PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851982

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851982

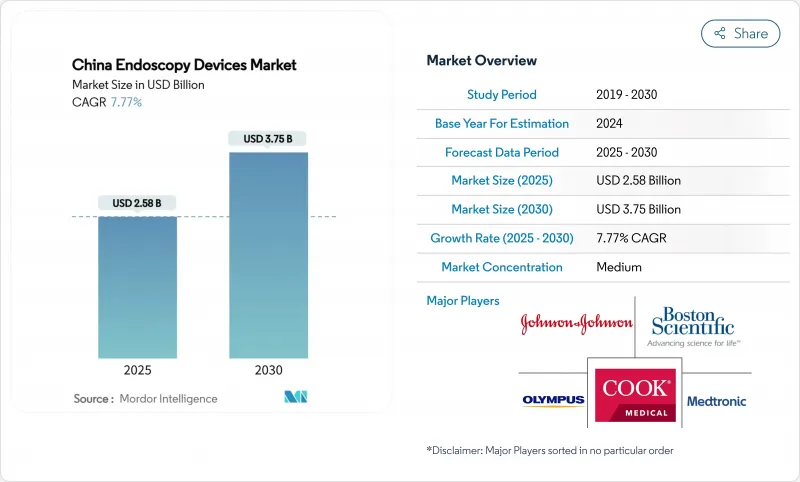

China Endoscopy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China endoscopy devices market is valued at USD 2.58 billion in 2025 and is forecast to reach USD 3.75 billion by 2030, expanding at a 7.77% CAGR.

Growth is underpinned by an aging population-26% of citizens will be at least 65 years old by 2050-together with national cancer-control goals that mandate earlier detection and wider procedural access. Rapid uptake of 4K/3D/AI visualization platforms, a shift toward single-use scopes, and wider insurance coverage for minimally invasive techniques are reinforcing demand. Domestic innovators are scaling output under the "Made in China 2025" localization target, eroding the longstanding dominance of imported models. Parallel investments in tertiary-hospital capacity and dedicated training hubs are easing procedural bottlenecks, while the National Medical Products Administration (NMPA) is accelerating approvals for high-technology systems. Collectively, these forces are creating multi-layered opportunities across hardware, software, and after-sales services inside the China endoscopy devices market.

China Endoscopy Devices Market Trends and Insights

Rising Prevalence of Gastrointestinal Diseases Coupled with Growing Aging Population

Gastrointestinal disorders are climbing in tandem with China's demographic shift toward later-life morbidity. Among citizens aged 80 and over, multimorbidity already affects 40.2% of individuals. Government-funded screening pilots show incremental cost-effectiveness ratios as low as USD 1,343 per QALY, confirming fiscal viability for large-scale roll-outs. These economics, combined with public awareness campaigns, drive steady throughput in colonoscopy and EGD suites inside the China endoscopy devices market.

Technological Advancements in Endoscopy Equipment

Artificial-intelligence engines now cut capsule-review time by 89.3% while boosting lesion detection to 95.9% versus manual reads. Robotic bronchoscopy systems such as the MONARCH platform extend reach to peripheral nodules, broadening therapeutic indications. Integrated 3D 4K fluorescence units combine depth perception, ultra-high definition, and real-time perfusion assessment to improve oncologic margins. Experimental Raman-enabled scopes promise histology-level insight without biopsies, signalling the next frontier in precision diagnostics. These breakthroughs collectively elevate clinical expectations, accelerating capital-equipment replacement cycles throughout the China endoscopy devices market.

High Cost of Advanced Endoscopy Systems

Capital prices for robotics and fluorescence units remain steep. A leading multi-port surgical robot, now discounted to spur uptake, still saw annual installations fall by nearly 30%. Annual service contracts, repair outlays, and intensive training add invisible overheads, discouraging budget-constrained hospitals. Competitive pricing by emerging local vendors is lowering the barrier, but full convergence with international cost structures is still several years away in the China endoscopy devices market.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Healthcare Infrastructure and Medical Tourism

- Government Initiatives and Support for Medical Devices

- Stringent Regulatory Approvals and Certification Processes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible instruments commanded a 48% revenue share in 2024, anchoring the China endoscopy devices market through routine GI, bronchial, and ENT work. Robot-assisted systems, however, represent the fastest CAGR at 14.7% through 2030, driven by demand for sub-millimeter control and integrated AI navigation. High-definition imaging, haptic feedback, and cloud analytics are converting once-experimental prototypes into daily-use assets, particularly for peripheral lung nodules and complex urologic lesions.

Manufacturers are layering fluorescence, 3D visualization, and deep-learning pathology prediction directly into robotic arms, compressing diagnostic and therapeutic cycles. Single-use flexible robots for airway management are also under evaluation, pairing infection-control benefits with mechanical stability. As these innovations roll out, the China endoscopy devices market size for robot platforms is set to outpace legacy categories, although disposable scope ecosystems will remain indispensable in high-volume respiratory clinics.

Gastrointestinal indications held 42% of 2024 value and remain the procedural backbone of the China endoscopy devices market. Yet respiratory care shows the steepest curve, with pulmonology devices forecast to rise at 10.2% CAGR on the back of air-pollution-induced COPD and lung-cancer screening mandates. Hospitals are expanding bronchoscopy capacities and adopting microwave ablation catheters that rely on endoscopic guidance for peripheral tumors.

Orthopedic centers are scaling arthroscopic sports-medicine programs, while interventional cardiology is experimenting with micro-endoscopes for valve inspection. ENT clinics maintain consistent demand for laryngoscopes amid rising voice-disorder awareness. Gynecology and neurosurgery remain smaller but high-complexity niches where 4K 3D views are critical. This diversified pipeline reinforces the resilience of the China endoscopy devices market across clinical cycles.

The China Endoscopy Devices Market Report is Segmented by Device Type (Endoscopes [Flexible Endoscope, and More], Endoscopic Operative Devices, and More), Application (Gastroenterology, Pulmonology, Orthopedic Surgery, and More), End User (Class III Hospitals, Specialty Clinics, and More), Hygiene (Reusable Endoscopes, and More), Technology (HD Imaging, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Olympus

- FUJIFILM

- Boston Scientific

- Medtronic

- Johnson & Johnson (Ethicon & Auris)

- Karl Storz

- Stryker

- PENTAX Medical (HOYA)

- Conmed

- Cook Group

- Mindray Bio-Medical Electronics

- Scivita Medical Technology

- Shanghai Aohua Photoelectricity Endoscope

- Jiangsu Vedkang Medical Sci-Tech

- Anrei Medical (Hangzhou)

- Shanghai MicroPort Endoscopy

- EndoFresh (Zhuhai)

- United Imaging Healthcare (UIH)

- Ambu

- Intuitive Surgical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Gastrointestinal Diseases Coupled with Growing Aging Population

- 4.2.2 Technological Advancements in Endoscopy Equipment

- 4.2.3 Expanding Healthcare Infrastructure and Medical Tourism

- 4.2.4 Government Initiatives and Support for Medical Devices

- 4.2.5 Growing Adoption of Minimally Invasive Procedures

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Endoscopy Systems

- 4.3.2 Stringent Regulatory Approvals and Certification Processes

- 4.3.3 Limited Reimbursement Policies and Low Insurance Coverage

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Endoscopes

- 5.1.1.1 Flexible Endoscope

- 5.1.1.2 Rigid Endoscope

- 5.1.1.3 Capsule Endoscope

- 5.1.1.4 Robot-Assisted Endoscope

- 5.1.1.5 Single-Use/Disposable Endoscope

- 5.1.2 Endoscopic Operative Devices

- 5.1.2.1 Energy & Hemostasis Systems

- 5.1.2.2 Access & Closure Devices

- 5.1.2.3 Insufflation Systems

- 5.1.3 Visualization Equipment

- 5.1.3.1 Endoscopic Cameras

- 5.1.3.2 HD Systems

- 5.1.3.3 4K / 3D / AI-Enabled Systems

- 5.1.4 Accessories & Reprocessing Devices

- 5.1.1 Endoscopes

- 5.2 By Application

- 5.2.1 Gastroenterology

- 5.2.2 Pulmonology

- 5.2.3 Orthopedic Surgery

- 5.2.4 Cardiology

- 5.2.5 ENT Surgery

- 5.2.6 Gynecology

- 5.2.7 Neurology

- 5.2.8 Pediatric Endoscopy

- 5.3 By End User

- 5.3.1 Class III Hospitals

- 5.3.2 Class II & I Hospitals

- 5.3.3 Ambulatory Surgery Centers (ASCs)

- 5.3.4 Specialty Clinics

- 5.4 By Hygiene

- 5.4.1 Reusable Endoscopes

- 5.4.2 Single-Use Endoscopes

- 5.4.3 Reprocessing & Sterilization Systems

- 5.5 By Technology

- 5.5.1 HD Imaging

- 5.5.2 4K / 3D Imaging

- 5.5.3 AI-Assisted Imaging (NBI, TXI, CADx)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Olympus Corporation

- 6.3.2 Fujifilm Holdings

- 6.3.3 Boston Scientific Corporation

- 6.3.4 Medtronic plc

- 6.3.5 Johnson & Johnson (Ethicon & Auris)

- 6.3.6 KARL STORZ SE & Co. KG

- 6.3.7 Stryker Corporation

- 6.3.8 PENTAX Medical (HOYA)

- 6.3.9 Conmed Corporation

- 6.3.10 Cook Medical

- 6.3.11 Mindray Bio-Medical Electronics

- 6.3.12 Scivita Medical Technology

- 6.3.13 Shanghai Aohua Photoelectricity Endoscope

- 6.3.14 Jiangsu Vedkang Medical Sci-Tech

- 6.3.15 Anrei Medical (Hangzhou)

- 6.3.16 Shanghai MicroPort Endoscopy

- 6.3.17 EndoFresh (Zhuhai)

- 6.3.18 United Imaging Healthcare (UIH)

- 6.3.19 Ambu A/S

- 6.3.20 Intuitive Surgical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment