PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851882

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851882

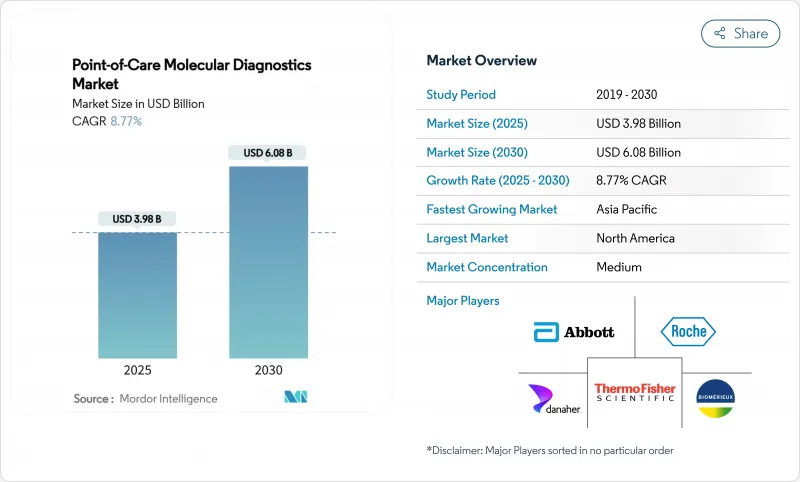

Point-of-Care Molecular Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The point of care molecular diagnostics market is valued at USD 3.98 billion in 2025 and is projected to reach USD 6.08 billion in 2030, reflecting an 8.77% CAGR over 2025-2030.

This solid upward path underscores an industry-wide transition from centralized laboratories to compact platforms that deliver polymerase chain reaction-grade sensitivity in less than 30 minutes at the bedside. Growth drivers include the widening menu of respiratory, gastrointestinal, sexually transmitted, and oncology assays, strong public investment in diagnostic resilience, and the rapid integration of cloud-based data management that allows clinicians to retrieve, interpret, and archive results almost instantly.

North America remains the largest regional contributor, benefitting from an extensive installed base, early regulatory approvals, and relatively predictable payer frameworks, while Asia Pacific is emerging as the volume engine as China and India invest in decentralized testing to support antimicrobial stewardship and precision oncology. Competitive intensity is building as incumbents miniaturize thermal cyclers, newcomers commercialize isothermal systems that omit temperature cycling, and both groups deploy software dashboards that knit scattered devices into unified diagnostic networks. Even so, reimbursement ambiguity, the rising cost of regulatory compliance for laboratory-developed tests, and gaps in cold-chain infrastructure for reagent distribution threaten to slow uptake in certain settings, particularly tropical or resource-constrained regions that stand to benefit most.

Global Point-of-Care Molecular Diagnostics Market Trends and Insights

Increased Demand for Decentralized and Rapid Respiratory Infection Testing

Widespread clinical adoption of sub-20-minute respiratory panels has trimmed emergency department wait times, reduced empiric drug use, and limited unnecessary admissions. Health systems report that point-of-care molecular results shift therapeutic plans in the majority of encounters, which improves antimicrobial stewardship and shortens length of stay. Connectivity modules use HL7 or FHIR to push data into electronic health records, giving infection-control teams near real-time visibility that previously arrived hours later. These clear operational wins fuel high cartridge volumes during influenza and coronavirus seasons, which in turn secure stable recurring revenue for manufacturers within the point of care molecular diagnostics market.

Government and Programmatic Support for POC Molecular Diagnostics Adoption

The National Institutes of Health Point-of-Care Technologies Research Network opened six targeted funding calls in 2024, accelerating prototype development across oncology, infectious disease, and chronic condition monitoring. The U.S. Food and Drug Administration granted the first point-of-care hepatitis C RNA authorization in June 2024, enabling same-visit diagnosis and treatment for millions of chronically infected Americans. Comparable initiatives in Europe and Japan allocate multi-year budgets for platform deployment to shore up health-system preparedness against future outbreaks. Predictable public-sector support signals a structural rather than episodic demand curve, which improves capital planning for firms competing in the point of care molecular diagnostics market.

Fragmented and Uncertain Reimbursement Landscapes

Coding frameworks designed for central laboratories do not always translate to near-patient platforms, leaving providers unsure of payment rates. The 2024 FDA decision to phase out enforcement discretion for laboratory-developed tests imposes fresh compliance and documentation costs just as vendors lobby payers for equitable reimbursement. Oncology and multi-cancer early detection panels face even greater uncertainty because coverage determinations lag behind regulatory clearances, slowing uptake despite evident clinical benefit.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements Enabling New Applications in Oncology and Antimicrobial Stewardship

- Expansion of POC MDx into Non-Traditional Settings

- Cold-Chain Gaps for Lyophilized Reagents in Tropical Low-Income Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Abbott Laboratories

- Roche

- Danaher

- Thermo Fisher Scientific

- bioMerieux

- Siemens Healthineers

- Beckton Dickinson

- Hologic

- QIAGEN

- QuidelOrtho

- Visby Medical Inc.

- Orasure Technologies

- Meridian Bioscience

- Co-Diagnostics

- Pfizer

- T2 Biosystems

- Genedrive plc

- Binx Health, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Demand for Decentralized and Rapid Respiratory Infection Testing

- 4.2.2 Government and Programmatic Support for POC Molecular Diagnostics Adoption

- 4.2.3 Technological Advancements Enabling New Applications (e.g., Oncology, Antimicrobial Stewardship)

- 4.2.4 Expansion of POC MDx into Non-Traditional Settings (e.g., Physician Offices, Retail Pharmacies)

- 4.2.5 CLIA-waived Multiplex PCR Platforms Adoption in U.S. Physician Offices

- 4.2.6 Microfluidic Cartridge Innovation Catalyzing Oncology Gene Panels in Asia

- 4.3 Market Restraints

- 4.3.1 Fragmented and Uncertain Reimbursement Landscapes

- 4.3.2 High Regulatory and Transition Costs

- 4.3.3 Cold-Chain Gaps for Lyophilized Reagents in Tropical Low-Income Regions

- 4.3.4 Clinician Skepticism due to False-Positives in Isothermal NAAT

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value/Volume)

- 5.1 By Product & Service

- 5.1.1 Assays & Kits

- 5.1.2 Instruments / Analyzers

- 5.1.3 Software & Digital Services

- 5.2 By Application

- 5.2.1 Infectious Diseases

- 5.2.2 Oncology

- 5.2.3 Hematology

- 5.2.4 Prenatal & Neonatal Testing

- 5.2.5 Endocrinology

- 5.2.6 Pharmacogenomics & Companion Dx

- 5.2.7 Other Applications

- 5.3 By Technology

- 5.3.1 PCR-based

- 5.3.2 INAAT

- 5.3.3 Other Technologies

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Homecare Settings

- 5.4.3 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Abbott

- 6.4.2 F. Hoffmann-La Roche Ltd

- 6.4.3 Danaher

- 6.4.4 Thermo Fisher Scientific Inc.

- 6.4.5 BioMerieux SA

- 6.4.6 Siemens Healthineers AG

- 6.4.7 Becton, Dickinson and Company

- 6.4.8 Hologic Inc.

- 6.4.9 Qiagen N.V.

- 6.4.10 QuidelOrtho Corporation

- 6.4.11 Visby Medical Inc.

- 6.4.12 OraSure Technologies Inc.

- 6.4.13 Meridian Bioscience Inc.

- 6.4.14 Co-Diagnostics Inc.

- 6.4.15 Pfizer Inc.

- 6.4.16 T2 Biosystems Inc.

- 6.4.17 Genedrive plc

- 6.4.18 Binx Health, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment