PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851893

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851893

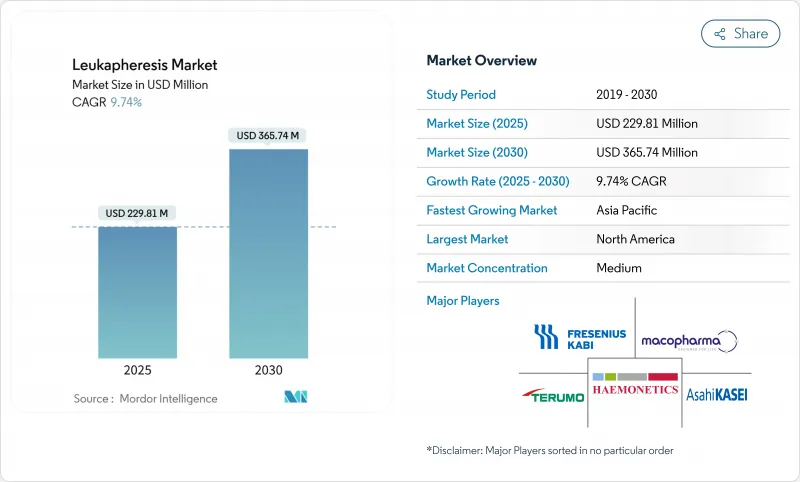

Leukapheresis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Leukapheresis Market size is estimated at USD 229.81 million in 2025, and is expected to reach USD 365.74 million by 2030, at a CAGR of 9.74% during the forecast period (2025-2030).

Rising leukemia incidence, accelerating CAR-T commercialization, and the shift toward automated continuous-flow apheresis systems anchor this expansion. Hospitals broaden therapeutic use beyond hyperleukocytosis, while cell-therapy manufacturers scale collection capacity to support autologous and emerging allogeneic pipelines. Investment in point-of-care devices and AI-guided donor scheduling improves throughput, easing the pressure created by skilled professional shortages. Cold-chain innovation safeguards cell viability during long-distance transport, lowering manufacturing failure rates and reinforcing demand for premium-quality leukopaks.

Global Leukapheresis Market Trends and Insights

Rising Incidence of Leukemia and Associated Hyperleukocytosis

Incidence curves for acute myeloid leukemia continue to climb, with global cases moving from 79,372 in 1990 to 144,645 in 2021 and trending toward 184,287 by 2040. Hyperleukocytosis, defined as white-blood-cell counts above 100,000/µl, demands urgent cytoreduction to prevent respiratory distress and neurologic complications. Leukapheresis has therefore transitioned from elective therapy to standard emergency intervention. Male patients register steeper growth in incidence than females, while adults aged 80-84 exhibit the highest case density. Health-system protocols now automatically route eligible leukemia admissions to apheresis units, ensuring same-day access and cementing procedure volumes across tertiary centers in the leukapheresis market.

Growing Need for High-Yield, Research-Grade Leukopaks

CAR-T and natural-killer-cell manufacturers increasingly specify leukopaks that deliver 10 billion or more mononuclear cells per collection. Manufacturing failure rates correlate directly with starting-material quality; a compromised leukopak can invalidate a USD 300,000 manufacturing run. Over 500 active clinical trials now depend on donor-derived immune cells, and the pivot toward allogeneic "off-the-shelf" therapies elevates recurring demand. Automated continuous-flow centrifugation secures tight leukocyte concentration windows and reduces red-cell contamination, streamlining downstream enrichment. Standardized donor-screening algorithms supported by AI scheduling software raise per-center capacity, enabling suppliers to meet escalating leukopaks requisitions without overtaxing staff.

High Costs Associated with Therapeutic Leukapheresis Procedures

Patient invoices for single-dose CAR-T therapies routinely exceed USD 500,000 and reach USD 1 million in complex pediatric cases, with leukapheresis comprising a meaningful early share. Stand-alone private collection centers operate 32% cheaper than hospital-based settings, yet most low- and middle-income regions lack such facilities. Equipment depreciation, single-use kits, and mandatory sterility audits inflate baseline costs. Although Medicare's 2025 rule broadened reimbursement definitions, coverage gaps linger in many public systems aabb.org. Until payors harmonize around bundled-payment models, high procedural outlay will temper demand in price-sensitive geographies.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Expansion of CAR-T and Other Cell & Gene-Therapy Manufacturing Facilities

- Widespread Uptake of Continuous-Flow Apheresis Systems

- Shortage of Skilled Apheresis Professionals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Leukapheresis devices are expanding at a 10.85% CAGR from 2025-2030 as centers upgrade to continuous-flow platforms with optical-detection sensors. The leukapheresis market size for devices equaled USD 111.9 million in 2025 and is positioned to outpace disposables growth through the forecast. Spectra Optia's algorithmic interface and the FDA-cleared Rika Plasma Donation System V2.1 exemplify device-level innovation. Product pipelines now include portable bedside units that target point-of-care leukoreduction in hematology wards and emergency departments.

Disposables retained 51.27% of leukapheresis market share in 2024 due to their single-use safety profile and recurring-revenue model. Elevated procedure volumes ensure consistent kit sales, reinforcing manufacturer cash flows and incentivizing investment in integrated tubing sets that cut priming times. Leukoreduction filters remain a mature niche, yet demand persists because many blood-bank protocols still enforce universal leukocyte reduction. Columns and cell separators support specialized pathogen-reduction workflows, though their penetration concentrates in academic centers. Overall, packaging disposables with capital-equipment leases locks in account loyalty, anchoring the segment's leadership within the leukapheresis market.

The Leukapheresis Market Report is Segmented by Product Type (Leukapheresis Devices [Apheresis Devices, and More], and Leukapheresis Disposables), Application (Therapeutic Applications and Research Applications), End User (Blood Centers & Donor Clinics, Hospitals & Transplant Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the leukapheresis market with a 45.84% share in 2024. U.S. leadership stems from FDA regulatory clarity and unmatched CAR-T approval volume, including the 2024 clearances of afamitresgene autoleucel and obecabtagene autoleucel. Medicare's 2025 reimbursement expansion for therapeutic apheresis further bolsters financial viability. Canada and Mexico contribute through cross-border clinical-trial networks and joint manufacturing initiatives that streamline donor logistics. Concentration of device makers such as Terumo BCT and Haemonetics within the region speeds tech adoption cycles, sustaining North America's prime position in the leukapheresis market.

Europe remains a mature yet dynamic arena. EMA guidelines deliver consistent evaluation pathways for CAR-T products, fostering steady demand for high-performance leukapheresis systems. The European Blood Alliance campaigns for two million additional voluntary donors, incentivizing centers to adopt continuous-flow platforms that maximize platelet yield and donor comfort. Germany, France, and the United Kingdom invest in integrated apheresis suites tied to national cancer plans, while Italy and Spain expand regional cell-therapy nodes. Supply-chain resilience, particularly in cold-chain trucking, dominates investment agendas and stabilizes procedure throughput.

Asia Pacific posts the fastest growth at an 11.57% CAGR to 2030. Japan's advanced geriatric care drives premium device uptake, whereas India benefits from government-backed cell-therapy clusters in Hyderabad and Bengaluru. Regulatory authorities in Australia and South Korea introduce accelerated review pathways mirroring FDA's RMAT designation, catalyzing early commercial rollouts. Overall, infrastructure modernization, coupled with local manufacturing incentives, transitions Asia from technology import destination to fully integrated supply-chain hub in the leukapheresis market.

- Terumo Blood & Cell Technologies

- Fresenius

- Haemonetics

- Asahi Kasei

- B. Braun

- MacoPharma

- Baxter

- Stem Cell Technologies

- BioIVT

- StemExpress

- HemaCare Corporation

- Grifols BioSupplies

- Charles River

- Lonza Group

- Medica S.p.A.

- Infomed

- Therakos (Mallinckrodt)

- Kawasumi Laboratories

- Cerus

- Teratec Japan

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Leukemia and Associated Hyperleukocytosis

- 4.2.2 Growing Need for High-Yield, Research-Grade Leukopaks

- 4.2.3 Rapid Expansion of Car-T And Other Cell & Gene Therapy Manufacturing Facilities

- 4.2.4 Widespread Uptake of Continuous-Flow Apheresis Systems

- 4.2.5 Shift Toward Point-of-Care Leukoreduction at the Bedside

- 4.2.6 AI-Driven Donor Management and Scheduling Tools

- 4.3 Market Restraints

- 4.3.1 High Costs Associated with Therapeutic Leukapheresis

- 4.3.2 Regulatory Complexity in Donor Recruitment and Cross-Border Biologics Movement

- 4.3.3 Shortage of Skilled Apheresis Professionals

- 4.3.4 Viability Loss of Harvested Cells During Long-Distance Cold-Chain Transport

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Leukapheresis Devices

- 5.1.1.1 Apheresis Devices

- 5.1.1.2 Leukapheresis Columns & Cell Separators

- 5.1.1.3 Leukoreduction Filters

- 5.1.2 Leukapheresis Disposables

- 5.1.1 Leukapheresis Devices

- 5.2 By Application

- 5.2.1 Therapeutic Applications

- 5.2.2 Research Applications

- 5.3 By End User

- 5.3.1 Blood Centers & Donor Clinics

- 5.3.2 Hospitals & Transplant Centers

- 5.3.3 Academic & Research Institutes

- 5.3.4 Cell- & Gene-Therapy Manufacturers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Terumo Blood & Cell Technologies

- 6.3.2 Fresenius SE & Co. KGaA

- 6.3.3 Haemonetics Corporation

- 6.3.4 Asahi Kasei Medical Co. Ltd

- 6.3.5 B. Braun Melsungen AG

- 6.3.6 Macopharma

- 6.3.7 Baxter International

- 6.3.8 STEMCELL Technologies

- 6.3.9 BioIVT

- 6.3.10 StemExpress

- 6.3.11 HemaCare Corporation

- 6.3.12 Grifols BioSupplies

- 6.3.13 Charles River Laboratories

- 6.3.14 Lonza Group

- 6.3.15 Medica S.p.A.

- 6.3.16 Infomed SA

- 6.3.17 Therakos (Mallinckrodt)

- 6.3.18 Kawasumi Laboratories

- 6.3.19 Cerus Corporation

- 6.3.20 Teratec Japan

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment