PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906961

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906961

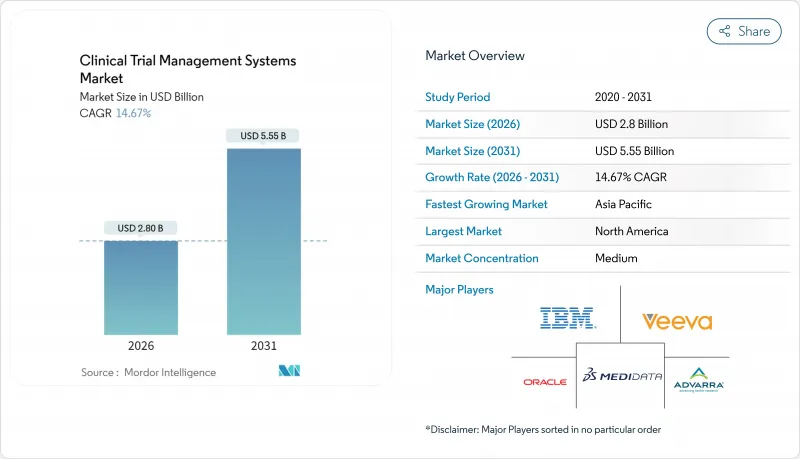

Clinical Trial Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Clinical Trial Management Systems market is expected to grow from USD 2.44 billion in 2025 to USD 2.8 billion in 2026 and is forecast to reach USD 5.55 billion by 2031 at 14.67% CAGR over 2026-2031.

Rising digital maturity across pharmaceutical research, tighter transparency rules, and the growing complexity of protocol design are the main forces behind this climb. Cloud computing adoption, artificial-intelligence-enabled analytics, and an outsourcing wave that pushes specialist Contract Research Organizations (CROs) into central roles all reinforce demand for modern platforms. The shift toward decentralized and hybrid trials also enlarges the addressable base for real-time oversight tools that link sponsors, investigators, and patients. Vendors that marry regulatory expertise with flexible deployment models are winning contracts as buyers move away from fragmented point solutions toward integrated clinical ecosystems.

Global Clinical Trial Management Systems Market Trends and Insights

Expanding Global Clinical Trial Volume

Oncology alone registered more than 28 million new cases in 2024, a rise that fuels record numbers of interventional studies worldwide. Global sponsors react by expanding trial footprints into new countries and indications, which raises the load on project managers and data stewards. Enterprise-wide platforms within the clinical trial management system (CTMS) market gain traction because they let central teams plan, budget, and track endpoints across multi-site, multi-arm programs in one workspace. ICON plc more than doubled revenue between 2020 and 2024 by scaling such integrated services to meet this surge. Heightened demand also stimulates investment in analytics modules that spot enrollment lags early and help sponsors shift resources before timelines drift.

Shift Toward Cloud-Based Clinical Solutions

COVID-19 lockdowns proved that remote monitoring is viable and often more efficient than on-site visits. Since then, sponsors have replaced aging on-premise stacks with cloud tools that provide instant data access, automated audit trails, and secure collaboration for globally dispersed teams. Hybrid and hosted private cloud options expand at 16.45% because they blend public-cloud agility with private-cloud controls that satisfy regional privacy statutes. Vendors that guide customers through data migration and validation win long contracts, while those tied to legacy architectures risk shrinking footprints.

High Implementation and Maintenance Costs

An enterprise-wide deployment often requires USD 5 million over five years once licenses, validation, and integration are counted. In regions where clinical budgets remain lean, this capital burden slows adoption. Added service layers-such as 21 CFR Part 11 validation-can raise total cost by 30% to 50%. Vendors are responding with modular subscriptions and accelerated "configure-not-code" templates that lower up-front risk, but sticker shock persists for mid-size biotechs.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Mandates for Trial Data Transparency

- Growing Adoption of Outsourced Research Models

- Data Security and Privacy Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud-based systems kept a 57.22% revenue lead in 2025, confirming that the CTMS market favors web-native tools for speed and collaboration. Hybrid deployments rise at 16.12% CAGR because they let sponsors park sensitive datasets on internal servers while streaming operational dashboards from the cloud. This flexibility is essential for companies that conduct oncology trials in both the European Union and China, two regions with divergent data-sovereignty laws.

Hybrid designs also extend the clinical trial management systems market life of older on-premise assets. Many mid-tier biopharma firms still run validated middleware that links to lab instruments. A hybrid bridge lets them keep those investments live while layering modern enrollment and site-payment modules on top. Vendors with proven migration roadmaps therefore see higher renewal rates, while pure-play on-premise providers lose ground rapidly.

Software licenses drove 63.88% of the clinical trial management system market revenue in 2025, reflecting the foundational role of core databases, scheduling tools, and monitoring dashboards. Yet services expand at 16.48% CAGR, highlighting buyer need for configuration, user training, and audit readiness. Every cross-border study triggers localization, language support, and regulatory validation tasks that sponsors are rarely staffed to manage internally.

The clinical trial management systems market size for implementation services is swelling as precision-medicine protocols raise data-integration demands. Modern oncology trials now ingest radiology images, patient-reported outcomes, and laboratory genomics in near-real time. Specialist integrators stitch these feeds into unified workstreams and document each workflow for regulators. Vendors that combine software with managed service bundles thus capture larger share of wallet.

The Clinical Trial Management Systems Market Report is Segmented by Delivery Mode (On-Premise, and More), Component (Software and Services), Type (Enterprise-Wide CTMS, and More), Clinical Trial Phase (Phase I, and More), End User (Medical Device Manufacturers, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America produced 35.12% of the clinical trial management systems market revenue in 2025, due to its dense sponsor base, experienced investigator networks, and predictable regulatory guidance. Large enterprises routinely roll out platform upgrades across U.S. and Canadian sites first because talent pools understand 21 CFR Part 11 validation and HIPAA rules. Growth, however, slows compared with earlier years as the region approaches saturation in Tier-1 pharma accounts.

Asia-Pacific returns the fastest 15.56% CAGR and is set to expand the clinical trial management systems market size materially over the next five years. China's streamlined Human Genetic Resources Administration Office procedures and India's New Drugs and Clinical Trial Rules both simplify start-up timelines, inviting multinational studies. Governments also employ incentives such as tax credits to grow local biotech scenes, creating fresh pools of domestic buyers. Vendors that offer multilingual support and local hosting benefit most.

Europe contributes steady mid-single-digit growth as the EU Clinical Trials Regulation harmonizes approvals across member states. Sponsors value the continent for scientific expertise and high-quality data, yet Brexit complicates UK-EU cross-border submissions, forcing dual workflows inside some platforms. The Middle East & Africa and South America collectively form a smaller slice today, but improvements in research infrastructure and public-health funding make them attractive for late-phase patient recruitment. Vendors active in these regions can secure a foothold in the broader clinical trial management system market.

- Oracle Corp.

- Dassault Systmes (Medidata)

- Veeva Systems

- IBM Corp.

- Advarra

- Aris Global

- Calyx

- MedNet Solutions

- DATATRAK Intl

- Bioclinica (Clario)

- RealTime Software Solutions

- ERT Clinical (IQVIA Technologies)

- DZS Clinical Services

- PAREXEL Intl

- OpenClinica

- Anju Software

- ICON

- IQVIA Holdings

- eClinicalWorks

- Trial By Fire Solutions (SimpleTrials)

- Xybion Digital

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Global Clinical Trial Volume

- 4.2.2 Shift Toward Cloud-Based Clinical Solutions

- 4.2.3 Regulatory Mandates for Trial Data Transparency

- 4.2.4 Growing Adoption of Outsourced Research Models

- 4.2.5 Increasing Complexity of Trial Protocols

- 4.2.6 Rising Demand for Real-Time Trial Oversight

- 4.3 Market Restraints

- 4.3.1 High Implementation and Maintenance Costs

- 4.3.2 Data Security and Privacy Concerns

- 4.3.3 Limited Adoption in Emerging Markets

- 4.3.4 Integration Challenges with Legacy Systems

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitutes

- 4.5.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Delivery Mode

- 5.1.1 On-Premise

- 5.1.2 Cloud-Based

- 5.1.3 Hybrid / Hosted Private Cloud

- 5.2 By Component

- 5.2.1 Software

- 5.2.2 Services

- 5.3 By Type

- 5.3.1 Enterprise-Wide CTMS

- 5.3.2 Site CTMS

- 5.3.3 eClinical Platform-Integrated CTMS

- 5.4 By Clinical Trial Phase

- 5.4.1 Phase I

- 5.4.2 Phase II

- 5.4.3 Phase III

- 5.4.4 Phase IV / Post-Marketing

- 5.5 By End User

- 5.5.1 Pharmaceutical and Biotechnological Companies

- 5.5.2 Medical Device Manufacturers

- 5.5.3 Contract Research Organizations (CROs)

- 5.5.4 Other End Users

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.5.3.1 GCC

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials As Available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Oracle Corp.

- 6.3.2 Dassault Systmes (Medidata)

- 6.3.3 Veeva Systems

- 6.3.4 IBM Corp.

- 6.3.5 Advarra

- 6.3.6 ArisGlobal

- 6.3.7 Calyx

- 6.3.8 MedNet Solutions

- 6.3.9 DATATRAK Intl

- 6.3.10 Bioclinica (Clario)

- 6.3.11 RealTime Software Solutions

- 6.3.12 ERT Clinical (IQVIA Technologies)

- 6.3.13 DZS Clinical Services

- 6.3.14 PAREXEL Intl

- 6.3.15 OpenClinica

- 6.3.16 Anju Software

- 6.3.17 ICON Plc

- 6.3.18 IQVIA Holdings

- 6.3.19 eClinicalWorks

- 6.3.20 Trial By Fire Solutions (SimpleTrials)

- 6.3.21 Xybion Digital

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment