PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852012

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852012

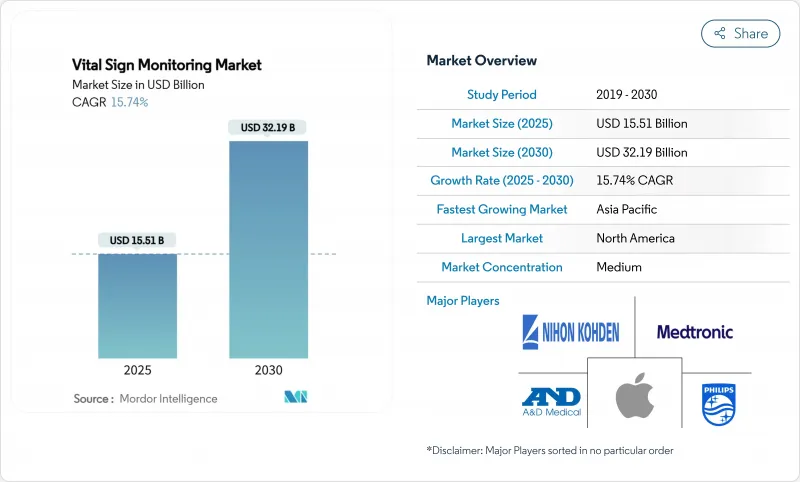

Vital Sign Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The vital signs monitoring market size stands at USD 15.51 billion in 2025 and is projected to reach USD 32.19 billion by 2030, advancing at a 15.74% CAGR.

This rapid trajectory reflects the healthcare sector's shift toward preventive, data-driven care models that rely on continuous physiologic surveillance to avert emergency admissions and curb readmissions. Pervasive sensor miniaturization, the maturation of artificial-intelligence algorithms, and broad 5G coverage are lowering latency to sub-50 milliseconds, enabling real-time clinical interventions across hospital, ambulatory, and home settings. Digital health reimbursement expansions, especially in the United States and parts of Europe, are reinforcing purchasing confidence among providers. Meanwhile, consumer acceptance of medical-grade metrics in wearables is dissolving the historic divide between professional devices and consumer electronics, opening fresh revenue streams for device makers.

Global Vital Sign Monitoring Market Trends and Insights

Rising Prevalence of Chronic and Lifestyle Diseases

Cardiovascular mortality climbed 18.6% globally between 2020 and 2024, prompting health systems to shift resources to continuous cardiac surveillance tools. As 48% of U.S. adults now live with some form of heart disease, ambulatory monitoring solutions that capture arrhythmia and nocturnal hypertension are gaining priority funding. Diabetes prevalence reached 537 million adults in 2024, reinforcing demand for multi-parameter monitors that track glucose alongside blood pressure and heart rate. Payers face a USD 4.1 trillion annual chronic-disease burden and are rewarding remote monitoring platforms that demonstrate outcome improvements, accelerating procurement of integrated vital-sign solutions. Collectively, these epidemiologic forces underpin the long-run expansion of the vital signs monitoring market.

Accelerating Adoption of Telehealth and Remote Patient Monitoring

Medicare's 2024 decision to reimburse 16 remote-monitoring billing codes-worth roughly USD 188 in monthly revenue per beneficiary-has reshaped provider economics. UnitedHealthcare followed by broadening wearable-device coverage in 2025, signaling payer alignment around preventive care. Health systems now embed monitoring dashboards within EHRs to support population-wide stratification and real-time alerts. Edge computing and 5G networks permit sub-50 millisecond data transmission, letting clinicians intervene during early episodes rather than after deterioration. As reimbursement solidifies and infrastructure matures, providers are embedding continuous vital-sign feeds into routine chronic-care pathways, fueling sustained demand within the vital signs monitoring market.

Data Privacy and Cybersecurity Challenges

Healthcare breaches exposed 133 million records in 2024, triggering USD 75 million in HIPAA penalties. Connected monitoring devices expand attack surfaces, and IoMT vulnerabilities rose 45% year over year. Europe's Medical Device Regulation adds six to twelve months to approvals due to cybersecurity audits, delaying launches. Providers lacking in-house infosec depth hesitate to implement continuous streaming devices, dampening orders. Until secure-by-design architectures become standard, data-leak fears will moderate the adoption speed of the vital signs monitoring market.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Technological Advancements in Sensor and Connectivity Technologies

- Growing Preference for Home Healthcare and Self-Management

- High Capital Costs and Pricing Pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medical devices accounted for 45.32% of the vital signs monitoring market share in 2024, underpinned by proven accuracy standards and hospital purchasing norms. Blood-pressure monitors remain the revenue anchor, benefiting from formal reimbursement grids and entrenched clinical protocols. Pulse-oximeter sales climbed after renewed respiratory-health vigilance, and FDA-cleared over-the-counter models by Masimo are widening consumer access. Temperature and respiratory-rate modules now integrate with telehealth software, strengthening the clinical value proposition.

Consumer wearables are advancing at a 17.65% CAGR, reflecting evolving regulatory acceptance of smartwatch-driven ECG, SPO2, and blood-pressure estimates. Apple's Series 10 achieved diagnostic-level ECG concordance in peer-reviewed trials, and smart patches that remain adhered for 14 days are emerging as the highest-growth sub-group. As clinical validation mounts, device-makers are cross-licensing algorithms, blending wellness and medical domains. The convergence of the two categories is drawing non-traditional entrants and expanding the overall vital signs monitoring market.

Hospitals controlled 52.34% of revenue in 2024, owing to critical-care deployments and peri-operative monitoring. However, payer pressure to shorten inpatient stays is accelerating the hand-off of monitoring responsibilities to outpatient settings. Ambulatory centers leverage compact monitors to support same-day discharge, while AI-augmented dashboards flag early deterioration for care-team intervention.

Home-care settings are growing at an 18.76% CAGR as Medicare Advantage and private payers reimburse RPM bundles. Consumers increasingly self-install Wi-Fi or cellular-connected devices, and clinicians accept remote data into electronic charts. This momentum is cementing distributed care models, reshaping the vital signs monitoring market around the patient's residence rather than the hospital ward.

The Vital Signs Monitoring Market Report is Segmented by Product (Consumer Wearables and Medical Devices), End-User (Hospitals & Clinics, and More), Form Factor (Hand-Held Devices, and More), Distribution Channel (Hospital & Clinic Procurement, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 42.45% of revenue in 2024, propelled by Medicare reimbursement and USD 29.1 billion in annual digital-health infrastructure outlays. High per-capita spending and mature EHR penetration simplify remote-monitoring integration. Canada deploys telemonitoring to alleviate rural-provider shortages, while Mexico's urban middle class drives smartwatch uptake despite limited insurer coverage.

Asia-Pacific is the fastest-growing region at a 16.54% CAGR. China's Healthy China 2030 plan earmarks USD 850 billion for health IT expansions, including village telehealth hubs. Japan's super-aged demographic propels demand for home monitors that support independent living; Nihon Kohden's subscription bundles lower capital hurdles. India's Ayushman Bharat Digital Mission links 1.4 billion citizens to electronic health IDs, creating a vast prospective pool, though device pricing must align with local income levels.

Europe posts steady growth as stringent GDPR and MDR regulations, although challenging, build consumer trust. Germany's Digital Healthcare Act allows physicians to prescribe reimbursed health apps, and France is piloting remote-monitoring bundles for hypertension. The Middle East invests oil surpluses into smart-hospital projects, but infrastructure gaps restrain pervasive home adoption in Africa. South American momentum centers on Brazil, where public-private consortia trial AI-assisted cardiac monitoring. Collectively, regional dynamics diversify revenue dependencies for the vital signs monitoring market.

- Medtronic

- Apple

- Masimo

- Contec Medical Systems

- GE Healthcare

- iRhythm Technologies

- BioBeat Technologies

- Nihon Kohden

- OMRON

- A&D Company

- Mindray

- Koninklijke Philips

- Hill-Rom / Baxter

- Nonin Medical

- Welch Allyn / Hill-Rom

- Microlife Corp.

- SunTech Medical

- Smiths Group

- Abbott Laboratories

- Vivalink

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic and Lifestyle Diseases

- 4.2.2 Accelerating Adoption of Telehealth and Remote Patient Monitoring

- 4.2.3 Continuous Technological Advancements in Sensor and Connectivity Technologies

- 4.2.4 Growing Preference for Home Healthcare and Self-Management

- 4.2.5 Increasing Healthcare Expenditure and Infrastructure Digitization

- 4.2.6 Supportive Government Policies and Reimbursement Frameworks

- 4.3 Market Restraints

- 4.3.1 Data Privacy and Cybersecurity Challenges

- 4.3.2 High Capital Costs and Pricing Pressure

- 4.3.3 Stringent Regulatory Compliance and Approval Timelines

- 4.3.4 Accuracy and Reliability Concerns in Wearable Measurements

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat Of New Entrants

- 4.6.2 Bargaining Power Of Buyers

- 4.6.3 Bargaining Power Of Suppliers

- 4.6.4 Threat Of Substitutes

- 4.6.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Consumer Wearables

- 5.1.1.1 Smartwatches

- 5.1.1.2 Fitness & Activity Trackers

- 5.1.1.3 Smart Patches

- 5.1.1.4 Other Wearables

- 5.1.2 Medical Devices

- 5.1.2.1 Blood Pressure Monitors (Analog & Digital)

- 5.1.2.2 Pulse Oximeters (Fingertip, Hand-Held & Others)

- 5.1.2.3 Temperature Monitoring Devices

- 5.1.2.4 Respiratory-Rate Monitors

- 5.1.1 Consumer Wearables

- 5.2 By End-User

- 5.2.1 Hospitals & Clinics

- 5.2.2 Ambulatory & Health Centres

- 5.2.3 Home-Care Settings

- 5.3 By Form Factor

- 5.3.1 Hand-Held Devices

- 5.3.2 Table-Top / Bedside Monitors

- 5.3.3 Wrist-Worn Wearables

- 5.3.4 Patch-Based Devices

- 5.3.5 Ring / Other Miniaturised Form Factors

- 5.4 By Distribution Channel

- 5.4.1 Hospital & Clinic Procurement

- 5.4.2 Retail Pharmacies

- 5.4.3 Online / E-Commerce

- 5.4.4 Direct-To-Consumer

- 5.4.5 OEM / ODM B2B Sales

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Apple Inc.

- 6.3.3 Masimo Corporation

- 6.3.4 Contec Medical Systems

- 6.3.5 GE HealthCare

- 6.3.6 iRhythm Technologies

- 6.3.7 BioBeat Technologies

- 6.3.8 Nihon Kohden Corporation

- 6.3.9 Omron Healthcare

- 6.3.10 A&D Company

- 6.3.11 Mindray

- 6.3.12 Koninklijke Philips N.V.

- 6.3.13 Hill-Rom / Baxter

- 6.3.14 Nonin Medical

- 6.3.15 Welch Allyn / Hill-Rom

- 6.3.16 Microlife Corp.

- 6.3.17 SunTech Medical

- 6.3.18 Smiths Medical

- 6.3.19 Abbott Laboratories

- 6.3.20 Vivalink

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment