PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851966

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851966

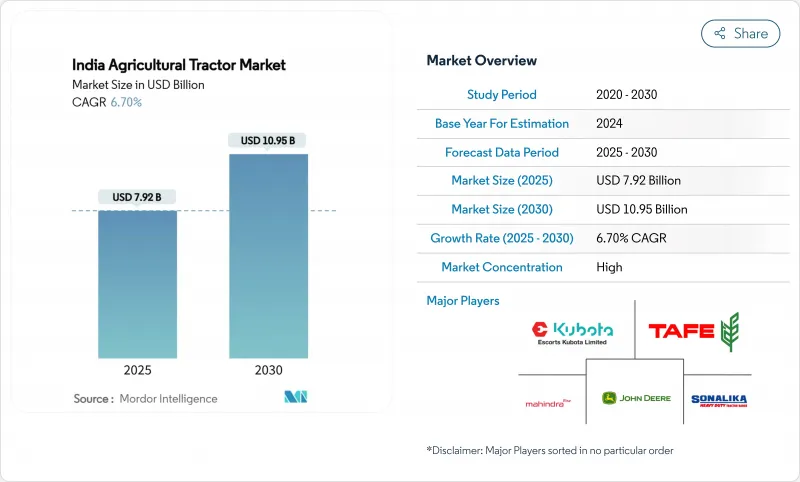

India Agricultural Tractor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India agricultural tractor market size stands at USD 7.92 billion in 2025 and is forecast to reach USD 10.95 billion by 2030, advancing at a 6.70% CAGR.

Growth is tied to direct-benefit transfer programs, emission compliance deadlines, and state-backed mechanization funds that shape procurement cycles. Expanding solar pump coverage, rapid digitalization of used-equipment platforms, and precision-agriculture adoption are widening the customer base, while a gradually tightening credit environment tempers momentum. Regional demand is highly concentrated in the northern plains, and western states have recently registered the quickest expansion as diversified crop portfolios justify premium equipment.

India Agricultural Tractor Market Trends and Insights

Subsidy-Linked Demand Spikes After PM-Kisan Direct Benefit Transfers

Quarterly PM-Kisan disbursements of INR 20,500 crore (USD 2.5 billion) in August 2025 infused liquidity that lifted tractor finance applications within six weeks Beneficiary farmers recently cover up to 20% of a down payment on 31-50 HP models, reinforcing cyclical surges that producers synchronize with payment calendars. The tractor industry in the Indian market, therefore, tracks fiscal flows more closely than crop-seasonality alone. Manufacturers hedge volatility by splitting production runs between mid-range volumes and premium variants, while dealers preload inventory before each installment release. Digital payment rails shrink leakages and make sales forecasting more reliable. As long as the annual INR 6,000 (USD 72) benefit stays intact, the tractor industry in the Indian market is likely to ride predictable liquidity waves.

Rapid Tractor Fleet Electrification Pilots in Sugar-Cane Belts

Subsidies covering up to 40% of e-tractor acquisition costs under the PM E-DRIVE (PM Electric Drive Revolution in Innovative Vehicle Enhancement) program have triggered pilots where cane cooperatives measure 60-70% fuel-cost savings per hour. Maharashtra and Uttar Pradesh leverage dense cane clusters that assure high utilization, boosting payback prospects. Early adopters retrofit sheds with 30 kW chargers linked to off-peak tariffs. Component makers report a nascent domestic ecosystem for traction batteries, thermal management, and compact inverters. The tractor industry in the Indian market sees electrification as an avenue to sidestep emission penalties and win ESG-minded buyers. While current pilot numbers are in the low hundreds, battery cost declines projected for 2027 could unlock mainstream uptake in the 25-35 HP range, especially where solar pumps already improve rural load factors.

Tightening Non-Road Emission Standards (TREM-V), Inflating Price Tags

Stage V limits for engines above 37 kW add emission after-treatment systems that raise factory costs by 8-12%. Larger OEMs (Original Equipment Manufacturers) localize DOC-DPF modules at new lines such as FPT's F28 plant in Noida. Smaller brands risk market exit or seeking contract manufacturing. Farmers front-load purchases of pre-stage tractors, causing a demand pull-forward in 2024-25 and a potential trough thereafter. Credit financiers split loan tenors so residual values align with regulatory obsolescence. Over time, cost pass-through will normalize as suppliers scale filter substrates and sensors, but an interim affordability gap dampens the tractor industry in the Indian market's growth.

Other drivers and restraints analyzed in the detailed report include:

- Formalization of Used-Tractor Marketplaces Improving Upgrade Cycles

- Minimum Support Price (MSP) indexation favoring mid-HP tractor sales

- Low Telematics Adoption is Limiting Financing Innovation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 31-50 HP band owns 46% of the tractor industry in India market share, anchored in plots of 1-3 hectares where versatility trumps specialized power. Farmers gravitate to engines that balance purchase price with fuel efficiency, especially after diesel price spikes. The 51-80 HP segment expands at a 9.3% CAGR as multi-crop rotations and baler adoption demand higher torque. Premiumization gathers pace because TREM-V compliance pushes base-model prices closer to feature-rich trims. GPS guidance, CAN-enabled implement control, and longer service intervals are becoming standard above 50 HP. Mahindra's thrust into sub-30 HP niches illustrates residual demand for micro-plots, yet financing hurdles temper growth. Above 80 HP units cater to contractors and export-crop estates but remain niche until consolidation advances.

Mid-range tractors increasingly embed telematics that capture hours, load, and fuel, assisting lenders with risk scoring. As used-tractor portals mature, residual values for 31-50 HP units strengthen, further validating ownership economics. Field trials show a 12% productivity lift when mid-HP tractors pair with minimal-tillage implements, especially in rice-wheat systems across the Indo-Gangetic plain. High-HP modules leverage robotic shift transmissions and electro-hydraulic steering to cut operator fatigue, but adoption hinges on wage inflation and custom-hiring density. The tractor industry in the Indian market thus sees power-band stratification: value retention in mid-range, innovation in upper tiers, and affordability pressure in sub-compact classes.

The India Tractor Market Report is Segmented by Engine Power (Less Than 30 HP, 31-50 HP, and More), by Drive Type (Two-Wheel Drive and Four-Wheel Drive), and by Application (Row Crop Tractors, Orchard Tractors, and Other Applications). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mahindra&Mahindra Ltd.

- Tractors and Farm Equipment Limited

- Escorts Kubota Limited.

- Deere & Company

- CNH Industrial N.V.

- Sonalika Group (International Tractors Limited (ITL)

- VST Tillers Tractors Limited

- Same Deutz-Fahr India Private Limited (SDF Group S.p.A.)

- Indo Farm Equipment Limited

- Captain Tractors Pvt. Ltd.

- Action Construction Equipment Limited

- Preet Tractors Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Subsidy-linked demand spikes after PM-Kisan Direct Benefit transfers

- 4.2.2 Rapid tractor fleet electrification pilots in sugar-cane belts

- 4.2.3 Formalization of used-tractor marketplaces improving upgrade cycles

- 4.2.4 Minimum Support Price (MSP) indexation favoring mid-HP tractor sales

- 4.2.5 Drone-ready hitching systems boosting cross-selling

- 4.2.6 On-farm solar-pump schemes raising tractor PTO (Power take-off) utilization

- 4.3 Market Restraints

- 4.3.1 Tightening non-road emission standards (TREM-V) inflating price tags

- 4.3.2 Persistent land-holding fragmentation below 1 hectare

- 4.3.3 Low telematics adoption limiting financing innovation

- 4.3.4 Stagnant rural credit growth post-NBFC (Non-Banking Financial Company) liquidity crunch

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Engine Power

- 5.1.1 Less than 30 HP

- 5.1.2 31-50 HP

- 5.1.3 51-80 HP

- 5.1.4 Above 80 HP

- 5.2 By Drive Type

- 5.2.1 Two-wheel Drive

- 5.2.2 Four-wheel Drive

- 5.3 By Application

- 5.3.1 Row-Crop Tractors

- 5.3.2 Orchard Tractors

- 5.3.3 Other Applications

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Mahindra&Mahindra Ltd.

- 6.4.2 Tractors and Farm Equipment Limited

- 6.4.3 Escorts Kubota Limited.

- 6.4.4 Deere & Company

- 6.4.5 CNH Industrial N.V.

- 6.4.6 Sonalika Group (International Tractors Limited (ITL)

- 6.4.7 VST Tillers Tractors Limited

- 6.4.8 Same Deutz-Fahr India Private Limited (SDF Group S.p.A.)

- 6.4.9 Indo Farm Equipment Limited

- 6.4.10 Captain Tractors Pvt. Ltd.

- 6.4.11 Action Construction Equipment Limited

- 6.4.12 Preet Tractors Private Limited

7 Market Opportunities and Future Outlook