PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851912

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851912

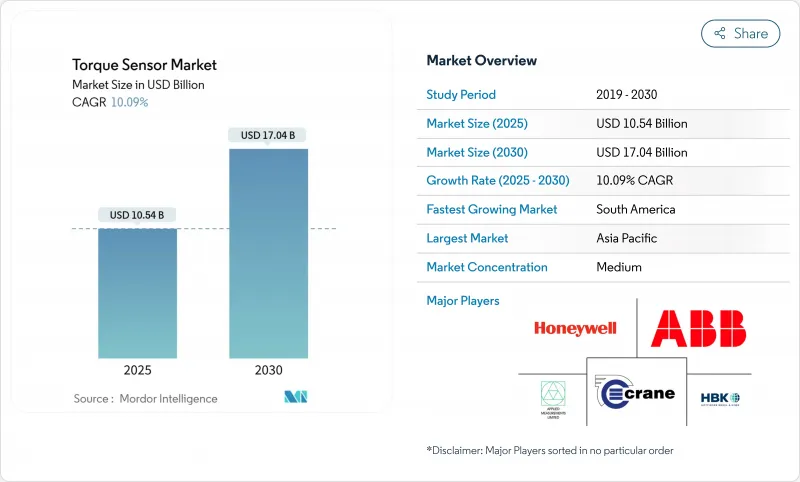

Torque Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global torque sensor market size stood at USD 10.54 billion in 2025 and is forecast to reach USD 17.04 billion by 2030, advancing at a 10.09% CAGR.

Momentum has been underpinned by the rapid electrification of vehicle powertrains, deepening industrial automation, and stricter precision-measurement requirements in infrastructure, energy and medical equipment. Automotive electrification continued to anchor demand as torque feedback became integral to electric power-steering, drivetrain control and advanced driver-assistance functions. Parallel growth in collaborative robots increased the sensor content per machine, while e-bike and other micromobility platforms multiplied high-volume, low-cost opportunities. Vendors shifted differentiation away from raw accuracy toward electromagnetic-interference resilience, wireless telemetry, and integration with predictive-analytics platforms. Supply chain exposure to high-grade magnetoelastic alloys remained a limiting factor, although regional sourcing initiatives in India and South America sought to ease dependence on Chinese rare-earth metals.

Global Torque Sensor Market Trends and Insights

Electrification of Power-Steering (EPS) Systems

Mandated torque monitoring for electric power-steering hardened demand even during economic slow-downs. European regulations issued in 2024 required continuous steering-torque feedback for autonomous-readiness, obligating every EPS unit to embed at least one sensor. OEMs adopted dual-redundant designs to satisfy functional-safety targets, effectively doubling sensor volumes per vehicle. Suppliers such as Vitesco cited EPS torque sensing as a core enabler for semi-autonomous lane-keeping and driver-intention prediction. The same data channel is reused in over-the-air analytics, increasing lifetime service revenue for integrators. As legacy hydraulic steering platforms sunset, the addressable automotive base shifted irreversibly toward EPS architectures.

Rising Automation and Cobots in Manufacturing

Collaborative robots required instantaneous torque detection to comply with ISO 10218 safety limits, creating a one-to-one relationship between cobot shipments and sensor units. Global cobot sales outpaced conventional industrial robots in 2024, inducing a steep ramp in EMI-resistant, multi-axis torque sensors destined for electronics, food and light-assembly lines. Certification guidelines enforced redundant sensing, effectively raising bill-of-materials value for each robot. Penetration remained only 26% among Polish SMEs in 2024, illustrating vast latent upside across European manufacturing. Long-term impact spans beyond discrete automation as smart work-cells propagate into textile and agri-processing plants.

Price Sensitivity in Volume Automotive Programs

OEM cost-down targets capped sensor pricing near USD 50 per unit in mainstream EV platforms, pressuring suppliers to strip auxiliary features. The need to offset battery-pack costs heightened scrutiny of every drivetrain component, with platform standardization further commoditizing specifications. Rare-earth magnet supply disruptions in 2024 exacerbated the dilemma, forcing Indian and South American automakers to weigh substitute materials that risked lower precision. Suppliers countered with modular electronics, allowing optional conditioning boards for premium trims while preserving a low-cost core for entry variants.

Other drivers and restraints analyzed in the detailed report include:

- Surge in E-Bike and Micromobility Production

- Growing Use in Axial-Flux Motors for EV Drivetrains

- Reliability Issues under Electromagnetic Interference

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rotational units captured 65.5% of torque sensor market share in 2024 on the strength of drivetrain, wind-turbine and process-control deployments. They offered continuous, in-situ measurement that supported closed-loop control in EVs and turbines. Reaction types, while smaller in base, posted an 11.8% CAGR as automated test-stands proliferated across machining and battery-cell wrap processes. Digital telemetry elevated rotational designs by removing slip rings, boosting reliability in harsh industrial settings.

Rotational sensors evolved into edge-computing nodes, streaming data to cloud dashboards for predictive maintenance. In-process machining adopted reaction units to catch torque spikes indicative of tool wear, advancing zero-defect programs in aerospace structural milling. The torque sensor market benefits as OEMs retrofit older assembly lines to meet traceability mandates, ensuring both sensor categories sustain parallel growth.

Strain-gauges retained 48.3% revenue in 2024, favored for cost and proven ruggedness. Yet, SAW sensors recorded a 13.2% CAGR and gained share where EMI immunity and wireless data mattered most. Magnetoelastic variants served sealed, non-contact duties in pump shafts, whereas optical fibers targeted lab and aerospace calibration where nano-radian resolution justified premium pricing.

SAW innovations in 2024 achieved temperature tolerance to 1,000 °C and 10 µm displacement resolution. Such capabilities unlocked extreme-environment markets like gas turbines and deep-well drilling. The torque sensor market thus witnessed technology bifurcation: low-cost strain-gauges for commoditized automotive steering, and high-value SAW or optical units for hazardous or mission-critical niches.

The Global Torque Sensor Market Report is Segmented by Product Type (Reaction Torque Sensors, Rotational/Rotary Torque Sensors), Technology (Strain-Gauge, Magnetoelastic, and More), Application (Automotive, Aerospace and Defense, and More), End-User Industry (OEM Test-Stand and QA, In-Process Monitoring, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 36.3% of 2024 revenue and sustained leadership through dense automotive assembly, semiconductor fabrication and robotics adoption. China led EPS volumes, Japan supplied precision strain-gauge substrates, and South Korea's electronics majors deployed high-resolution torque feedback in battery and display lines. India's push to localize rare-earth magnet production, with 500-tonne annual capacity targeted by 2026, promised to moderate raw-material risk across the region.

North America maintained its premium niche as aerospace and defense integrators employed high-temperature optical sensors for engine testing. US EV start-ups leveraged axial-flux motors requiring sophisticated torque control loops, bolstering demand for SAW and magnetoelastic devices. Mexico's growing role as an automotive export hub amplified mid-volume, cost-sensitive orders for steering and drivetrain sensing.

Europe advanced steadily on regulatory mandates that embedded torque measurement into collaborative robot safety standards and vehicle autonomous-readiness rules. Germany's automation vendors integrated sensor gateways into programmable-logic controllers, while France's nuclear maintenance contractors adopted wireless torque heads to accelerate outage turnarounds. South America, led by Brazil, posted the fastest 11.4% CAGR as OEMs installed new stamping and powertrain lines requiring extensive test-stand instrumentation.

- ABB Ltd

- Honeywell International Inc.

- Hottinger Bruel & Kjaer (HBK - Spectris plc)

- TE Connectivity Ltd

- Kistler Instrumente AG

- Infineon Technologies AG

- Norbar Torque Tools Ltd

- Crane Electronics Ltd

- S. Himmelstein & Company Inc.

- Datum Electronics Ltd (Indutrade AB)

- Applied Measurements Ltd

- PCB Piezotronics Inc. (MTS)

- MagCanica Inc.

- Futek Advanced Sensor Technology Inc.

- Forsentek Co. Ltd

- Bota Systems AG

- ATI Industrial Automation (Novanta)

- Althen Sensors & Controls GmbH

- Sensor Technology Ltd (TorqSense)

- Burster Prazisionsmesstechnik GmbH

- Transense Technologies plc (SAWSense)

- Interface Inc.

- Mountz Inc.

- KTR Kupplungstechnik GmbH

- OPKON Optik Elektronik Kontrol San. A.S.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification of Power-Steering (EPS) systems

- 4.2.2 Rising Automation and Cobots in Manufacturing

- 4.2.3 Surge in E-bike and Micromobility Production

- 4.2.4 Growing Use in Axial-Flux Motors for EV Drivetrains

- 4.2.5 On-board Torque Monitoring in Smart Wind Turbines

- 4.3 Market Restraints

- 4.3.1 Price Sensitivity in Volume Automotive Programs

- 4.3.2 Reliability Issues under Electromagnetic Interference

- 4.3.3 Supply Bottlenecks for High-Grade Magnetoelastic Alloys

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors

- 4.9 Industry Value-Chain Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Reaction

- 5.1.2 Rotational / Rotary

- 5.2 By Technology

- 5.2.1 Strain-Gauge

- 5.2.2 Magnetoelastic

- 5.2.3 Optical

- 5.2.4 SAW (Surface Acoustic Wave)

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Industrial Manufacturing and Robotics

- 5.3.4 Medical and Healthcare

- 5.3.5 Energy and Power

- 5.4 By End-User Industry

- 5.4.1 OEM Test-Stand and QA

- 5.4.2 In-Process Monitoring

- 5.4.3 Research and Development

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Honeywell International Inc.

- 6.4.3 Hottinger Bruel & Kjaer (HBK - Spectris plc)

- 6.4.4 TE Connectivity Ltd

- 6.4.5 Kistler Instrumente AG

- 6.4.6 Infineon Technologies AG

- 6.4.7 Norbar Torque Tools Ltd

- 6.4.8 Crane Electronics Ltd

- 6.4.9 S. Himmelstein & Company Inc.

- 6.4.10 Datum Electronics Ltd (Indutrade AB)

- 6.4.11 Applied Measurements Ltd

- 6.4.12 PCB Piezotronics Inc. (MTS)

- 6.4.13 MagCanica Inc.

- 6.4.14 Futek Advanced Sensor Technology Inc.

- 6.4.15 Forsentek Co. Ltd

- 6.4.16 Bota Systems AG

- 6.4.17 ATI Industrial Automation (Novanta)

- 6.4.18 Althen Sensors & Controls GmbH

- 6.4.19 Sensor Technology Ltd (TorqSense)

- 6.4.20 Burster Prazisionsmesstechnik GmbH

- 6.4.21 Transense Technologies plc (SAWSense)

- 6.4.22 Interface Inc.

- 6.4.23 Mountz Inc.

- 6.4.24 KTR Kupplungstechnik GmbH

- 6.4.25 OPKON Optik Elektronik Kontrol San. A.S.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment