PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851887

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851887

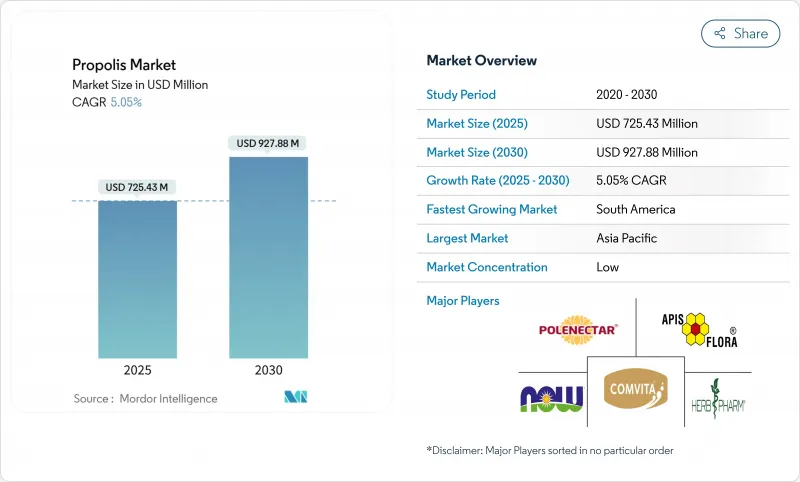

Propolis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The propolis market size is estimated to be USD 725.43 million in 2025, and is expected to reach USD 927.88 million by 2030, at a CAGR of 5.05% during the forecast period (2025-2030).

Consumers increasingly choose natural health products, especially after the global health crisis sparked greater interest in immune-strengthening supplements. Propolis effectively reduces triglycerides, LDL-cholesterol, and blood pressure levels, which strengthens its position in the health supplements market. The market exhibits robust growth due to enhanced consumer understanding of propolis's therapeutic properties, particularly its antimicrobial, anti-inflammatory, and antioxidant characteristics. This heightened awareness has generated increased demand across multiple industrial segments. Continuous scientific investigation into propolis's therapeutic applications facilitates market expansion and stimulates product innovation among manufacturers.

Global Propolis Market Trends and Insights

Rising Demand For Natural Immunity-Boosting Products Drives Demand

The immunity supplements market experienced significant growth due to changing consumer preferences for natural health products. This growth has generated sustained demand for propolis-based formulations, particularly for their immunomodulatory properties in athletic performance and recovery applications. The post-pandemic health consciousness has evolved from a temporary response into a lasting lifestyle change, with consumers prioritizing preventive health solutions over reactive treatments. Propolis aligns with this shift through its dual role as both a traditional remedy and a scientifically validated bioactive compound. This trend is especially evident among aging populations where immune system support is a primary health concern, driving consistent demand for propolis supplements across various delivery formats. According to the Population Reference Bureau (PRB), in 2023, Monaco had the highest percentage of its population aged over 65, at 36%, followed by Japan at 29%. Portugal and Bulgaria shared the third position, at 24% .

Increasing Product Launches in Functional Food Space Surges Growth

The integration of propolis into functional foods represents a shift from traditional supplement formats to mainstream consumer products. The vitamins, minerals, and supplements market shows growth in alternative formats such as gummies and liquids, with investors focusing on brands offering proprietary formulations. This diversification provides new opportunities for propolis applications, particularly in children's health products and adult formulations. Companies are developing functional beverages, health bars, and fortified foods using propolis's natural sweetness and antimicrobial properties to meet consumer demand for convenient nutrition solutions. Advances in propolis processing, including fermentation techniques, are improving the nutritional value and bioactivity of bee products compared to conventional extracts.

Limited Scientific Validation Reduces Mainstream Acceptance Globally

The propolis market faces regulatory challenges due to the absence of Food and Drug Administration (FDA) established standardization protocols for safety and efficacy assessment. The lack of a regulatory framework creates market uncertainty and limits healthcare practitioners' recommendations in evidence-based medical settings. The varying chemical composition of propolis, which depends on geographic location and bee species, complicates the standardization process required for regulatory approval. While research studies demonstrate specific health benefits, the insufficient number of large-scale clinical trials restricts insurance coverage and medical integration. The substantial investment required for research and development to obtain regulatory approval creates entry barriers for smaller companies and reduces market adoption rates.

Other drivers and restraints analyzed in the detailed report include:

- Influencer Marketing Boosting Awareness of Propolis Benefits

- Propolis Recognized as Natural Antibiotic Alternative Globally

- High Product Prices Restrict Mass Market Growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Capsules hold the dominant market share at 37.66% in 2024, as consumers prefer their standardized dosing and familiar format for supplement consumption. Liquid formulations are growing at the fastest rate with a 7.65% CAGR through 2030, due to their higher bioavailability and adaptability in functional food products. This growth indicates increasing consumer awareness of absorption differences between formats, as liquid forms offer quicker absorption and better retention of bioactive compounds. Tablets remain a stable segment, while creams and topical applications gain momentum in cosmetics and oral care, particularly for their antimicrobial and anti-inflammatory properties.

The market shift toward liquid formats reflects the supplement industry's move away from traditional pills, particularly among younger consumers and individuals with pill-swallowing difficulties. Creams and topical applications show strong performance in wound healing and oral health applications, with clinical evidence supporting their effectiveness as alternatives to conventional antimicrobial treatments. The "Others" category, which includes gummies and functional beverages, presents opportunities for product differentiation in the market.

The Global Propolis Market is Segmented Into Product Type (Capsules, Tablets, Liquids, Creams, and Others), Category (Conventional, and Organic), Distribution Channel (Supermarkets/Hypermarkets, Pharmacies and Drugstores, Online Retail Stores, and Other Distribution Channels), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

Asia-Pacific dominates with a 32.65% market share in 2024 as consumers integrate traditional medicine practices and prioritize health awareness. China leads the regional market, though Comvita experienced a 17.6% revenue decline in Chinese markets during 2024. India targets mass market distribution while Japan focuses on premium segments, creating distinct growth pathways. The region's strong apiculture foundation and cultural acceptance drive market growth, though companies face challenges navigating varied regulations across countries.

South America drives market expansion at 6.87% CAGR through 2030, with Brazil leading propolis production and processing. Brazilian producers create premium-grade propolis, valued for its unique chemical properties and health benefits. The region strengthens its position through enhanced export capabilities and trade agreements. Argentina offers growth opportunities despite economic challenges affecting market stability. Sustainable production practices and diverse propolis varieties give South American producers a competitive edge.

North America and Europe shape market standards through strict regulations and premium positioning. These regions grow through product innovations and increased market reach. European regulators now require apiculture importers to register in the EU's Trade Control and Expert System, benefiting established companies. North American consumers readily accept premium prices for scientifically-proven products, supported by healthcare professionals. The Middle East and Africa show growth potential as economic development increases, though limited infrastructure and developing regulations currently restrict market expansion.

- Comvita Ltd

- Apiary Polenecter

- Apis Flora Industrial e Comercial Ltda (Apis Flora)

- NOW Foods

- Herb Pharm LLC

- Uniflora Nutraceutica Ltda (Uniflora Health Foods)

- YS Organic Bee Farms

- Sunyata Produtos Alternativos Ltda (Sunyata Pon Lee)

- Wax Green

- INW Manufacturing, LLC (Bee Health Ltd)

- Bio-Botanica Inc. (Nature's Answer)

- SBS Scientific Bio Solutions (Bee&You (BEEO Food)

- Natura Nectar LLC

- Hong Leong Group (Manuka Health New Zealand)

- New Zealand Health Food Co.

- Apiter Laboratories

- Arataki Honey Ltd

- Honey Pacifica Company

- Sunlite India Agro Producer Company Ltd.

- Aravalli Honey Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand For Natural Immunity-Boosting Products Drives Demand

- 4.2.2 Increasing Product Launches In Functional Food Space Surges Growth

- 4.2.3 Influencer Marketing Boosting Awareness of Propolis

- 4.2.4 Propolis Recognized As Natural Antibiotic Alternative Globally

- 4.2.5 Increasing Use In Natural Skincare And Cosmetics Drives Demand

- 4.2.6 Consumer Shift Toward Clean Label Ingredients Grows Demand For Propolis

- 4.3 Market Restraints

- 4.3.1 Limited Scientific Validation Reduces Mainstream Acceptance Globally

- 4.3.2 High Product Prices Restrict Mass Market Growth

- 4.3.3 Allergen Concerns Limit Use Among Sensitive Consumers

- 4.3.4 Rising Preference For Alternative And Traditional Medicines

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Advancements

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Capsules

- 5.1.2 Tablets

- 5.1.3 Liquids

- 5.1.4 Creams

- 5.1.5 Others

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Pharmacies and Drugstores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Comvita Ltd

- 6.4.2 Apiary Polenecter

- 6.4.3 Apis Flora Industrial e Comercial Ltda (Apis Flora)

- 6.4.4 NOW Foods

- 6.4.5 Herb Pharm LLC

- 6.4.6 Uniflora Nutraceutica Ltda (Uniflora Health Foods)

- 6.4.7 YS Organic Bee Farms

- 6.4.8 Sunyata Produtos Alternativos Ltda (Sunyata Pon Lee)

- 6.4.9 Wax Green

- 6.4.10 INW Manufacturing, LLC (Bee Health Ltd)

- 6.4.11 Bio-Botanica Inc. (Nature's Answer)

- 6.4.12 SBS Scientific Bio Solutions (Bee&You (BEEO Food)

- 6.4.13 Natura Nectar LLC

- 6.4.14 Hong Leong Group (Manuka Health New Zealand)

- 6.4.15 New Zealand Health Food Co.

- 6.4.16 Apiter Laboratories

- 6.4.17 Arataki Honey Ltd

- 6.4.18 Honey Pacifica Company

- 6.4.19 Sunlite India Agro Producer Company Ltd.

- 6.4.20 Aravalli Honey Industries

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK