PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851979

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851979

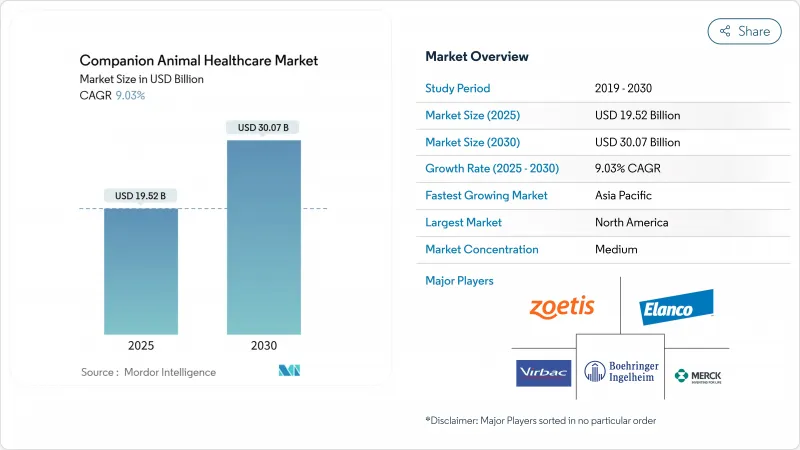

Companion Animal Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The companion animal healthcare market size reached USD 19.52 billion in 2025 and is forecast to advance to USD 30.07 billion by 2030, reflecting a 9.03% CAGR.

Rising pet humanization, steady roll-outs of AI-enabled diagnostics, and the diffusion of subscription wellness plans have broadened both demand and access to veterinary services. Breakthrough monoclonal antibodies are strengthening the therapeutics portfolio, while point-of-care (POC) analyzers shorten diagnostic turn-around times and improve clinical decision-making. Digital commerce channels continue to scale, complementing the traditional clinic model by linking teleconsultation, pharmacy fulfillment, and home delivery. Geographically, North America retains the largest revenue pool, yet Asia-Pacific represents the fastest-growing arena as urbanization and disposable incomes climb.

Global Companion Animal Healthcare Market Trends and Insights

Increase in Pet Adoption & "Humanization" of Animals

Pet humanization has shifted spending priorities; 66% of owners are willing to consider life-extending medicines, and median monthly outlays rose to USD 260 in 2024. Chinese surveys show 55% of owners now view pets as children, spurring premium-care purchases. Wellness budgets increasingly favor quality-of-life drugs, advanced imaging, and tailored nutrition. Insurance uptake echoes this change, with 45% of dog parents and 36% of cat parents holding policies, embedding veterinary care into household financial planning.

Expanding Penetration of Pet Insurance

Premiums reached USD 4.5 billion in 2024, more than double 2019 levels. The top 10 carriers control 90% of the market, sharpening product design and underwriting efficiency. Regulatory clarity arrived via the 2024 NAIC Pet Insurance Model Act, which separates preventive wellness add-ons from true risk-transfer products. However, medical inflation prompted Nationwide to exit 100,000 contracts, illustrating cost-containment pressures even as distribution partnerships-such as Petco plus Nationwide-seek scale advantages.

Escalating Veterinary Service & Drug Costs

Care costs climbed 60% since 2014, outpacing overall inflation. Corporate groups wield pricing power; Mars Veterinary Health controls nearly half of corporate-owned clinics. Higher bills reduced 2024 visit volumes by 2.3% and lengthened intervals between check-ups by 48%. Legislators are responding: the proposed PAW Act would allow HSA/FSA disbursement up to USD 1,000, while the Department of Defense now reimburses military families USD 2,000 for pet relocation, partially softening affordability barriers.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of Advanced In-Clinic & POC Diagnostics

- Boom in Chronic-Care Monoclonal Antibodies (MAbs)

- Proliferation of Counterfeit/Grey-Market Medicines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The therapeutics segment commanded 42.78% of the companion animal healthcare market in 2024, buoyed by vaccines, parasiticides, and rapid monoclonal antibody uptake. Bedinvetmab's performance helped Zoetis push its companion portfolio 18% higher in Q3 2024. Preventive vaccines maintain an essential role, though parasiticide revenue is leaking to retail channels. Generic competition curbs anti-infective growth, and antimicrobial resistance keeps regulatory scrutiny intense.

Diagnostics post the fastest 12.58% CAGR through 2030, signaling structural change toward precision medicine. AI-enabled analyzers combine hematology, urinalysis, and imaging in unified platforms, reducing diagnostic turnaround from days to minutes. Clinics using POC devices report improved client adherence and incremental revenue gains. The companion animal healthcare market size for diagnostics is projected to scale materially as machine learning cuts interpretation variability and drives evidence-based care models.

The Companion Animal Healthcare Market Report is Segmented by Product Type (Therapeutics, Diagnostics, and Digital Health & Services), Animal Type (Dogs, Cats, and Other Animal Types), Distribution Channel (Veterinary Hospitals & Clinics, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 42.32% of 2024 global revenue as mature insurance penetration, advanced practice infrastructure, and loyalty programs like Banfield's preventive plans underpin sustained spend. Consolidation reshaped the landscape when Chubb combined Healthy Paws and a USD 8.6 billion multi-clinic merger to form a 750-location network. Despite scale, veterinarian shortages threaten access; projections warn that 75 million pets could lack care by 2030, prompting regulatory push for incentives.

Asia-Pacific is the fastest-growing territory at a 10.31% CAGR, spurred by rising urban middle-class households. China's pet healthcare sector touched 1,062 billion yuan in 2022 after a 17.7% compound climb since 2015, yet clinic density lags the United States. In South Korea, lifestyle surveys reveal younger adults preferring pets over children, channeling discretionary funds into premium care. Australia demonstrates a mature sub-market, with Zoetis' USD 484 million 2023 sales and its Melbourne manufacturing acquisition signaling long-term regional anchoring.

Europe records steady expansion aided by robust veterinary curricula and harmonized medicine regulation. Bedinvetmab's simultaneous roll-out across France, Germany, Italy, Spain, and the UK validates appetite for advanced biologics. Sustainability imperatives influence treatment choices, favoring products with reduced carbon footprints and animal welfare credentials. Cross-border investment remains active as EQT acquired VetPartners, adding 267 clinics to its network and illustrating the continent's integrated service ambitions.

- Zoetis

- Boehringer Ingelheim

- Elanco

- IDEXX

- Virbac

- Merck Animal Health (MSD)

- Ceva

- Phibro Animal Health

- Mars Veterinary Health (Banfield & VCA)

- Covetrus

- Heska

- Dechra Pharmaceuticals plc

- Vetoquinol

- Neogen Corp.

- Norbrook Laboratories

- KRKA d.d.

- Zomedica Corp.

- PetIQ Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Pet Adoption & Humanization of Animals

- 4.2.2 Expanding Penetration of Pet Insurance

- 4.2.3 Rapid Uptake of Advanced In-Clinic & POC Diagnostics

- 4.2.4 Boom in Chronic-Care Monoclonal Antibodies (Mabs) for OA & Dermatology

- 4.2.5 Commercialisation of Microbiome-Based Therapeutics

- 4.2.6 Subscription-Based Wellness Plans by Vet-Clinic Chains

- 4.3 Market Restraints

- 4.3.1 Escalating Veterinary Service & Drug Costs

- 4.3.2 Proliferation of Counterfeit/Grey-Market Medicines

- 4.3.3 Global Shortage of Skilled Veterinarians & Vet Techs

- 4.3.4 Regulatory Lag for Gene-Editing & Cell-Therapy Products

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Therapeutics

- 5.1.1.1 Vaccines

- 5.1.1.2 Parasiticides

- 5.1.1.3 Anti-infectives

- 5.1.1.4 NSAIDs & Pain Management

- 5.1.1.5 Monoclonal Antibodies

- 5.1.1.6 Medical Feed Additives

- 5.1.1.7 Other Therapeutics

- 5.1.2 Diagnostics

- 5.1.2.1 Immunodiagnostic Tests

- 5.1.2.2 Molecular Diagnostics

- 5.1.2.3 Diagnostic Imaging

- 5.1.2.4 Point-of-care Testing Devices

- 5.1.2.5 Other Diagnostics

- 5.1.3 Digital Health & Services

- 5.1.3.1 Tele-medicine Platforms

- 5.1.3.2 Practice-management Software

- 5.1.3.3 Wearable Monitoring Devices

- 5.1.1 Therapeutics

- 5.2 By Animal Type

- 5.2.1 Dogs

- 5.2.2 Cats

- 5.2.3 Other Animal Types

- 5.3 By Distribution Channel

- 5.3.1 Veterinary hospitals & clinics

- 5.3.2 Retail pharmacies

- 5.3.3 Online / e-commerce platforms

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Zoetis Inc.

- 6.3.2 Boehringer Ingelheim Animal Health

- 6.3.3 Elanco Animal Health

- 6.3.4 IDEXX Laboratories Inc.

- 6.3.5 Virbac

- 6.3.6 Merck Animal Health (MSD)

- 6.3.7 Ceva Sant Animale

- 6.3.8 Phibro Animal Health Corp.

- 6.3.9 Mars Veterinary Health (Banfield & VCA)

- 6.3.10 Covetrus Inc.

- 6.3.11 Heska Corp.

- 6.3.12 Dechra Pharmaceuticals plc

- 6.3.13 Vetoquinol SA

- 6.3.14 Neogen Corp.

- 6.3.15 Norbrook Laboratories

- 6.3.16 KRKA d.d.

- 6.3.17 Zomedica Corp.

- 6.3.18 PetIQ Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment