PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851897

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851897

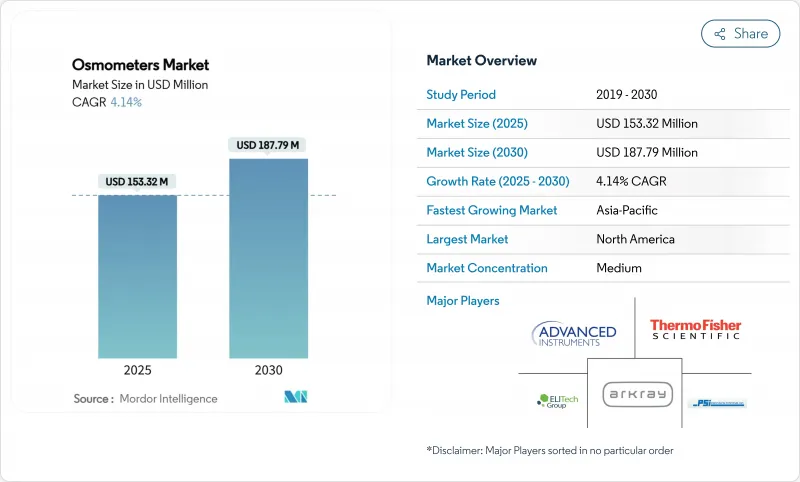

Osmometers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The osmometers market reached USD 153.32 million in 2025 and is forecast to climb to USD 187.79 million by 2030, reflecting a steady 4.14% CAGR that signals a mature but opportunity-rich landscape.

Demand is buoyed by laboratory automation, stricter compliance rules and biopharma's tilt toward high-concentration biologics, even as device approvals take longer under the European Union Medical Device Regulation (EU MDR). Strategic combinations-such as Advanced Instruments' pending USD 2.2 billion purchase of Nova Biomedical-underline an industry pivot toward integrated analytical platforms able to navigate complex global regulations. Meanwhile, the new EU rule that forces manufacturers to pre-alert regulators six months before supply interruptions is reshaping risk-management playbooks for every major supplier. In North America, continued clinical infrastructure investment supports stable replacement demand, while Asia-Pacific's modernization push drives above-trend unit growth and fuels competition from impedance-based, point-of-care (POC) newcomers.

Global Osmometers Market Trends and Insights

Technological Advancements & Automation

European laboratories are adopting fully automated osmometry workcells that link directly with analytical LC-MS, chemistry analyzers and laboratory information systems, shrinking manual steps and minimizing cross-contamination risks. A province-wide CoreLIMS roll-out in Northern Ireland has shown how seamless integration allows real-time osmolality data to flow into blood-bank and microbiology modules, improving traceability across 1,200 sample points per day. Vendors now position "connected" osmometers that generate HL7-formatted results in under 60 seconds, a capability that resonates with hospitals chasing zero-waste, high-throughput operations. The osmometers market is thus witnessing higher average selling prices tied to software, cyber-security updates and remote diagnostics bundles. Adoption is sharpest in North America's core reference labs, but EU-based networks are narrowing the gap through region-funded digital health programs.

Growing R&D Spend & Disease Burden

Global R&D outlays in advanced therapies push osmolality to the front line of process analytics, with recent trials showing adeno-associated virus titers jump 22% when producers orchestrate timed osmolality shifts mid-culture. Chronic kidney disease prevalence, now topping 9% of the EU adult population, heightens need for decentralized kidney-function screens that depend on rapid urine osmometry. Nova Biomedical's CE-marked creatinine/eGFR meter pairs osmolarity and kidney markers in a two-minute test, enabling rural physicians to triage patients without central lab support. High disease burden therefore amplifies the osmometers market's clinical installed base and shifts procurement criteria toward devices that blend speed, analytical depth and ergonomic design.

Intrinsic Accuracy/Throughput Limits

Freezing-point cycles surpass three minutes when protein loads exceed 150 mg/mL, throttling daily capacity inside mega-labs that already run 800 million tests annually. Vapor-pressure devices improve accuracy but require long equilibration; thus they seldom slot into STAT benches where 15-minute turnaround is non-negotiable. This trade-off steers some buyers to non-contact refractive sensors, eroding addressable share in rapid-response niches.

Other drivers and restraints analyzed in the detailed report include:

- Biopharma Shift To High-Concentration Biologics

- Portable Impedance-Based Devices For Home Renal Care

- Shortage Of Skilled Operators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Freezing point instruments retained 68.78% of 2024 osmometers market share, underpinned by decades of clinical trust and clear regulatory acceptance. Impedance systems, though only a fraction of today's osmometers market size, are growing at 7.73% CAGR thanks to portable designs that suit critical care, dialysis and veterinary applications. Vapor-pressure units occupy a narrow high-concentration biologics niche where their performance premium offsets slower cycle times. Manufacturers now bundle maintenance contracts, remote firmware pushes and auto-calibration features to keep compliance costs predictable.

Technology updates echo industry moves toward connectivity and service. Impedance devices achieve 95.5% accuracy with sub-20 µL samples-critical for newborn screening and animal health-and plug directly into Bluetooth-enabled patient apps, expanding the osmometers industry footprint in decentralized setting. Freezing-point leaders respond by embedding barcode scanners, reagent-lot traceability and AI-based quality control alerts that slash out-of-spec reruns. Vapor-pressure suppliers focus on stainless-steel wetted paths and 21 CFR Part 11 audit trails that attract gene-therapy CDMOs.

Single-sample analyzers held 60.36% of the osmometers market in 2024 as clinics and emergency rooms favored lower purchase prices and easy workflows. Yet multi-sample versions, climbing at 8.12% CAGR, now ship with robotic load drawers and LIS hubs that process up to 90 tubes per hour-features North American mega-labs deem essential for value-based reimbursement targets. The osmometers market size for high-throughput units should therefore outpace historical averages over the forecast as hospitals redesign core labs around modular automation.

European sites adopt 24-place racks with smartphone-style touchscreens, allowing one technologist to oversee parallel electrolyte, glucose and osmolality tests. In rural health centers, compact single-sample devices persist, but vendors refresh them with cloud logging, simplified QC and one-button maintenance. This balanced demand keeps both categories relevant yet sharply differentiated on throughput and connectivity.

The Osmometers Market Report is Segmented by Product Type (Freezing Point Osmometers, Vapor Pressure Osmometers, and More), Sampling Capacity (Single-Sample and Multi-Sample Osmometers), Application (Clinical, Pharmaceutical & Biotech, and More), End User (Hospitals, Diagnostic and Laboratory Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America kept 37.77% of global osmometers market share in 2024 as reimbursement stability and high test volumes underpinned steady upgrades. The region benefits from the deepest base of CLIA-certified labs and a dense biopharma corridor that values process analytical technology. Asia-Pacific, compounding at 7.98% CAGR, benefits from national health insurance expansions, aggressive biologics capacity build-outs and rising adoption of bedside testing in China, India and South Korea. Europe, while hampered by regulatory bottlenecks, leverages automation uptake and strong vaccine pipelines to maintain competitive parity. Middle East and Africa remain nascent but secure double-digit unit growth where hospital build programs pair with local device assembly incentives.

Government subsidies in Singapore, Korea and China tilt capex toward high-throughput, 21 CFR Part 11-ready osmometers that future-proof regulatory filings. EU MDR's protracted certification cycles delay some product launches, but also create white-space for nimble suppliers with pre-notified-body strategies. Across all regions, demand gravitates toward platforms that compress workflow, integrate data streams and reduce total cost of ownership.

- Advanced Instrumentations

- Precision Systems

- ELITech Group

- Arkray

- ASTORI TECNICA

- KNAUER Wissenschaftliche Gerate GmbH

- Loser Messtechnik

- SanoTec GmbH

- TearLab Corporation

- Mechatronics Instruments BV

- Gonotec GmbH

- Shanghai Medical Instruments Co.

- Labnics Equipment

- Thermo Fisher Scientific

- Beijing Hiyi Technology Co., Ltd.

- Merck

- Bio-Techne

- Anton Paar

- Precision Systems Science Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Advancements & Automation

- 4.2.2 Growing R&D Spend & Disease Burden

- 4.2.3 Biopharma Shift To High-Concentration Biologics

- 4.2.4 Portable Impedance-Based Devices For Home Renal Care

- 4.2.5 Regulatory Push For In-Process Osmolality Testing

- 4.2.6 LIS-Integrated QA In Food & Beverage Plants

- 4.3 Market Restraints

- 4.3.1 Intrinsic Accuracy/Throughput Limits

- 4.3.2 Shortage Of Skilled Operators

- 4.3.3 Cryoscopic Sensor Supply-Chain Risks

- 4.3.4 Emerging Non-Contact T-Measurement Alternatives

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product Type

- 5.1.1 Freezing Point Osmometers

- 5.1.2 Vapor Pressure Osmometers

- 5.1.3 Membrane Osmometers

- 5.1.4 Impedance-Based (Others)

- 5.2 By Sampling Capacity

- 5.2.1 Single-sample Osmometers

- 5.2.2 Multi-sample Osmometers

- 5.3 By Application

- 5.3.1 Clinical

- 5.3.2 Pharmaceutical & Biotech

- 5.3.3 Industrial & Food QC

- 5.3.4 Research & Academic

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic & Laboratory Centers

- 5.4.3 Biopharma Manufacturers

- 5.4.4 Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Advanced Instruments LLC

- 6.3.2 Precision Systems Inc.

- 6.3.3 ELITech Group

- 6.3.4 ARKRAY Inc.

- 6.3.5 ASTORI TECNICA

- 6.3.6 KNAUER Wissenschaftliche Gerate GmbH

- 6.3.7 Loser Messtechnik

- 6.3.8 SanoTec GmbH

- 6.3.9 TearLab Corporation

- 6.3.10 Mechatronics Instruments BV

- 6.3.11 Gonotec GmbH

- 6.3.12 Shanghai Medical Instruments Co.

- 6.3.13 Labnics Equipment

- 6.3.14 Thermo Fisher Scientific

- 6.3.15 Beijing Hiyi Technology Co., Ltd.

- 6.3.16 Merck KGaA

- 6.3.17 Bio-Techne Corporation

- 6.3.18 Anton Paar GmbH

- 6.3.19 Precision Systems Science Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment