PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851941

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851941

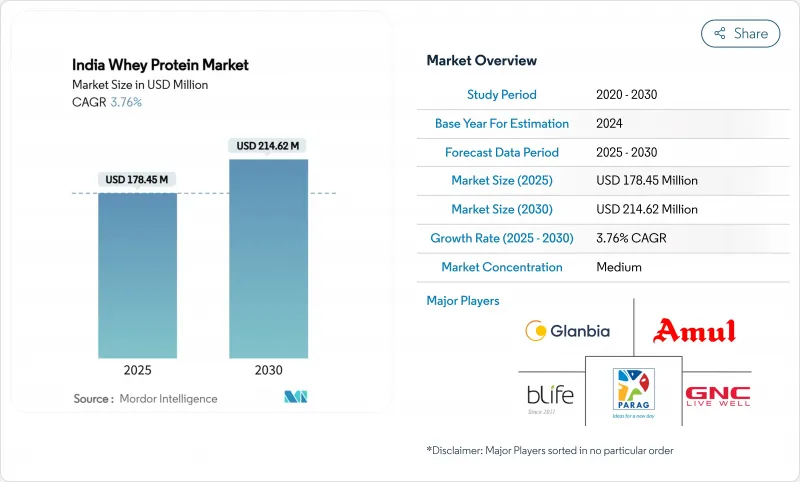

India Whey Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India whey protein market is valued at USD 178.45 million in 2025 and is projected to grow to USD 214.62 million by 2030, registering a CAGR of 3.76%.

The market's growth is driven by increasing health consciousness among consumers, a rising preference for protein-rich diets, and the expanding fitness and wellness industry in the country. Additionally, the growing adoption of whey protein in various applications, including dietary supplements, functional foods, and beverages, is further fueling market demand. The market also benefits from advancements in product formulations and the introduction of innovative flavors and formats, catering to diverse consumer preferences. The forecast period is expected to witness sustained growth as manufacturers focus on expanding their distribution networks and enhancing product accessibility across urban and rural areas.

India Whey Protein Market Trends and Insights

Rising sports and gym culture among millennials and gen z

The rising sports and gym culture among Millennials and Gen Z is a significant driver of the India whey protein market. According to the Ministry of Youth Affairs and Sports, the government has been actively promoting fitness initiatives, such as the Fit India Movement, which institutionalizes fitness culture through age-appropriate protocols recommending 30-60 minutes of moderate-to-vigorous physical activity daily . This has encouraged young individuals to adopt healthier lifestyles. Additionally, digital fitness adoption accelerated post-COVID, with fitness apps experiencing significant increases in user engagement. This shift has created educated consumers who understand the role of protein in muscle recovery and performance. The transition from traditional Indian fitness practices to modern gym culture has further driven demand for scientifically-formulated nutrition products, positioning whey protein as an essential rather than optional supplementation. The growing trend is expected to continue driving the market during the forecast period.

Growing awareness of protein deficiency in indian diets

The growing awareness of protein deficiency in Indian diets is a significant driver of the India whey protein market. A large portion of the Indian population suffers from inadequate protein intake due to dietary habits that rely heavily on carbohydrates and fats. This deficiency has led to increased health concerns, including weakened immunity, muscle loss, and other related issues. As a result, consumers are actively seeking protein-rich alternatives to address these nutritional gaps. Whey protein, known for its high bioavailability and complete amino acid profile, has emerged as a preferred choice among health-conscious individuals. Additionally, government initiatives and campaigns by health organizations to promote balanced diets and protein consumption are further fueling the demand for whey protein products in the country. This trend is expected to drive market growth during the forecast period.

High import dependence and volatile whey prices

In 2025, India is set to import 23,000 MT of whey protein, marking a 20% jump from 2024 figures. This surge makes the Indian market susceptible to global price swings and disruptions in the supply chain . Even with an impressive annual milk production of 240 million tonnes, India finds itself contributing to less than 0.5% of the global dairy export pie. Its foothold in the lucrative whey product segment pales in comparison to the US, which boasts a 6.7% share in global exports. The US has voiced its apprehensions at the WTO, spotlighting India's newly minted dairy import certificate mandates. These requirements could muddle the import process and inflate compliance expenses for overseas suppliers. Domestically, India grapples with hurdles: a dearth of investment in cheese and whey processing, soaring production costs, and lapses in quality compliance. These challenges stymie the scaling up of domestic manufacturing. Furthermore, fluctuations in global whey prices reverberate through Indian consumer pricing. This volatility introduces demand elasticity hurdles, curbing market growth, especially when import costs surge.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of e-commerce and D2C health-nutrition brands

- Government PLI incentives for dairy-protein processing

- Rising popularity of plant-based protein alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Whey Protein Concentrate continues to dominate the India Whey Protein Market, holding a significant 41.37% market share in 2024. This dominance is attributed to its affordability and widespread availability, making it a preferred choice among cost-conscious mass consumers. The concentrate segment caters to a broad audience, including individuals seeking basic protein supplementation for general health and fitness. Its relatively lower price point compared to isolates makes it accessible to a larger demographic, particularly in price-sensitive markets. However, the segment faces challenges from increasing consumer awareness about lactose intolerance and the growing demand for cleaner, more refined protein options.

Whey Protein Isolate, on the other hand, is experiencing robust growth, with a projected CAGR of 6.18% through 2030, significantly outpacing the overall market growth. This segment benefits from rising consumer sophistication and a willingness to invest in premium products that offer higher protein content and reduced lactose levels. The isolate segment is particularly appealing to fitness enthusiasts and health-conscious consumers who prioritize cleaner nutritional profiles and superior quality. Additionally, the increasing awareness of lactose intolerance in India further drives demand for isolates, as they cater to individuals seeking protein supplements with minimal lactose content. This growing preference for isolates highlights a clear market bifurcation between cost-driven and quality-focused consumer segments.

The India Whey Protein Market Report is Segmented by Product Type (Whey Protein Concentrate, Whey Protein Isolate, Hydrolyzed Whey Protein), Category (Mass, Premium), Distribution Channel (Online Retail, Supermarkets and Hypermarkets, Health and Wellness Stores, Other Distribution Channels). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Parag Milk Foods Ltd

- Gujarat Cooperative Milk Mktg Federation

- Glanbia PLC

- Bright Lifecare Pvt. Ltd.

- GNC Holdings, LLC

- MyFitFuel

- The Hut Group

- AS-IT-IS Nutrition

- Bigmuscles Nutrition Pvt. Ltd.

- Medisysbiotech Pvt Ltd

- BellRing Brands, Inc.

- Fast&Up (Aeronutrix)

- Nutricore Biosciences Pvt. Ltd.

- Herbalife Nutrition Ltd.

- Ultimate Nutrition, Inc.

- One Science Nutrition

- Asitis Nutrition

- MAXN India Pvt. Ltd.

- Advance Nutratech (Advance MuscleMass)

- Labrada Nutrition, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising sports and gym culture among millennials and gen z

- 4.2.2 Growing awareness of protein deficiency in indian diets

- 4.2.3 Expansion of e-commerce and D2C health-nutrition brands

- 4.2.4 Increasing adoption of whey in infant-nutrition formulas

- 4.2.5 Government PLI incentives for dairy-protein processing

- 4.2.6 Surge in female recreational-fitness participation

- 4.3 Market Restraints

- 4.3.1 High import dependence and volatile whey prices

- 4.3.2 Rising popularity of plant-based protein alternatives

- 4.3.3 Stringent FSSAI compliance and testing costs

- 4.3.4 Limited cold-chain for RTD whey beverages

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Whey Protein Concentrate

- 5.1.2 Whey Protein Isolate

- 5.1.3 Hydrolyzed Whey Protein

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 By Distribution Channel

- 5.3.1 Online Retail

- 5.3.2 Supermarkets and Hypermarkets

- 5.3.3 Health and Wellness Stores

- 5.3.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Parag Milk Foods Ltd

- 6.4.2 Gujarat Cooperative Milk Mktg Federation

- 6.4.3 Glanbia PLC

- 6.4.4 Bright Lifecare Pvt. Ltd.

- 6.4.5 GNC Holdings, LLC

- 6.4.6 MyFitFuel

- 6.4.7 The Hut Group

- 6.4.8 AS-IT-IS Nutrition

- 6.4.9 Bigmuscles Nutrition Pvt. Ltd.

- 6.4.10 Medisysbiotech Pvt Ltd

- 6.4.11 BellRing Brands, Inc.

- 6.4.12 Fast&Up (Aeronutrix)

- 6.4.13 Nutricore Biosciences Pvt. Ltd.

- 6.4.14 Herbalife Nutrition Ltd.

- 6.4.15 Ultimate Nutrition, Inc.

- 6.4.16 One Science Nutrition

- 6.4.17 Asitis Nutrition

- 6.4.18 MAXN India Pvt. Ltd.

- 6.4.19 Advance Nutratech (Advance MuscleMass)

- 6.4.20 Labrada Nutrition, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK