PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851886

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851886

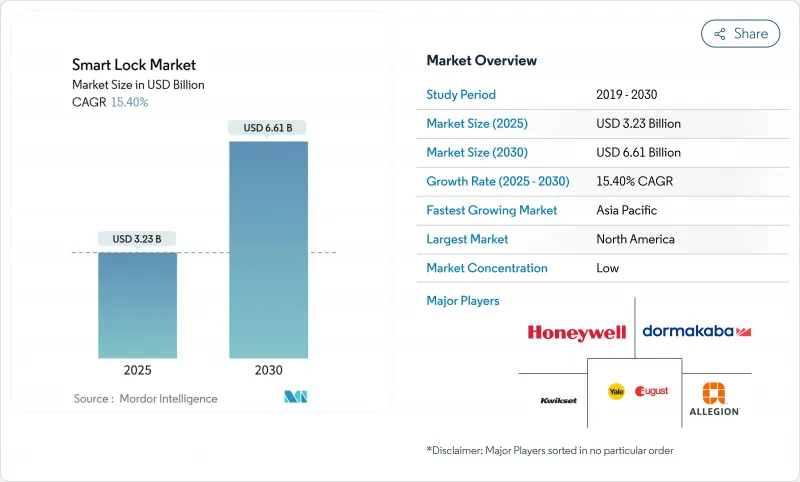

Smart Lock - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart lock market stands at a valuation of USD 3.23 billion in 2025 and is forecast to reach USD 6.61 billion by 2030, reflecting a 15.40% CAGR.

The outlook highlights the convergence of maturing smart-home platforms, rising urban security concerns, and expanding IoT connectivity that favors remote door access. Interoperability progress through the Matter and Thread standards now removes many integration barriers, while declining biometric sensor prices are broadening feature sets across both residential and light-commercial models. Price increases linked to semiconductor shortages are a near-term headwind, yet insurance premium discounts and total-cost-of-ownership savings continue to encourage replacement of mechanical locks. Intensifying acquisition activity shows established access-control leaders positioning to secure scale, channel reach, and core technology.

Global Smart Lock Market Trends and Insights

Rapid Adoption of Smart-Home Ecosystems

Growing preference for unified device control makes smart lock integration one of the first upgrades in connected homes. Matter-over-Thread launches by Yale, Schlage, and Level are removing vendor lock-in and extending battery life to more than 12 months. Voice assistants already reside in 70% of United States households, which accelerates voice-enabled locking. Scheduled Thread 1.4 adoption by 2026 will let new products join existing networks without additional hubs, further tightening ecosystem stickiness.

Rising Burglary and Safety Concerns in Urban Areas

Urban crime patterns have raised homeowner vigilance, and data show 83% of burglars survey security setups before entry. Integrating a smart lock with video verification closes the 15-second alarm response gap common in legacy systems. Lockly's facial recognition engine now flags unauthorized faces in 1.5 seconds, sending real-time alerts that deter opportunistic crime. Multi-factor combinations of biometrics and PINs add layered protection for dense residential high-rises where anonymity often aids break-ins.

Cyber-Security and Hacking Vulnerabilities

High-profile breaches have exposed biometric bypasses and cloneable NFC tags in mainstream models. Tests by one consumer association found 85.7% of chip-activated units exhibited at least one critical flaw. Vendors now ship end-to-end encryption and two-factor log-ins, yet fragmented hardware designs make universal patching hard to maintain. Industry groups within the Connectivity Standards Alliance are drafting baseline requirements, but wide variation in implementation keeps cyber-risk elevated.

Other drivers and restraints analyzed in the detailed report include:

- Smartphone and IoT Proliferation Enabling Remote Access

- Building-Code Push for Keyless Energy-Efficient Doors

- Up-Front Device and Installation Cost Premium

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Deadbolts retained 45.7% of 2024 revenue, reflecting widespread homeowner confidence in their physical robustness. This share equates to the largest slice of the smart lock market size for hardware formats. Lever handle systems achieved the leading 15.6% CAGR due to ADA compliance needs in hotels and offices, demonstrating how ease-of-operation appeals to high-traffic settings.

Consumers seeking discreet upgrades have driven interest in retrofit cylinders that hide electronics inside existing housings, exemplified by Level's invisible mechanism. Padlock-style smart devices service out-door industrial use cases but remain niche because of weather-proofing costs. Continuous miniaturization will likely blur category boundaries, though deadbolts are expected to keep a commanding presence through 2030 in the smart lock market.

Bluetooth held 62.3% share in 2024, translating into the top position within the smart lock market share for connectivity. Its phone-to-lock pairing simplicity favors rental properties where router access is uncertain. Range and mesh limitations, however, make it less suited to multi-unit dwellings.

The Zigbee-Thread stack is projected for a 17.2% CAGR, propelled by Matter certification and Silicon Labs' ultra-low-power SoCs. Wi-Fi continues in cloud-first deployments that prioritize direct remote control despite battery drain. Emerging ultra-wideband adds hands-free precision but sits within the "Others" bucket until shipping volumes scale. Across protocols, standardization is shrinking fragmentation, a trend that will raise the overall smart lock market adoption curve.

Smart Lock Market is Segmented by Lock Type (Deadbolt, Lever Handle, and More), Communication Technology (Bluetooth, Wi-Fi, and More), Authentication Method (Pin-Code / Keypad, Biometric (Fingerprint, Face), and More), End User (Residential, Commercial Offices, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secured 37.7% of 2024 revenue due to early smart-home adoption, favorable codes, and insurance discounts of up to 10% for connected security. The United States drives renovation demand as developers view smart locks as standard amenity packages. Canada follows, leveraging similar building norms and broadband penetration.

Asia-Pacific is set for the highest 15.9% CAGR, reflecting rapid urban migration and growing middle-class disposable income. China leads smart-home shipments, while India's residential automation pipeline shows a 39.79% expansion outlook that positions smart locks near the top of consumer upgrade lists. Japan's aging demographic attracts contactless door solutions supporting senior independence.

Europe posts steady progression anchored by energy-efficiency directives and strong privacy oversight. Advanced encryption requirements raise development costs yet promote differentiated offerings that comply with GDPR. The Middle East and Africa, though smaller today, benefit from smart-city investments baked into greenfield real-estate projects, enabling leapfrog adoption paths that raise the future baseline of the smart lock market.

- ASSA ABLOY (Yale, August)

- Allegion plc (Schlage)

- Spectrum Brands Holdings (Kwikset)

- dormakaba Group

- Honeywell International

- SALTO Systems

- U-TEC (ULTRALOQ)

- Lockly

- Master Lock

- Nuki Home Solutions

- Netatmo (Legrand)

- SimpliSafe

- Samsung SDS

- Aqara (Xiaomi)

- Eufy Security (Anker)

- Level Home

- Tedee

- Hanman International

- Panasonic Life Solutions

- Xiaomi Mi Smart Home

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of smart-home ecosystems

- 4.2.2 Rising burglary and safety concerns in urban areas

- 4.2.3 Smartphone and IoT proliferation enabling remote access

- 4.2.4 Building-code push for keyless energy-efficient doors

- 4.2.5 Airbnb-style rentals demanding automated guest access

- 4.2.6 Home-insurance premium discounts for connected locks

- 4.3 Market Restraints

- 4.3.1 Cyber-security and hacking vulnerabilities

- 4.3.2 Up-front device and installation cost premium

- 4.3.3 Battery-life / maintenance anxieties among consumers

- 4.3.4 Inter-protocol interoperability gaps in retrofit projects

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Lock Type

- 5.1.1 Deadbolt

- 5.1.2 Lever Handle

- 5.1.3 Padlock

- 5.1.4 Others

- 5.2 By Communication Technology

- 5.2.1 Bluetooth

- 5.2.2 Wi-Fi

- 5.2.3 Zigbee

- 5.2.4 Others

- 5.3 By Authentication Method

- 5.3.1 Pin-Code / Keypad

- 5.3.2 Biometric (Fingerprint, Face)

- 5.3.3 RFID / NFC Card

- 5.3.4 Others

- 5.4 By End-user

- 5.4.1 Residential

- 5.4.2 Commercial Offices

- 5.4.3 Hospitality and Short-term Rentals

- 5.4.4 Industrial and Infrastructure

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.2.5 Egypt

- 5.5.5.2.6 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ASSA ABLOY (Yale, August)

- 6.4.2 Allegion plc (Schlage)

- 6.4.3 Spectrum Brands Holdings (Kwikset)

- 6.4.4 dormakaba Group

- 6.4.5 Honeywell International

- 6.4.6 SALTO Systems

- 6.4.7 U-TEC (ULTRALOQ)

- 6.4.8 Lockly

- 6.4.9 Master Lock

- 6.4.10 Nuki Home Solutions

- 6.4.11 Netatmo (Legrand)

- 6.4.12 SimpliSafe

- 6.4.13 Samsung SDS

- 6.4.14 Aqara (Xiaomi)

- 6.4.15 Eufy Security (Anker)

- 6.4.16 Level Home

- 6.4.17 Tedee

- 6.4.18 Hanman International

- 6.4.19 Panasonic Life Solutions

- 6.4.20 Xiaomi Mi Smart Home

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment