PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851938

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851938

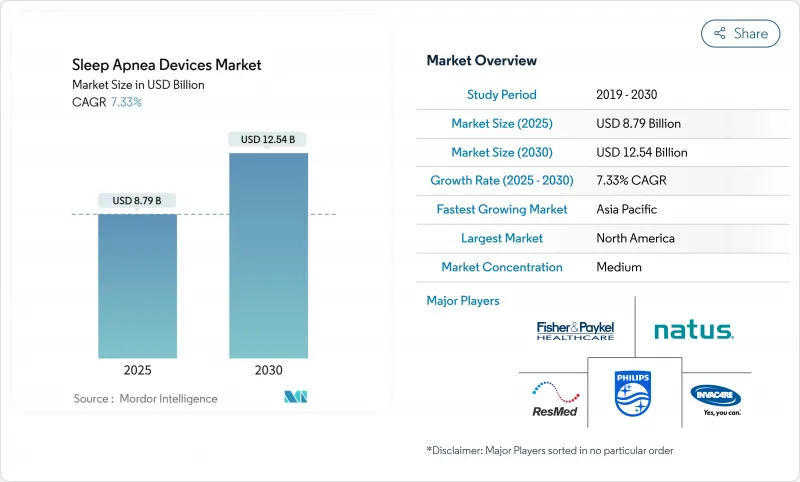

Sleep Apnea Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The sleep apnea devices market size is valued at USD 8.79 billion in 2025 and is forecast to reach USD 12.54 billion by 2030, expanding at a 7.33% CAGR during 2025-2030.

Momentum stems from the growing recognition that untreated sleep apnea accelerates cardiovascular disease, worsens glycemic control, and impairs cognition. In parallel, the Philips recall has redirected procurement budgets toward alternative suppliers, while reimbursement expansions in major markets lower out-of-pocket costs and enlarge the treated population. Consumer electronics brands are entering the therapeutic continuum with FDA-cleared screening functions, further broadening the funnel of newly diagnosed patients. Device makers are therefore repositioning from hardware suppliers to data-enabled care-management partners, strengthening recurring revenue streams and creating new cross-sell opportunities in software and analytics.

Global Sleep Apnea Devices Market Trends and Insights

Rising Global Prevalence of Obstructive Sleep Apnea Linked to Obesity Epidemic

Obesity remains the strongest modifiable risk factor for obstructive sleep apnea (OSA), and epidemiologic curves for both conditions rise in tandem. In morbidly obese surgical candidates, OSA prevalence reaches 95% for body-mass-index levels above 60 . Yet of the 30 million U.S. adults estimated to have sleep apnea, only 6 million carry a formal diagnosis. This latent clinical need underpins sustained demand for diagnostic devices, remote monitoring accessories, and long-term therapy solutions. Insurers increasingly acknowledge the downstream economic burden of untreated apnea-such as hypertension-related admissions-making coverage expansion politically and fiscally attractive.

Expanding Insurance Coverage for PAP & Oral Appliance Therapies Across Major Markets

Reimbursement reforms now embrace a broader toolkit of treatments. In the United States, the Centers for Medicare & Medicaid Services reimburse continuous positive airway pressure (CPAP) initiated by either in-lab polysomnography or qualified home tests. Coverage further extends to oral appliances and hypoglossal-nerve stimulation when patients meet specific clinical criteria. Similar policy shifts in France, Germany, and Japan shorten pay-back periods for device purchases and elevate replacement cycles. Payers have also instituted adherence audits, tying continued rental payments to the upload of usage data-an arrangement that incentivizes connected hardware and software ecosystems.

Product Recalls and Safety Concerns Undermining Patient Trust

The 2021-2024 Philips Respironics recall-covering millions of CPAP, BiPAP, and ventilator units-linked foam degradation to respiratory injuries and 560 deaths, according to FDA medical-device reports. A January 2024 consent decree bars Philips from selling new sleep-apnea devices in the United States until it satisfies manufacturing-quality obligations. The episode has heightened regulatory vigilance across the category, with additional pre-market testing now required for foam stability and biocompatibility. While rival brands benefit from share gains, they also shoulder the cost of intensified quality-assurance protocols, which can erode near-term margins and lengthen production lead times.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Compact, Connected PAP and Home Sleep Test Devices

- Increasing Adoption of Home Sleep Testing to Reduce Diagnostic Backlogs

- Stringent Regulatory Approval Timelines for Novel Connected Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polysomnography systems still generated the lion's share of revenue, capturing 42.0% of the Sleep Apnea Devices market in 2024. Yet the unit-volume ascent belongs to home-sleep-test kits, whose FDA clearances accelerated post-2022 as pandemic backlogs forced payers and providers to embrace decentralized diagnostics nature.com. Clinical studies confirm 84.5% of cleared HST devices underwent prospective accuracy trials, cementing clinical confidence and paving the way for reimbursement parity with in-lab testing. Manufacturers that once solely supplied full polysomnography workstations now bundle compact Type-3 recorders, cloud dashboards, and AI-driven scoring services to defend share against HST-native challengers.

Continued uptake should lift the diagnostic sub-segment's revenue contribution from USD 3.03 billion in 2025 to USD 4.31 billion by 2030, implying a 7.3% compound pace in line with the broader Sleep Apnea Devices market. Pay-per-test SaaS models underpin stable recurring economics and create inbound cross-selling leads for therapeutic hardware. The segment's success also alleviates lab-capacity constraints, accelerating the conversion of undiagnosed patients into device-supported therapy cohorts.

The Sleep Apnea Devices Market Report is Segmented by Diagnostic Devices (Polysomnography Systems (PSG), and More), Therapeutic Devices (Positive Airway Pressure (PAP) Devices, Oxygen Therapy Devices, and More), End-User (Sleep Laboratories & Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest revenue contributor with 38.0% of 2024 sales, supported by high diagnostic penetration, robust private insurance adoption, and mature distributor networks. Philips' consent decree has reshaped the regional supply landscape, freezing its U.S. shipments for five to seven years and accelerating competitor gains. ResMed reported an 11.27% year-over-year revenue uplift in Q3 2024, visibly outpacing a 2.6% contraction among smaller rivals. Clinician preference for devices with established safety track records further cements that momentum. Looking ahead, the Sleep Apnea Devices market will pivot toward integrated cloud services as value-based reimbursement schemes reward documented outcomes.

Asia Pacific is forecast to clock an 8.9% CAGR from 2025-2030, the fastest regional trajectory in the global Sleep Apnea Devices market. Prevalence data highlight substantial latent demand: systematic reviews peg adult OSA rates as high as 23.6% in China and suggest India may harbor more than 50 million affected adults. Diagnosis remains limited by physician awareness and sleep-lab scarcity, but government insurance expansion in China and India is underwriting the adoption of portable HST kits. Multinational brands partner with respiratory-therapy chains and telehealth portals to deploy loaner CPAP programs that convert to household purchases once adherence is proven.

Europe's market shows lower volatility yet steady replacement demand, benefitting from stringent regulatory frameworks and national reimbursement lists that favor clinically validated products. The region's Sleep Apnea Devices market size is projected to reach USD 3.53 billion by 2032. However, supply shocks ripple through procurement cycles: hospitals pivoted rapidly to Fisher & Paykel masks after a UK patent ruling invalidated ResMed's earlier intellectual-property claim. Regional innovation focuses on noise-attenuation materials and recyclable components to comply with EU environmental directives while safeguarding clinical performance.

- Koninklijke Philips

- Resmed

- Fisher & Paykel Healthcare

- Drive DeVilbiss Healthcare

- SomnoMed Ltd.

- Cadwell

- Nihon Kohden Corp.

- Vyaire Medical

- Invacare Corp.

- Teleflex

- Natus Medical

- Lwenstein Medical GmbH

- BMC Medical Co. Ltd.

- ZOLL Medical Corporation,

- Braebon Medical Corp.

- React Health (formerly Human Design Medical)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Prevalence of Obstructive Sleep Apnea Linked to Obesity Epidemic

- 4.2.2 Expanding Insurance Coverage for PAP & Oral Appliance Therapies Across Major Markets

- 4.2.3 Technological Advancements in Compact, Connected PAP and Home Sleep Test Devices

- 4.2.4 Increasing Adoption of Home Sleep Testing to Reduce Diagnostic Backlogs

- 4.2.5 Strategic Collaborations Between Device Makers and Telehealth Platforms

- 4.2.6 Growing Clinical Evidence for Health & Economic Benefits of Early OSA Intervention

- 4.3 Market Restraints

- 4.3.1 High Capital & Maintenance Costs of PSG Infrastructure in Emerging Markets

- 4.3.2 Product Recalls and Safety Concerns Undermining Patient Trust

- 4.3.3 Stringent Regulatory Approval Timelines for Novel Connected Devices

- 4.3.4 Poor Patient Compliance and Device Abandonment Rates Affecting Therapy Outcomes

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Diagnostic Devices

- 5.1.1 Polysomnography Systems (PSG)

- 5.1.2 Home Sleep Test (HST) Kits

- 5.1.3 Pulse Oximeters

- 5.1.4 Actigraphy Wearables

- 5.2 By Therapeutic Devices

- 5.2.1 Positive Airway Pressure (PAP) Devices

- 5.2.1.1 Continuous Positive Airway Pressure (CPAP)

- 5.2.1.2 Bi-level Positive Airway Pressure (BiPAP)

- 5.2.1.3 Automatic Positive Airway Pressure (Auto-PAP)

- 5.2.2 Oxygen Therapy Devices

- 5.2.2.1 Stationary Oxygen Concentrators

- 5.2.2.2 Portable Oxygen Concentrators

- 5.2.3 Oral Appliances

- 5.2.4 Adaptive Servo-Ventilation (ASV)

- 5.2.5 Nasal & Full-face Masks

- 5.2.6 Accessories & Consumables

- 5.2.1 Positive Airway Pressure (PAP) Devices

- 5.3 By End-User

- 5.3.1 Sleep Laboratories & Hospitals

- 5.3.2 Home-care Settings

- 5.3.3 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Koninklijke Philips N.V.

- 6.4.2 ResMed Inc.

- 6.4.3 Fisher & Paykel Healthcare Ltd.

- 6.4.4 Drive DeVilbiss Healthcare LLC

- 6.4.5 SomnoMed Ltd.

- 6.4.6 Cadwell Laboratories Inc.

- 6.4.7 Nihon Kohden Corp.

- 6.4.8 Vyaire Medical Inc.

- 6.4.9 Invacare Corp.

- 6.4.10 Teleflex Inc.

- 6.4.11 Natus Medical Inc.

- 6.4.12 Lwenstein Medical GmbH

- 6.4.13 BMC Medical Co. Ltd.

- 6.4.14 ZOLL Medical Corporation,

- 6.4.15 Braebon Medical Corp.

- 6.4.16 React Health (formerly Human Design Medical)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment