PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851930

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851930

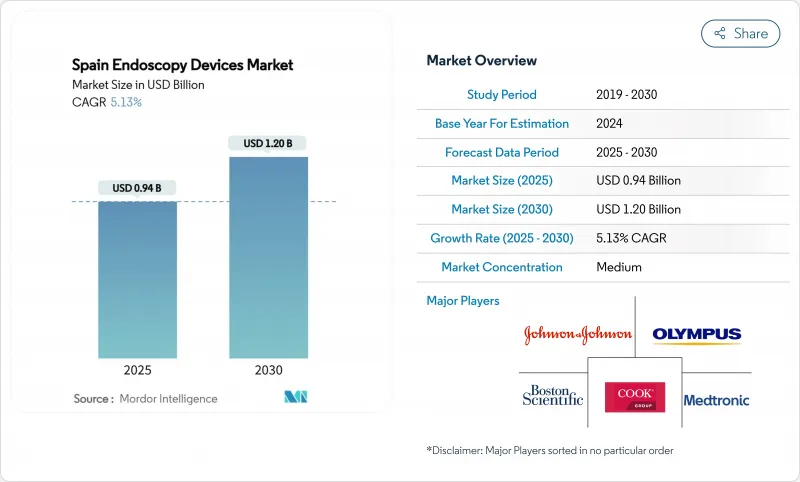

Spain Endoscopy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Spain endoscopy devices market size is USD 0.94 billion in 2025 and is projected to reach USD 1.20 billion by 2030, expanding at a 5.13% CAGR.

Growing demand for minimally invasive procedures, higher diagnostic volumes from colorectal-cancer screening, and rapid upgrades to HD and AI-ready platforms are accelerating equipment refresh cycles. Procedure throughput is also rising as Spain's private insurance enrollment climbs, lifting device demand in ambulatory surgery centers. At the same time, the aging population is pushing up gastrointestinal disease prevalence, reinforcing the need for advanced visualization systems that shorten hospital stays and cut overall treatment costs. Leading manufacturers are responding with single-use scopes that address infection-control gaps and with software updates that embed real-time lesion-recognition algorithms.

Spain Endoscopy Devices Market Trends and Insights

Rising Prevalence of GI Disorders & Cancer in an Aging Spanish Population

Colorectal cancer is now Spain's second-most common malignancy, and 20.5% of Spaniards are already over 65 years old. National screening expansion is boosting colonoscopy volumes, and the TEOGIC cohort anticipates a 15%-20% procedure jump by 2027. Providers therefore prioritize high-definition wide-field scopes and AI computer-aided detection (CADe) modules to spot flat lesions early. Hospitals in Galicia and Asturias have accelerated equipment replacement schedules, citing higher regional incidence of early-onset GI cancers. Manufacturers benefit because tender specifications now require image-enhancement modes such as narrow-band-imaging plus cloud-based analytics.

Shift Toward Minimally Invasive Procedures Reducing Hospital Stay & Costs

Public hospitals use these gains to shrink waiting lists, while private groups market same-day discharge packages. Insurers now reimburse laparoscopic or endoscopic approaches at parity with traditional surgery, reinforcing uptake. Device vendors increasingly bundle energy sources, insufflators, and imaging towers, offering cost-per-procedure contracts that fit constrained SNS budgets.

High Capital and Lifecycle Maintenance Costs Limiting Adoption

Premium video systems cost EUR 80,000-150,000, while annual service fees reach 8-12% of purchase price. Spain's NHS allocates only 7.9% of its health budget to medical technologies, below the EU mean of 8.3%. Smaller regional hospitals therefore stretch equipment beyond recommended years of use, widening the technology gap with tertiary centers. Cost-effectiveness thresholds hover at EUR 22,000-25,000 per QALY, restricting approval for premium upgrades unless they clearly displace follow-up procedures.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Technological Advances in HD/4K Imaging and AI Integration

- Growing Penetration of Private Health Insurance Driving Procedure Volumes

- Complex Reprocessing Requirements Raising Total Cost of Ownership

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Endoscopes commanded 47.7% of Spain endoscopy devices market size in 2024, underpinned by entrenched use across gastroenterology and pulmonology suites. Investment priorities remain centered on high-definition video gastroscopes and colonoscopes that support virtual-chromoscopy modes. Disposable scopes, however, are accelerating at a 12.0% CAGR as infection-control audits expose reprocessing gaps; AI-capable processors that pair seamlessly with single-use models are easing the transition.

Visualization towers rank second by revenue, driven by progressive rollouts of 4K and near-infrared systems that improve lesion contrast and facilitate fluorescence imaging. Endotherapy instruments trail but enjoy robust uptake in therapeutic ESD and POEM procedures. Software platforms embedding computer-aided detection illustrate how Spain endoscopy devices market fosters a shift from hardware-centric procurement toward integrated digital ecosystems.

Gastroenterology represented 57.0% of Spain endoscopy devices market share in 2024, tied to nationwide colorectal-cancer screening that targets full eligibility coverage by 2026. Capsule endoscopy and bariatric endoluminal therapies broaden procedural mix, supporting repeat purchases of slim scopes and disposable overtubes. Pulmonology usage is expanding at a 9.0% CAGR as chronic respiratory diseases and post-COVID sequelae raise bronchoscopic volumes.

AI staging modules for lung-nodule assessment and single-use bronchoscopes combine to shorten ICU turnover times. ENT and gynecology segments remain smaller yet benefit from 3-chip rigid camera heads that migrate down the cost curve. Spain endoscopy devices industry players also note rising intraoperative visualization demand in hybrid ORs, pressuring suppliers to integrate scopes with surgical navigation systems.

The Spain Endoscopy Devices Market Report is Segmented by Product (Endoscopes [Flexible Endoscopes, and More], Visualization Systems, and More), Application (Gastroenterology, Pulmonology, Urology, Orthopedic & Arthroscopy, and More), End User (Public Hospitals, Private Hospitals, and More), Usage (Reusable Endoscopes, and More), and Technology (2D HD Endoscopy, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Olympus

- Karl Storz

- Boston Scientific

- Johnson & Johnson

- FUJIFILM

- HOYA

- Medtronic

- Stryker

- Richard Wolf

- Cook Group

- Ambu

- Conmed

- Cantel Medical (Steris plc)

- Arthrex

- Mindray

- SonoScape Medical Corp.

- Karl Kaps GmbH & Co. KG

- Optomic Spain

- Palex Medical SA

- VirtaMed

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of GI Disorders & Cancer in Ageing Spanish Population Boosting Diagnostic Endoscopy Demand

- 4.2.2 Shift Toward Minimally-Invasive Procedures Reducing Hospital Stay & Costs across Spanish Healthcare

- 4.2.3 Rapid Technological Advances in HD/4K Imaging and AI Integration Enhancing Clinical Accuracy & Adoption

- 4.2.4 Growing Penetration of Private Health Insurance Driving Procedure Volumes in Private Hospitals & ASCs

- 4.2.5 Replacement Cycle Driven by Robotic & Digital Endoscopy Platforms Elevating Capital Spend

- 4.3 Market Restraints

- 4.3.1 High Capital & Lifecycle Maintenance Costs Limiting Adoption in Budget-Constrained Public Hospitals

- 4.3.2 Complex Reprocessing Requirements Raising Total Cost of Ownership and Infection-Control Challenges

- 4.3.3 Shortage of Trained Endoscopy Nurses & Technicians Curtailing Throughput Capacity

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Endoscopes

- 5.1.1.1 Flexible Endoscopes

- 5.1.1.2 Rigid Endoscopes

- 5.1.1.3 Capsule Endoscopes

- 5.1.1.4 Robot-Assisted Endoscopes

- 5.1.1.5 Disposable / Single-Use Endoscopes

- 5.1.2 Visualization Systems

- 5.1.2.1 Video Processors & Light Sources

- 5.1.2.2 Camera Heads & Monitors

- 5.1.3 Operative Devices & Accessories

- 5.1.3.1 Endotherapy & Energy Devices

- 5.1.3.2 Insufflation & Irrigation Systems

- 5.1.4 Software & AI Platforms

- 5.1.1 Endoscopes

- 5.2 By Application

- 5.2.1 Gastroenterology

- 5.2.2 Pulmonology

- 5.2.3 ENT Surgery

- 5.2.4 Gynecology

- 5.2.5 Urology

- 5.2.6 Orthopedic & Arthroscopy

- 5.2.7 Cardiology

- 5.2.8 Neurology / Neuroendoscopy

- 5.2.9 Intraoperative Visualization

- 5.3 By End User

- 5.3.1 Public Hospitals (SNS)

- 5.3.2 Private Hospitals

- 5.3.3 Ambulatory Surgery Centers

- 5.3.4 Specialty Clinics

- 5.4 By Usage

- 5.4.1 Reusable Endoscopes

- 5.4.2 Disposable / Single-Use Endoscopes

- 5.4.3 Reprocessed (Third-Party) Endoscopes

- 5.5 By Technology

- 5.5.1 2D HD Endoscopy

- 5.5.2 4K / UHD Endoscopy

- 5.5.3 3D & Robotic Endoscopy

- 5.5.4 AI-Assisted Endoscopy

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Olympus Corporation

- 6.3.2 KARL STORZ SE & Co. KG

- 6.3.3 Boston Scientific Corporation

- 6.3.4 Johnson & Johnson (Ethicon Inc.)

- 6.3.5 Fujifilm Holdings Corporation

- 6.3.6 Hoya Corporation (Pentax Medical)

- 6.3.7 Medtronic plc

- 6.3.8 Stryker Corporation

- 6.3.9 Richard Wolf GmbH

- 6.3.10 Cook Medical LLC

- 6.3.11 Ambu A/S

- 6.3.12 ConMed Corporation

- 6.3.13 Cantel Medical (Steris plc)

- 6.3.14 Arthrex Inc.

- 6.3.15 Mindray Medical International Ltd.

- 6.3.16 SonoScape Medical Corp.

- 6.3.17 Karl Kaps GmbH & Co. KG

- 6.3.18 Optomic Spain

- 6.3.19 Palex Medical SA

- 6.3.20 VirtaMed AG

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment