PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907276

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907276

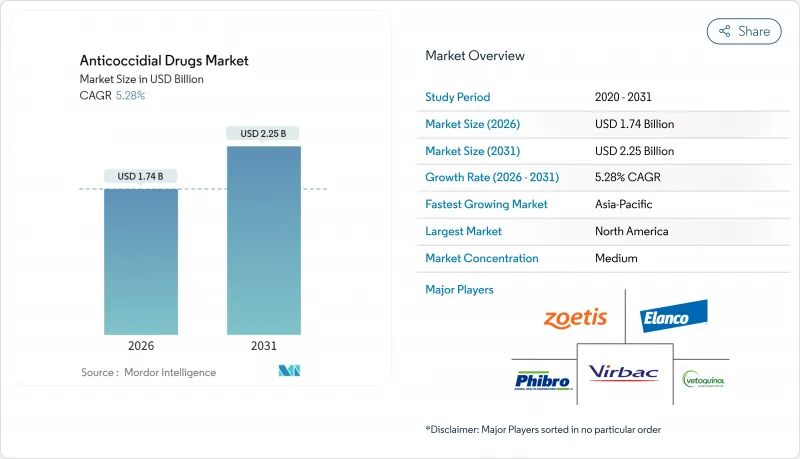

Anticoccidial Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The anticoccidial drugs market is expected to grow from USD 1.65 billion in 2025 to USD 1.74 billion in 2026 and is forecast to reach USD 2.25 billion by 2031 at 5.28% CAGR over 2026-2031.

Rising global demand for affordable animal protein, tightening biosecurity requirements, and increasingly sophisticated preventive-health protocols keep anticoccidiosis control top of mind for commercial producers. North America retains its leadership position because well-capitalized producers routinely implement rotation programs and adopt new formulations ahead of other regions. Botanical and phytogenic alternatives gain traction as regulators scrutinize antimicrobial feed additives, while digital ordering channels broaden product access for veterinarians and producers alike. Competitive intensity is moderate; a handful of diversified animal-health companies leverage integrated manufacturing, distribution, and technical-service capabilities to defend share, yet smaller innovators are finding white space in residue-free and combination therapies that mitigate rising drug resistance.

Global Anticoccidial Drugs Market Trends and Insights

Rising Prevalence of Coccidiosis in Poultry and Livestock

Recent surveillance shows infection rates exceeding 75% on Korean broiler farms, with field isolates resistant to six main drug classes. Transitions to cage-free and free-range housing elevate pathogen exposure because birds encounter higher environmental oocyst loads. Subclinical infections reduce growth by up to one-third and worsen feed-conversion ratios, eroding already thin producer margins. Regional monitoring programs additionally reveal that Eimeria strains adapt quickly to environmental and pharmacologic pressure, shortening the effective lifespan of older molecules. These trends reinforce demand for rotation schemes, dual-mode combinations, and vaccination add-ons that keep parasite loads below performance-limiting thresholds.

Expansion Of Global Animal Protein Production

Projected meat-consumption growth of 70% by 2050 drives rapid capacity additions, particularly in Asia-Pacific and Africa. Facilities such as Chip Mong Group's USD 60 million feed plant in Cambodia illustrate investment in vertically integrated systems capable of supporting advanced medicated-feed programs. Production clusters often emerge in regions where veterinary infrastructure trails demand, prompting interest in broad-spectrum, easy-to-administer anticoccidial options. Policymakers in several emerging markets now fast-track registrations for well-established molecules to accelerate domestic supply security and curtail costly imports.

Stringent Regulations on Antimicrobial Feed Additives

The EU increasingly classifies ionophores alongside medically important antimicrobials, triggering use restrictions and heightened record-keeping requirements. Economic modeling suggests full ionophore withdrawal from UK broiler production would cost producers as much as GBP 109.95 million annually and release an extra 84,000 t of CO2, illustrating the policy's broad implications. Compliance expenses weigh heaviest on smallholders that lack sophisticated rotation or vaccination programs. The resulting market bifurcates: premium brands capitalize on vaccine-only claims, while conventional operations lobby for continued, albeit limited, chemical options.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Innovation in Veterinary Pharmaceutical Formulations

- Growth Of Commercial Feed Manufacturing Capacity In Emerging Markets

- Growing Anticoccidial Drug Resistance Among Eimeria Species

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ionophores captured 51.78% of anticoccidial drugs market share in 2025 and continue to underpin large-scale poultry programs because half a century of field data confirms reliable performance with comparatively slower resistance buildup. The anticoccidial drugs market size for botanicals is small today yet grows faster than any other class at 7.18% CAGR, a trajectory fueled by consumer demand for residues-free poultry and regulators' tightening stance on antimicrobials. In practice, producers increasingly layer phytogenic actives over low-dose ionophores to stretch efficacy cycles. Synthetic chemicals and sulfonamides occupy mature positions and face flat demand in regions where drug rotation relies on established molecules, while triazine derivatives and specialized combinations serve niche failures. Regulatory gatekeepers, especially the FDA and EMA, prioritize combination approvals that demonstrate synergistic efficacy and clear stewardship benefits.

Adoption patterns diverge regionally. European firms invest heavily in botanical portfolios to navigate ionophore restrictions, whereas U.S. integrators still rely on monensin and salinomycin as rotation mainstays. APAC producers embrace mixed programs, integrating low-cost ionophores with locally sourced plant extracts to balance economics and export-market compliance. As raw-material availability expands and extraction yields improve, cost gaps between botanicals and chemicals narrow, supporting broader uptake without sacrificing margin targets.

Preventive programs favor coccidiostatic modes, which together comprised 67.90% of the anticoccidial drugs market size in 2025. Steady low-level exposure dampens pathogenic replication and permits immunity development, aligning with industry economics that reward predictable average daily gain over episodic treatment. Coccidiocidal products, although smaller in share, post a brisk 7.44% CAGR because they are indispensable when outbreaks occur or when rotation schemes lose efficacy. Producers regularly pair a static product during grow-out with a short cidal pulse before slaughter to reset flock exposure and curb resistance.

Field researchers note that certain Eimeria strains remain partially susceptible to statics yet display tolerance toward cidal molecules, illustrating the complexity of resistance evolution. Consequently, innovators explore sequential or simultaneous combinations to exploit differential sensitivity. Regulatory labeling now encourages explicit preventive versus therapeutic claims, easing veterinarian decision-making and promoting more judicious antimicrobial stewardship in high-output settings.

The Anticoccidial Drugs Market Report is Segmented by Drug Class (Ionophores, and More), Drug Action (Coccidiostatic and Coccidiocidal), Animal (Livestock Animals and Companion Animals), Distribution Channel (Veterinary Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest regional contribution with 40.85% share in 2025. High levels of commercial integration support routine anticoccidial usage, and FDA pharmacovigilance standards set benchmarks internationally. The United States dominates regional revenue thanks to its expansive broiler and feedlot industries that routinely adopt full-cycle preventive protocols. Canada and Mexico reinforce continental scale through cross-border flows of live birds, feed ingredients, and finished pharmaceuticals, underscoring a trilateral supply chain.

Asia-Pacific posts the fastest advance at 6.25% CAGR to 2031 as protein-consumption gains intersect with farm-modernization programs. Chinese producers expand layer and broiler complexes that deploy automatic dosing and recycle litter less frequently, both of which elevate baseline demand for effective anticoccidials. Government-backed initiatives in Vietnam, Indonesia, and India funnel credit into new feed mills, embedding medicated feeds into standard operating procedures.

Europe remains strategically important despite antimicrobial-use restrictions. Producers pivot toward botanical blends and vaccination protocols, and suppliers that can document residue-free status win premium shelf placement. The region's stringent rules often foreshadow global standards, making European validation critical for molecules targeting export markets.

South America and Middle East & Africa together capture a modest but rising slice as poultry integrators scale operations. Currency volatility and patchy cold-chain infrastructure moderate uptake of newer products, yet multinationals increasingly site secondary packaging or premix facilities in Brazil, South Africa, and the Gulf to shorten lead times and localize pricing.

- Zoetis

- Phibro Animal Health

- Huvepharma

- Elanco

- Ceva Sante Animale

- MSD Animal Health

- Boehringer Ingelheim

- Virbac

- Vetoquinol

- Hipra

- Impextraco

- Kemin Industries

- Novus International

- De Heus Animal Nutrition

- AdvaCare

- Biochek

- ECO Animal Health Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Coccidiosis in Poultry and Livestock

- 4.2.2 Expansion of Global Animal Protein Production

- 4.2.3 Continuous Innovation in Veterinary Pharmaceutical Formulations

- 4.2.4 Growth of Commercial Feed Manufacturing Capacity in Emerging Markets

- 4.2.5 Regulatory Support for In-Feed Medicated Additives in High-Burden Regions

- 4.2.6 Increasing Adoption of Preventive Animal Health Management Practices

- 4.3 Market Restraints

- 4.3.1 Stringent Regulations on Antimicrobial Feed Additives

- 4.3.2 Growing Anticoccidial Drug Resistance Among Eimeria Species

- 4.3.3 Consumer Shift Toward Antibiotic-Free And Organic Animal Products

- 4.3.4 Supply Chain Disruptions and Price Volatility Of Active Pharmaceutical Ingredients

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat Of New Entrants

- 4.5.2 Bargaining Power Of Buyers/Consumers

- 4.5.3 Bargaining Power Of Suppliers

- 4.5.4 Threat Of Substitute Products

- 4.5.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value; USD)

- 5.1 By Drug Class

- 5.1.1 Ionophores

- 5.1.2 Synthetic Chemicals

- 5.1.3 Sulphonamides

- 5.1.4 Triazine Derivatives

- 5.1.5 Combination Products

- 5.1.6 Botanicals & Phytogenic Alternatives

- 5.1.7 Other Drug Classes

- 5.2 By Drug Action

- 5.2.1 Coccidiostatic

- 5.2.2 Coccidiocidal

- 5.3 By Animal

- 5.3.1 Livestock Animals

- 5.3.1.1 Cattle

- 5.3.1.2 Poultry

- 5.3.1.3 Swine

- 5.3.1.4 Sheep & Goats

- 5.3.1.5 Other Livestock

- 5.3.2 Companion Animals

- 5.3.2.1 Dogs

- 5.3.2.2 Cats

- 5.3.2.3 Other Companion Animals

- 5.3.1 Livestock Animals

- 5.4 By Distribution Channel

- 5.4.1 Veterinary Hospitals

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.4.4 Other Distribution Channels

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Zoetis

- 6.3.2 Phibro Animal Health Corporation

- 6.3.3 Huvepharma

- 6.3.4 Elanco

- 6.3.5 Ceva Sante Animale

- 6.3.6 MSD Animal Health

- 6.3.7 Boehringer Ingelheim

- 6.3.8 Virbac

- 6.3.9 Vetoquinol SA

- 6.3.10 HIPRA

- 6.3.11 Impextraco NV

- 6.3.12 Kemin Industries

- 6.3.13 Novus International

- 6.3.14 De Heus Animal Nutrition

- 6.3.15 Advacare Pharma

- 6.3.16 BioChek BV

- 6.3.17 ECO Animal Health

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment