PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851998

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851998

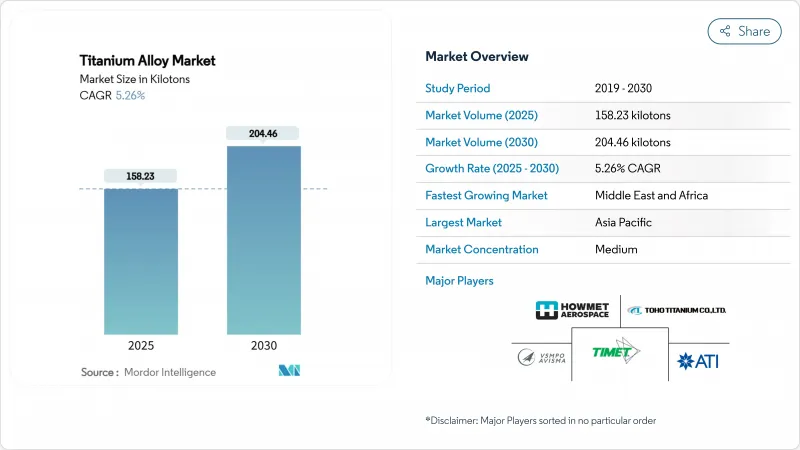

Titanium Alloy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Titanium Alloy Market size is estimated at 158.23 kilotons in 2025, and is expected to reach 204.46 kilotons by 2030, at a CAGR of 5.26% during the forecast period (2025-2030).

Consistent order backlogs at Boeing and Airbus, revived defense procurement cycles, and a widening medical-implant customer base anchor demand. Sustained performance hinges on titanium's high strength-to-weight ratio, corrosion resistance, and biocompatibility, traits that continue to outweigh its higher production cost in critical applications. Producers are adding melt capacity, often through hydrogen-assisted reduction or additive manufacturing, to alleviate supply bottlenecks, while customers diversify sourcing to mitigate geopolitical risk. Cost-down innovation and regulatory push for fuel-efficient aircraft further reinforce the growth narrative of the titanium alloy market.

Global Titanium Alloy Market Trends and Insights

Growing Aerospace and Defense Airframe Demand

Orders exceeding 15,000 commercial aircraft place titanium squarely in structural, landing-gear, and engine components, where weight reduction translates into fuel savings. ATI drew 66% of Q1 2025 revenue from aerospace and defense and locked in a five-year USD 1 billion supply pact with Airbus. Howmet Aerospace recorded 17% commercial-aerospace sales growth in Q3 2024 on surging engine demand. Titanium intensity now reaches 15-25% of a jet engine's weight, while defense programs specify the alloy for stealth and durability. Diversification away from Russian feedstock is driving new partnerships with Japanese and Middle Eastern suppliers, reinforcing the titanium alloy market's production realignment.

Military Ground-Vehicle Light-Weighting Programs

Defense planners increasingly swap steel for titanium in armor, drivetrains, and suspensions to boost range and payload without sacrificing protection. The U.S. Department of Defense's USD 47.1 million award to IperionX underscores a national push for secure, low-cost titanium capacity. NATO standards that harmonize material specifications amplify cross-border demand, and field data show 15-20% fuel savings when titanium components replace steel. Advanced manufacturing shortens part lists, easing maintenance burden for deployed vehicle fleets and fueling long-run momentum in the titanium alloy market.

High Production Cost and Complex Metallurgy

The legacy Kroll route burns 11-13 MWh per ton, making titanium 3-4 times pricier than aluminum and 10-15 times pricier than steel. Reactive metallurgy demands inert atmospheres and specialized cutting fluids, hampering productivity in downstream machining. Hydrogen-assisted reduction pathways promise lower temperatures but remain pre-commercial. University of Tokyo techniques for oxygen removal via yttrium reactions offer potential cost savings, yet industrial scaling is several years. Until new processes mature, elevated conversion costs cap the full potential of the titanium alloy market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Medical and Dental Implant Procedures

- Additive Manufacturing Unlocking Novel Grades

- Geopolitical Dependence on Russian Feedstock

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Beta alloys are projected to register a 6.14% CAGR through 2030, while Alpha-Beta grades retained 51.67% of the titanium alloy market share in 2024. Ti-5553 demonstrates superior castability, delivering high strength-to-weight ratios vital for wing-carry-throughs and landing-gear structures. Research into high-entropy intermetallics incorporating zirconium and hafnium achieves yield strengths of 1.5 GPa with 8% plastic strain, expanding options for hypersonic applications.

Ongoing additive-manufacturing deployments enable near-net-shape production, slashing buy-to-fly ratios by up to 60% and supporting intricate cooling-channel architectures in turbine blades. Beta alloys' titanium alloy market size is on track to close the decade at roughly 25% of overall volume, supported by synergistic gains in powder-atomization capacity and qualification tests for critical flight hardware. Parallel interest in Alpha and Near-Alpha alloys for temperatures above 500 °C preserves demand in gas turbines and space-propulsion contexts. As producers standardize vacuum-arc-remelting parameters, alloy chemistries stabilize, improving confidence among aerospace and defense primes.

The Titanium Alloy Report is Segmented by Microstructure (Alpha and Near-Alpha, Alpha-Beta, and Beta), End-User Industry (Aerospace, Automotive and Shipbuilding, Chemical Processing, Power and Desalination, Medical and Dental Implants, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Kilotons).

Geography Analysis

Asia-Pacific commanded 41.35% of the titanium alloy market in 2024, anchored by China's 60% share of global metal output. However, the region's aerospace certification gap curtails immediate penetration into high-value jet programs. India collaborates with HAL and DRDO on indigenous sponge capacity, while Australian miners explore downstream alloying to capture margin farther along the value chain. These initiatives collectively support robust volume gains, although quality hurdles remain.

The Middle East and Africa region, expanding at a 5.94% CAGR, benefits from Saudi Arabia's USD 46 billion mining strategy, which aims to lift mining GDP share to 75 billion by 2030 and position the kingdom as a neutral titanium supplier. North American consumption stays high despite minimal sponge output. Cumberland County, North Carolina, secured a USD 867 million plant to rebuild domestic capacity with hydrogen-assisted reduction that could supply 10,000 tons annually once fully operational. In Canada, Quebec's hydro-powered ilmenite operations explore vertically integrating into low-carbon sponge.

Across the Atlantic, European OEMs juggle sanction compliance and production continuity, prompting joint-venture discussions with Kazakh and Japanese suppliers; the EU's Critical Raw Materials Act expedites permitting for sponge projects in Norway and Spain. South America remains largely a raw-ore exporter, but Brazil's state development bank signals interest in co-financing downstream alloy plants near existing ilmenite mines. Overall, shifting supply footprints continue to reshape the titanium alloy market.

- ATI

- Alleima

- AMG

- BAOTI Group Co.,Ltd.

- Corporation VSMPO-AVISMA

- CRS Holdings, LLC

- Daido Steel Co., Ltd.

- Hermith GmbH

- Howmet Aerospace

- KOBE STEEL, LTD.

- OSAKA Titanium Technologies Co.,Ltd.

- Perryman Company

- PJSC VSMPO-AVISMA Corporation

- TIMET (Precision Castparts Corp.)

- Toho Titanium Co., Ltd.

- Weber Metals (OTTO FUCHS Kommanditgesellschaft)

- Western Superconducting Technologies Co., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Aerospace and Defense Airframe Demand

- 4.2.2 Military Ground-Vehicle Light-Weighting Programs

- 4.2.3 Expansion of Medical and Dental Implant Procedures

- 4.2.4 Additive Manufacturing Unlocking Novel Grades

- 4.2.5 Heat-Exchanger Demand in Emerging Hydrogen Economy

- 4.3 Market Restraints

- 4.3.1 High Production Cost and Complex Metallurgy

- 4.3.2 Limited Global Sponge Capacity

- 4.3.3 Geopolitical Dependence on Russian Feedstock

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Microstructure

- 5.1.1 Alpha and Near-Alpha

- 5.1.2 Alpha-Beta

- 5.1.3 Beta

- 5.2 By End-User Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive and Shipbuilding

- 5.2.3 Chemical Processing

- 5.2.4 Power and Desalination

- 5.2.5 Medical and Dental Implants

- 5.2.6 Other End-user Industries (Oil and Gas, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ATI

- 6.4.2 Alleima

- 6.4.3 AMG

- 6.4.4 BAOTI Group Co.,Ltd.

- 6.4.5 Corporation VSMPO-AVISMA

- 6.4.6 CRS Holdings, LLC

- 6.4.7 Daido Steel Co., Ltd.

- 6.4.8 Hermith GmbH

- 6.4.9 Howmet Aerospace

- 6.4.10 KOBE STEEL, LTD.

- 6.4.11 OSAKA Titanium Technologies Co.,Ltd.

- 6.4.12 Perryman Company

- 6.4.13 PJSC VSMPO-AVISMA Corporation

- 6.4.14 TIMET (Precision Castparts Corp.)

- 6.4.15 Toho Titanium Co., Ltd.

- 6.4.16 Weber Metals (OTTO FUCHS Kommanditgesellschaft)

- 6.4.17 Western Superconducting Technologies Co., Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment