PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851913

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851913

In Mold Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

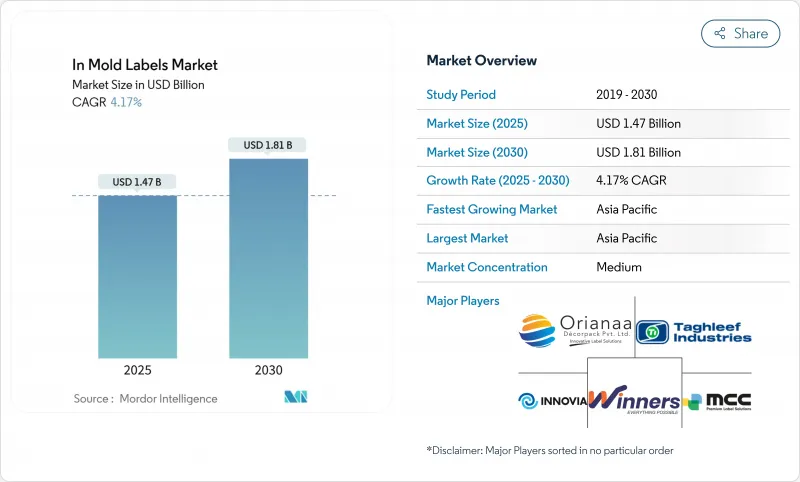

The in-mold labels market size reached USD 1.47 billion in 2025 and is forecast to expand to USD 1.81 billion by 2030, advancing at a 4.17% CAGR.

Steady growth reflects the sector's shift from capacity-driven expansion toward regulatory compliance, energy efficiency, and premium decoration. Europe's Packaging and Packaging Waste Regulation (PPWR) is accelerating the transition to mono-material packaging that can be mechanically recycled in existing streams. Asia-Pacific manufacturers meanwhile leverage high-cavitation injection molding and lower operating costs to win global contracts, while North American converters focus on premium designs for cosmetics and food. Digital printing is unlocking cost-effective short runs and personalization, and polypropylene (PP) remains the preferred substrate as it balances processability with recyclability. Despite PP price volatility, capital spending on energy-efficient thermoformers and electric presses is expected to sustain competitiveness across the in-mold labels market.

Global In Mold Labels Market Trends and Insights

Surging Demand for Mono-Material Packaging Enabling Easier Recycling

Mandatory recyclability from 2028 under the PPWR forces converters to redesign labels so container and decoration share the same polymer, eliminating separation steps and improving bale purity. MCC Verstraete's NextCycle IML delivers a polypropylene label-on-polypropylene container solution that passes mechanical recycling trials without ink bleed.Brand owners in beverages and dairy increasingly lock in three-year supply agreements that specify mono-material requirements, creating a predictable baseline for capex returns in the in-mold labels market. Asian resin makers respond with higher-clarity PP grades compatible with food contact, and US retailers introduce scorecards that penalize mixed-material decoration. As recycling targets tighten, converters that pre-qualify mono-material formats will be preferred partners, reinforcing first-mover advantage.

Expansion of High-Cavitation Injection Molding Capacity in Asia

China, Vietnam, and Thailand added more than 1,200 high-cavitation presses during 2023-2025. FCS Machinery alone booked tool sets that run up to 128 cavities, cutting unit labor costs by 28% and energy use by 30% against legacy hydraulic presses. Global brand owners shift safety-stock policies to align with this regional capacity, accelerating order visibility through 2026. Lower per-part costs allow converters to absorb PP price fluctuation without eroding margin, supporting long-term upside in the in-mold labels market. Skills programs jointly funded by local governments and multinational packaging groups further widen Asia-Pacific's cost-quality gap over Western competitors, especially in food-grade applications.

PP Price Volatility Squeezing Converter Margins

Polypropylene spot prices in North America rose 9 cents per lb in Q1 2025, driven by propylene monomer shortages and higher recycled resin demand. Smaller converters lack hedging instruments, forcing them to renegotiate quarterly, which risks account churn. Some mitigate exposure by adopting thin-wall thermoforming, cutting gram weight by 11% without redesign. Others sign multi-year resin supply agreements indexed to Brent crude, smoothing cash flows but raising working-capital needs. Until feedstock capacity additions in Texas and Ningbo come onstream in 2027, margin pressure will temper aggressive expansion plans in the in-mold labels market.

Other drivers and restraints analyzed in the detailed report include:

- Brand-Owner Shift Toward Premium, No-Label-Look Decoration

- Growth of Digital IML Printing for Short Runs and Personalization

- Limited Barrier Properties Versus Sleeve/PSL Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Injection molding accounted for USD 0.84 billion of the in-mold labels market size in 2024, translating to 57.23% revenue. Thermoforming, however, is on pace to log a 7.32% CAGR, outstripping every other process. Brown Machine's Quad Series machines cut energy draw by up to 35% while running 250,000 lids per hour, converting many dairy plants from injection to thermoforming. Blow molding remains vital for refillable beverage bottles where rib-strength and drop-impact resistance are critical.

Capital budgets show thermoforming lines integrating robotic stackers and camera inspection, raising overall equipment effectiveness (OEE) above 85%. Embedded analytics detect sheet temperature variation and auto-correct heater zones within 50 ms, enhancing yield. Converters note that thin-gauge PP rollstock lowers resin cost per thousand impressions by nearly 18 USD, cushioning PP price volatility. Injection molding still dominates complex closures and multi-component parts, but its share will plateau as sustainability audits favor thermoforming's lower carbon intensity in the in-mold labels market.

Polypropylene supplied labels on USD 0.67 billion worth of containers in 2024, capturing 45.42% of in-mold labels market share and expanding at an 8.92% CAGR. Regulators endorse PP because it can be sorted with containers, eliminating detaching steps. New random copolymer grades achieve haze below 1% and impact strength beyond 35 kJ/m2, widening their use in clear food pots. PE remains the choice for squeeze tubes that require flex-crack resistance, while PET is confined to high-clarity display jars.

Chinese resin majors fast-track meta-allocene catalysts that double melt-flow rate without compromising stiffness, aiding thin-wall parts. Post-consumer recycled PP now exceeds 60% inclusion in some cosmetic tubes, meeting premium brand pledges. Although bio-based PP trials show promise, feedstock supply is limited; thus, fossil-based PP with ISCC Plus certification will remain mainstream across the in-mold labels market.

The In-Mold Labels Market Report is Segmented by Production Process (Injection Molding, Blow Molding, Thermoforming), Material Type (Polypropylene, Polyethylene, and More), Printing Technology (Flexographic, Digital, and More), End-User Industry (Food, Beverage, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the in-mold labels market with a 40.12% revenue share in 2024 and is forecast to post a 7.91% CAGR through 2030. Capacity additions in China drive tooling availability, while Japanese positive-list regulations harmonize food-contact compliance, easing market access. India's Chemplast Sanmar invested INR 160 crore in specialty resins supporting local label demand and export contracts. Regional governments subsidize electric press retrofits, lowering greenhouse gas intensity per unit by 28%.

Europe remains the regulatory pacesetter. PPWR pushes for 30% PCR in PET food packs by 2030, catalyzing investment in removable barrier coatings and tethered closures. Switzerland's ink ordinance adds transparency requirements, compelling suppliers to maintain exhaustive substance registers.These rules squeeze marginal players but reward converters with early-compliance track records, sustaining premium pricing in the in-mold labels market.

North America feels cost headwinds from PP volatility and labor shortages, yet consumer appetite for premium packaging keeps cosmetics and functional dairy lines vibrant. Reshoring grants for molding machinery under the CHIPS-and-FABS programs spur toolmakers to localize spare-parts hubs, trimming downtime. The Middle East and Africa see rising demand for fortified dairy and ready-meals, opening green-field plant opportunities in UAE logistics zones. South America's soybean-oil derived PET investments widen substrate choices, albeit slower than APAC growth trajectories.

- Innovia Films (CCL Industries)

- Multi-Color Corporation (MCC Verstraete)

- Taghleef Industries

- Constantia Flexibles

- Huhtamaki Oyj

- Coveris Holdings

- Inland Label & Marketing Services

- Cosmo Films

- Jindal Films

- UPM Raflatac

- ITC Packaging SLU

- Nissha Metallizing Solutions

- MCC Verstraete (Belgium)

- Mold-Tek Packaging Ltd.

- IML Labels & Systems

- ORIANA Decorpack

- Letra Graphix Pvt. Ltd.

- WINNERS LABELS LLP

- RPC Superfos

- Greiner Packaging

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for mono-material packaging enabling easier recycling

- 4.2.2 Expansion of high-cavitation injection molding capacity in Asia

- 4.2.3 Brand-owner shift toward premium, no-label-look decoration

- 4.2.4 Growth of digital IML printing for short runs and personalization

- 4.2.5 Mandatory tethered-cap rules driving IML for lightweight closures

- 4.3 Market Restraints

- 4.3.1 PP price volatility squeezing converter margins

- 4.3.2 Limited barrier properties versus sleeve/PSL alternatives

- 4.3.3 Slow tool-changeover deterring very high SKU counts

- 4.3.4 Stricter VOC limits on solvent-based inks in Europe

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Production Process

- 5.1.1 Injection Molding

- 5.1.2 Blow Molding

- 5.1.3 Thermoforming

- 5.2 By Material Type

- 5.2.1 Polypropylene (PP)

- 5.2.2 Polyethylene (PE)

- 5.2.3 Polyethylene Terephthalate (PET)

- 5.2.4 Other Material Types

- 5.3 By Printing Technology

- 5.3.1 Flexographic

- 5.3.2 Digital (Inkjet, EP)

- 5.3.3 Gravure

- 5.3.4 Other Printing Technology

- 5.4 By End-user Industry

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Cosmetics and Personal Care

- 5.4.4 Other End-user Industry

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Innovia Films (CCL Industries)

- 6.4.2 Multi-Color Corporation (MCC Verstraete)

- 6.4.3 Taghleef Industries

- 6.4.4 Constantia Flexibles

- 6.4.5 Huhtamaki Oyj

- 6.4.6 Coveris Holdings

- 6.4.7 Inland Label & Marketing Services

- 6.4.8 Cosmo Films

- 6.4.9 Jindal Films

- 6.4.10 UPM Raflatac

- 6.4.11 ITC Packaging SLU

- 6.4.12 Nissha Metallizing Solutions

- 6.4.13 MCC Verstraete (Belgium)

- 6.4.14 Mold-Tek Packaging Ltd.

- 6.4.15 IML Labels & Systems

- 6.4.16 ORIANA Decorpack

- 6.4.17 Letra Graphix Pvt. Ltd.

- 6.4.18 WINNERS LABELS LLP

- 6.4.19 RPC Superfos

- 6.4.20 Greiner Packaging

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment