PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851906

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851906

Polyphenol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

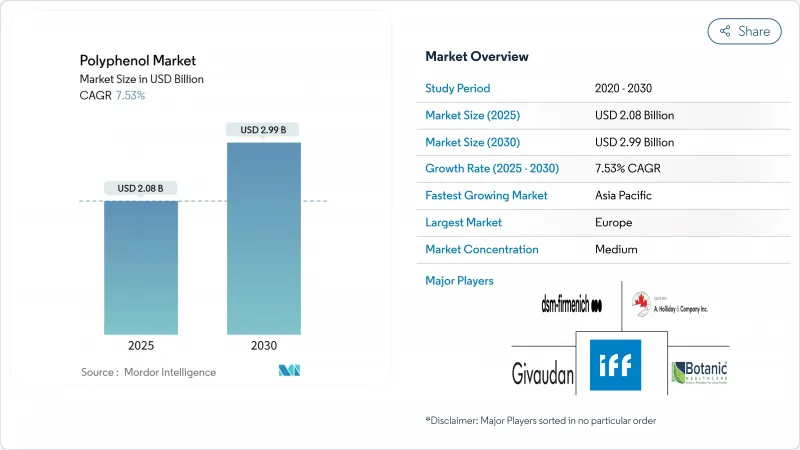

The polyphenol market size reached USD 2.08 billion in 2025 and is forecast to attain USD 2.99 billion by 2030, advancing at a 7.53% CAGR during the period.

This growth trajectory reflects the market's maturation beyond traditional antioxidant applications, driven by breakthrough encapsulation technologies that address the fundamental bioavailability challenge that has historically limited polyphenol efficacy in consumer products. These advancements tackle the bioavailability challenges that have long hindered the effectiveness of polyphenols in consumer products. The FDA's 2028 rollout of updated "healthy" food labeling criteria, as highlighted by the U.S. Department of Health and Human Services , is set to open new avenues for polyphenol-enhanced products. This regulatory shift, coupled with a surge in demand for functional beverages and nutricosmetics, underscores the market's evolution. Furthermore, firms are not just racing to innovate; they're also investing in sustainable extraction methods from waste streams, bolstering supply resilience and mitigating input risks. Early adopters are setting themselves apart with proprietary nano-delivery systems, ensuring traceability through vertical integration, and swiftly adapting to the tightening "healthy" labeling regulations across the U.S., Canada, and the EU. The Asia-Pacific region, buoyed by a burgeoning middle class and governmental pushes for self-sufficiency in nutraceuticals, promises a significant long-term growth trajectory for the polyphenol market.

Global Polyphenol Market Trends and Insights

Rising popularity of natural antioxidants in dietary supplements

The dietary supplement industry's pivot toward natural antioxidants is reshaping polyphenol demand patterns, with manufacturers increasingly positioning these compounds as scientifically-validated alternatives to synthetic antioxidants. Recent research demonstrates that polyphenol-rich extracts exhibit dose-dependent efficacy, with optimal consumption levels varying significantly based on individual metabolic profiles. This personalized nutrition approach is driving premium product development, as companies recognize that standardized dosing fails to maximize therapeutic potential. Regulatory clarity is accelerating adoption, with the FDA's 75-day premarket notification system providing clearer pathways for polyphenol-based dietary ingredients . The shift toward evidence-based marketing is compelling manufacturers to invest in clinical trials, creating a competitive advantage for companies with robust research capabilities. Additionally, the rising consumer awareness of the health benefits associated with polyphenols is further fueling market growth. The increasing prevalence of chronic diseases, such as cardiovascular disorders and diabetes, is also driving demand for polyphenol-enriched products.

Growing awareness of anti-inflammatory and cardiovascular benefits

Cardiovascular health applications are emerging as a primary growth driver, with polyphenols demonstrating measurable impacts on heart failure and cardiac hypertrophy through multiple molecular pathways. Clinical evidence shows polyphenols regulate heart failure-related molecules, prevent mitochondrial dysfunction, and improve lipid profiles, positioning them as viable alternatives to pharmaceutical interventions. The Mediterranean diet's association with longevity has elevated olive polyphenols specifically, with hydroxytyrosol and oleuropein showing promise in mitigating neurological complications associated with COVID-19. Nano-drug delivery methods are addressing bioavailability limitations that have historically constrained therapeutic applications, enabling more precise dosing and enhanced treatment outcomes. The aging global population is driving demand for preventive healthcare solutions, with polyphenols positioned as accessible interventions for age-related cardiovascular decline. Regulatory bodies are increasingly recognizing cardiovascular health claims, with the FDA's Significant Scientific Agreement standard providing pathways for validated health claims

Low bioavailability of polyphenols in native form

The bioavailability challenge represents the most significant technical barrier to polyphenol market expansion, with native forms demonstrating limited absorption and rapid degradation that constrains therapeutic efficacy. Research indicates that polyphenol bioavailability varies significantly due to chemical structure and individual metabolism, with daily intake estimated at approximately 1 gram but actual absorption rates remaining disappointingly low. This limitation has historically prevented polyphenols from achieving pharmaceutical-grade applications, relegating them to nutraceutical and functional food categories with less stringent efficacy requirements. Advanced delivery systems, including nanoencapsulation and targeted formulations, are emerging as solutions, but these technologies add significant cost and complexity to product development. The challenge is particularly acute in liquid formulations, where polyphenol stability is compromised by environmental factors including pH, temperature, and light exposure. Regulatory bodies are increasingly demanding bioavailability data to support health claims, creating additional compliance burdens for manufacturers seeking to market polyphenol-based products with therapeutic positioning.

Other drivers and restraints analyzed in the detailed report include:

- High demand for plant-based ingredients in cosmetic formulations

- Shifting consumer preferences toward organic and clean labels

- High cost of extraction and purification processes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powder formulations maintain market leadership with 45.35% share in 2024, driven by superior stability profiles and cost-effective manufacturing processes that enable broad commercial adoption across dietary supplements and functional food applications. The established supply chain infrastructure for powder handling provides logistical advantages, while extended shelf life reduces inventory risks for manufacturers and retailers. However, liquid formulations are experiencing the fastest growth at 8.32% CAGR through 2030, reflecting breakthrough innovations in stabilization technologies and consumer preference for convenient, ready-to-consume formats.

Liquid polyphenol products are gaining traction in the functional beverages, where manufacturers are leveraging advanced encapsulation techniques to overcome traditional stability challenges. The "Others" category, encompassing innovative delivery formats like gummies and fortified foods, represents emerging opportunities as manufacturers explore novel applications to differentiate their offerings. Microencapsulation technology is enabling powder formulations to achieve enhanced bioavailability while maintaining cost advantages, with spray drying and emulsion-based methods becoming industry standards. The convergence of form and function is creating hybrid products that combine the stability of powders with the convenience of liquids, positioning the market for continued innovation in delivery mechanisms.

The Polyphenol Market Report is Segmented by Form (Liquid, Powder, and Others), by Source (Fruits, Vegetables, Cocoa, and Others), Application (Functional Foods, Dietary Supplements, Beverages, Animal Feed, Cosmetics and Personal Care, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe holds 34.54% of the market share, supported by stringent regulatory standards that favor natural ingredients and comprehensive sustainability initiatives that align with polyphenol production from agricultural waste streams. The European Commission'sinvestment in seaweed polyphenol research illustrates regional commitment to innovative applications, with projects demonstrating commercial viability in both dietary supplements and personal care products. Germany's leadership in plant-based innovation and the UK's post-Brexit regulatory flexibility are creating competitive advantages for polyphenol producers.

Asia-Pacific emerges as the fastest-growing region through 2030 with a CAGR of 8.44%, with China and India driving demand through expanding middle classes and increasing health consciousness. The Indian nutraceutical market reached USD 6.1 billion in 2023 with 11.4% projected growth, creating substantial opportunities for polyphenol-based dietary supplements, according to Protein Foods and Nutrition Development Association of India. Japan's aging population and advanced regulatory framework for functional foods position the country as a premium market for innovative polyphenol applications.

North America maintains regional market leadership in 2024, driven by established dietary supplement infrastructure and consumer willingness to pay premiums for scientifically-validated health ingredients. The region benefits from clear regulatory frameworks that support health claims, with the FDA's updated "healthy" food labeling criteria creating new opportunities for polyphenol-fortified products. Canada's significant government investment in plant-based research and the U.S. biomass supply chain initiative are creating favorable conditions for polyphenol market expansion.

- Botanic Healthcare

- Givaudan SA

- International Flavors and Fragrances (IFF)

- A. Holliday and Company Inc.

- DSM-Firmenich AG

- MB-Holding GmbH and Co KG

- Indena SpA

- YARROW CHEM PRODUCTS

- Fengchen Group Co.,Ltd

- Lyan Natural Ingredients

- Sami-Sabinsa Group

- Kemin Industries, Inc.

- TOKIWA PHYTOCHEMICAL CO.,LTD.

- Zibo Anquan Chemical Co., Ltd.

- Taiyo International

- Vidya Pvt. Ltd.

- Botaniex, Inc.

- Biolink Group (Polyphenols AS)

- Groupe GRAP'SUD (Grapsud)

- ProviNord Group (Alsiano)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising popularity of natural antioxidants in dietary supplements

- 4.2.2 Growing awareness of anti-inflammatory and cardiovascular benefits

- 4.2.3 High demand for plant-based ingredients in cosmetic formulations

- 4.2.4 Shifting consumer preferences toward organic and clean labels

- 4.2.5 Innovation in polyphenol

- 4.2.6 Polyphenols as natural food preservatives

- 4.3 Market Restraints

- 4.3.1 Low bioavailability

- 4.3.2 High cost of extraction and purification processes

- 4.3.3 Limited shelf stability in end-product application

- 4.3.4 Bitterness and astringency affecting broader consumer appeal

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Liquid

- 5.1.2 Powder

- 5.1.3 Others

- 5.2 By Source

- 5.2.1 Fruits

- 5.2.2 Vegetables

- 5.2.3 Cocoa

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Functional Foods

- 5.3.2 Beverages

- 5.3.3 Dietary Supplements

- 5.3.4 Animal Feed

- 5.3.5 Cosmetics and Personal Care

- 5.3.6 Others

- 5.4 By Geography

- 5.4.1 United States

- 5.4.1.1 Canada

- 5.4.1.2 Mexico

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 United States

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Botanic Healthcare

- 6.4.2 Givaudan SA

- 6.4.3 International Flavors and Fragrances (IFF)

- 6.4.4 A. Holliday and Company Inc.

- 6.4.5 DSM-Firmenich AG

- 6.4.6 MB-Holding GmbH and Co KG

- 6.4.7 Indena SpA

- 6.4.8 YARROW CHEM PRODUCTS

- 6.4.9 Fengchen Group Co.,Ltd

- 6.4.10 Lyan Natural Ingredients

- 6.4.11 Sami-Sabinsa Group

- 6.4.12 Kemin Industries, Inc.

- 6.4.13 TOKIWA PHYTOCHEMICAL CO.,LTD.

- 6.4.14 Zibo Anquan Chemical Co., Ltd.

- 6.4.15 Taiyo International

- 6.4.16 Vidya Pvt. Ltd.

- 6.4.17 Botaniex, Inc.

- 6.4.18 Biolink Group (Polyphenols AS)

- 6.4.19 Groupe GRAP'SUD (Grapsud)

- 6.4.20 ProviNord Group (Alsiano)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK