GE HealthCare

- 6.3.10 Mizuho OSI

- 6.3.11 Dragerwerk AG & Co. KGaA

- 6.3.12 Olympus Corporation

- 6.3.13 Hill-Rom Holdings Inc.

- 6.3.14 Skytron LLC

- 6.3.15 Conmed Corporation

- 6.3.16 Zimmer Biomet Holdings Inc.

- 6.3.17 Leica Microsystems GmbH

- 6.3.18 Sony Medical Systems

- 6.3.19 EIZO Corp.

- 6.3.20 Trumpf Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment