PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851939

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851939

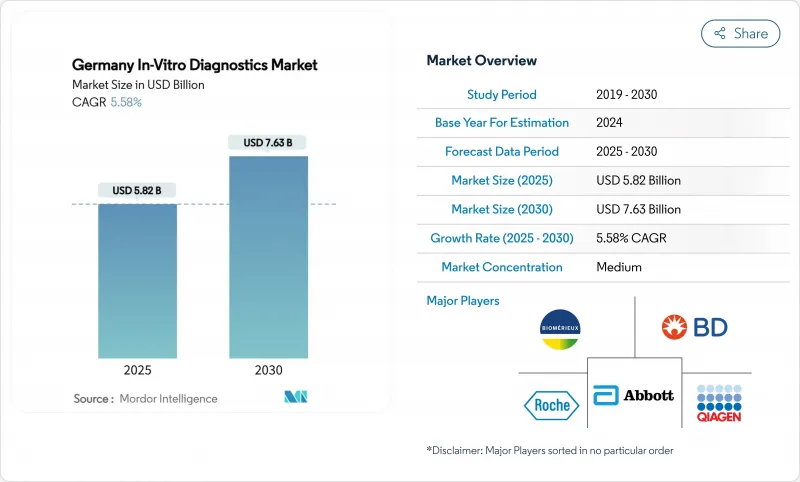

Germany In-Vitro Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Germany in-vitro diagnostics market size is USD 5.82 billion in 2025 and is forecast to reach USD 7.63 billion by 2030, advancing at a 5.58% CAGR; this sustained pace underscores the strategic weight of diagnostics within the nation's EUR 474 billion health-care budget.

Demand is powered by chronic-disease screening, precision oncology programs and rapid infectious-disease surveillance, while digital initiatives such as the Hospital Future Fund and the 2025 electronic patient record mandate accelerate laboratory automation. Manufacturers that obtain early EU IVDR certification enjoy faster market access through Germany's four Notified Bodies, creating a competitive moat for compliant portfolios. Precision-oncology assays leveraging NGS and multiplex immunohistochemistry represent the quickest revenue escalators, while point-of-care platforms benefit from expanding decentralized-care models in emergency and home settings. Collectively, these factors keep the Germany in-vitro diagnostics market on a clear growth trajectory despite reimbursement headwinds.

Germany In-Vitro Diagnostics Market Trends and Insights

Escalating Chronic & Lifestyle Disease Prevalence Fueling Routine IVD Demand

Germany's aging population profile widens the base of patients requiring metabolic, cardiac and renal panels. Diabetes prevalence crossed 9.3 million adults in 2025, lifting HbA1c and microalbumin testing volumes as per individualized-care protocols promoted by the American Diabetes Association. Cardiovascular risk screening likewise intensifies, with Eurostat noting Germany's 2024 hypertension rate at 24%, spurring lipid and hs-troponin utilization. These epidemiological realities cement clinical chemistry dominance while pushing molecular panels into routine algorithms, thereby propelling the Germany in-vitro diagnostics market. Laboratories respond by expanding automated core analyzers and high-throughput immunoassay lines to manage specimen inflow efficiently.

National Digital-Health & Hospital-Funding Programs Catalyzing Lab Automation & Integration

The EUR 4.3 billion Hospital Future Fund subsidizes middleware, track automation and interoperable LIS upgrades, enabling bidirectional data flow between labs and the national ePA backbone. DigitalRadar's 33/100 baseline in 2025 highlights untapped efficiency, prompting aggressive modernization projects. Early adopters such as Siemens Healthineers' autonomous robotic core lab in Heidelberg reported 86% cuts in manual steps, trimming turnaround times by 37%. Vendors offering cloud-native middleware and AI-driven quality-control modules gain competitive traction, reinforcing software as a growth lever within the Germany in-vitro diagnostics market.

Stringent EU IVDR Compliance Timeline Elevating Cost & Complexity

A 2024 Association for Molecular Pathology survey found 73% of German labs lacked full clarity on IVDR rules, and 41% had already deferred new-test launches. Although deadlines now stretch to 2027-2029, high-risk assay dossiers still demand costly performance studies and Notified-Body audits. Regulation 2024/1860 additionally imposes six-month stock-out alerts, compelling vendors to fortify supply chains. Compliance investments divert R&D budgets, tempering short-term innovation across the Germany in-vitro diagnostics market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Precision Oncology & Companion-Diagnostics Adoption

- Rising Decentralized & Home-Based Care Models Accelerating Point-of-Care Testing Uptake

- Reimbursement Pressure under EBM/DRG & Statutory Health Insurance Limiting Price Realization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Clinical chemistry anchored 25% of 2024 revenue, a cornerstone for electrolyte, liver-function and metabolic panels within the Germany in-vitro diagnostics market size. Routine volumes sustain platform investments, whereas immuno-diagnostics extend insights into infectious and autoimmune states. Molecular diagnostics, propelled by rapid PCR and liquid-biopsy workflows, logs a 9.05% CAGR, and CleanNA's CE-IVD cfDNA kit broadens oncology and prenatal applications.

Roche's 125-test pipeline underscores traction in oncology, neurology and cardiometabolic panels. As precision-medicine guidelines mature, labs integrate comprehensive sequencing with reflex immunohistochemistry, fast-tracking personalized therapies. Consequently, the Germany in-vitro diagnostics market enjoys a dynamic mix: stabilized baseline chemistry plus high-velocity molecular segments.

Immunoassays delivered 34% of 2024 turnover, their extensive menu and mature analyzer fleet yielding predictable reagent pull-through despite pricing pressure. PCR's versatility anchors infectious-disease surveillance, while isothermal NAAT grows in near-patient flu-RSV combos. Next-generation sequencing propels double-digit gains and lifts the Germany in-vitro diagnostics market size for complex genomic profiling.

Automation developments, such as MGI Tech's PrepALL liquid handler and Smart 8 pipetting station, trim sample prep lead times by up to 40%, boosting laboratory throughput. Mass spectrometry progresses from toxicology into endocrinology with tandem-MS steroid panels, whereas flow cytometry standardizes immunophenotyping protocols. Converging technologies thus raise analytical depth while safeguarding reagent uptime across the Germany in-vitro diagnostics market.

Reagents and kits furnished 69% of 2024 revenue, the recurrent-consumable model sustaining vendor cash flow within the Germany in-vitro diagnostics market share. Instrument sales follow replacement cycles, with middleware upgrades bundling connectivity and cybersecurity layers.

Software and services accelerate at 10.50% CAGR as labs digitize workflows. UniteLabs secured EUR 2.77 million seed to integrate heterogeneous devices into a single operating stack, slashing manual data transfers in biotech labs. Predictive-maintenance modules lower unplanned downtime, and cloud-based analytics generate actionable population insights, increasing the Germany in-vitro diagnostics market value beyond physical assay delivery.

The Germany In-Vitro Diagnostics Market Report is Segmented by Test Type (Clinical Chemistry, and More), Technology (PCR, NGS, and More), Product (Instruments, and More), Usability (Disposable IVD Devices and More), Setting (Centralised Laboratories and More), Application (Infectious Disease, Diabetes, and More), and End-Users (Independent Diagnostic Laboratories and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbott Laboratories

- Roche

- Siemens Healthineers

- Danaher (Beckman Coulter & Cepheid)

- bioMerieux

- Beckton Dickinson

- QIAGEN

- Sysmex Corp.

- Thermo Fisher Scientific

- Seegene Germany GmbH

- Epigenomics

- Ortho Clinical Diagnostics

- Werfen GmbH

- Randox Laboratories

- DiaSorin

- Illumina

- Synlab AG

- Limbach Group SE

- Nova Biomedical

- Bruker Daltonics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Chronic & Lifestyle Disease Prevalence Fueling Routine IVD Demand

- 4.2.2 National Digital-Health & Hospital-Funding Programs Catalyzing Lab Automation & Integration

- 4.2.3 Expansion of Precision Oncology & Companion-Diagnostics Adoption

- 4.2.4 Rising Decentralised & Home-Based Care Models Accelerating Point-of-Care Testing Uptake

- 4.2.5 Continuous Technological Innovation (Automation, AI-Driven Analytics, Multiplex Assays) Enhancing Test Capabilities

- 4.3 Market Restraints

- 4.3.1 Stringent EU IVDR Compliance Timeline Elevating Cost & Complexity for Market Participants

- 4.3.2 Reimbursement Pressure under EBM/DRG & Statutory Health Insurance Limiting Price Realisation

- 4.3.3 Supply-Chain Vulnerabilities & Import Dependence for Critical Reagents

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Test Type

- 5.1.1 Clinical Chemistry

- 5.1.2 Molecular Diagnostics

- 5.1.3 Immuno-Diagnostics

- 5.1.4 Hematology

- 5.1.5 Microbiology

- 5.1.6 Coagulation

- 5.1.7 Urinalysis

- 5.1.8 Others

- 5.2 By Technology

- 5.2.1 PCR

- 5.2.2 Isothermal NAAT

- 5.2.3 NGS

- 5.2.4 Immunoassay (ELISA, CLIA)

- 5.2.5 Mass Spectrometry

- 5.2.6 Flow Cytometry

- 5.3 By Product

- 5.3.1 Instruments & Analyzers

- 5.3.2 Reagents & Kits

- 5.3.3 Software & Services

- 5.4 By Usability

- 5.4.1 Disposable IVD Devices

- 5.4.2 Reusable IVD Devices

- 5.5 By Setting

- 5.5.1 Centralised Laboratories

- 5.5.2 Point-of-Care / Decentralised Sites

- 5.6 By Application

- 5.6.1 Infectious Disease

- 5.6.2 Diabetes

- 5.6.3 Oncology

- 5.6.4 Cardiology

- 5.6.5 Autoimmune Disease

- 5.6.6 Nephrology

- 5.6.7 Others

- 5.7 By End-User

- 5.7.1 Independent Diagnostic Laboratories

- 5.7.2 Hospital-Based Labs & Clinics

- 5.7.3 Physicians Office Labs (POL)

- 5.7.4 Home-Care & Self-Testing

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Roche Diagnostics

- 6.3.3 Siemens Healthineers

- 6.3.4 Danaher (Beckman Coulter & Cepheid)

- 6.3.5 bioMerieux SA

- 6.3.6 Becton Dickinson

- 6.3.7 Qiagen N.V.

- 6.3.8 Sysmex Corp.

- 6.3.9 Thermo Fisher Scientific

- 6.3.10 Seegene Germany GmbH

- 6.3.11 Epigenomics AG

- 6.3.12 Ortho Clinical Diagnostics

- 6.3.13 Werfen GmbH

- 6.3.14 Randox Laboratories

- 6.3.15 DiaSorin S.p.A.

- 6.3.16 Illumina Inc.

- 6.3.17 Synlab AG

- 6.3.18 Limbach Group SE

- 6.3.19 Nova Biomedical

- 6.3.20 Bruker Daltonics

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment