PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851907

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851907

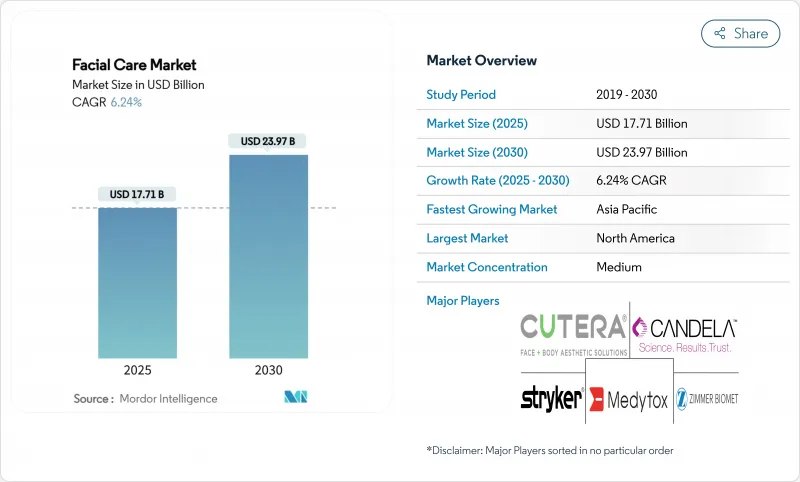

Facial Care - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Facial Care Market size is estimated at USD 17.71 billion in 2025, and is expected to reach USD 23.97 billion by 2030, at a CAGR of 6.24% during the forecast period (2025-2030).

Rising demand for preventive aesthetics, the popularity of "lunchtime" procedures, and AI-powered skin-diagnostic tools underpin this trajectory, especially in large urban centers. Social media accelerates product discovery and peer-to-peer referrals, encouraging younger consumers to start early with minimally invasive treatments. Consolidation among device makers and injectable suppliers is producing broad technology portfolios that let clinics tailor therapies to varied skin concerns. At the same time, male participation, subscription service models, and advances in regenerative injectables enlarge the addressable base, cushioning revenue streams against seasonality.

Global Facial Care Market Trends and Insights

Social-Media-Fuelled "Preventive Botox" Boom

Preventive neurotoxin use has surged, with 75% of facial plastic surgeons seeing more patients under 30 who aim to prevent static wrinkles rather than correct them. Viral "before-and-after" reels on TikTok convert interest into clinic visits, locking in multi-year treatment plans that stabilize practitioner revenues. The Zoom videoconference era amplified self-scrutiny and kept demand elevated even after offices reopened. Clinics now market conservative dosing protocols that preserve natural expression, a strategy that improves patient satisfaction and loyalty. These factors together strengthen the facial care market by embedding regular treatments into everyday grooming habits.

AI-Powered Hyper-Personalised Skin Diagnostics Drives Device Revenues

Machine-learning skin analyzers from Perfect Corp, SkinGPT, and others perform 3-D mapping and predict collagen density, allowing clinicians to match devices and injectables more accurately to individual needs. Improved diagnostic confidence reduces retreatment rates and boosts word-of-mouth referrals, directly raising per-patient revenue. The technology resonates in Asia-Pacific, where mobile-first consumers embrace virtual consultations. Manufacturers benefit because each diagnostic license or hardware bundle represents a recurring revenue stream beyond procedure fees. The capability also broadens the facial care industry's reach to skin of color, historically underserved by legacy imaging systems.

Tightening FDA Scrutiny of Dermal-Filler Indications

The February 2025 advisory panel flagged off-label injection sites and removal protocols, signaling tougher submissions and higher post-market data demands. New fillers now require longer pivotal trials, delaying revenue inflows for manufacturers. Clinics face added consent requirements that lengthen consultation times. Although the measures improve patient safety, they may slow product refresh cycles, tempering short-term facial care market growth.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Minimally Invasive, Lunchtime Procedures In Urban Clinics

- Exosome-Based Regenerative Injectables Reach Commercial Scale

- Consumer Pivot to "Clean / Natural" May Cannibalise Injectable Spend

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dermal fillers contributed 40.86% to 2024 revenue, illustrating the continued pull of hyaluronic-acid injectables that deliver immediate volumization with minimal downtime. The Evolysse Cold-X approval extended durability claims to 24 months, reducing annual syringe counts per patient and encouraging premium pricing. Botulinum toxin lines remain resilient due to consistent demand for glabellar and crow's-feet smoothing, bolstered by Letybo's FDA clearance in 2024. Radio-frequency microneedling systems now ship with interchangeable needle depths and impedance monitoring, widening treatable indications and enticing filler-averse clients.

Laser and other energy devices command the fastest 6.16% CAGR to 2030, reflecting patient appetite for non-injectable texture refinement. The MIRIA 1550 nm laser targets mid-dermal collagen while sparing the epidermis, reducing PIH risk for deeper skin tones. AI-guided settings shorten learning curves, allowing rapid deployment across multisite chains. Emerging categories such as exosome-infused biostimulators and diagnostic scanners form the "Others" bucket, which captures incremental wallet share as clinics upsell adjunct modalities. These cross-currents keep the facial care market dynamic and innovation-oriented.

The Facial Care Market Report is Segmented by Product Type (Dermal Fillers, Botulinum Toxin, Laser & Energy-Based Devices, Radio-Frequency Microneedling Systems, Others), Application (Facial Line Correction, Lip Augmentation, Skin Tightening/Lifting, Acne & Scar Treatment, Hyper-pigmentation/Tone Correction, Others), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 36.16% of the facial care market in 2024, supported by high household spending power and a dense network of board-certified dermatologists. Subscription plans that bundle quarterly toxin visits with annual fractional laser resurfacing underpin repeat revenues. Yet FDA vigilance and a vocal "clean beauty" community create selective headwinds that providers counter by adding exosome-based options.

Asia-Pacific posts the strongest 8.39% CAGR, bolstered by e-commerce beauty education, mobile payments, and K-beauty influence. China's tier-2 cities expand clinic counts to capture middle-income spend, while Japan and South Korea anchor technology R&D. AI diagnostic tools localize pigmentation analytics, reassuring consumers with Fitzpatrick skin types IV-VI. This adoption surge positions the region to command a growing slice of global facial care market size by 2030.

Europe exhibits steady replacement demand, benefitting from an aging population and a preference for evidence-based treatments. Strict MDR regulations lengthen device approvals but simultaneously elevate safety perceptions. South America and the Middle East record double-digit procedure volume growth from rising disposable incomes and cultural affinity for beauty services. Training partnerships with European laser academies are narrowing talent gaps, enabling faster technology transfer. Together, these regional patterns maintain robust top-line growth in the facial care industry despite localized challenges.

- AbbVie-Allergan

- Galderma

- Merz Pharma

- Johnson & Johnson (Mentor/Cerenovus)

- Cutera

- Candela Medical

- Cynosure

- InMode

- Stryker (Powered Aesthetics)

- Zimmer Biomet

- Revance Therapeutics

- Allergan Aesthetics (CoolSculpting(R))

- Sinclair Pharma

- GANA R&D

- BIOPLUS

- Cytophil

- BIOXIS Pharmaceuticals

- Lumenis

- Alma Lasers

- Suneva Medical

- Medytox

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Social-Media-Fuelled "Preventive Botox" Boom

- 4.2.2 AI-Powered Hyper-Personalised Skin Diagnostics Drives Device Revenues

- 4.2.3 Shift Toward Minimally-Invasive, Lunchtime Procedures In Urban Clinics

- 4.2.4 Exosome-Based Regenerative Injectables Reach Commercial Scale

- 4.2.5 Male Aesthetic-Wellness Uptake Expands Core Customer Base

- 4.2.6 Subscription-Based Treatment Plans Lock-In Lifetime Value

- 4.3 Market Restraints

- 4.3.1 Tightening FDA Scrutiny of Dermal-Filler Indications

- 4.3.2 Rising Adverse-Event Visibility on Social Platforms

- 4.3.3 Talent Shortage of Certified Injector-Physicians Outside Tier-1 Cities

- 4.3.4 Consumer Pivot to "Clean / Natural" May Cannibalise Injectable Spend

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Dermal Fillers

- 5.1.2 Botulinum Toxin (Neuromodulators)

- 5.1.3 Laser & Energy-based Devices

- 5.1.4 Radio-frequency Microneedling Systems

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Facial Line Correction

- 5.2.2 Lip Augmentation

- 5.2.3 Skin Tightening / Lifting

- 5.2.4 Acne & Scar Treatment

- 5.2.5 Hyper-pigmentation / Tone Correction

- 5.2.6 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AbbVie-Allergan

- 6.3.2 Galderma

- 6.3.3 Merz Pharma

- 6.3.4 Johnson & Johnson (Mentor/Cerenovus)

- 6.3.5 Cutera

- 6.3.6 Candela Medical

- 6.3.7 Cynosure

- 6.3.8 InMode

- 6.3.9 Stryker (Powered Aesthetics)

- 6.3.10 Zimmer Biomet

- 6.3.11 Revance Therapeutics

- 6.3.12 Allergan Aesthetics (CoolSculpting(R))

- 6.3.13 Sinclair Pharma

- 6.3.14 GANA R&D

- 6.3.15 BIOPLUS

- 6.3.16 Cytophil

- 6.3.17 BIOXIS Pharmaceuticals

- 6.3.18 Lumenis

- 6.3.19 Alma Lasers

- 6.3.20 Suneva Medical

- 6.3.21 Medytox

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment