PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851898

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851898

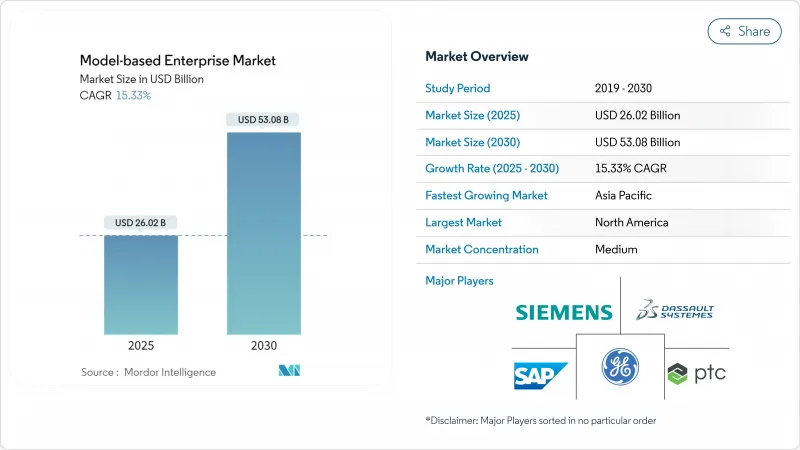

Model-based Enterprise - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The model-based enterprise market is valued at USD 26.02 billion in 2025 and is forecast to reach USD 53.08 billion by 2030, reflecting a CAGR of 15.33%.

This momentum is anchored in the shift from document-centric workflows to coherent digital threads that connect design, engineering, manufacturing, and service functions. The United States Department of Defense requirement that digital models act as the single authoritative data source is spurring swift uptake among aerospace and defense contractors. Automotive manufacturers are adopting similar practices to compress electric-vehicle development timelines, while cloud-native product-lifecycle-management suites are lowering barriers for small and medium manufacturers in Asia-Pacific. Vendors are investing in AI-driven simulation, additive-manufacturing quality loops, and integrated digital twins to deliver faster ROI, yet many users still grapple with workforce reskilling costs and data-interoperability gaps.

Global Model-based Enterprise Market Trends and Insights

DoD Digital Engineering Mandates Accelerating Adoption in North America

Defense contractors must now treat 3D models as the single source of truth for design, analysis, sourcing, and sustainment decisions. Close to 300,000 suppliers have started updating processes, software stacks, and cybersecurity safeguards to stay eligible for future contracts. Uptake is spilling over to commercial aerospace as shared subcontractors align with mandate-compliant workflows. Tool vendors are responding with packaged compliance templates and automated model-based definition (MBD) checkers that cut documentation time and enhance traceability.

Automotive OEM Shift to Full-3D Digital Thread for EV Platforms

Battery-electric programs rely on concurrent design of mechanical, electrical, and thermal systems. Deploying a unified 3D digital thread has allowed leading automakers to shrink platform cycles from 72 months to 36 months while improving traceability. The integration of digital twins with model-based systems engineering lets teams simulate energy flow, crash behavior, and battery degradation early, curbing late redesigns and warranty risk. These gains drive widespread rollouts across Europe, North America, and China.

Data-Interoperability Challenges Hinder Seamless Integration

Roughly 65% of engineering projects still encounter delays when transforming historical CAD files into feature-rich, MBD-ready models. Geometry translation alone is not enough; teams must also preserve features, constraints, and linked drawings built over decades. Specialized conversion tools are improving, yet enterprise-wide migrations remain resource intensive and carry risk of data loss that can stall digital-thread initiatives.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Cloud-Native PLM Suites Enabling SMB Access in Asia-Pacific

- ROI From Aerospace MRO Turn-Around-Time Reduction

- Workforce Reskilling Creates Implementation Hurdle

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Solutions segment generated 71% of 2024 revenue, underscoring its role as the backbone of most deployments. Service engagements, however, are registering a 17.8% CAGR as enterprises confront the complexity of rolling out model-based practices at scale. Service providers are embedding AI to automate data migration and validation, shortening time-to-value and boosting confidence in model accuracy. Training and certification packages focused on digital-thread skills are rising in demand, highlighting the persistent talent gap. The influx of specialized service firms is broadening options for mid-market manufacturers seeking guidance without the expense of large consulting teams.

Rising subscription models are shifting revenue from perpetual software toward continuous service relationships tied to performance metrics and outcome-based contracts. Predictive analytics applied within maintenance and support agreements can flag integration glitches before they disrupt production. These capabilities reinforce client reliance on trusted partners, sustaining the upward trajectory of the Services share within the model-based enterprise market.

Product-lifecycle-management platforms remain the foundation of most implementations, but the Digital-Twin & Simulation segment is gaining prominence as organizations seek closed-loop feedback between design and operation. Real-time sensor data feeding high-fidelity models creates self-updating digital twins that guide maintenance, optimize performance, and extend asset life. The convergence of simulation and systems engineering reduces rework by validating requirements early, a benefit that is especially acute in regulated domains such as aerospace and medical devices.

Visualization and collaboration tools are adding AR/VR overlays to facilitate immersive design reviews. Engineers, suppliers, and even field technicians can inspect the same model in real time, shrinking the decision window. CAD/CAM/CAE suites now embed product-manufacturing information directly in 3D geometry. This allows downstream software, including inspection planning and shop-floor metrology platforms, to consume a single data set, trimming translation steps and minimizing revision errors.

The Model-Based Enterprise Market Report is Segmented by Offering (Solutions, and Services), Solution Type (PLM Software, CAD/CAM/CAE, and More), Service Type (Integration and Implementation, Consulting and Training, and More), Deployment Mode (On-Premise, and Cloud), End User Industry (Aerospace and Defense, Construction and Infrastructure, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38% of 2024 revenue, supported by defense spending, a mature aerospace supply chain, and automakers seeking to accelerate electric-vehicle launches. Federal policies that enforce digital models as the official technical baseline are nudging even conservative contractors to modernize. Canada and Mexico participate through integrated supply chains that must also prove compliance, driving widespread adoption across the continent.

Asia-Pacific is the fastest-growing region with an 18.7% CAGR over 2025-2030. Cloud-hosted PLM lowers entry barriers for Japan's precision manufacturers, South Korea's electronics champions, and India's engineering-services providers. China's investment in digital factories fuels demand for digital-thread solutions that can scale across vast production networks. Local governments promote smart-manufacturing grants, accelerating SMB participation.

Europe maintains robust adoption driven by Germany's Industrie 4.0 initiatives and France's advanced aerospace programs. A United Kingdom digital-twin center in Belfast demonstrates national commitment to remain competitive in next-generation aircraft development. Sustainability regulations further encourage model-centric design to track carbon footprints and optimize resource use. Regional standards bodies collaborate on interoperability frameworks, smoothing cross-border collaboration.

- Siemens AG

- Dassault Systemes SE

- PTC Inc.

- SAP SE

- Ansys, Inc.

- Autodesk Inc.

- IBM Corporation

- Oracle Corporation

- HCL Technologies Limited

- Aras Corporation

- Anark Corporation

- Hexagon AB

- Altair Engineering Inc.

- Ansys Inc.

- Rockwell Automation Inc.

- IFS AB

- Bentley Systems Inc.

- Capgemini SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 DoD Digital Engineering Mandates Accelerating Adoption in North America

- 4.2.2 Automotive OEM Shift to Full-3D Digital Thread for EV Platforms

- 4.2.3 Surge in Cloud-Native PLM Suites Enabling SMB Access in Asia-Pacific

- 4.2.4 ROI From Aerospace MRO Turn-Around Time Reduction

- 4.2.5 Integrating Model-Based Definition with Additive-Manufacturing Quality Workflows

- 4.3 Market Restraints

- 4.3.1 Data-Interoperability Gaps Between Legacy CAD and Next-Gen MBD Standards

- 4.3.2 High Up-Front Workforce Reskilling Costs

- 4.3.3 Cyber-security Concerns Over IP in Cloud Deployments

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Macroeconomic Impact Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Offering

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Solution Type

- 5.2.1 PLM Software

- 5.2.2 CAD/CAM/CAE

- 5.2.3 Digital-Twin and Simulation

- 5.2.4 Visualization and Collaboration

- 5.3 By Service Type

- 5.3.1 Integration and Implementation

- 5.3.2 Consulting and Training

- 5.3.3 Support and Maintenance

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

- 5.4.2.1 Public Cloud

- 5.4.2.2 Private Cloud

- 5.4.2.3 Hybrid Cloud

- 5.5 By End User Industry

- 5.5.1 Aerospace and Defense

- 5.5.2 Automotive

- 5.5.3 Construction and Infrastructure

- 5.5.4 Power and Energy

- 5.5.5 Retail and CPG

- 5.5.6 Electronics and Hi-Tech

- 5.5.7 Marine and Offshore

- 5.5.8 Other Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Peru

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Siemens AG

- 6.3.2 Dassault Systemes SE

- 6.3.3 PTC Inc.

- 6.3.4 SAP SE

- 6.3.5 Ansys, Inc.

- 6.3.6 Autodesk Inc.

- 6.3.7 IBM Corporation

- 6.3.8 Oracle Corporation

- 6.3.9 HCL Technologies Limited

- 6.3.10 Aras Corporation

- 6.3.11 Anark Corporation

- 6.3.12 Hexagon AB

- 6.3.13 Altair Engineering Inc.

- 6.3.14 Ansys Inc.

- 6.3.15 Rockwell Automation Inc.

- 6.3.16 IFS AB

- 6.3.17 Bentley Systems Inc.

- 6.3.18 Capgemini SE

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment