PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851916

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851916

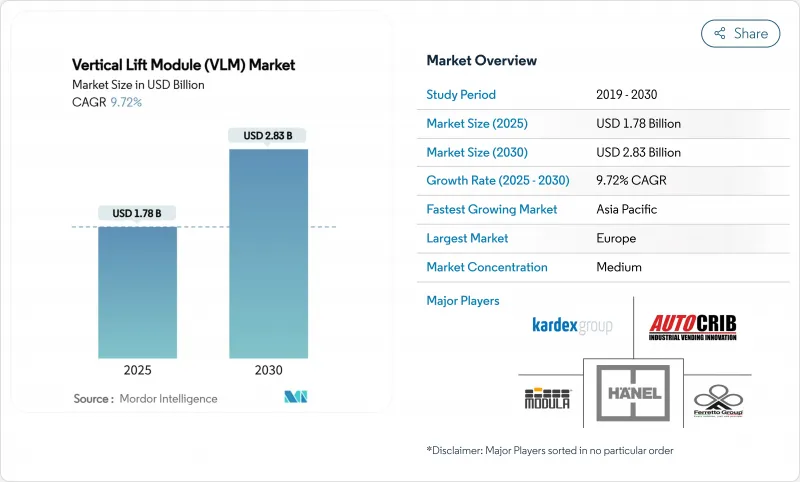

Vertical Lift Module (VLM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The vertical lift module market size stands at USD 1.78 billion in 2025 and is forecast to reach USD 2.83 billion by 2030, advancing at a 9.72% CAGR.

Demand accelerates as e-commerce firms replace bulky pallet racking with goods-to-person systems that compress fulfillment cycles from days to hours. Automakers add automated buffer storage to sustain just-in-time production rhythms, while life-sciences cleanrooms adopt enclosed modules that meet traceability and contamination-control mandates. Cold-chain operators view energy-efficient dual-drive motors as a route to ROI in less than 24 months, and predictive-maintenance software packages open an after-sales revenue stream for equipment makers.

Global Vertical Lift Module (VLM) Market Trends and Insights

E-commerce-led micro-fulfillment expansion

Retailers are shifting from regional distribution centers to automated micro-fulfillment nodes located inside or adjacent to existing stores. More than 7,300 automated micro-fulfillment centers are expected to be operational worldwide by 2030, almost half of them in the United States, creating sustained demand for compact, high-density modules that fit within 10,000 square-foot footprints . VLMs integrate with robotic pickers to achieve 99.99% order-accuracy rates while reducing labor needs by up to 66% . Although supply-chain constraints have slowed some retailer roll-outs, early adopters demonstrate rapid payback by compressing last-mile delivery lead times.

Accelerating VLM adoption in urban warehouses

Industrial rents in key Asian capitals outpace regional averages, forcing operators to reclaim vertical space. VLMs that reach ceiling heights of 98 feet quadruple storage density while shifting work from travel to picking, essential where labor is scarce and expensive. Daifuku's new manufacturing plant in India was commissioned to satisfy this surge in urban automation demand. Real-estate constraints and wage inflation thus act in tandem to move VLM investments higher on management priority lists.

Facility roof-height limitations in brownfield European sites

Many European plants built before 1990 lack the 25-foot clear height that unlocks peak VLM efficiency. Retrofitting involves floor reinforcement and structural checks that inflate project costs; in some locations, heritage rules bar vertical alterations. AutoStore estimates that 65% of its European installs occur in such retrofit scenarios, highlighting both opportunity and constraint

Other drivers and restraints analyzed in the detailed report include:

- OEM push for fully automated, closed-loop spare-parts storage in European automotive sector

- Compliance-driven traceability needs in U.S. life-sciences cleanrooms

- High up-front investment vs. multi-shuttle alternatives in APAC tier-2 cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Single-level systems captured 57% of 2024 revenue, a reflection of their compatibility with existing building heights and straightforward operations. Typical throughput averages 250 items per hour, adequate for medium-velocity environments. Dual-level variants, however, post an 11.9% CAGR through 2030. They hit 350 items per hour by allowing simultaneous extraction and presentation trays, making them a preferred choice when brownfield sites possess sufficient vertical clearance. Kardex has upgraded controller firmware to harmonize either configuration within the same WMS, giving operators flexibility to mix system types as order profiles evolve. The vertical lift module market continues to tilt toward dual-level investments as facilities chase higher picks-per-square-foot.

A modular design framework lowers engineering costs and accelerates installation. OEMs now offer plug-and-play conveyor docks and robotic interfaces, allowing single-level modules to serve as buffers for adjacent high-throughput zones while dual-level units handle fast movers. This hybrid strategy ensures continuity during seasonal spikes without oversizing equipment for average demand, reinforcing the vertical lift module market's value proposition for balanced capex planning.

Units rated for 20-50 tons held 43% market share in 2024, reflecting their suitability for boxed automotive parts, tote-handled e-commerce inventory, and pharmaceutical payloads that rarely exceed 1,000 pounds per tray. These systems form the backbone of multi-industry deployments because they require no special flooring or crane assistance. Above-50-ton modules record a 12.6% CAGR, fueled by aerospace and heavy-machinery suppliers consolidating oversized components into single storage points. Conversely, sub-20-ton machines occupy niche roles in electronics and medical device assembly lines where cleanliness and precision outweigh weight metrics.

Schaefer's LOGIMAT illustrates the trend, offering capacities up to 1 ton per tray with ERP connectors that reduce integration times by 30%. As Industry 4.0 spreads, facilities select load classes based on digital-twin simulations rather than generic rules of thumb. Consequently, procurement cycles extend to include data modeling, yet adoption momentum sustains because the vertical lift module market size aligns closely with quantifiable productivity gains.

Vertical Lift Module (VLM) Market is Segmented by Type (Single-Level Delivery, Dual-Level Delivery), Load Capacity (Up To 20 Tons, 20 - 50 Tons, Above 50 Tons ), Application (Storage and Buffering and More), End-User Industry (Automotive, Electrical and Electronics and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe leads with 36% revenue share in 2024, anchored by automotive manufacturing corridors in Germany, Spain, and France. Brownfield retrofits dominate because many facilities predate modern ceiling-height norms. OEM mandates for traceability and energy-footprint reduction, combined with strict worker-safety codes, keep the regional vertical lift module market growing even when new-build projects slow. Germany's Tier-1 suppliers integrate AI-based motor diagnostics to prevent unscheduled line stops, a feature now embedded in most European purchase specifications.

Asia-Pacific posts the fastest 12.3% CAGR through 2030. China deploys VLMs in greenfield smart factories where cell-based manufacturing needs compact point-of-use stores. India's logistics automation spending is climbing as new industrial corridors receive public funding for integrated supply-chain parks, reinforcing regional appetite for high-density vertical storage. Japan and South Korea apply modules to alleviate labor shortages caused by aging demographics. The region's scale and greenfield nature mean suppliers sell complete ecosystems-VLM hardware, WMS, and AMR fleets-in one turnkey package, bolstering the vertical lift module market size across the decade.

North America maintains a steady expansion track. Retailers retrofit suburban outlets with micro-fulfillment nodes, and life-sciences clusters in the U.S. Northeast adopt GMP-compliant modules for biologics. Cold-storage operators in the U.S. Midwest and Canada appreciate dual-drive hoist efficiencies that curb utility bills during peak tariffs. Latin America and the Middle East & Africa are emerging but uneven. Brazil's contract-logistics firms explore leasing models to bypass capex barriers, while South African distributors face power-quality issues that necessitate voltage-regulation add-ons, a factor that suppresses near-term vertical lift module market penetration.

- Kardex Group

- Hnel Storage Systems

- Modula Inc. (System Logistics)

- SSI SCHFER Systems International Inc.

- Ferretto Group S.p.A.

- AutoCrib Inc.

- Weland Lagersystem AB

- Automha S.p.A.

- Stanley Black & Decker Storage Solutions

- Green Automated Solutions Inc.

- Intertex Maschinenbau GmbH

- ICAM srl

- Mecalux S.A.

- Godrej

- Koerber Logistics Solutions

- Dexion (Gonvarri Material Handling)

- Constructor Group (Kasten)

- EffiMat Storage Technology A/S

- Randex Ltd.

- Omnia Technologies

- Sapient Automation

- ICY Lift Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce-led Micro-fulfilment Expansion Accelerating VLM Adoption in Urban Warehouses

- 4.2.2 OEM Push for Fully Automated

- 4.2.2.1 Closed-Loop Spare-Parts Storage in the European Automotive Sector

- 4.2.3 Compliance-Driven Traceability Needs in U.S. Life-Sciences Cleanrooms

- 4.2.4 Rising Labor-Cost Differentials in South-East Asia Driving AS/RS Retrofits

- 4.2.5 Energy-Efficient Dual-Drive Motors Enabling ROI < 24 Months in Cold-Storage Facilities

- 4.2.6 AI-Enabled Predictive-Maintenance Bundles from VLM OEMs Boosting After-sales Revenues

- 4.3 Market Restraints

- 4.3.1 Facility Roof-Height Limitations in Brownfield European Sites

- 4.3.2 High Up-front Investment vs. Multi-Shuttle Alternatives in APAC Tier-2 Cities

- 4.3.3 Power-Quality Variations in Emerging African Logistics Hubs

- 4.3.4 Limited Retrofit-Ready ERP/WMS Interfaces in SME Segments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Single-Level Delivery

- 5.1.2 Dual-Level Delivery

- 5.2 By Load Capacity

- 5.2.1 Up to 20 Tons

- 5.2.2 20 - 50 Tons

- 5.2.3 Above 50 Tons

- 5.3 By Application

- 5.3.1 Storage and Buffering

- 5.3.2 Order-Picking and Kitting

- 5.3.3 Spare-Parts Handling

- 5.4 By End-User Industry

- 5.4.1 Automotive

- 5.4.2 Metal and Machinery

- 5.4.3 Electrical and Electronics

- 5.4.4 Retail / Distribution and E-commerce

- 5.4.5 Life-Sciences (Pharma Medical Devices)

- 5.4.6 Food and Beverage

- 5.4.7 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 United Arab Emirates

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Kardex Group

- 6.4.2 Hnel Storage Systems

- 6.4.3 Modula Inc. (System Logistics)

- 6.4.4 SSI SCHFER Systems International Inc.

- 6.4.5 Ferretto Group S.p.A.

- 6.4.6 AutoCrib Inc.

- 6.4.7 Weland Lagersystem AB

- 6.4.8 Automha S.p.A.

- 6.4.9 Stanley Black & Decker Storage Solutions

- 6.4.10 Green Automated Solutions Inc.

- 6.4.11 Intertex Maschinenbau GmbH

- 6.4.12 ICAM srl

- 6.4.13 Mecalux S.A.

- 6.4.14 Godrej

- 6.4.15 Koerber Logistics Solutions

- 6.4.16 Dexion (Gonvarri Material Handling)

- 6.4.17 Constructor Group (Kasten)

- 6.4.18 EffiMat Storage Technology A/S

- 6.4.19 Randex Ltd.

- 6.4.20 Omnia Technologies

- 6.4.21 Sapient Automation

- 6.4.22 ICY Lift Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet