PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851980

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851980

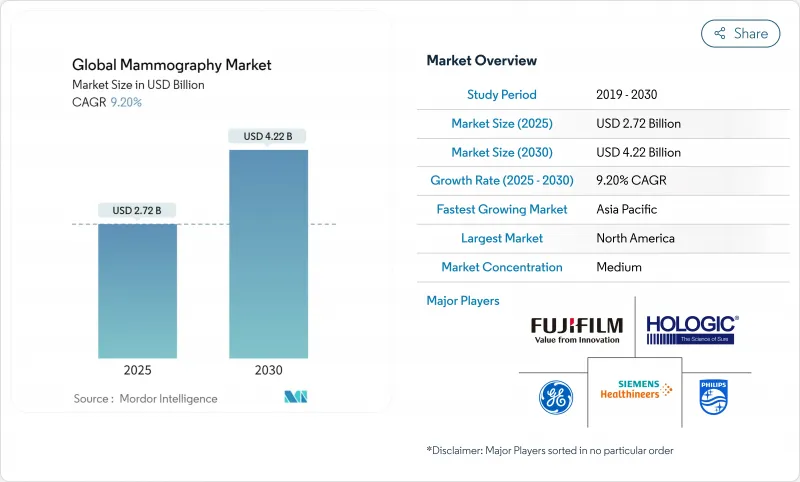

Global Mammography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The mammography systems market size stood at USD 2.72 billion in 2025 and is forecast to reach USD 4.22 billion by 2030 at a 9.20% CAGR.

Sustained growth comes from the convergence of rising breast-cancer incidence, rapid diffusion of 3-D tomosynthesis, and regulatory approvals for artificial-intelligence (AI) triage that ease radiologist workload. Broader screening access through mobile units, coupled with capital-grant programs in emerging economies, widens the purchasing base for both entry-level digital and premium photon-counting platforms. Competitive intensity sharpens as vendors integrate proprietary algorithms that raise cancer-detection sensitivity and trim false-positive rates; these performance gains justify premium pricing even as reimbursement schedules tighten. The mammography systems market also benefits from dose-optimized imaging advances that temper consumer radiation anxieties and strengthen providers' quality-of-care metrics.

Global Mammography Market Trends and Insights

Growing Burden of Breast Cancer

Global breast-cancer incidence continues to climb, with 385,837 new cases reported in China in 2022 alone, reinforcing the need for widespread screening infrastructure. Urbanization, later childbearing, and lifestyle shifts are pushing incidence curves upward, especially across Asia-Pacific. Policymakers respond by embedding population-wide mammography targets into national non-communicable-disease strategies, positioning the mammography systems market as a public-health priority. Early detection lowers therapy costs and raises five-year survival odds, so ministries of health channel investment toward mobile units and breast-health outreach in peri-urban districts. This epidemiological pressure creates a resilient baseline for equipment demand that is largely insulated from macroeconomic cycles.

Technological Shift to 3-D/AI-Enabled Imaging

Digital breast tomosynthesis detects 5.3 cancers per 1,000 screens versus 4.0 for 2-D mammography, while lowering recall rates to 7.2%. Multi-vendor AI triage amplifies these gains; the MASAI trial logged a 29% lift in cancer detection and a 44.2% cut in reader workload. Health systems absorb higher capital costs because throughput and diagnostic accuracy translate into tangible cost-of-care savings. Consequently, the mammography systems market rewards manufacturers with integrated algorithm portfolios, expansive regulatory clearances, and agile upgrade pathways. Facilities that lag in 3-D adoption risk reimbursement penalties and patient out-migration, fueling a technology-upgrade race.

Radiation-Dose Related Consumer Push-Back

Although modern systems limit exposure to 0.4-1 mSv per exam, public perception of radiation risk can suppress screening adherence, especially in countries that now mandate density notifications under MQSA amendments . Social-media amplification of dose concerns forces providers to allocate chair-time to counseling and to invest in low-dose protocols. Manufacturers promote photon-counting technology and patient-education apps to mitigate hesitancy, yet lingering anxiety drags utilization rates and, by extension, refresh cycles within the mammography systems market.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Public-Private Screening Campaigns

- Capital Grants in Emerging Economies

- Shrinking Reimbursement Rates in OECD

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital platforms represented 62.34% of mammography systems market share in 2024, yet 3-D tomosynthesis is racing ahead at 9.82% CAGR to 2030. Superior lesion conspicuity and a clinically proven reduction in false positives drive hospital committees to re-allocate capital budgets toward tomosynthesis fleets, despite premium acquisition costs. Retrofit digital kits remain relevant among cost-sensitive clinics, but stringent screening-program accreditation rules across Europe are accelerating analog retirement. Contrast-enhanced systems, boasting 95.9% sensitivity in dense breasts, are carving a niche within tertiary oncology centers, signaling further product-mix sophistication for the mammography systems market.

The dual-tier structure persists: value-oriented purchasers in Africa, South Asia, and parts of Latin America rely on computed-radiography kits that extend analog lifespan, while tech-forward institutions in North America and Japan leapfrog to AI-ready 3-D suites. Vendors are thus compelled to maintain split product roadmaps, balancing affordability with innovation. As retrofits phase out post-2028, the mammography systems market size attributable to analog derivatives is projected to shrink, freeing capital toward photon-counting and contrast-enhanced units.

Photon-counting detectors, expanding at 10.03% CAGR, promise lower dose and higher spatial resolution, making them a strategic anchor for flagship portfolios. Despite 2-D full-field digital holding 50.35% of the mammography systems market size in 2024, replacement demand tilts decisively toward technologies that embed AI CAD. RadNet's USD 103 million purchase of iCAD underscores how service providers view proprietary algorithms as competitive moats. Regulatory benches in the U.S. and EU are streamlining AI-supplemental filings, removing historical launch bottlenecks and compressing time-to-market for iterative software releases.

The mammography systems market favors suppliers that can demonstrate multi-modal integration-combining wide-angle tomosynthesis, contrast enhancement, and AI triage in a single workflow. Siemens' Mammomat B.brilliant delivers a 5-second sweep with 50° coverage, showing how hardware refresh cycles now revolve around throughput as much as image quality. Second-generation photon-counting prototypes aim for detector cost reductions through fabrication optimizations, potentially democratizing access to the technology after 2027.

The Mammography Systems Market Report is Segmented by Product Type (Digital Systems, and More), Technology (2-D Full-Field Digital, and More), Imaging Modality (Screening, Diagnostic, and More), End User (Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Others), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 42.85% of mammography systems market share in 2024, anchored by established screening guidelines and rapid AI adoption. Yet 1,400+ unfilled radiologist vacancies and Medicare's 9.67% tomosynthesis fee reduction will moderate replacement demand through 2026. Providers counter by deploying AI triage to bridge staffing gaps, which maintains modality-utilization levels while extending hardware life cycles. Canada channels federal breast-health funding toward northern-territory mobile units, reflecting sustained commitment to equitable access despite fiscal headwinds.

Asia-Pacific registers a 10.54% CAGR, the fastest worldwide, propelled by China's ballooning incidence and India's state-led health-insurance schemes that subsidize mammography caravans. Indonesia's blended-finance procurement underscores the role of multilateral banks in scaling infrastructure. Japan, South Korea, and Singapore already embrace 3-D tomosynthesis, while Southeast Asian markets emphasize rugged, portable units that traverse archipelagic geographies. The mammography systems market thus spans a spectrum from high-end photon-counting installations in Tokyo to battery-powered vans servicing Indonesian islands.

Europe's mature screening programs sustain steady but restrained growth. The Medical Device Regulation (EU) 2017/745, fully effective since 2021, tightens conformity-assessment timelines yet improves cross-border device-transfer transparency . The European Commission's 2023 endorsement of tomosynthesis as a superior technology boosts upgrade justification, particularly in Germany and the Nordics. Budget pressures and workforce shortages shift focus toward productivity-oriented features over next-gen detector upgrades, making AI software refreshes more palatable than complete hardware replacements in the mammography systems market.

- FUJIFILM

- GE Healthcare

- Hologic

- Siemens Healthineers

- Koninklijke Philips

- Canon

- Carestream Health

- Konica Minolta

- Agfa-Gevaert

- Metaltronica

- General Medical Merate

- Planmed

- IMS srl

- Delphinus Medical Technologies

- Sectra

- Hitachi

- Mindray

- Analogic

- Varex Imaging

- iCAD Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden Of Breast Cancer

- 4.2.2 Technological Shift To 3-D/AI-Enabled Imaging

- 4.2.3 Expanding Public-Private Screening Campaigns

- 4.2.4 Capital Grants In Emerging Economies

- 4.2.5 AI-Based Triage Reimbursement Approvals

- 4.2.6 Mobile Mammography For Rural Outreach

- 4.3 Market Restraints

- 4.3.1 Radiation-Dose Related Consumer Push-Back

- 4.3.2 Shrinking Reimbursement Rates In OECD

- 4.3.3 Detector-Grade Semiconductor Shortages

- 4.3.4 Radiologist Staffing Gaps

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Digital Systems

- 5.1.2 3-D Breast Tomosynthesis Systems

- 5.1.3 Analog Systems

- 5.1.4 Computed-radiography Retrofit Kits

- 5.1.5 Contrast-enhanced Mammography Systems

- 5.2 By Technology

- 5.2.1 2-D Full-field Digital

- 5.2.2 3-D / Tomosynthesis

- 5.2.3 Photon-counting Digital

- 5.2.4 AI-enabled CAD & Image-triage

- 5.3 By Imaging Modality

- 5.3.1 Screening Mammography

- 5.3.2 Diagnostic Mammography

- 5.3.3 Interventional (Stereo-biopsy)

- 5.3.4 Intra-operative Specimen Imaging

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Imaging Centers

- 5.4.3 Ambulatory Surgical Centers

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Fujifilm Holdings Corporation

- 6.3.2 GE HealthCare

- 6.3.3 Hologic Inc.

- 6.3.4 Siemens Healthineers

- 6.3.5 Koninklijke Philips N.V.

- 6.3.6 Canon Medical Systems

- 6.3.7 Carestream Health

- 6.3.8 Konica Minolta Inc.

- 6.3.9 Agfa-Gevaert Group

- 6.3.10 Metaltronica SpA

- 6.3.11 General Medical Merate SpA

- 6.3.12 Planmed Oy

- 6.3.13 IMS srl

- 6.3.14 Delphinus Medical Technologies

- 6.3.15 Sectra AB

- 6.3.16 Hitachi Ltd.

- 6.3.17 Mindray Medical International

- 6.3.18 Analogic Corporation

- 6.3.19 Varex Imaging Corporation

- 6.3.20 iCAD Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment